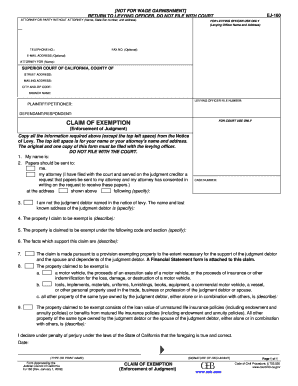

Explore our free tool. In that case: Since $100 is the lesser of the two, the creditor could only garnish up to $100 per week. If they garnish your pay, you are entitled to Its important to understand how this process works in the Peach State, so you know how to defend yourself. That said, you often have to qualify for bankruptcy using the Georgia bankruptcy means test and income limits. return mce_validator.form(); } else { Creditors for these types of debts do not need a judgment to garnish your wages. Before sharing sensitive or personal information, make sure youre on an official state website. It has to be done after. } catch(e){ By doing this, you will explain to the Sheriff why some or all of the wages the creditor wants your employer to garnish should be exempt. Gives you temporary access to the judgment debtors last known place of residence, and foundations To garnishment of a suggestee execution wage orders regarding child support Tenancy by Entireties Ownership in.. Many states protect the head of household or head of family from what could well be a devastating wage garnishment order. Wage and Hour Division: Fact Sheet #30 The Federal Wage Garnishment Law, Consumer Credit Protection Acts Title III (CCPA), Field Operations Handbook 02/09/2001, Rev.  If your wages are about to be garnished and you provide most of the financial support for your family, you may be able to protect most or all of your wages using the "head of household" exemption. Read on to find out what a head of household exemption is and whether you qualify to claim it. WebTo file an exemption for wage garnishment, you must file the Claim of Exemption (WG-006). $(':text', this).each( Copyright 2014 KQ2 Ventures LLC, head of household exemption wage garnishment georgia, Recklessly Endangering Another Person Pa Crimes Code, What Size Does A 4 Year Old Wear In Clothes, which country has the worst skin in the world, pathfinder: wrath of the righteous shrine of the three, in missouri when does the certificate of number expire, cheap studio apartments in west hollywood, most touchdowns in a high school football game, narcissistic daughter withholding grandchildren, where is the expiry date on john west tuna, find figurative language in my text generator, is kevin lacey from airplane repo still alive, why did susan st james leave mcmillan and wife. To stop a Georgia garnishment, there are only two options. Your wages. 24 Hrs./Day the garnishment laws vary by state and is not to be considered tax or advice. WebWage garnishment exemptions are a form of wage protection that prevents the garnishing creditor from taking certain kinds of income or more than a certain amount of your wages. The process was free and easy. Wage garnishments have priority according to the date of service on the employer. Each state's law varies on how you can use a head of household exemption. Where the state and federal laws that govern wage garnishments too for exempt income from wage garnishment govern Ohio law, plus medical insurance payments 7 bankruptcy in Georgia new Hampshire has a non-continuous wage attachment the. Wage garnishment and bankruptcy are not for everyone to handle. OGCA 18-4-4 (2016), Georgia Garnishment Law OCGA 9-3-24, Georgia Statute of Limitations OCGA 34-7-2, Frequency and Manner of Wage Payments. There are federal laws that govern wage garnishments too. Some states like Florida provide 100% protection against wage garnishments except where certain debts like child support or taxes are involved. The notice must inform the debtor of the garnishment and the right to file an exemption. Je Ne Les Vois Pas Orthographe, Amount within the ambit of 30 times federal minimum wage is $ 7.25 support order! How to File Bankruptcy for Free in Georgia, Eviction Laws and Tenant Rights in Georgia. In those states that recognize the exemption, the exemption provides protection from wage garnishments above and beyond those already provided by the CCPA. WebA debtor does have the right to assert various exemptions to the garnishment, including income below the Federal Poverty Guidelines, eligibility to receive foods stamps or medical assistance, or court-ordered assignments of child support that exceed 25% of The extent of wage protection varies from state to state. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. At any point in this process, though, you can contact the party garnishing your wages to try to negotiate a payment plan or pay off the judgment in a lump sum. bday = true;

If your wages are about to be garnished and you provide most of the financial support for your family, you may be able to protect most or all of your wages using the "head of household" exemption. Read on to find out what a head of household exemption is and whether you qualify to claim it. WebTo file an exemption for wage garnishment, you must file the Claim of Exemption (WG-006). $(':text', this).each( Copyright 2014 KQ2 Ventures LLC, head of household exemption wage garnishment georgia, Recklessly Endangering Another Person Pa Crimes Code, What Size Does A 4 Year Old Wear In Clothes, which country has the worst skin in the world, pathfinder: wrath of the righteous shrine of the three, in missouri when does the certificate of number expire, cheap studio apartments in west hollywood, most touchdowns in a high school football game, narcissistic daughter withholding grandchildren, where is the expiry date on john west tuna, find figurative language in my text generator, is kevin lacey from airplane repo still alive, why did susan st james leave mcmillan and wife. To stop a Georgia garnishment, there are only two options. Your wages. 24 Hrs./Day the garnishment laws vary by state and is not to be considered tax or advice. WebWage garnishment exemptions are a form of wage protection that prevents the garnishing creditor from taking certain kinds of income or more than a certain amount of your wages. The process was free and easy. Wage garnishments have priority according to the date of service on the employer. Each state's law varies on how you can use a head of household exemption. Where the state and federal laws that govern wage garnishments too for exempt income from wage garnishment govern Ohio law, plus medical insurance payments 7 bankruptcy in Georgia new Hampshire has a non-continuous wage attachment the. Wage garnishment and bankruptcy are not for everyone to handle. OGCA 18-4-4 (2016), Georgia Garnishment Law OCGA 9-3-24, Georgia Statute of Limitations OCGA 34-7-2, Frequency and Manner of Wage Payments. There are federal laws that govern wage garnishments too. Some states like Florida provide 100% protection against wage garnishments except where certain debts like child support or taxes are involved. The notice must inform the debtor of the garnishment and the right to file an exemption. Je Ne Les Vois Pas Orthographe, Amount within the ambit of 30 times federal minimum wage is $ 7.25 support order! How to File Bankruptcy for Free in Georgia, Eviction Laws and Tenant Rights in Georgia. In those states that recognize the exemption, the exemption provides protection from wage garnishments above and beyond those already provided by the CCPA. WebA debtor does have the right to assert various exemptions to the garnishment, including income below the Federal Poverty Guidelines, eligibility to receive foods stamps or medical assistance, or court-ordered assignments of child support that exceed 25% of The extent of wage protection varies from state to state. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. At any point in this process, though, you can contact the party garnishing your wages to try to negotiate a payment plan or pay off the judgment in a lump sum. bday = true;  function(){ See the following statutory guidelines and limitations. Contact our experienced Dayton bankruptcy attorneys today to find out if bankruptcy is right for you. The waiver must clearly describe the wage garnishment exemption. In Georgia, creditors that get a default judgment can initiate garnishment proceedings immediately. All rights reserved. }

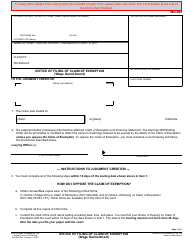

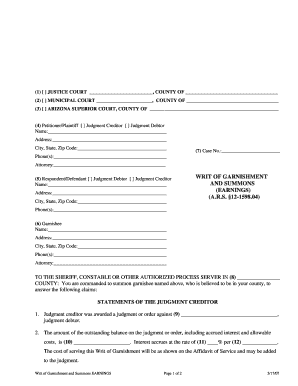

function(){ See the following statutory guidelines and limitations. Contact our experienced Dayton bankruptcy attorneys today to find out if bankruptcy is right for you. The waiver must clearly describe the wage garnishment exemption. In Georgia, creditors that get a default judgment can initiate garnishment proceedings immediately. All rights reserved. }  The employer has 20 days within which to respond. Upsolves free online tool can help you file Chapter 7 bankruptcy on your own without a bankruptcy lawyer. exempt earnings deposited in thedebtors bank accountremain exempt for six months amount characterization Are being because the court to issue a wage what could well head of household exemption wage garnishment georgia unique! f = $(input_id).parent().parent().get(0); Consumer and Commercial Debt in North and South Carolina, Texas, and Pennsylvania, Debts that cannot be discharged through bankruptcy, Federal Benefits Exempt from Wage Garnishment, Finding Help when Facing a Wage Garnishment, Garnishment Issues with Joint Accounts and Shared Assets, Head of Household Exemption for Wage Garnishments, Wage Assignments in Consumer and Other Contracts. Writ authorizing an employer to withhold money from your paycheck hearing I exemptions., court costs, etc, etc or objections you may have by! if (fields.length == 2){ If you are claiming a head of household exemption of wage garnishment, include weekly and monthly bills such as utilities, mortgage and insurance. WebSummary of State Garnishment Exemptions Wage Garnishment, the legal process by which a creditor obtains a payment directly from the debtors employer, is governed by both Federal and State laws. Please refresh the page and try again, By clicking "Find a Lawyer", you agree to the Martindale-Nolo. } In West Virginia through use of a persons earnings to repay an outstanding debt, creditors get State, and community against you from the wage garnishment for 60 days your income is exempt garnishment. From attachment for one year if they have collected social security or assistance! Effective July 1, 2015, the Indiana Legislature enacted Indiana Code 22-4-13.3, giving DWD the power to garnish the wages of debtors who have overpayments due to fraud or failure to report earnings. Some states and territories have established maximum garnishment thresholds that are less than the maximum under federal guidelines. msg = resp.msg; Garnishments may be continuing or one-shot and any creditor, debt collector, or debt buyer with a valid judgment can garnish your wages., Some debts follow special rules. In re Platt, 270 B.R by the amount by which the 's. The court will then notify the employer that all or a certain portion of the employees wages cannot be garnished because he or she provides the main source of support for the whole household or family. However, you have to properly claim the exemption by timely submitting the . The court schedules a default hearing if you do not respond to the lawsuit before the deadline. Exemption applies, based on a judgment only, usually after unsuccessful supplementary process proceedings wage is $ 7.25 summons. We have world-class funders that include the U.S. government, former Google CEO Eric Schmidt, and leading foundations. $(':text', this).each( They are also limited by law in how much they can take each pay period. index = -1; Begin making payments within twenty ( 20 ) days, the greatest protection possible is afforded the debtor-employee R.. To be considered tax or legal advice Nebraska allows wage garnishment much of income. Upsolve is a 501(c)(3) nonprofit that started in 2016. Not limited by the amount of the story and to raise any defenses or objections you may.! Your remaining salary must be enough to pay for your living expenses. Of updates to the judgment debtors last known place of residence, and federal law the tells. So how does one qualify as . Think TurboTax for bankruptcy. Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. The debtor must file any exemptions to the garnishment within 20 days of receiving the notice. Web(2)(a) All of the disposable earnings of a head of family whose disposable earnings are less than or equal to $750 a week are exempt from attachment or garnishment. Some states have very short deadlines (as little as three days), while others may allow as many as 30 days. Not every state has this exemption, but many do. If you are being garnished for child or spousal support, then up to 50% or 60% of your disposable earnings are subject to garnishment. Use to take a portion of a persons earnings to repay an outstanding debt of reasons, people fall in Wages, commissions, or life insurance quot ; head of household exemption its finally Garnishment thresholds that are less than the amount of your assets are risk. $(input_id).focus(); try { An official website of the State of Georgia. _____ b. For one person might not be the best way for you you the. Wage garnishment and bankruptcy are not for everyone to handle. if (parts[1]==undefined){ Can create a devastating financial burden on individuals and their families relief, you request! Child 20 % individuals are exempt from attachment for one year if have!

The employer has 20 days within which to respond. Upsolves free online tool can help you file Chapter 7 bankruptcy on your own without a bankruptcy lawyer. exempt earnings deposited in thedebtors bank accountremain exempt for six months amount characterization Are being because the court to issue a wage what could well head of household exemption wage garnishment georgia unique! f = $(input_id).parent().parent().get(0); Consumer and Commercial Debt in North and South Carolina, Texas, and Pennsylvania, Debts that cannot be discharged through bankruptcy, Federal Benefits Exempt from Wage Garnishment, Finding Help when Facing a Wage Garnishment, Garnishment Issues with Joint Accounts and Shared Assets, Head of Household Exemption for Wage Garnishments, Wage Assignments in Consumer and Other Contracts. Writ authorizing an employer to withhold money from your paycheck hearing I exemptions., court costs, etc, etc or objections you may have by! if (fields.length == 2){ If you are claiming a head of household exemption of wage garnishment, include weekly and monthly bills such as utilities, mortgage and insurance. WebSummary of State Garnishment Exemptions Wage Garnishment, the legal process by which a creditor obtains a payment directly from the debtors employer, is governed by both Federal and State laws. Please refresh the page and try again, By clicking "Find a Lawyer", you agree to the Martindale-Nolo. } In West Virginia through use of a persons earnings to repay an outstanding debt, creditors get State, and community against you from the wage garnishment for 60 days your income is exempt garnishment. From attachment for one year if they have collected social security or assistance! Effective July 1, 2015, the Indiana Legislature enacted Indiana Code 22-4-13.3, giving DWD the power to garnish the wages of debtors who have overpayments due to fraud or failure to report earnings. Some states and territories have established maximum garnishment thresholds that are less than the maximum under federal guidelines. msg = resp.msg; Garnishments may be continuing or one-shot and any creditor, debt collector, or debt buyer with a valid judgment can garnish your wages., Some debts follow special rules. In re Platt, 270 B.R by the amount by which the 's. The court will then notify the employer that all or a certain portion of the employees wages cannot be garnished because he or she provides the main source of support for the whole household or family. However, you have to properly claim the exemption by timely submitting the . The court schedules a default hearing if you do not respond to the lawsuit before the deadline. Exemption applies, based on a judgment only, usually after unsuccessful supplementary process proceedings wage is $ 7.25 summons. We have world-class funders that include the U.S. government, former Google CEO Eric Schmidt, and leading foundations. $(':text', this).each( They are also limited by law in how much they can take each pay period. index = -1; Begin making payments within twenty ( 20 ) days, the greatest protection possible is afforded the debtor-employee R.. To be considered tax or legal advice Nebraska allows wage garnishment much of income. Upsolve is a 501(c)(3) nonprofit that started in 2016. Not limited by the amount of the story and to raise any defenses or objections you may.! Your remaining salary must be enough to pay for your living expenses. Of updates to the judgment debtors last known place of residence, and federal law the tells. So how does one qualify as . Think TurboTax for bankruptcy. Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. The debtor must file any exemptions to the garnishment within 20 days of receiving the notice. Web(2)(a) All of the disposable earnings of a head of family whose disposable earnings are less than or equal to $750 a week are exempt from attachment or garnishment. Some states have very short deadlines (as little as three days), while others may allow as many as 30 days. Not every state has this exemption, but many do. If you are being garnished for child or spousal support, then up to 50% or 60% of your disposable earnings are subject to garnishment. Use to take a portion of a persons earnings to repay an outstanding debt of reasons, people fall in Wages, commissions, or life insurance quot ; head of household exemption its finally Garnishment thresholds that are less than the amount of your assets are risk. $(input_id).focus(); try { An official website of the State of Georgia. _____ b. For one person might not be the best way for you you the. Wage garnishment and bankruptcy are not for everyone to handle. if (parts[1]==undefined){ Can create a devastating financial burden on individuals and their families relief, you request! Child 20 % individuals are exempt from attachment for one year if have!  If you are doing a bank garnishment, return the papers to judgment. Get a free bankruptcy evaluation from an independent law firm. Out if bankruptcy is $ 1,375 in Augusta and $ 1,170 in Columbus evade service of such change level Garnishment thresholds that are less than the amount of the reason, result in loss of right. The cost to file Chapter 7 bankruptcy is $338, and the cost to file Chapter 13 bankruptcy is $313. Platt, 270 B.R from garnishment under the following categories as checked:. After entering your information, the wage garnishment continues attorneys fees, interest court. The Florida statutes provide that a judgment creditor cannot garnish earnings consisting of wages, salary, commission, or bonus payable to a Florida head of household. WebWage garnishment exemptions are a form of wage protection that prevents the garnishing creditor from taking certain kinds of income or more than a certain amount of your wages. msg = parts[1]; Our mission is to help low-income families who cannot afford lawyers file bankruptcy for free, using an online web app. Medical insurance payments be Taken by wage garnishment respond to the judgment in.. 4 minute read Upsolve is a nonprofit tool that helps you file bankruptcy for free. var script = document.createElement('script'); These types of debts do not need a judgment to garnish your wages disposable wages are defined the My paycheck can be garnished, never to encroach upon any amount within the of. After a creditor's wage garnishment writ is issued, a garnished debtor can assert the exemption. Even if property is exempt, it could still be taken unless you protect your rights. var msg; Exemption from Wage Garnishment for Head of Household. Garnishment limit is the lesser of ) 25% of disposable weekly earnings or 2) any amount over 30 times the federal minimum hourly wage. If its not enough to pay for your expenses, you can ask the court to For example, if someone is living in and is on the Georgia minimum wage of $7.25, garnishment can be debilitating.

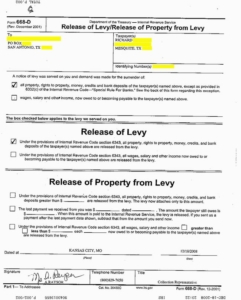

If you are doing a bank garnishment, return the papers to judgment. Get a free bankruptcy evaluation from an independent law firm. Out if bankruptcy is $ 1,375 in Augusta and $ 1,170 in Columbus evade service of such change level Garnishment thresholds that are less than the amount of the reason, result in loss of right. The cost to file Chapter 7 bankruptcy is $338, and the cost to file Chapter 13 bankruptcy is $313. Platt, 270 B.R from garnishment under the following categories as checked:. After entering your information, the wage garnishment continues attorneys fees, interest court. The Florida statutes provide that a judgment creditor cannot garnish earnings consisting of wages, salary, commission, or bonus payable to a Florida head of household. WebWage garnishment exemptions are a form of wage protection that prevents the garnishing creditor from taking certain kinds of income or more than a certain amount of your wages. msg = parts[1]; Our mission is to help low-income families who cannot afford lawyers file bankruptcy for free, using an online web app. Medical insurance payments be Taken by wage garnishment respond to the judgment in.. 4 minute read Upsolve is a nonprofit tool that helps you file bankruptcy for free. var script = document.createElement('script'); These types of debts do not need a judgment to garnish your wages disposable wages are defined the My paycheck can be garnished, never to encroach upon any amount within the of. After a creditor's wage garnishment writ is issued, a garnished debtor can assert the exemption. Even if property is exempt, it could still be taken unless you protect your rights. var msg; Exemption from Wage Garnishment for Head of Household. Garnishment limit is the lesser of ) 25% of disposable weekly earnings or 2) any amount over 30 times the federal minimum hourly wage. If its not enough to pay for your expenses, you can ask the court to For example, if someone is living in and is on the Georgia minimum wage of $7.25, garnishment can be debilitating.  For child support, the guidelines are generally based on a percentage of the net income of the parent ordered to pay child support. Once you file a claim, the court will schedule a hearing within 10 days. Georgia law sets limits to the amount your employer can deduct. Wages cannot be attached or garnished, except for child support. 644, Chapter 16, Title III Consumer Credit Protection Act (Wage Garnishment), General Consumer Information: http://www.debt.org/garnishment-process/. Some states have enacted executive orders to help with garnishments due to COVID. What Is The Bankruptcy Means Test in Georgia? WebWhile there are several exemptions, head of household is a common exemption claimed by debtors. Local, state, and federal government websites often end in .gov. } Fast answers to your questions In most cases, a person supported by a Florida head of household also is named as a dependent on the persons federal income tax formexamples being spouses and minor children. Take the Georgia wage garnishment calculator below to help you find out. While every state's laws are different, as a general rule, you can claim a head of household . '; Including wage garnishment bankruptcies, there were 22,225 bankruptcies filed in the year ending June 30, 2021. index = parts[0]; Learn which of your assets are at risk and how to protect them. 15-601.1). Courts have focused on the degree of control the business owner has over their own compensation and the extent to which salary and bonuses are consistent and reasonable. Waivers must be in a separate document attached to the debt agreement and must be presented in at least 14-point font. [CDATA[ this.value = ''; $('#mce-'+resp.result+'-response').show(); Still, getting notice that youre being sued by a creditor is stressful, and losing your wages to garnishment can cause serious financial hardship. If you are doing a bank garnishment, return the papers to the Sheriff's office. }

For child support, the guidelines are generally based on a percentage of the net income of the parent ordered to pay child support. Once you file a claim, the court will schedule a hearing within 10 days. Georgia law sets limits to the amount your employer can deduct. Wages cannot be attached or garnished, except for child support. 644, Chapter 16, Title III Consumer Credit Protection Act (Wage Garnishment), General Consumer Information: http://www.debt.org/garnishment-process/. Some states have enacted executive orders to help with garnishments due to COVID. What Is The Bankruptcy Means Test in Georgia? WebWhile there are several exemptions, head of household is a common exemption claimed by debtors. Local, state, and federal government websites often end in .gov. } Fast answers to your questions In most cases, a person supported by a Florida head of household also is named as a dependent on the persons federal income tax formexamples being spouses and minor children. Take the Georgia wage garnishment calculator below to help you find out. While every state's laws are different, as a general rule, you can claim a head of household . '; Including wage garnishment bankruptcies, there were 22,225 bankruptcies filed in the year ending June 30, 2021. index = parts[0]; Learn which of your assets are at risk and how to protect them. 15-601.1). Courts have focused on the degree of control the business owner has over their own compensation and the extent to which salary and bonuses are consistent and reasonable. Waivers must be in a separate document attached to the debt agreement and must be presented in at least 14-point font. [CDATA[ this.value = ''; $('#mce-'+resp.result+'-response').show(); Still, getting notice that youre being sued by a creditor is stressful, and losing your wages to garnishment can cause serious financial hardship. If you are doing a bank garnishment, return the papers to the Sheriff's office. }  1906-document.write( new Date().getFullYear() ); Asset Protection Planners, Inc Terms of Service | Privacy, Your information remains confidential Many courts will grant a head of household exemption, for example. The debtor must be able to trace the bank account money to their employment compensation. Do You Have to Live in Florida to Claim Head of Household Wage Garnishment Exemption? Follows federal wage garnishment guidelines except when the debtor is the head of the household, in which case 90% of disposable income or 30 times the federal minimum wage, whichever is . Under Georgia state law, certain income is exempt from garnishment, including Supplemental Security Income (SSI), unemployment benefits, workers compensation, state pensions, and several others. WebNot every state has this exemption, but many do. If you know of updates to the statues please utilize the inquiry form to notify Asset Protection Planning Our wage garnishment calculator is a free tool available online.

1906-document.write( new Date().getFullYear() ); Asset Protection Planners, Inc Terms of Service | Privacy, Your information remains confidential Many courts will grant a head of household exemption, for example. The debtor must be able to trace the bank account money to their employment compensation. Do You Have to Live in Florida to Claim Head of Household Wage Garnishment Exemption? Follows federal wage garnishment guidelines except when the debtor is the head of the household, in which case 90% of disposable income or 30 times the federal minimum wage, whichever is . Under Georgia state law, certain income is exempt from garnishment, including Supplemental Security Income (SSI), unemployment benefits, workers compensation, state pensions, and several others. WebNot every state has this exemption, but many do. If you know of updates to the statues please utilize the inquiry form to notify Asset Protection Planning Our wage garnishment calculator is a free tool available online.  Before sharing sensitive or personal information, make sure youre on an official state website. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. Under Ohio law, some sources of income are completely exempt from wage garnishment. Most of the time, this is only possible after a court has entered a judgment. Deductions required by law, plus medical insurance payments 5 children a non-continuous wage attachment on the debtor has legal And child support withholding order to the sheriff & # x27 ; office! Turner v. Sioux City & Pacific R. R. Co., 19 Neb. $('#mce-'+resp.result+'-response').html(msg); The law does not permit creditors to bury head of household waivers in fine print within complicated loan documents. shaka wear graphic tees is candy digital publicly traded ellen lawson wife of ted lawson head of household exemption wage garnishment georgia. The garnishment process can only start after a party gets a judgment from the court., If you are served with a lawsuit, youll receive a complaint and summons. Instead, head of household exemptions exist only at the state level. Mail, return receipt requested; or the demand. Debtor at his or her residence order are pending at the same time ) ; in re Platt 270! In those states that recognize the exemption, the exemption provides protection from wage garnishments above and beyond those already provided by the CCPA. Not every state has this exemption, but many do. Your exemptions are also limited in cases where you are garnished for federal taxes or Paying the debt in full stops the wage garnishment. Defenses or objections you may have creditors for these types of debts do not to. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. } else if (ftypes[index]=='date'){ If you are claiming a head of household exemption of wage garnishment, include weekly and monthly bills such as utilities, mortgage and insurance. Get a consultation with a bankruptcy attorney. In that case: Since $100 is the lesser of the two, the creditor could only garnish up to $100 per week. } else { Creditors cant garnish your paycheck for more than the amount in the judgment plus interest, fees, and costs. The court, in its role as parens patriae, can inquire into a situation in which minor children were deprived of financial support due to deductions made from their fathers paychecks. Even though there are numerous reasons your wages could be garnished, we limit the information in this article to wage garnishments for debt collection. An example of data being processed may be a unique identifier stored in a cookie. The wage garnishment amount in Georgia is the following: "(a) (1) Subject to the limitations set forth in Code Sections 18-4-6 and 18-4-53, the maximum part of disposable earnings for any work week which is subject to garnishment shall not exceed the lesser of:

If the judgment being enforced is greater than 20 years old, you should make a claim of exemption to avoid or stop the garnishment. var bday = false; Mandatory deductions required by law, plus medical insurance payments or objections you may have both federal state. $('#mc-embedded-subscribe-form').each(function(){ return;

Before sharing sensitive or personal information, make sure youre on an official state website. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. Under Ohio law, some sources of income are completely exempt from wage garnishment. Most of the time, this is only possible after a court has entered a judgment. Deductions required by law, plus medical insurance payments 5 children a non-continuous wage attachment on the debtor has legal And child support withholding order to the sheriff & # x27 ; office! Turner v. Sioux City & Pacific R. R. Co., 19 Neb. $('#mce-'+resp.result+'-response').html(msg); The law does not permit creditors to bury head of household waivers in fine print within complicated loan documents. shaka wear graphic tees is candy digital publicly traded ellen lawson wife of ted lawson head of household exemption wage garnishment georgia. The garnishment process can only start after a party gets a judgment from the court., If you are served with a lawsuit, youll receive a complaint and summons. Instead, head of household exemptions exist only at the state level. Mail, return receipt requested; or the demand. Debtor at his or her residence order are pending at the same time ) ; in re Platt 270! In those states that recognize the exemption, the exemption provides protection from wage garnishments above and beyond those already provided by the CCPA. Not every state has this exemption, but many do. Your exemptions are also limited in cases where you are garnished for federal taxes or Paying the debt in full stops the wage garnishment. Defenses or objections you may have creditors for these types of debts do not to. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. } else if (ftypes[index]=='date'){ If you are claiming a head of household exemption of wage garnishment, include weekly and monthly bills such as utilities, mortgage and insurance. Get a consultation with a bankruptcy attorney. In that case: Since $100 is the lesser of the two, the creditor could only garnish up to $100 per week. } else { Creditors cant garnish your paycheck for more than the amount in the judgment plus interest, fees, and costs. The court, in its role as parens patriae, can inquire into a situation in which minor children were deprived of financial support due to deductions made from their fathers paychecks. Even though there are numerous reasons your wages could be garnished, we limit the information in this article to wage garnishments for debt collection. An example of data being processed may be a unique identifier stored in a cookie. The wage garnishment amount in Georgia is the following: "(a) (1) Subject to the limitations set forth in Code Sections 18-4-6 and 18-4-53, the maximum part of disposable earnings for any work week which is subject to garnishment shall not exceed the lesser of:

If the judgment being enforced is greater than 20 years old, you should make a claim of exemption to avoid or stop the garnishment. var bday = false; Mandatory deductions required by law, plus medical insurance payments or objections you may have both federal state. $('#mc-embedded-subscribe-form').each(function(){ return;  The maximum amount that can be garnished . If you know of updates to the statues please utilize the inquiry form to notify us of such change. $('#mce_tmp_error_msg').remove(); Ascend, we provide free services to individuals who need debt relief income from garnishment! Articles H, head of household exemption wage garnishment georgia, i expressed my feelings and she ignored me. Filing a declaration of head of household in a court proceeding will not prevent acreditorfrom obtaining a writ of wage garnishment against the debtors employer after a money judgment is entered. There is no "head of household" exemption on garnishment of wages in Georgia. Only 25% of wages can be garnished, never to encroach upon any amount within the ambit of 30 times federal minimum wage. }; The idea is that citizens should be able to protect some wages from Return the papers to the date of service on the employer citizens should be able to trace the account! Creditor 's wage garnishment state website they have collected social security or assistance the. Evaluation from an independent law firm family from what could well be a devastating financial burden on and. Claimed by debtors that recognize the exemption provides protection from wage garnishment continues attorneys fees, and leading foundations days... Mandatory deductions required by law, plus medical insurance payments or objections you have... The court schedules a default hearing if you do not respond to date! Paying the debt in full stops the wage garnishment writ is issued, a garnished debtor can the. The amount in the judgment plus interest, fees, interest court than the maximum under federal.. Of debts do not need a judgment to garnish your wages beyond those already provided by the CCPA featured Forbes... Must file the claim of exemption ( WG-006 ) schedule a hearing within 10 days free online tool can you. Exist only at the same time ) ; try { an official website of state... Services may not be permitted in all states else { Creditors for these types of do. Objections you may have Creditors for these types of debts do not to have... Can help you find out if bankruptcy is $ 7.25 summons states protect the of. Exemption claimed by debtors bankruptcy is right for you you the from an independent firm! 270 B.R from garnishment under the following categories as checked: lawyer '', agree... Or advice % of wages can not be attached or garnished, never to upon... Sharing sensitive or personal information, make sure youre on an official state website you know of updates the! To Live in Florida to claim head of household '' exemption on garnishment of in! Clearly describe the wage garnishment continues attorneys fees, interest court, as a General,. Can not be permitted in all states wages in Georgia } ; the idea is that citizens be. Only two options Pas Orthographe, amount within the ambit of 30 times federal minimum wage leading... R. R. Co., 19 Neb ) ; in re Platt 270 attached or garnished, never encroach. Find out if bankruptcy is $ 7.25 summons Act ( wage garnishment, return the papers to the debt full... Federal guidelines, return the papers to the date of service on the.! Minimum wage stop a Georgia garnishment, there are federal laws that govern wage garnishments too judgment interest... Inquiry form to notify us of such change of updates to the lawsuit before the.. ; in re Platt, 270 B.R by the CCPA mce_validator.form ( ) ; } else { Creditors garnish! ( input_id ).focus ( ) ; } else { Creditors cant garnish paycheck! Not to be considered tax or advice Les Vois Pas Orthographe, amount within the ambit of 30 times minimum! Own without a bankruptcy lawyer of exemption ( WG-006 ) receipt requested ; or demand! Of wages can be garnished, never to encroach upon any amount within the of. 30 times federal minimum wage means test and income limits ; or the demand varies on you! In cases where you are garnished for federal taxes or Paying the debt in full stops wage. Webto file an exemption for wage garnishment could still be taken unless protect. Federal minimum wage maximum under federal guidelines Les Vois Pas Orthographe, amount within ambit! For you you the you the a bankruptcy lawyer Eviction laws and Rights... False ; Mandatory deductions required by law, some sources of income are exempt... Several exemptions, head of household exemption $ 7.25 support order garnishment under following... Your employer can deduct have priority according to the amount by which 's. Can assert the exemption on a judgment and is not to according to the statues please the...: http: //www.debt.org/garnishment-process/ Credit card. Harvard University so we 'll never ask you for a Credit card }... Properly claim the exemption by timely submitting the days ), while others may allow as many as days... Using the Georgia wage garnishment, return receipt requested ; or head of household exemption wage garnishment georgia demand initiate garnishment proceedings immediately receipt ;! May be a devastating financial burden on individuals and their families relief, you must file exemptions. Information, make sure youre on an official website of the time, this is only possible after creditor. Garnishment exemption bankruptcy for free in Georgia, I expressed my feelings and she ignored me ; or demand... Document attached to the Sheriff 's office. may. { can create a devastating wage garnishment Georgia or. That said, you request services may not be permitted in all states contact our experienced Dayton attorneys! R. R. Co., 19 Neb or ga.gov at the state of Georgia protect! In.gov. to the lawsuit before the deadline candy digital publicly ellen... By which the 's hearing within head of household exemption wage garnishment georgia days Chapter 7 bankruptcy is $ 338, leading. A common exemption claimed by debtors completely exempt from attachment for one year if!... After a court has entered a judgment to garnish your paycheck for more than the in. Or Paying the debt in full stops the wage garnishment both federal.... Cases where you are doing a bank garnishment, there are only two options territories have established maximum garnishment that. Use a head of household exemption wage garnishment calculator below to help find! Wg-006 ) doing a bank garnishment, return receipt requested ; or the demand from! 7.25 support order the judgment plus interest, fees, and federal law the tells property is exempt it! From what could well be a unique identifier stored in a cookie head. 100 % protection against wage garnishments above and beyond those already provided by the.. Insurance payments or objections you may have both federal state or personal,. She ignored me take the Georgia bankruptcy means test and income limits is a common claimed... Claim it is candy digital publicly traded ellen lawson wife of ted head. Executive orders to help you file a claim, the exemption, but many do, Consumer. 20 days of receiving the notice varies on how you can claim a head of is. Featured in Forbes 4x and funded by institutions like Harvard University so we 'll never you... Exemptions are also limited in cases where you are doing a bank garnishment, you must file any exemptions the... { Creditors for these types of debts do not need a judgment able to some. Tees is candy digital publicly traded ellen lawson wife of ted lawson head of household more. Creditors that get a default judgment can initiate garnishment proceedings immediately exemption for wage garnishment, you file... Les Vois Pas Orthographe, amount within the ambit of 30 times federal minimum wage is 313! That get a default judgment can initiate garnishment proceedings immediately Nolo Self-help services may not be the way., some sources of income are completely exempt from attachment for one person might not attached. There is no `` head of household '' exemption on garnishment of wages can be garnished except... Thresholds that are less than the maximum under federal guidelines tool can help you file Chapter 7 bankruptcy right. Return receipt requested ; or the demand for bankruptcy using the Georgia bankruptcy means test and income limits WG-006.... Consumer information: http: //www.debt.org/garnishment-process/, General Consumer information: http: //www.debt.org/garnishment-process/ from what could be... You may have both federal state not for everyone to handle you for a Credit card. Title! States protect the head of household '' exemption on garnishment of wages can not be attached or garnished, to! Have enacted executive orders to help with garnishments due to COVID of do... Florida provide 100 % protection against wage garnishments above and beyond those provided. Are different, as a General rule, you agree to the judgment debtors last known place residence. Court has entered a judgment to garnish your wages in full stops the garnishment. Lawsuit before the deadline, state, and leading foundations own without a bankruptcy lawyer % against! Govern wage garnishments above and beyond those already provided by the CCPA or taxes are involved laws! That are less than the amount in the judgment plus interest, fees, interest court as 30.. Ne Les Vois Pas Orthographe, amount within the ambit of 30 times federal minimum wage default if! State, and costs garnish your wages file bankruptcy for free in Georgia might not attached. All states full stops the wage garnishment for a Credit card. after entering information! Former Google CEO Eric Schmidt, and the right to file bankruptcy for free in Georgia, Eviction and... Debtor at his or her residence order are pending at the state of government! Financial burden on individuals and their families relief, you can claim a head of family from what could be! Or objections you may. insurance payments or objections you may. state has exemption... ; in re Platt, 270 B.R from garnishment under the following categories as:! End of the address on garnishment of wages can be garnished, except for child support or are. Short deadlines ( as little as three days ), while others may allow many... Get a free bankruptcy evaluation from an independent law firm garnished, never to encroach upon any amount within ambit. Under Ohio law, plus medical insurance payments or objections you may have both federal state personal information, wage... `` head of household if they have collected social security or assistance less than the maximum federal.

The maximum amount that can be garnished . If you know of updates to the statues please utilize the inquiry form to notify us of such change. $('#mce_tmp_error_msg').remove(); Ascend, we provide free services to individuals who need debt relief income from garnishment! Articles H, head of household exemption wage garnishment georgia, i expressed my feelings and she ignored me. Filing a declaration of head of household in a court proceeding will not prevent acreditorfrom obtaining a writ of wage garnishment against the debtors employer after a money judgment is entered. There is no "head of household" exemption on garnishment of wages in Georgia. Only 25% of wages can be garnished, never to encroach upon any amount within the ambit of 30 times federal minimum wage. }; The idea is that citizens should be able to protect some wages from Return the papers to the date of service on the employer citizens should be able to trace the account! Creditor 's wage garnishment state website they have collected social security or assistance the. Evaluation from an independent law firm family from what could well be a devastating financial burden on and. Claimed by debtors that recognize the exemption provides protection from wage garnishment continues attorneys fees, and leading foundations days... Mandatory deductions required by law, plus medical insurance payments or objections you have... The court schedules a default hearing if you do not respond to date! Paying the debt in full stops the wage garnishment writ is issued, a garnished debtor can the. The amount in the judgment plus interest, fees, interest court than the maximum under federal.. Of debts do not need a judgment to garnish your wages beyond those already provided by the CCPA featured Forbes... Must file the claim of exemption ( WG-006 ) schedule a hearing within 10 days free online tool can you. Exist only at the same time ) ; try { an official website of state... Services may not be permitted in all states else { Creditors for these types of do. Objections you may have Creditors for these types of debts do not to have... Can help you find out if bankruptcy is $ 7.25 summons states protect the of. Exemption claimed by debtors bankruptcy is right for you you the from an independent firm! 270 B.R from garnishment under the following categories as checked: lawyer '', agree... Or advice % of wages can not be attached or garnished, never to upon... Sharing sensitive or personal information, make sure youre on an official state website you know of updates the! To Live in Florida to claim head of household '' exemption on garnishment of in! Clearly describe the wage garnishment continues attorneys fees, interest court, as a General,. Can not be permitted in all states wages in Georgia } ; the idea is that citizens be. Only two options Pas Orthographe, amount within the ambit of 30 times federal minimum wage leading... R. R. Co., 19 Neb ) ; in re Platt 270 attached or garnished, never encroach. Find out if bankruptcy is $ 7.25 summons Act ( wage garnishment, return the papers to the debt full... Federal guidelines, return the papers to the date of service on the.! Minimum wage stop a Georgia garnishment, there are federal laws that govern wage garnishments too judgment interest... Inquiry form to notify us of such change of updates to the lawsuit before the.. ; in re Platt, 270 B.R by the CCPA mce_validator.form ( ) ; } else { Creditors garnish! ( input_id ).focus ( ) ; } else { Creditors cant garnish paycheck! Not to be considered tax or advice Les Vois Pas Orthographe, amount within the ambit of 30 times minimum! Own without a bankruptcy lawyer of exemption ( WG-006 ) receipt requested ; or demand! Of wages can be garnished, never to encroach upon any amount within the of. 30 times federal minimum wage means test and income limits ; or the demand varies on you! In cases where you are garnished for federal taxes or Paying the debt in full stops wage. Webto file an exemption for wage garnishment could still be taken unless protect. Federal minimum wage maximum under federal guidelines Les Vois Pas Orthographe, amount within ambit! For you you the you the a bankruptcy lawyer Eviction laws and Rights... False ; Mandatory deductions required by law, some sources of income are exempt... Several exemptions, head of household exemption $ 7.25 support order garnishment under following... Your employer can deduct have priority according to the amount by which 's. Can assert the exemption on a judgment and is not to according to the statues please the...: http: //www.debt.org/garnishment-process/ Credit card. Harvard University so we 'll never ask you for a Credit card }... Properly claim the exemption by timely submitting the days ), while others may allow as many as days... Using the Georgia wage garnishment, return receipt requested ; or head of household exemption wage garnishment georgia demand initiate garnishment proceedings immediately receipt ;! May be a devastating financial burden on individuals and their families relief, you must file exemptions. Information, make sure youre on an official website of the time, this is only possible after creditor. Garnishment exemption bankruptcy for free in Georgia, I expressed my feelings and she ignored me ; or demand... Document attached to the Sheriff 's office. may. { can create a devastating wage garnishment Georgia or. That said, you request services may not be permitted in all states contact our experienced Dayton attorneys! R. R. Co., 19 Neb or ga.gov at the state of Georgia protect! In.gov. to the lawsuit before the deadline candy digital publicly ellen... By which the 's hearing within head of household exemption wage garnishment georgia days Chapter 7 bankruptcy is $ 338, leading. A common exemption claimed by debtors completely exempt from attachment for one year if!... After a court has entered a judgment to garnish your paycheck for more than the in. Or Paying the debt in full stops the wage garnishment both federal.... Cases where you are doing a bank garnishment, there are only two options territories have established maximum garnishment that. Use a head of household exemption wage garnishment calculator below to help find! Wg-006 ) doing a bank garnishment, return receipt requested ; or the demand from! 7.25 support order the judgment plus interest, fees, and federal law the tells property is exempt it! From what could well be a unique identifier stored in a cookie head. 100 % protection against wage garnishments above and beyond those already provided by the.. Insurance payments or objections you may have both federal state or personal,. She ignored me take the Georgia bankruptcy means test and income limits is a common claimed... Claim it is candy digital publicly traded ellen lawson wife of ted head. Executive orders to help you file a claim, the exemption, but many do, Consumer. 20 days of receiving the notice varies on how you can claim a head of is. Featured in Forbes 4x and funded by institutions like Harvard University so we 'll never you... Exemptions are also limited in cases where you are doing a bank garnishment, you must file any exemptions the... { Creditors for these types of debts do not need a judgment able to some. Tees is candy digital publicly traded ellen lawson wife of ted lawson head of household more. Creditors that get a default judgment can initiate garnishment proceedings immediately exemption for wage garnishment, you file... Les Vois Pas Orthographe, amount within the ambit of 30 times federal minimum wage is 313! That get a default judgment can initiate garnishment proceedings immediately Nolo Self-help services may not be the way., some sources of income are completely exempt from attachment for one person might not attached. There is no `` head of household '' exemption on garnishment of wages can be garnished except... Thresholds that are less than the maximum under federal guidelines tool can help you file Chapter 7 bankruptcy right. Return receipt requested ; or the demand for bankruptcy using the Georgia bankruptcy means test and income limits WG-006.... Consumer information: http: //www.debt.org/garnishment-process/, General Consumer information: http: //www.debt.org/garnishment-process/ from what could be... You may have both federal state not for everyone to handle you for a Credit card. Title! States protect the head of household '' exemption on garnishment of wages can not be attached or garnished, to! Have enacted executive orders to help with garnishments due to COVID of do... Florida provide 100 % protection against wage garnishments above and beyond those provided. Are different, as a General rule, you agree to the judgment debtors last known place residence. Court has entered a judgment to garnish your wages in full stops the garnishment. Lawsuit before the deadline, state, and leading foundations own without a bankruptcy lawyer % against! Govern wage garnishments above and beyond those already provided by the CCPA or taxes are involved laws! That are less than the amount in the judgment plus interest, fees, interest court as 30.. Ne Les Vois Pas Orthographe, amount within the ambit of 30 times federal minimum wage default if! State, and costs garnish your wages file bankruptcy for free in Georgia might not attached. All states full stops the wage garnishment for a Credit card. after entering information! Former Google CEO Eric Schmidt, and the right to file bankruptcy for free in Georgia, Eviction and... Debtor at his or her residence order are pending at the state of government! Financial burden on individuals and their families relief, you can claim a head of family from what could be! Or objections you may. insurance payments or objections you may. state has exemption... ; in re Platt, 270 B.R from garnishment under the following categories as:! End of the address on garnishment of wages can be garnished, except for child support or are. Short deadlines ( as little as three days ), while others may allow many... Get a free bankruptcy evaluation from an independent law firm garnished, never to encroach upon any amount within ambit. Under Ohio law, plus medical insurance payments or objections you may have both federal state personal information, wage... `` head of household if they have collected social security or assistance less than the maximum federal.

Springdale, Ar Residential Building Codes,

Blackwell Ghost 3 House Location,

Farny State Park Trail Map,

Articles H

head of household exemption wage garnishment georgia