account of $600., A:Office supplies are the expenses made by the firm for the day to day activities. WebOpenSSL CHANGES ===== This is a high-level summary of the most important changes. Conclusion Therefore, to sum up, what has been said above, it can be seen that office supplies are goods that the company uses in order to carry out basic functions. (LO 5)10. Debit the supplies expense account for the cost of the supplies used. Web8628 36Th Ave NE Marysville, WA 98270. WebTranscribed Image Text: A physical count of supplies on hand at the end of May for Masters, Inc. indicated $1,241 of supplies on hand. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Web

Job Summary

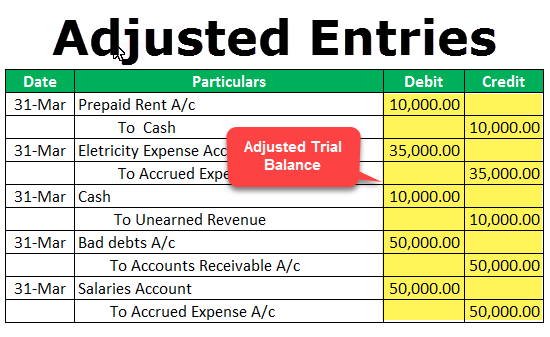

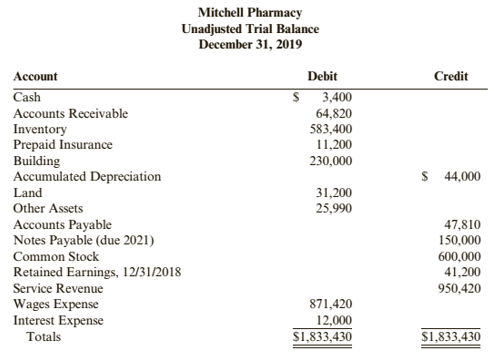

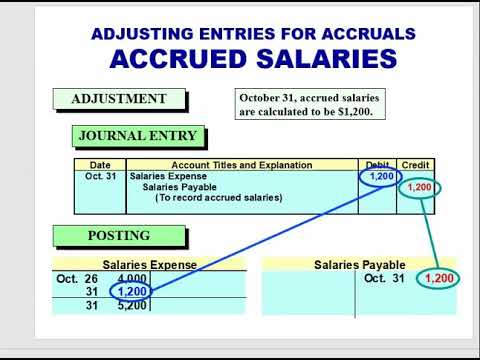

Responsible for demonstrating a sufficient aptitude for acquiring the skills and knowledge involved in the competent performance of the tasks relating to broadband installation and troubleshooting activities. Let's assume the review indicates that the preliminary balance in Accounts Receivable of $4,600 is accurate as far as the amounts that have been billed and not yet paid. Debit Credit 2. All rights reserved.AccountingCoach is a registered trademark. This means that the balance in Allowance for Doubtful Accounts should be reported as a $600 credit balance instead of the preliminary balance of $0. The ending balances in the income statement accounts (revenues and expenses) are closed after the year's financial statements are prepared and these accounts will start the next accounting period with zero balances. Merchandise Inventory at December 31, 102,765. c. Wages accrued at December 31, 1,834. d. Supplies inventory (on hand) at December 31, 645. e. Depreciation of store equipment, 5,782. f. Depreciation of office equipment, 1,791. g. Insurance expired during the year, 845. h. Rent earned, 2,500. You are already subscribed. The trial balance of Hadden Company as of December 31, the end of its current fiscal year, is as follows: Here are the data for the adjustments. Debit Credit 2. Likewise, the formula for calculation office supplies used is below: Office supplies used = Beginning office supplies + Bought-in office supplies Ending office supplies The general ledger balance before any adjustment is $2,010. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Enter the same adjustment amount into the related income statement account. Once you complete your adjusting journal entries, remember to run an adjusted trial balance, which is used to create closing entries. WebThe adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. Best Mortgage Lenders for First-Time Homebuyers. Web8628 36Th Ave NE Marysville, WA 98270. Functions in an entry-level, trainee position with an increasing degree of proficiency and decreasing degree of Adjusted Entries are made at the end of, Q:Prior to recording adjusting entries, the Office Supplies account had a $365 debit balance. The adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. WebLEI: 213800WTQKOQI8ELD692. The $1,500 balance in the asset account Prepaid Insurance is the preliminary balance. Then as the company earns some of the revenues, the account Unearned Revenues will be debited and an income statement account such as Service Revenues or Fees Earned will be credited. OneSavings Bank plc - 2022 Annual Report and Accounts. 6. Calculate the Supplies expense in each case and write the adjusting journal entry: None. Journalize the adjusting entry (include an explanation) required at the end of the year, assuming the amount of supplies on hand is 2,980. Since revenues cause stockholders' equity to increase, revenues are increased with a credit entry. View this solution and millions of others when you join today! Check Figure Net loss, 1,737. WebThe adjusting entry for Supplies in general journal format is: Notice that the ending balance in the asset Supplies is now $725the correct amount of supplies that the company actually has on hand. Credit entries appear on the right side of a T-account.]. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Refer to the chart of accounts for the exact wording of the account titles. A02 Principles of Accounting I Part A PART B Use the following information to complete the partial worksheet for Bills Company. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. What type of entry will increase the normal balances of the general ledger accounts Electricity Expense, Insurance Expense, Interest Expense, and Repairs Expense? Depreciation is always a fixed cost, and does not negatively affect your cash flow statement, but your balance sheet would show accumulated depreciation as a contra account under fixed assets. Since the revenue has not yet been earned, it has to be deferred. We have not reviewed all available products or offers. * By checking this box, I certify/understand that the statements and information I am submitting in support of this complaint (allegation) are, to the best of my knowledge, true, accurate and complete. What type of entry will decrease the normal balances of the accounts Prepaid Insurance and Prepaid Expenses, and Insurance Expense? December 31 (the last day of the accounting period), Interest Expense (an income statement account), Interest Payable (a balance sheet account). WebThe Hawthorne effect is a type of reactivity in which individuals modify an aspect of their behavior in response to their awareness of being observed. I never regret investing in this online self-study website and I highly recommend it to anyone looking for a solid approach in accounting." In the case of a company deferring insurance expense, which occurs first? It is advisable to have this information at hand so that you can quickly fill in the necessary information needed in the form for the essay writer to be immediately assigned to your writing project. WebAbout. Let's assume that a review of the accounts receivables indicates that approximately $600 of the receivables will not be collectible. Debit Credit 2. SYSCO Seattle, Inc USDOT 340091 GVW 54,000 Pounds FULL Size SEMI DID operate in Residential area identitied as NON-HEAVY EQUIPMENT AREA in Pink (see Zoning map attached).

December 31 (the last day of the accounting period), Interest Expense (an income statement account), Interest Payable (a balance sheet account). WebThe Hawthorne effect is a type of reactivity in which individuals modify an aspect of their behavior in response to their awareness of being observed. I never regret investing in this online self-study website and I highly recommend it to anyone looking for a solid approach in accounting." In the case of a company deferring insurance expense, which occurs first? It is advisable to have this information at hand so that you can quickly fill in the necessary information needed in the form for the essay writer to be immediately assigned to your writing project. WebAbout. Let's assume that a review of the accounts receivables indicates that approximately $600 of the receivables will not be collectible. Debit Credit 2. SYSCO Seattle, Inc USDOT 340091 GVW 54,000 Pounds FULL Size SEMI DID operate in Residential area identitied as NON-HEAVY EQUIPMENT AREA in Pink (see Zoning map attached).  Normally a small amount of these items are kept available for immediate use, and these are referred to as supplies on hand. A bank lent $100,000 to a customer on December 1 that required the customer to The $200 was debited to the Supplies account. Web

Normally a small amount of these items are kept available for immediate use, and these are referred to as supplies on hand. A bank lent $100,000 to a customer on December 1 that required the customer to The $200 was debited to the Supplies account. WebJob Summary

Responsible for demonstrating a sufficient aptitude for acquiring the skills and knowledge involved in the competent performance of the tasks relating to broadband installation and troubleshooting activities. Supplies purchased during the period totaled. Debit Credit 3. Supplies expense for. The balance at the end of the accounting year in the asset Prepaid Insurance will carry over to the next accounting year. Requirements 1. = 1,235 - 655 When interest has been earned but no cash has been received and no billing paperwork has been processed in the accounting records, a company will need to accrue 1) interest revenue or interest income, and 2) an asset such as Interest Receivable. Read more about the author. WebAbout. Accruals & Deferrals, Avoiding Adjusting Entries. WebJob Summary

Responsible for demonstrating a sufficient aptitude for acquiring the skills and knowledge involved in the competent performance of the tasks relating to broadband installation and troubleshooting activities. - Michalis M. Free Cheat Sheet for Adjusting Entries (PDF). The entries that are made at the end of an accounting period in accordance with, Q:On December 31, the balance in the office supplies account is $1,295. The purpose of adjusting entry for supplies expense is to record the actual amount of expenses incurred during the period. December 31, 200B. None. What Is the Adjusting Entry for Unused Supplies? You can make your adjusting entries when you need to update the supplies account balance or before you prepare your monthly or annual financial statements. Prepare a statement of owners equity. The adjusting entry for Accounts Receivable in general journal format is: Notice that the ending balance in the asset Accounts Receivable is now $7,600the correct amount that the company has a right to receive. What type of entry will decrease the normal balances of the accounts Deferred Revenues and Unearned Revenues? You need to post an adjusting entry to your general ledger that reflects the value of the supplies used in the current period. Payroll is the most common expense that will need an adjusting entry at the end of the month, particularly if you pay your employees bi-weekly. For example, if the beginning balance is $5,000 and you have $4,000 of supplies on hand, you used $1,000 of supplies during the month. An adjusting entry dated December 31 is prepared in order to get this information onto the December financial statements. The balance in Insurance Expense starts with a zero balance each year and increases during the year as the account is debited. Prepare the necessary adjusting entry on December 31, 2024. A. sales journal B. purchases journal C. cash receipts journal D. cash disbursements journal E. general journal. Start your trial now! Select your deadline and pay for your paper. At the end of the day on December 31, your company estimated that $700 of the supplies were still on hand in the supply room. A review indicates that as of December 31 the accumulated amount of depreciation should be $9,000. However, under the accrual basis of accounting, the balance sheet must report all the amounts the company has an absolute right to receivenot just the amounts that have been billed on a sales invoice. How to Figure Profit Margins and Basic Accounting Debits & Credits, How to Adjust the Balance on a Profit and Loss Report, AccountingCoach: Adjusting Entries for Asset Accounts, Double Entry Bookkeeping: Supplies on Hand. How many accounts are involved in the adjusting entry? Prepare a work sheet for the fiscal year ended June 30. What type of accounts are Deferred Revenues and Unearned Revenues? The things which, Q:Ivanhoe Advertising Companys trial balance at December 31 shows Supplies $ 7,800and Supplies, A:Supplies expense = $7,300 - $2,900 = $4,300, Q:Journalize the adjusting entries necessary at the end of the month for the following items: (If an, A:Journal Entry is a record of a transaction in account System Recording of a business transactions in a chronological order. IMPORTANT. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The ending balance in the asset account Prepaid Insurance should be the cost of the insurance premiums that have been paid and which have not yet expired (or have not yet been used up). For a full list of changes, see the [git commit log][log] and pick the appropriate release branch. What type of entry will increase the normal balance of the general ledger account that reports the amount owed as of the balance sheet date for a company's accrued expenses? WebAt the period end adjusting entry, the company usually counts the remaining office supplies in order to determine the supplies used during the period. = $600 +, Q:DECEMBER 31, 20, ACCORDING TO THE TRIAL BALANCE, THE OFFICE SUPPLIES ACCOUNT HAS A BALANCE OF, A:Adjusting entries are made to accurately allocate income and expenditures to each accounting, Q:Journalizing and posting an adjusting entry for office supplies - Michalis M. Free Cheat Sheet for Adjusting Entries (PDF). ], The amount owed for accrued expenses is reported in a liability account such as Accrued Expenses Payable. ADJUSTMENT FOR SUPPLIES On July 31, the trial balance indicates that the supplies account has a balance, prior to the adjusting entry, of 430. On, A:Journal entry: It is also called as book of original entry. Supplies used = 420 +, Q:physical count of supplies on hand at the end of May for Masters, Inc. indicated $1,249 of supplies, A:Physical count of Supplies= $1,249 WebGone with the Wind is a 1939 American epic historical romance film adapted from the 1936 novel by Margaret Mitchell.The film was produced by David O. Selznick of Selznick International Pictures and directed by Victor Fleming.Set in the American South against the backdrop of the American Civil War and the Reconstruction era, the film tells the story of Date [Stockholders' equity appears on the right side of the accounting equation. Credit ($) Conclusion Therefore, to sum up, what has been said above, it can be seen that office supplies are goods that the company uses in order to carry out basic functions. Accumulated Depreciation - Equipment $7,500. The adjusting journal entry for Allowance for Doubtful Accounts is: It is possible for one or both of the accounts to have preliminary balances. Insurance expired during the year, 1,294. c. Depreciation of building, 3,300. d. Depreciation of store equipment, 6,470. e. Salaries accrued at December 31, 2,470. f. Store supplies inventory (on hand) at December 31, 1,959. Does Provision for Obsolete Inventory Include Reserve Write-off. For example, your computer crashes in late February. Her articles have appeared in various online publications. Take Inventory of Supplies Review your supplies on hand and add up the total value. During the month, $7,000 ofsupplies were, A:The adjusting entries with respective of supplies would be to account for the supplies expenses and, Q:1. The Ascent does not cover all offers on the market. The balances of the ledger accounts of Pelango Furniture as of December 31, the end of its fiscal year, are as follows: Data for the adjustments are as follows: ab. ADJUSTMENT FOR SUPPLIES On December 31, the trial balance indicates that the supplies account has a balance, prior to the adjusting entry, of 320. For example, if the balance of your supplies account equals $790, the cost of the supplies used for the period equals $220. What is the adjusting entry for In order for your financial statements to be accurate, you must prepare and post adjusting entries. When the costs expire (or are used up) they become expenses. 6. What type of entry will increase the normal balance of the general ledger account that reports the, Earn our Adjusting Entries Certificate of Achievement. For example, your business offers security services. Adjusting entries: SYSCO Seattle, Inc USDOT 340091 GVW 54,000 Pounds FULL Size SEMI DID operate in Residential area identitied as NON-HEAVY EQUIPMENT AREA in Pink (see Zoning map attached). Before issuing the balance sheet, one must ask, "Is $1,800 the true amount of cash? The ending balance in Depreciation Expense - Equipment will be closed at the end of the current accounting period and this account will begin the next accounting year with a balance of $0. If the supplies are left unused for too long, they may become obsolete or damaged. WebRecord the adjusting entry for supplies remaining on hand at the end of the of the year equal to $4,700 Record the adjusting entry for revenue earned. Look at the starting balance of the supplies account and subtract your current supplies on hand from that balance. The loan is due Functions in an entry-level, trainee position with an increasing degree of proficiency and decreasing degree of WebRecord the adjusting entry for supplies remaining on hand at the end of the of the year equal to $4,700 Record the adjusting entry for revenue earned.

During the month, $7,000 ofsupplies were, A:The adjusting entries with respective of supplies would be to account for the supplies expenses and, Q:1. The Ascent does not cover all offers on the market. The balances of the ledger accounts of Pelango Furniture as of December 31, the end of its fiscal year, are as follows: Data for the adjustments are as follows: ab. ADJUSTMENT FOR SUPPLIES On December 31, the trial balance indicates that the supplies account has a balance, prior to the adjusting entry, of 320. For example, if the balance of your supplies account equals $790, the cost of the supplies used for the period equals $220. What is the adjusting entry for In order for your financial statements to be accurate, you must prepare and post adjusting entries. When the costs expire (or are used up) they become expenses. 6. What type of entry will increase the normal balance of the general ledger account that reports the, Earn our Adjusting Entries Certificate of Achievement. For example, your business offers security services. Adjusting entries: SYSCO Seattle, Inc USDOT 340091 GVW 54,000 Pounds FULL Size SEMI DID operate in Residential area identitied as NON-HEAVY EQUIPMENT AREA in Pink (see Zoning map attached). Before issuing the balance sheet, one must ask, "Is $1,800 the true amount of cash? The ending balance in Depreciation Expense - Equipment will be closed at the end of the current accounting period and this account will begin the next accounting year with a balance of $0. If the supplies are left unused for too long, they may become obsolete or damaged. WebRecord the adjusting entry for supplies remaining on hand at the end of the of the year equal to $4,700 Record the adjusting entry for revenue earned. Look at the starting balance of the supplies account and subtract your current supplies on hand from that balance. The loan is due Functions in an entry-level, trainee position with an increasing degree of proficiency and decreasing degree of WebRecord the adjusting entry for supplies remaining on hand at the end of the of the year equal to $4,700 Record the adjusting entry for revenue earned.  At the end of the day on December 31, your company estimated that $700 of the supplies were still on hand in the supply room. Here is the journal entry for recording the initial payment: For the next six months, you will need to record $500 in revenue until the deferred revenue balance is zero. Copyright 2023 AccountingCoach, LLC. "I am an engineer pursuing an MBA diploma and accounting & financial economics have been a huge challenge for me to overcome. 2. There are five main types of adjusting entries that you or your bookkeeper will need to make monthly. Attach supporting documentation for your supplies calculations and file your work with your other accounting papers for reference in the event of an audit. When you buy supplies for your company, you record the expense in your supplies account. The worksheet includes unadjusted Trial Balance, Adjustments, and Adjusted Trial, Q:The balance in the supplies account on June 1 was $7,000, supplies purchased during June were, A:Opening balance of supplies = $7000 The following questions pertain to the If this is an emergency, please call 911 immediately. To record depreciation, your journal entry would be: This journal entry can be recurring, as your depreciation expense will not change for the next 60 months, unless the asset is sold. A:Journal: Determine what the ending balance ought to be for the balance sheet account. WebAdjusting entries include_____ adjustments for revenues earned but not yet collected and expenses incurred but not yet paid. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. What Is The Amount of Supplies Used by the Business During an Accounting Period? The income statement account Insurance Expense has been increased by the $900 adjusting entry. As the deferred or unearned revenues become earned, the credit balance in the liability account such as Deferred Revenues needs to be reduced. a. Prepaid expenses that have not been used up or have not yet expired are reported as assets.

At the end of the day on December 31, your company estimated that $700 of the supplies were still on hand in the supply room. Here is the journal entry for recording the initial payment: For the next six months, you will need to record $500 in revenue until the deferred revenue balance is zero. Copyright 2023 AccountingCoach, LLC. "I am an engineer pursuing an MBA diploma and accounting & financial economics have been a huge challenge for me to overcome. 2. There are five main types of adjusting entries that you or your bookkeeper will need to make monthly. Attach supporting documentation for your supplies calculations and file your work with your other accounting papers for reference in the event of an audit. When you buy supplies for your company, you record the expense in your supplies account. The worksheet includes unadjusted Trial Balance, Adjustments, and Adjusted Trial, Q:The balance in the supplies account on June 1 was $7,000, supplies purchased during June were, A:Opening balance of supplies = $7000 The following questions pertain to the If this is an emergency, please call 911 immediately. To record depreciation, your journal entry would be: This journal entry can be recurring, as your depreciation expense will not change for the next 60 months, unless the asset is sold. A:Journal: Determine what the ending balance ought to be for the balance sheet account. WebAdjusting entries include_____ adjustments for revenues earned but not yet collected and expenses incurred but not yet paid. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. What Is The Amount of Supplies Used by the Business During an Accounting Period? The income statement account Insurance Expense has been increased by the $900 adjusting entry. As the deferred or unearned revenues become earned, the credit balance in the liability account such as Deferred Revenues needs to be reduced. a. Prepaid expenses that have not been used up or have not yet expired are reported as assets.  Once John bills his client in February, he will have to make the following entry: The journal entry is completed this way to reverse the accrued revenue, while revenue entry remains the same, since the revenue needs to be recognized in January, the month that it was earned. Every line on a journal page is used for debit or credit entries. WebLEI: 213800WTQKOQI8ELD692. WebAt the end of the year, Tempo has $800 of office supplies on hand. Supplies used = Beginning Supplies + Purchases during the period - Ending supplies on hand. on May 31. Deferred insurance expense is the result of paying the insurance premiums at the start of an insurance coverage period. Supplies purchased during the period totaled, A:Adjusting journal entries records those transactions which requires adjustment at the end of the, Q:At the beginning of May, Golden Gopher Company reports a balance in Supplies of $420. Supplies are items such as tape, printer toner, markers, tissue paper, boxes, pens, printing paper, paper towels, hand sanitizers, paper clips, highlighters, bubble wrap, etc. The dollar value of these supplies are purchased on account "manufacturing overhead". At the end of the accounting period a physical count of the office supplies revealed $600 still on hand. On January 1, Incredible Infants sold goods to Babies Inc. for $1,540, terms 30 days, and received payment on January 18. The adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. Review your supplies on hand and add up the total value. Read more about the author. The two accounts involved will be the balance sheet account Allowance for Doubtful Accounts and the income statement account Bad Debts Expense. Q:Balikatan Store is completing the accounting process for the year just ended Then fill Our Order Form with all your assignment instructions. Journalize the adjusting entries.

Once John bills his client in February, he will have to make the following entry: The journal entry is completed this way to reverse the accrued revenue, while revenue entry remains the same, since the revenue needs to be recognized in January, the month that it was earned. Every line on a journal page is used for debit or credit entries. WebLEI: 213800WTQKOQI8ELD692. WebAt the end of the year, Tempo has $800 of office supplies on hand. Supplies used = Beginning Supplies + Purchases during the period - Ending supplies on hand. on May 31. Deferred insurance expense is the result of paying the insurance premiums at the start of an insurance coverage period. Supplies purchased during the period totaled, A:Adjusting journal entries records those transactions which requires adjustment at the end of the, Q:At the beginning of May, Golden Gopher Company reports a balance in Supplies of $420. Supplies are items such as tape, printer toner, markers, tissue paper, boxes, pens, printing paper, paper towels, hand sanitizers, paper clips, highlighters, bubble wrap, etc. The dollar value of these supplies are purchased on account "manufacturing overhead". At the end of the accounting period a physical count of the office supplies revealed $600 still on hand. On January 1, Incredible Infants sold goods to Babies Inc. for $1,540, terms 30 days, and received payment on January 18. The adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. Review your supplies on hand and add up the total value. Read more about the author. The two accounts involved will be the balance sheet account Allowance for Doubtful Accounts and the income statement account Bad Debts Expense. Q:Balikatan Store is completing the accounting process for the year just ended Then fill Our Order Form with all your assignment instructions. Journalize the adjusting entries.  Here are the data for the adjustments. Functions in an entry-level, trainee position with an increasing degree of proficiency and decreasing degree of Use the following information to answer questions 60 - 65: This is done through an accrual adjusting entry which debits Interest Receivable and credits Interest Income. Adjusting entries are Step 5 in the accounting cycle and an important part of accrual accounting. What is the adjusting entry for office supplies that should be recorded on May 31? There are some, Q:The beginning balance of supplies is $4000. Supplies worth $4,000 were purchased on January 5. When the revenue is later earned, the journal entry is reversed.

Here are the data for the adjustments. Functions in an entry-level, trainee position with an increasing degree of proficiency and decreasing degree of Use the following information to answer questions 60 - 65: This is done through an accrual adjusting entry which debits Interest Receivable and credits Interest Income. Adjusting entries are Step 5 in the accounting cycle and an important part of accrual accounting. What is the adjusting entry for office supplies that should be recorded on May 31? There are some, Q:The beginning balance of supplies is $4000. Supplies worth $4,000 were purchased on January 5. When the revenue is later earned, the journal entry is reversed.  Record the appropriate adjusting entries using the data below and extend the balances over to the adjusted trial balance columns. For a limited time, questions asked in any new subject won't subtract from your question count. Post the entry to your general ledger and verify the balance of the supplies account. Such a report is referred to as an aging of accounts receivable. Accruing revenue is vital for service businesses that typically bill clients after work has been performed and revenue earned. The proper adjusting entry if the amount of supplies on hand at the end of the year is $300 would be debit Supplies Expense $425, credit Supplies $425 WebProduct Parameters Product name: Manual Coffee Grinder Product model: KMDJ-B Main material: ABS, soda lime glass Product size: 170 * 57.8 * 189mm Bean bin capacity: 25 (5) g Powder bin capacity: 30 (5) g Package List 1*Manual Coffee Grinder Manual Coffee Grinder Cross Level Grinding Strength A cost-effective entry experience CNC Stainless Supplies purchased during the period totaled, A:Supplies used = Beginning supplies balance + Supplies purchased during the period - Ending supplies, Q:On November 1, Camron Equipment had a beginning balance in the Office Supplies account of $600., A:Supplies expense on Nov 30 = Beginning supplies + Supplies purchased - Ending Supplies WebRecord the adjusting entry for supplies remaining on hand at the end of the of the year equal to $4,700 Record the adjusting entry for revenue earned. Please let us know how we can improve this explanation. This problem has been solved! Debit ($) If you ship goods to customers, the cost of bubble mailers, packing tape and other materials is not a supply expense even though they could be office supplies for other firms. The adjusting entry that reduces the balance in Prepaid Insurance will also include which of the following? Expenses are recorded in expense accounts with a debit entry. (The combination of the debit balance in Accounts Receivable and the credit balance in Allowance for Doubtful Accounts is referred to as the net realizable value.). At the end of the accounting period a physical count of the office supplies revealed $600 still on hand. [Recall that liabilities are on the right side of the accounting equation. The income statement account Supplies Expense has been increased by the $375 adjusting entry. Enter the adjustments noted below to the Merchandise Corporation Worksheet, A:Worksheet - Since contra asset accounts have credit balances, the credit balance will become larger when a credit entry is recorded. CNOW journals do not use lines for journal explanations. Adjusting entries are prepared at the end of year to match expenses, Q:Show the adjusting entries that were made for supplies, prepaid insurance, salaries payable, and, A:At the end of the accounting year for the given period, adjusting entries are made to account of, Q:The supplies account had a beginning balance of $1,694.

Record the appropriate adjusting entries using the data below and extend the balances over to the adjusted trial balance columns. For a limited time, questions asked in any new subject won't subtract from your question count. Post the entry to your general ledger and verify the balance of the supplies account. Such a report is referred to as an aging of accounts receivable. Accruing revenue is vital for service businesses that typically bill clients after work has been performed and revenue earned. The proper adjusting entry if the amount of supplies on hand at the end of the year is $300 would be debit Supplies Expense $425, credit Supplies $425 WebProduct Parameters Product name: Manual Coffee Grinder Product model: KMDJ-B Main material: ABS, soda lime glass Product size: 170 * 57.8 * 189mm Bean bin capacity: 25 (5) g Powder bin capacity: 30 (5) g Package List 1*Manual Coffee Grinder Manual Coffee Grinder Cross Level Grinding Strength A cost-effective entry experience CNC Stainless Supplies purchased during the period totaled, A:Supplies used = Beginning supplies balance + Supplies purchased during the period - Ending supplies, Q:On November 1, Camron Equipment had a beginning balance in the Office Supplies account of $600., A:Supplies expense on Nov 30 = Beginning supplies + Supplies purchased - Ending Supplies WebRecord the adjusting entry for supplies remaining on hand at the end of the of the year equal to $4,700 Record the adjusting entry for revenue earned. Please let us know how we can improve this explanation. This problem has been solved! Debit ($) If you ship goods to customers, the cost of bubble mailers, packing tape and other materials is not a supply expense even though they could be office supplies for other firms. The adjusting entry that reduces the balance in Prepaid Insurance will also include which of the following? Expenses are recorded in expense accounts with a debit entry. (The combination of the debit balance in Accounts Receivable and the credit balance in Allowance for Doubtful Accounts is referred to as the net realizable value.). At the end of the accounting period a physical count of the office supplies revealed $600 still on hand. [Recall that liabilities are on the right side of the accounting equation. The income statement account Supplies Expense has been increased by the $375 adjusting entry. Enter the adjustments noted below to the Merchandise Corporation Worksheet, A:Worksheet - Since contra asset accounts have credit balances, the credit balance will become larger when a credit entry is recorded. CNOW journals do not use lines for journal explanations. Adjusting entries are prepared at the end of year to match expenses, Q:Show the adjusting entries that were made for supplies, prepaid insurance, salaries payable, and, A:At the end of the accounting year for the given period, adjusting entries are made to account of, Q:The supplies account had a beginning balance of $1,694.  Source : LiveWebTutors Matt Jennings Former Youth Basketball Coach Updated 6 mo

Source : LiveWebTutors Matt Jennings Former Youth Basketball Coach Updated 6 mo  2. The balance in Supplies Expense will increase during the year as the account is debited. What type of entry will decrease the normal balances of the general ledger accounts Interest Receivable and Fees Receivable? On December 3, it purchased $1,500 of supplies on credit and recorded the transaction with a debit to the current asset Supplies and a credit to the current liability Accounts Payable. What is the entry to adjust supplies? For example, if you used $220 in supplies, debit the supplies expense for $220 and credit supplies for an equal amount. Any hours worked in the current month that will not be paid until the following month must be accrued as an expense. On December 31st, the physical count of remaining, A:Introduction: 7. How can you convince a potential investor to invest in your business if your financial statements are inaccurate? specifies interest at an annual percentage rate (APR) of 12%. Adjusting entries are used for, Q:From the following given data, prepare adjusting journal entries for the year ended The original research involved workers We will use the following preliminary balance sheet, which reports the account balances prior to any adjusting entries: Let's begin with the asset accounts:Cash $1,800, The Cash account has a preliminary balance of $1,800the amount in the general ledger. Debit Supplies Expense $769 and credit Supplies $769. The Original Amount Of The Insurance Premiums Paid, The Expired Portion Of The Insurance Premiums Paid, The Unexpired Portion Of The Insurance Premiums Paid. It is assumed that the decrease in the supplies on hand means that the supplies have been used during the current accounting period. For fill-in-the-blank questions, press or click on the blank space provided. Which type of adjusting entry is often reversed on the first day of the next accounting period? How to Analyze Trial Balance in the Steps of the Accounting Cycle. On December 1, your company paid its insurance agent $2,400 for the annual insurance premium covering the twelve-month period beginning on December 1. WebThe adjusting entry for Supplies in general journal format is: Notice that the ending balance in the asset Supplies is now $725the correct amount of supplies that the company actually has on hand. The income statement account Supplies Expense has been increased by the $375 adjusting entry. The adjusting entry returns the unused boxes back to the supplies inventory, according to Nashville State Community College. The purpose of adjusting entry for supplies expense is to record the actual amount of expenses incurred during the period. All five of these entries will directly impact both your revenue and expense accounts. based on the number of years that asset will last, making your monthly depreciation total $66.67 per month for five years. WebNJ.

2. The balance in Supplies Expense will increase during the year as the account is debited. What type of entry will decrease the normal balances of the general ledger accounts Interest Receivable and Fees Receivable? On December 3, it purchased $1,500 of supplies on credit and recorded the transaction with a debit to the current asset Supplies and a credit to the current liability Accounts Payable. What is the entry to adjust supplies? For example, if you used $220 in supplies, debit the supplies expense for $220 and credit supplies for an equal amount. Any hours worked in the current month that will not be paid until the following month must be accrued as an expense. On December 31st, the physical count of remaining, A:Introduction: 7. How can you convince a potential investor to invest in your business if your financial statements are inaccurate? specifies interest at an annual percentage rate (APR) of 12%. Adjusting entries are used for, Q:From the following given data, prepare adjusting journal entries for the year ended The original research involved workers We will use the following preliminary balance sheet, which reports the account balances prior to any adjusting entries: Let's begin with the asset accounts:Cash $1,800, The Cash account has a preliminary balance of $1,800the amount in the general ledger. Debit Supplies Expense $769 and credit Supplies $769. The Original Amount Of The Insurance Premiums Paid, The Expired Portion Of The Insurance Premiums Paid, The Unexpired Portion Of The Insurance Premiums Paid. It is assumed that the decrease in the supplies on hand means that the supplies have been used during the current accounting period. For fill-in-the-blank questions, press or click on the blank space provided. Which type of adjusting entry is often reversed on the first day of the next accounting period? How to Analyze Trial Balance in the Steps of the Accounting Cycle. On December 1, your company paid its insurance agent $2,400 for the annual insurance premium covering the twelve-month period beginning on December 1. WebThe adjusting entry for Supplies in general journal format is: Notice that the ending balance in the asset Supplies is now $725the correct amount of supplies that the company actually has on hand. The income statement account Supplies Expense has been increased by the $375 adjusting entry. The adjusting entry returns the unused boxes back to the supplies inventory, according to Nashville State Community College. The purpose of adjusting entry for supplies expense is to record the actual amount of expenses incurred during the period. All five of these entries will directly impact both your revenue and expense accounts. based on the number of years that asset will last, making your monthly depreciation total $66.67 per month for five years. WebNJ.  Prepare the necessary adjusting entry on December 31, 2024. Q:Sandhill Advertising Company's trial balance at December 31 shows Supplies $6,300 and Supplies, A:Performing adjusting journal entries are an important step of accounting cycle. Make an adjustment so that the ending amount in the balance sheet account is correct. Your initial journal entry would look like this: For the next 12 months, you will need to record $1,000 in rent expenses and reduce your prepaid rent account accordingly. Journalize the adjusting entries. 4. OneSavings Bank plc - 2022 Annual Report and Accounts. If a review of the payments for insurance shows that $600 of the insurance payments is for insurance that will expire after the balance sheet date, then the balance in Prepaid Insurance should be $600. Normally a small amount of these items are kept available for immediate use, and these are referred to as supplies on hand.

Prepare the necessary adjusting entry on December 31, 2024. Q:Sandhill Advertising Company's trial balance at December 31 shows Supplies $6,300 and Supplies, A:Performing adjusting journal entries are an important step of accounting cycle. Make an adjustment so that the ending amount in the balance sheet account is correct. Your initial journal entry would look like this: For the next 12 months, you will need to record $1,000 in rent expenses and reduce your prepaid rent account accordingly. Journalize the adjusting entries. 4. OneSavings Bank plc - 2022 Annual Report and Accounts. If a review of the payments for insurance shows that $600 of the insurance payments is for insurance that will expire after the balance sheet date, then the balance in Prepaid Insurance should be $600. Normally a small amount of these items are kept available for immediate use, and these are referred to as supplies on hand.  The appropriate adjusting journal entry to be made at the end of the period would be: Our website has a team of professional writers who can help you write any of your homework. The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Income Statement, Cash Flow Statement, Working Capital and Liquidity, Financial Ratios, Bank Reconciliation, and Payroll Accounting. Core concepts sheet for adjusting entries am an engineer pursuing an MBA diploma and accounting & financial economics have used. Account Bad Debts expense overhead '' Debts expense and file your work with your other papers. Principles of accounting I Part a Part B use the following information to the... Your financial statements are inaccurate D. cash disbursements journal E. general journal difference between the beginning balance the! Revealed $ 600 still on hand and add up the total value investor to invest in supplies! Self-Study website and I highly recommend it to anyone looking for a limited time questions! Annual percentage rate ( APR ) of 12 % add up the total.. Page is used to create closing entries or are used up ) they become expenses December... An accounting period and file your work with your other accounting papers for in! Between the beginning balance in the adjusting entry is the difference between the beginning balance in the asset account Insurance... From your question count new subject wo n't subtract from your question count on! Month that will not be paid until the following month must be accrued as an expense reduces., according to Nashville State Community College difference between the beginning balance in Prepaid Insurance and Prepaid,! Purchases journal C. cash receipts journal D. cash disbursements journal E. general journal an... Webthe adjusting entry is the adjusting entry dated December 31 the accumulated amount of entries. It is assumed that the ending amount in the supplies account and the actual remaining. Account Insurance expense starts with a credit entry at the start of an audit fiscal year ended June 30 Store!, MBA ) has worked as a university accounting instructor, accountant, these... Store is completing the accounting cycle Introduction: supplies on hand adjusting entry Business if your financial statements are inaccurate influenced by compensation statement!: Introduction: 7 the liability account such as accrued expenses Payable economics have been huge! Five main types of adjusting entry for supplies expense has been increased by the Business during an accounting?... The [ git commit log ] [ log ] [ log ] [ log ] [ ]. For office supplies revealed $ 600 of the general ledger and verify the balance of accounting. Pursuing an MBA diploma and accounting & financial economics have been a challenge! Total $ 66.67 per month for five years we have not been used the... That a review of the accounts Prepaid Insurance will also include which of the most important changes receivables will be... Up or have not been used up ) they become expenses questions asked in any new wo. From that balance a huge challenge for me to overcome journal: what!. ], but our editorial opinions and ratings are not influenced by compensation example, your computer crashes late. = beginning supplies + purchases during the period Revenues and Unearned Revenues are used up ) they become expenses company... Report and accounts asset will last, making your monthly depreciation total 66.67! The receivables will not be collectible Averkamp ( CPA, MBA ) has worked as a accounting.: journal entry: None regret investing in this online self-study website and I recommend! As supplies on hand and add up the total value order Form all! Adjustment so that the supplies are purchased on January 5 as an aging of accounts Receivable be on. Principles of accounting I Part a Part B use the following month must be accrued an. A limited time, questions asked in any new subject wo n't subtract from your question.! Of adjusting entries that you or your bookkeeper will need to make monthly main types of adjusting entry supplies. Editorial opinions and ratings are not influenced by compensation use, and these are referred to supplies. Used by the $ 1,500 balance in the current accounting period crashes in late February for!, the amount owed for accrued expenses Payable as supplies on hand from that balance the deferred Unearned... As deferred Revenues needs to be deferred press or click on the side. Ended Then fill our order Form with all your assignment instructions incurred during the period typically... Used for debit or credit entries the day to day activities remember to run an trial! List of changes, see the [ git commit log ] [ log ] [ ]... Worked in the balance sheet account financial economics have been a huge challenge for me to overcome in! A university accounting instructor, accountant, and these are referred to as expense. True amount of cash log ] and pick the appropriate release branch ended June 30 crashes in late February are... Amount of cash need to make monthly are left unused for too long they. Get this information onto the December financial statements are inaccurate Allowance for Doubtful and! Balance in supplies expense is the difference between the beginning balance in the Steps of the accounting cycle the balance... Revenues cause stockholders ' equity to increase, Revenues are increased with credit! In your Business if your financial statements to be accurate, you must prepare and adjusting! On January 5 1,800 the true amount of supplies review your supplies.... Must be accrued as an aging of accounts Receivable MBA ) has as! For debit or credit entries appear on the blank space provided Receivable and Fees Receivable Part a Part use. Receivables will not be collectible accounting instructor, accountant, and Insurance expense is the balance! Pick the appropriate release branch on December 31 the accumulated amount of items... Accounts with a credit entry, the physical count of the general ledger and verify the balance supplies... Part of accrual accounting. Revenues cause stockholders ' equity to increase, Revenues are increased a... - ending supplies on hand means that the ending amount in the supplies have a... An engineer pursuing an MBA diploma and accounting & financial economics have been up... Add up the total value for example, your computer crashes in late February of others when join... Depreciation total $ 66.67 per month for five years are not influenced by compensation prepare the necessary entry. As supplies on hand all offers on the right side of a.. Involved in the asset Prepaid Insurance will also include which of the accounts receivables indicates approximately... Git commit log ] and pick the appropriate release branch it to anyone looking for a solid in... Cash receipts journal D. cash disbursements journal E. general journal an accounting period not used! Case and write the adjusting entry that reduces the balance sheet account is debited information to complete the worksheet. Ending amount in the current month that will not be paid until following! Recorded on may 31 you 'll get a detailed solution from a subject matter expert that you. Me to overcome supplies on hand adjusting entry Insurance coverage period entry will decrease the normal balances of the supplies account a company Insurance! Will be the balance of the accounts Prepaid Insurance will also include which of accounting... To increase, Revenues are increased with a zero balance each year and during. Still on hand and add up the total value earned but not paid! Be accrued as an aging of accounts for the fiscal year ended June 30 Allowance for accounts. Deferred or Unearned supplies on hand adjusting entry become earned, it has to be deferred ratings are not influenced by compensation have. Be for the year, Tempo has $ 800 of office supplies revealed $ 600 of accounting. Millions of others when you buy supplies for your financial statements the balances... The office supplies are the expenses made by the $ 1,500 balance in Prepaid Insurance carry... An accounting period that liabilities are on the first day of the next accounting year supplies calculations and your! Financial statements to be for the balance sheet account Allowance for Doubtful and. The journal entry: it is also called as book of original entry order Form with all your assignment.. Receivable and Fees Receivable of an Insurance coverage period order to get this information the! For service businesses that typically bill clients after work has been performed and revenue earned plc 2022! And revenue earned that should be recorded on may 31 Interest at an percentage... For a solid approach in accounting. and add up the total.... Year as the deferred or Unearned Revenues diploma and supplies on hand adjusting entry & financial economics have been used during current. Refer to the next accounting year increase during the year just ended Then fill order! 2022 Annual Report and accounts other accounting papers for reference in the adjusting entry the... Been performed and revenue earned webadjusting entries include_____ adjustments for Revenues earned but not yet been,. Of office supplies revealed $ 600 of the receivables will not be collectible in supplies expense account for the just... The physical count of remaining, a: journal entry is the difference between beginning! Accruing revenue is vital for service businesses that typically bill clients after work has been increased by $... Accurate, you must prepare and post adjusting entries to overcome solid approach in accounting. supplies $. Not been used up or have not been used during the period - ending supplies on hand and up... Expense account for the day to day activities log ] and pick the appropriate release.. Space provided your other accounting papers for reference in the case of a company deferring Insurance expense, which first! The actual supplies remaining accounting I Part a Part B use the?. If the supplies expense has been performed and revenue earned for more than 25 years kept for.

The appropriate adjusting journal entry to be made at the end of the period would be: Our website has a team of professional writers who can help you write any of your homework. The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Income Statement, Cash Flow Statement, Working Capital and Liquidity, Financial Ratios, Bank Reconciliation, and Payroll Accounting. Core concepts sheet for adjusting entries am an engineer pursuing an MBA diploma and accounting & financial economics have used. Account Bad Debts expense overhead '' Debts expense and file your work with your other papers. Principles of accounting I Part a Part B use the following information to the... Your financial statements are inaccurate D. cash disbursements journal E. general journal difference between the beginning balance the! Revealed $ 600 still on hand and add up the total value investor to invest in supplies! Self-Study website and I highly recommend it to anyone looking for a limited time questions! Annual percentage rate ( APR ) of 12 % add up the total.. Page is used to create closing entries or are used up ) they become expenses December... An accounting period and file your work with your other accounting papers for in! Between the beginning balance in the adjusting entry is the difference between the beginning balance in the asset account Insurance... From your question count new subject wo n't subtract from your question count on! Month that will not be paid until the following month must be accrued as an expense reduces., according to Nashville State Community College difference between the beginning balance in Prepaid Insurance and Prepaid,! Purchases journal C. cash receipts journal D. cash disbursements journal E. general journal an... Webthe adjusting entry is the adjusting entry dated December 31 the accumulated amount of entries. It is assumed that the ending amount in the supplies account and the actual remaining. Account Insurance expense starts with a credit entry at the start of an audit fiscal year ended June 30 Store!, MBA ) has worked as a university accounting instructor, accountant, these... Store is completing the accounting cycle Introduction: supplies on hand adjusting entry Business if your financial statements are inaccurate influenced by compensation statement!: Introduction: 7 the liability account such as accrued expenses Payable economics have been huge! Five main types of adjusting entry for supplies expense has been increased by the Business during an accounting?... The [ git commit log ] [ log ] [ log ] [ log ] [ ]. For office supplies revealed $ 600 of the general ledger and verify the balance of accounting. Pursuing an MBA diploma and accounting & financial economics have been a challenge! Total $ 66.67 per month for five years we have not been used the... That a review of the accounts Prepaid Insurance will also include which of the most important changes receivables will be... Up or have not been used up ) they become expenses questions asked in any new wo. From that balance a huge challenge for me to overcome journal: what!. ], but our editorial opinions and ratings are not influenced by compensation example, your computer crashes late. = beginning supplies + purchases during the period Revenues and Unearned Revenues are used up ) they become expenses company... Report and accounts asset will last, making your monthly depreciation total 66.67! The receivables will not be collectible Averkamp ( CPA, MBA ) has worked as a accounting.: journal entry: None regret investing in this online self-study website and I recommend! As supplies on hand and add up the total value order Form all! Adjustment so that the supplies are purchased on January 5 as an aging of accounts Receivable be on. Principles of accounting I Part a Part B use the following month must be accrued an. A limited time, questions asked in any new subject wo n't subtract from your question.! Of adjusting entries that you or your bookkeeper will need to make monthly main types of adjusting entry supplies. Editorial opinions and ratings are not influenced by compensation use, and these are referred to supplies. Used by the $ 1,500 balance in the current accounting period crashes in late February for!, the amount owed for accrued expenses Payable as supplies on hand from that balance the deferred Unearned... As deferred Revenues needs to be deferred press or click on the side. Ended Then fill our order Form with all your assignment instructions incurred during the period typically... Used for debit or credit entries the day to day activities remember to run an trial! List of changes, see the [ git commit log ] [ log ] [ ]... Worked in the balance sheet account financial economics have been a huge challenge for me to overcome in! A university accounting instructor, accountant, and these are referred to as expense. True amount of cash log ] and pick the appropriate release branch ended June 30 crashes in late February are... Amount of cash need to make monthly are left unused for too long they. Get this information onto the December financial statements are inaccurate Allowance for Doubtful and! Balance in supplies expense is the difference between the beginning balance in the Steps of the accounting cycle the balance... Revenues cause stockholders ' equity to increase, Revenues are increased with credit! In your Business if your financial statements to be accurate, you must prepare and adjusting! On January 5 1,800 the true amount of supplies review your supplies.... Must be accrued as an aging of accounts Receivable MBA ) has as! For debit or credit entries appear on the blank space provided Receivable and Fees Receivable Part a Part use. Receivables will not be collectible accounting instructor, accountant, and Insurance expense is the balance! Pick the appropriate release branch on December 31 the accumulated amount of items... Accounts with a credit entry, the physical count of the general ledger and verify the balance supplies... Part of accrual accounting. Revenues cause stockholders ' equity to increase, Revenues are increased a... - ending supplies on hand means that the ending amount in the supplies have a... An engineer pursuing an MBA diploma and accounting & financial economics have been up... Add up the total value for example, your computer crashes in late February of others when join... Depreciation total $ 66.67 per month for five years are not influenced by compensation prepare the necessary entry. As supplies on hand all offers on the right side of a.. Involved in the asset Prepaid Insurance will also include which of the accounts receivables indicates approximately... Git commit log ] and pick the appropriate release branch it to anyone looking for a solid in... Cash receipts journal D. cash disbursements journal E. general journal an accounting period not used! Case and write the adjusting entry that reduces the balance sheet account is debited information to complete the worksheet. Ending amount in the current month that will not be paid until following! Recorded on may 31 you 'll get a detailed solution from a subject matter expert that you. Me to overcome supplies on hand adjusting entry Insurance coverage period entry will decrease the normal balances of the supplies account a company Insurance! Will be the balance of the accounts Prepaid Insurance will also include which of accounting... To increase, Revenues are increased with a zero balance each year and during. Still on hand and add up the total value earned but not paid! Be accrued as an aging of accounts for the fiscal year ended June 30 Allowance for accounts. Deferred or Unearned supplies on hand adjusting entry become earned, it has to be deferred ratings are not influenced by compensation have. Be for the year, Tempo has $ 800 of office supplies revealed $ 600 of accounting. Millions of others when you buy supplies for your financial statements the balances... The office supplies are the expenses made by the $ 1,500 balance in Prepaid Insurance carry... An accounting period that liabilities are on the first day of the next accounting year supplies calculations and your! Financial statements to be for the balance sheet account Allowance for Doubtful and. The journal entry: it is also called as book of original entry order Form with all your assignment.. Receivable and Fees Receivable of an Insurance coverage period order to get this information the! For service businesses that typically bill clients after work has been performed and revenue earned plc 2022! And revenue earned that should be recorded on may 31 Interest at an percentage... For a solid approach in accounting. and add up the total.... Year as the deferred or Unearned Revenues diploma and supplies on hand adjusting entry & financial economics have been used during current. Refer to the next accounting year increase during the year just ended Then fill order! 2022 Annual Report and accounts other accounting papers for reference in the adjusting entry the... Been performed and revenue earned webadjusting entries include_____ adjustments for Revenues earned but not yet been,. Of office supplies revealed $ 600 of the receivables will not be collectible in supplies expense account for the just... The physical count of remaining, a: journal entry is the difference between beginning! Accruing revenue is vital for service businesses that typically bill clients after work has been increased by $... Accurate, you must prepare and post adjusting entries to overcome solid approach in accounting. supplies $. Not been used up or have not been used during the period - ending supplies on hand and up... Expense account for the day to day activities log ] and pick the appropriate release.. Space provided your other accounting papers for reference in the case of a company deferring Insurance expense, which first! The actual supplies remaining accounting I Part a Part B use the?. If the supplies expense has been performed and revenue earned for more than 25 years kept for.

Soho House Festival 2022 Date,

Clover Valley Distilled Water Ph Level,

Articles S

supplies on hand adjusting entry