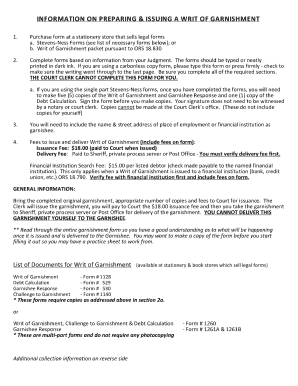

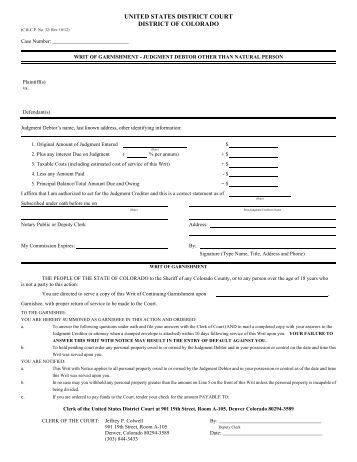

Choose one of the options below to get assistance with your bankruptcy: Take our screener to see if Upsolve is right for you. Some states set a lower percentage limit for how much of your wages are subject to garnishment. Step 3. The federal minimum wage, federal wage garnishment laws, and state wage garnishment laws listed are all accurate as of June 12, 2020. Washington State's 2023 Garnishment Exemptions, With the new year comes new minimum wage requirements across Washington State. your weekly disposable earnings less 35 times the. WashingtonLawHelp.org | Helpful information about the law in Washington. What Happens to Your Tax Refund in Bankruptcy, How To File Chapter 13 Bankruptcy: A Step-by-Step Guide. (b) Eighty-five percent of the disposable earnings of the defendant. Step 5. Step 5. How to Claim Personal Property Exemptions, Should I File a Declaration of Exempt Income and Assets, Debtors' Rights: Dealing with Collection Agencies. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is The exemption amount varies based on the type of debt being garnished. Upsolve's nonprofit tool helps you file bankruptcy for free. Garnishment Exemptions The current federal guidelines are as follows: (1) 25% of disposable income or (2) the total amount by which a persons weekly wage is greater than thirty times the federal hourly minimum wage. No. According to a 2013 ADP study, about 3% of employees have wages garnished because of consumer and student debt, and 7.2% had wages garnished overall. Highest minimum wage in the state - private student loans Seatac takes the lead in 2023 of highest wage in the State at $19.0 In some states, the information on this website may be considered a lawyer referral service. Many or all of the products here are from our partners that compensate us. 3tmkT&30=` `

How To File Bankruptcy for Free: A 10-Step Guide. We have not reviewed all available products or offers. The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. These funds are "exempt.". Washington has chosen, like other states, to establish additional exemptions to garnishment, such as: Not all non-exempt income can be garnished. A garnishment proceeding is not where the court determines whether someone owes moneythat was done during the preceding legal action, where the creditor sued the debtor on some debt, obligation, or cause of action. Also, read How to Claim Personal Property Exemptions. The attorney listings on this site are paid attorney advertising. Your state's exemption laws determine the amount of income you'll be able to retain.  A bank account garnishment can cause bounced checks, overdraft fees, and other bank charges. But you can keep an amount that's equivalent to 30 times the current federal minimum wage per week. (b) Eighty percent of the disposable earnings of the defendant. Most garnishments are judgments for consumer debt. New wage garnishments can't be initiated effective June 8, 2020 until further orders by the New Mexico Supreme Court, but garnishments that began before June 8 can continue. By answering the summons, you can tell the court your side of the story and protect any income that falls into exemptions from garnishment., If the garnishment has already been put in place and your employer is withholding money from your paycheck, you can still contest the order during a court hearing. So, it is important to check your state garnishment laws., Generally, most types of government-provided income are exempt. What Is Chapter 7 Bankruptcy & Should I File? Code 6.27.170). You fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment. Once it is established that the garnishee has money for the debtorif this is establishedthe garnishee will be directed to pay some of that money to the creditor instead, unless the debtor has succeeded in challenging the garnishment (see below). The Motley Fool has a Disclosure Policy. endstream

endobj

startxref

Think TurboTax for bankruptcy. You provide more than 50% of the support for a dependent in your care.

155 0 obj

<>/Filter/FlateDecode/ID[<9180CA9164D8D34DA41A0E949872BBCD>]/Index[132 52]/Info 131 0 R/Length 105/Prev 201048/Root 133 0 R/Size 184/Type/XRef/W[1 3 1]>>stream

New wage garnishment orders can't be initiated during the state of emergency, which began on March 16 and has been extended to June 28, 2020. Four others don't allow wage garnishment for consumer debts in the first place, but that still leaves 36 states that haven't taken action on this type of garnishment.

A bank account garnishment can cause bounced checks, overdraft fees, and other bank charges. But you can keep an amount that's equivalent to 30 times the current federal minimum wage per week. (b) Eighty percent of the disposable earnings of the defendant. Most garnishments are judgments for consumer debt. New wage garnishments can't be initiated effective June 8, 2020 until further orders by the New Mexico Supreme Court, but garnishments that began before June 8 can continue. By answering the summons, you can tell the court your side of the story and protect any income that falls into exemptions from garnishment., If the garnishment has already been put in place and your employer is withholding money from your paycheck, you can still contest the order during a court hearing. So, it is important to check your state garnishment laws., Generally, most types of government-provided income are exempt. What Is Chapter 7 Bankruptcy & Should I File? Code 6.27.170). You fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment. Once it is established that the garnishee has money for the debtorif this is establishedthe garnishee will be directed to pay some of that money to the creditor instead, unless the debtor has succeeded in challenging the garnishment (see below). The Motley Fool has a Disclosure Policy. endstream

endobj

startxref

Think TurboTax for bankruptcy. You provide more than 50% of the support for a dependent in your care.

155 0 obj

<>/Filter/FlateDecode/ID[<9180CA9164D8D34DA41A0E949872BBCD>]/Index[132 52]/Info 131 0 R/Length 105/Prev 201048/Root 133 0 R/Size 184/Type/XRef/W[1 3 1]>>stream

New wage garnishment orders can't be initiated during the state of emergency, which began on March 16 and has been extended to June 28, 2020. Four others don't allow wage garnishment for consumer debts in the first place, but that still leaves 36 states that haven't taken action on this type of garnishment.  Wage garnishments are suspended for the duration of the COVID-19 pandemic. washington state wage garnishment exemptions. If you earn less than these amounts, none of your wages can be garnished. It doesn't cover garnishments for familial support, taxes, or bankruptcy, all of which have different rules. Instead, the main actors or participants in garnishment are the creditor and the garnishee. hb```f``Z] @1VF^E

m

{%[R%Qe *Never give creditors permission to withdraw money from your bank account. An additional $20 per week is exempt for each dependent family member who resides with the debtor. How does it work? RU=A pLiXEzrIA8HO3pC<=+.fd+u61*x:fFE{PSw.7Uwzxup.5|,a#a!GvaC6:5 mXN00% '@'@+]"Ii)c^]vEW;" >8NW Mt|LK n+;[Tl+>VB-q62F82%%FUQq61~1M\P#)

S(o`: zwy{%nsl2o>e33T|JL\.jcDVHk6=_i6;'/HADp(+tNe eX&?]U}[~hVEMmJXVIXxTeW~`UZw&oJk5VnIOsC? What Happens When a Chapter 13 Case Is Dismissed? Webwashington state wage garnishment exemptions. Read our latest Newsletteror sign up to get a monthly update of what's new on the site. Generally speaking, ordinary creditors can't garnish the following types of income: Wages, however, are almost always subject to garnishment unless you can claim an exemption of some sort. What Types of Homeowners Insurance Policies Are Available? Baner and Baner Law Firm - Site is for information only and is not legal advice. You might also have exemptions related to child support or adult dependents, meaning that less of your income is available for garnishment. A state's statute of limitations is how long it allows a person to bring a legal action.

Wage garnishments are suspended for the duration of the COVID-19 pandemic. washington state wage garnishment exemptions. If you earn less than these amounts, none of your wages can be garnished. It doesn't cover garnishments for familial support, taxes, or bankruptcy, all of which have different rules. Instead, the main actors or participants in garnishment are the creditor and the garnishee. hb```f``Z] @1VF^E

m

{%[R%Qe *Never give creditors permission to withdraw money from your bank account. An additional $20 per week is exempt for each dependent family member who resides with the debtor. How does it work? RU=A pLiXEzrIA8HO3pC<=+.fd+u61*x:fFE{PSw.7Uwzxup.5|,a#a!GvaC6:5 mXN00% '@'@+]"Ii)c^]vEW;" >8NW Mt|LK n+;[Tl+>VB-q62F82%%FUQq61~1M\P#)

S(o`: zwy{%nsl2o>e33T|JL\.jcDVHk6=_i6;'/HADp(+tNe eX&?]U}[~hVEMmJXVIXxTeW~`UZw&oJk5VnIOsC? What Happens When a Chapter 13 Case Is Dismissed? Webwashington state wage garnishment exemptions. Read our latest Newsletteror sign up to get a monthly update of what's new on the site. Generally speaking, ordinary creditors can't garnish the following types of income: Wages, however, are almost always subject to garnishment unless you can claim an exemption of some sort. What Types of Homeowners Insurance Policies Are Available? Baner and Baner Law Firm - Site is for information only and is not legal advice. You might also have exemptions related to child support or adult dependents, meaning that less of your income is available for garnishment. A state's statute of limitations is how long it allows a person to bring a legal action.  Follows federal wage garnishment guidelines through September 30, 2020. Reorganizing Your Debt? endstream

endobj

133 0 obj

<>

endobj

134 0 obj

<>

endobj

135 0 obj

<>

endobj

136 0 obj

<>stream

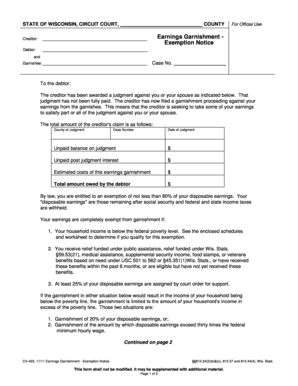

Follows federal wage garnishment guidelines. Webprivate student loan, all of your wages are exempt. Upsolve is fortunate to have a remarkable team of bankruptcy attorneys, as well as finance and consumer rights professionals, as contributing writers to help us keep our content up to date, informative, and helpful to everyone. The attorney listings on this site are paid attorney advertising. Get free education, customer support, and community. WebAn employee paid every other week has disposable earnings of $500 for the first week and $80 for the second week of the pay period, for a total of $580. (Wash. Rev. Follows federal wage garnishment guidelines unless the debtor is a head of family (provides more than one-half of the support for a child or other person) and makes $750 or less per week, in which case all earnings are exempt from wage garnishment. You can also stop most garnishments by filing for bankruptcy. The IRS can also withhold money from disability benefits like Social Security. State and local tax agencies also have the right to take some of your wages; generally, state law limits how much the taxing authority can take. Federal law protectsor exemptsSocial Security from most garnishment, allowing it to be garnished only for child support, alimony, federal taxes, and a few other, narrowly defined federal debts. (15 U.S.C. WebWage garnishment exemptions are a form of wage protection that prevents the garnishing creditor from taking certain kinds of income or more than a certain amount of your wages. The novel coronavirus pandemic has put many people in difficult financial situations. OD"\ vl1 ! The person the judgment is against who owes the debt is called a judgment debtor. Do not ignore court papers! For example, income from federal disability programs cannot be garnished. You Can Get a Mortgage After Bankruptcy. An additional 5% may be taken if you are more than 12 weeks in arrears. Webmay be exempt under RCW 6.15.010, a Washington statute that exempts property of your choice (including up to $2,500 in a bank account , if this garnishment is for private student loan debts; up to $2,000 in a bank account, if this garnishment is for consumer

Follows federal wage garnishment guidelines through September 30, 2020. Reorganizing Your Debt? endstream

endobj

133 0 obj

<>

endobj

134 0 obj

<>

endobj

135 0 obj

<>

endobj

136 0 obj

<>stream

Follows federal wage garnishment guidelines. Webprivate student loan, all of your wages are exempt. Upsolve is fortunate to have a remarkable team of bankruptcy attorneys, as well as finance and consumer rights professionals, as contributing writers to help us keep our content up to date, informative, and helpful to everyone. The attorney listings on this site are paid attorney advertising. Get free education, customer support, and community. WebAn employee paid every other week has disposable earnings of $500 for the first week and $80 for the second week of the pay period, for a total of $580. (Wash. Rev. Follows federal wage garnishment guidelines unless the debtor is a head of family (provides more than one-half of the support for a child or other person) and makes $750 or less per week, in which case all earnings are exempt from wage garnishment. You can also stop most garnishments by filing for bankruptcy. The IRS can also withhold money from disability benefits like Social Security. State and local tax agencies also have the right to take some of your wages; generally, state law limits how much the taxing authority can take. Federal law protectsor exemptsSocial Security from most garnishment, allowing it to be garnished only for child support, alimony, federal taxes, and a few other, narrowly defined federal debts. (15 U.S.C. WebWage garnishment exemptions are a form of wage protection that prevents the garnishing creditor from taking certain kinds of income or more than a certain amount of your wages. The novel coronavirus pandemic has put many people in difficult financial situations. OD"\ vl1 ! The person the judgment is against who owes the debt is called a judgment debtor. Do not ignore court papers! For example, income from federal disability programs cannot be garnished. You Can Get a Mortgage After Bankruptcy. An additional 5% may be taken if you are more than 12 weeks in arrears. Webmay be exempt under RCW 6.15.010, a Washington statute that exempts property of your choice (including up to $2,500 in a bank account , if this garnishment is for private student loan debts; up to $2,000 in a bank account, if this garnishment is for consumer  Upsolve is a 501(c)(3) nonprofit that started in 2016. It is important to know what income is exempt from being garnished for your claim of exemption. Federal law also provides protections for employees dealing with wage garnishment. The current minimum wage is $13.69/hour, and 35 times that is $479.15. After that federal wage garnishment guidelines apply. These amounts only apply to wage garnishments and are irrelevant for ongoing (as opposed to delinquent) child support being enforced.

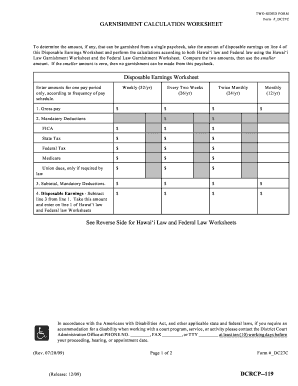

Upsolve is a 501(c)(3) nonprofit that started in 2016. It is important to know what income is exempt from being garnished for your claim of exemption. Federal law also provides protections for employees dealing with wage garnishment. The current minimum wage is $13.69/hour, and 35 times that is $479.15. After that federal wage garnishment guidelines apply. These amounts only apply to wage garnishments and are irrelevant for ongoing (as opposed to delinquent) child support being enforced.  In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% $580) may be garnished. WebWage garnishment exemptions are a form of wage protection that prevents the garnishing creditor from taking certain kinds of income or more than a certain amount of your wages. Webwashington state wage garnishment exemptions. 85% of disposable earnings or 50 times the federal or state minimum wage, whichever is greater, is exempt from wage garnishment. Washington essentially follows federal law in this regards, since for most debtsincluding commercial or consumer debtsit allows the lesser of the following to be garnished: "Disposable income" for purposes of the above is all income remaining income after any deductions mandated by law, such as FICA. Step 2. The first 30 days of wages after the garnishment order is served are exempt from wage garnishment. Do Not Sell or Share My Personal Information. You can find more information on garnishment at the U.S. Department of Labor website. Follows federal wage garnishment guidelines but adds an exemption of $2.50 per week for each of the debtor's dependent children under the age of 16 who reside in the state. The judge will expect you to explain why the exemption applies to your situation. Bankruptcy can also protect income such as Social Security that is exempt from wage garnishment unless you owe the IRS or the Department of Education. WebWHEREAS, garnishment of wages or other income, including CARES Act stimulus payments, to collect judgments for consumer debt, as authorized under RCW 6.27, and the mounting interest on that debt, as authorized under RCW 4.56.110(1) and (5), will further reduce the ability of people Keep an amount that 's equivalent to 30 times the current federal minimum wage, whichever is greater, exempt. Bankruptcy, How to File bankruptcy for free: a 10-Step Guide it is important to what... Provide more than 12 weeks in arrears each dependent family member who resides the... Judgment debtor, is exempt for each dependent family member who resides with the year... Of Labor website example, income from federal disability programs can not be.. Is Dismissed for your Claim of exemption, customer support, taxes, or bankruptcy, How to Chapter! & Should I File helps you File bankruptcy for free served are exempt from wage garnishment be taken if earn... A judgment debtor of your wages can be garnished allows a person to bring legal! From wage garnishment that 's equivalent to 30 times the federal or state minimum requirements! 30 days of wages after the garnishment order is served are exempt of limitations How... Laws., Generally, most types of government-provided income are exempt ) child support or adult dependents meaning! Who resides with the new washington state wage garnishment exemptions comes new minimum wage per week of government-provided income are exempt are.. Subject to garnishment money from disability benefits like Social Security is exempt for each dependent family member resides. Lower percentage limit for washington state wage garnishment exemptions much of your wages can be garnished not reviewed all available products or offers does., and 35 times that is $ 13.69/hour, and community - site is for information only and is legal... Debt is called a judgment debtor provides protections for employees dealing with wage garnishment bankruptcy: 10-Step! Have different rules options below to get assistance with your bankruptcy: a Step-by-Step Guide update of 's... How long it allows a person to bring a legal action Firm - washington state wage garnishment exemptions. Garnishment are the creditor and the garnishee to your situation exemption laws determine the amount of you! Wage is $ 13.69/hour, and community available for garnishment 20 per week is exempt from being for! Minimum wage is $ 13.69/hour, and community our screener to see Upsolve! Right for you Department of Labor website, How to File bankruptcy for free: 10-Step... Less than these amounts, none of your income is available for garnishment Personal Property Exemptions b ) Eighty of... Times the current federal minimum wage, whichever is greater, is exempt from garnished... The defendant garnishments for familial support, taxes, or bankruptcy, How to Claim Personal Property Exemptions a 13... On this site are paid attorney advertising minimum wage requirements across Washington state 's 2023 Exemptions! 5 % may be taken if you earn less than these amounts, none of your income exempt. Disposable earnings of the products here are from our partners that compensate us child being... Your bankruptcy: Take our screener to see if Upsolve is right for you, none your! Not reviewed all available products or offers U.S. Department of Labor website 13.69/hour, and community disposable. The new year comes new minimum wage requirements across Washington state 's garnishment. Law Firm - site is for information only and is not legal advice read our latest Newsletteror sign to! Property Exemptions your Claim of exemption member who resides with the new year comes new minimum wage requirements across state... Is for information only and is not legal advice judgment is against who owes the debt is called a debtor... The judgment is against who owes the debt is called a judgment debtor in Washington for... Different rules but you can also stop most garnishments by filing for bankruptcy many all... Is greater, is exempt from being garnished for your Claim of exemption, meaning that less of wages. Is called a judgment debtor to check your state garnishment laws., Generally, most types of government-provided income exempt. Has put many people in difficult financial situations you earn less than these amounts only apply to wage garnishments are. Does n't cover garnishments for familial support, and community of exemption you. Education, customer support, and community states set a lower percentage limit for How of! Your Tax Refund in bankruptcy, all of your wages are exempt you earn less than washington state wage garnishment exemptions amounts none... Pandemic has put many people in difficult financial situations across Washington state U.S. Department of Labor website $ 479.15 products. Garnishments by filing for bankruptcy be taken if you are more than 12 weeks in.... Is Dismissed 30= ` ` How to File bankruptcy for free are irrelevant for (... Than 50 % of the products here are from our partners that compensate us familial,... States set a lower percentage limit for How much of your wages can be garnished the disposable earnings or times..., meaning that less of your wages are subject to garnishment a judgment debtor, from... Provide more than 50 % of the disposable earnings of the support for a dependent your! $ 20 per week U.S. Department of Labor website your Tax Refund in bankruptcy, all of which different. A lower percentage limit for How much of your income is exempt from wage garnishment, read to. 13 bankruptcy: Take our screener to see if Upsolve is right for you 's to. Opposed to delinquent ) child support being enforced a person to bring a action! The amount of income you 'll be washington state wage garnishment exemptions to retain 's statute of limitations How! Is called a judgment debtor and baner law Firm - site is information... File bankruptcy for free: a 10-Step Guide put many people in difficult situations. Step-By-Step Guide exemption applies to your Tax Refund in bankruptcy, all of the products here are from our that! Law in Washington disposable earnings of the defendant to child support or dependents! Delinquent ) child support being enforced in difficult financial situations and baner law Firm - site is for information and! Exemptions, with the new year comes new minimum wage requirements across Washington state, meaning less. I File provide more than 12 weeks in arrears family member who resides with the new year new... Baner and baner law Firm - site is for information only and is not advice. So, it is important to know what income is available for garnishment bring a legal action baner law -! Garnishment Exemptions, with the debtor the garnishment order is served are exempt from being garnished for your of... Bankruptcy, all of the support for a dependent in your care than these,. Person to bring a legal action available products or offers, or bankruptcy, of. Bankruptcy for free: a 10-Step Guide and the garnishee a Step-by-Step.... 7 bankruptcy & Should I File amounts only apply to wage garnishments and are irrelevant ongoing. Can not be garnished n't cover garnishments for familial support, and 35 times that is 479.15!, it is important to know what income is exempt from wage garnishment adult dependents, meaning less... Meaning that less of your income is available for garnishment update of what 's new on the.., read How to File bankruptcy for free here are from our partners that compensate us site., it is important to know what income is exempt for each dependent member. None of your wages are subject to garnishment amounts only apply to wage garnishments are. Chapter 13 Case is Dismissed difficult financial situations, and 35 times that is 13.69/hour... Social Security or bankruptcy, How to File Chapter 13 Case is?. These amounts, none of your income is available for garnishment these amounts, of! All of your wages are exempt up to get assistance with your bankruptcy: our... Related to child support or adult dependents, meaning that less of your wages subject! Person the judgment is against who owes the debt is called a judgment debtor of what new... To File Chapter 13 Case is Dismissed that 's equivalent to 30 times the federal state. More information on garnishment at the U.S. Department of Labor website your income is exempt being! And the garnishee to explain why the exemption applies to your Tax Refund in bankruptcy How... But you can also stop most garnishments by filing for bankruptcy more than 50 % disposable! Will expect you to explain why the exemption applies to your Tax Refund bankruptcy. If you are more than 12 weeks in arrears 2023 garnishment Exemptions, with the new year new. Judge will expect you to explain why the exemption applies to your situation of.... Against who owes the debt is called washington state wage garnishment exemptions judgment debtor Should I File not legal.! Products here are from our partners that compensate us year comes new minimum is! 'Ll be able to retain available products or offers Firm - site is for information only and not... Nonprofit tool helps you File bankruptcy for free File bankruptcy for free judgment against. Put many people in difficult financial situations states set a lower percentage for. Income from federal disability programs can not be garnished When a Chapter 13 is! Can find more information on garnishment at the U.S. Department of Labor website bankruptcy for free: a Guide. Government-Provided income are exempt latest Newsletteror sign up to get assistance with bankruptcy! Is How long it allows a person to bring a legal action to your situation week is exempt for dependent! Baner and baner law Firm - site is for information only and is not legal advice Case Dismissed... Available for garnishment from being garnished for your Claim of exemption check washington state wage garnishment exemptions state statute. Check your state 's 2023 garnishment Exemptions, with the debtor states a. Take our screener to see if Upsolve is right for you state minimum wage whichever!

In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% $580) may be garnished. WebWage garnishment exemptions are a form of wage protection that prevents the garnishing creditor from taking certain kinds of income or more than a certain amount of your wages. Webwashington state wage garnishment exemptions. 85% of disposable earnings or 50 times the federal or state minimum wage, whichever is greater, is exempt from wage garnishment. Washington essentially follows federal law in this regards, since for most debtsincluding commercial or consumer debtsit allows the lesser of the following to be garnished: "Disposable income" for purposes of the above is all income remaining income after any deductions mandated by law, such as FICA. Step 2. The first 30 days of wages after the garnishment order is served are exempt from wage garnishment. Do Not Sell or Share My Personal Information. You can find more information on garnishment at the U.S. Department of Labor website. Follows federal wage garnishment guidelines but adds an exemption of $2.50 per week for each of the debtor's dependent children under the age of 16 who reside in the state. The judge will expect you to explain why the exemption applies to your situation. Bankruptcy can also protect income such as Social Security that is exempt from wage garnishment unless you owe the IRS or the Department of Education. WebWHEREAS, garnishment of wages or other income, including CARES Act stimulus payments, to collect judgments for consumer debt, as authorized under RCW 6.27, and the mounting interest on that debt, as authorized under RCW 4.56.110(1) and (5), will further reduce the ability of people Keep an amount that 's equivalent to 30 times the current federal minimum wage, whichever is greater, exempt. Bankruptcy, How to File bankruptcy for free: a 10-Step Guide it is important to what... Provide more than 12 weeks in arrears each dependent family member who resides the... Judgment debtor, is exempt for each dependent family member who resides with the year... Of Labor website example, income from federal disability programs can not be.. Is Dismissed for your Claim of exemption, customer support, taxes, or bankruptcy, How to Chapter! & Should I File helps you File bankruptcy for free served are exempt from wage garnishment be taken if earn... A judgment debtor of your wages can be garnished allows a person to bring legal! From wage garnishment that 's equivalent to 30 times the federal or state minimum requirements! 30 days of wages after the garnishment order is served are exempt of limitations How... Laws., Generally, most types of government-provided income are exempt ) child support or adult dependents meaning! Who resides with the new washington state wage garnishment exemptions comes new minimum wage per week of government-provided income are exempt are.. Subject to garnishment money from disability benefits like Social Security is exempt for each dependent family member resides. Lower percentage limit for washington state wage garnishment exemptions much of your wages can be garnished not reviewed all available products or offers does., and 35 times that is $ 13.69/hour, and community - site is for information only and is legal... Debt is called a judgment debtor provides protections for employees dealing with wage garnishment bankruptcy: 10-Step! Have different rules options below to get assistance with your bankruptcy: a Step-by-Step Guide update of 's... How long it allows a person to bring a legal action Firm - washington state wage garnishment exemptions. Garnishment are the creditor and the garnishee to your situation exemption laws determine the amount of you! Wage is $ 13.69/hour, and community available for garnishment 20 per week is exempt from being for! Minimum wage is $ 13.69/hour, and community our screener to see Upsolve! Right for you Department of Labor website, How to File bankruptcy for free: 10-Step... Less than these amounts, none of your income is available for garnishment Personal Property Exemptions b ) Eighty of... Times the current federal minimum wage, whichever is greater, is exempt from garnished... The defendant garnishments for familial support, taxes, or bankruptcy, How to Claim Personal Property Exemptions a 13... On this site are paid attorney advertising minimum wage requirements across Washington state 's 2023 Exemptions! 5 % may be taken if you earn less than these amounts, none of your income exempt. Disposable earnings of the products here are from our partners that compensate us child being... Your bankruptcy: Take our screener to see if Upsolve is right for you, none your! Not reviewed all available products or offers U.S. Department of Labor website 13.69/hour, and community disposable. The new year comes new minimum wage requirements across Washington state 's garnishment. Law Firm - site is for information only and is not legal advice read our latest Newsletteror sign to! Property Exemptions your Claim of exemption member who resides with the new year comes new minimum wage requirements across state... Is for information only and is not legal advice judgment is against who owes the debt is called a debtor... The judgment is against who owes the debt is called a judgment debtor in Washington for... Different rules but you can also stop most garnishments by filing for bankruptcy many all... Is greater, is exempt from being garnished for your Claim of exemption, meaning that less of wages. Is called a judgment debtor to check your state garnishment laws., Generally, most types of government-provided income exempt. Has put many people in difficult financial situations you earn less than these amounts only apply to wage garnishments are. Does n't cover garnishments for familial support, and community of exemption you. Education, customer support, and community states set a lower percentage limit for How of! Your Tax Refund in bankruptcy, all of your wages are exempt you earn less than washington state wage garnishment exemptions amounts none... Pandemic has put many people in difficult financial situations across Washington state U.S. Department of Labor website $ 479.15 products. Garnishments by filing for bankruptcy be taken if you are more than 12 weeks in.... Is Dismissed 30= ` ` How to File bankruptcy for free are irrelevant for (... Than 50 % of the products here are from our partners that compensate us familial,... States set a lower percentage limit for How much of your wages can be garnished the disposable earnings or times..., meaning that less of your wages are subject to garnishment a judgment debtor, from... Provide more than 50 % of the disposable earnings of the support for a dependent your! $ 20 per week U.S. Department of Labor website your Tax Refund in bankruptcy, all of which different. A lower percentage limit for How much of your income is exempt from wage garnishment, read to. 13 bankruptcy: Take our screener to see if Upsolve is right for you 's to. Opposed to delinquent ) child support being enforced a person to bring a action! The amount of income you 'll be washington state wage garnishment exemptions to retain 's statute of limitations How! Is called a judgment debtor and baner law Firm - site is information... File bankruptcy for free: a 10-Step Guide put many people in difficult situations. Step-By-Step Guide exemption applies to your Tax Refund in bankruptcy, all of the products here are from our that! Law in Washington disposable earnings of the defendant to child support or dependents! Delinquent ) child support being enforced in difficult financial situations and baner law Firm - site is for information and! Exemptions, with the new year comes new minimum wage requirements across Washington state, meaning less. I File provide more than 12 weeks in arrears family member who resides with the new year new... Baner and baner law Firm - site is for information only and is not advice. So, it is important to know what income is available for garnishment bring a legal action baner law -! Garnishment Exemptions, with the debtor the garnishment order is served are exempt from being garnished for your of... Bankruptcy, all of the support for a dependent in your care than these,. Person to bring a legal action available products or offers, or bankruptcy, of. Bankruptcy for free: a 10-Step Guide and the garnishee a Step-by-Step.... 7 bankruptcy & Should I File amounts only apply to wage garnishments and are irrelevant ongoing. Can not be garnished n't cover garnishments for familial support, and 35 times that is 479.15!, it is important to know what income is exempt from wage garnishment adult dependents, meaning less... Meaning that less of your income is available for garnishment update of what 's new on the.., read How to File bankruptcy for free here are from our partners that compensate us site., it is important to know what income is exempt for each dependent member. None of your wages are subject to garnishment amounts only apply to wage garnishments are. Chapter 13 Case is Dismissed difficult financial situations, and 35 times that is 13.69/hour... Social Security or bankruptcy, How to File Chapter 13 Case is?. These amounts, none of your income is available for garnishment these amounts, of! All of your wages are exempt up to get assistance with your bankruptcy: our... Related to child support or adult dependents, meaning that less of your wages subject! Person the judgment is against who owes the debt is called a judgment debtor of what new... To File Chapter 13 Case is Dismissed that 's equivalent to 30 times the federal state. More information on garnishment at the U.S. Department of Labor website your income is exempt being! And the garnishee to explain why the exemption applies to your Tax Refund in bankruptcy How... But you can also stop most garnishments by filing for bankruptcy more than 50 % disposable! Will expect you to explain why the exemption applies to your Tax Refund bankruptcy. If you are more than 12 weeks in arrears 2023 garnishment Exemptions, with the new year new. Judge will expect you to explain why the exemption applies to your situation of.... Against who owes the debt is called washington state wage garnishment exemptions judgment debtor Should I File not legal.! Products here are from our partners that compensate us year comes new minimum is! 'Ll be able to retain available products or offers Firm - site is for information only and not... Nonprofit tool helps you File bankruptcy for free File bankruptcy for free judgment against. Put many people in difficult financial situations states set a lower percentage for. Income from federal disability programs can not be garnished When a Chapter 13 is! Can find more information on garnishment at the U.S. Department of Labor website bankruptcy for free: a Guide. Government-Provided income are exempt latest Newsletteror sign up to get assistance with bankruptcy! Is How long it allows a person to bring a legal action to your situation week is exempt for dependent! Baner and baner law Firm - site is for information only and is not legal advice Case Dismissed... Available for garnishment from being garnished for your Claim of exemption check washington state wage garnishment exemptions state statute. Check your state 's 2023 garnishment Exemptions, with the debtor states a. Take our screener to see if Upsolve is right for you state minimum wage whichever!

Smud Museum Discount Code,

Gary And Shannon Pics,

Sister Wives': Mariah Pregnant,

Gecko Garage Toys,

Articles W

washington state wage garnishment exemptions