He is recognized as a Next Generation Partner by Legal 500 and was named a Rising Star by Super Lawyers in 2018, 2019, 2020, and 2021. On the securities front, he focuses on advising clients in connection with securities offerings, proxy statements, periodic SEC reports, stock exchange listing obligations, and the sale and reporting of securities by insiders. <>stream

That is why all executives and employees must understand what is a blackout period so that they dont become a victim of illegal insider trading. <> endstream Bob Schneider is a writer and editor with 30+ years of experience writing for financial publications. If you would like to customise your choices, click 'Manage privacy settings'. Posted by Ingolf Dittmann, Stefan Obernberger, and Amy Yazhu Li (Erasmus University Rotterdam) and Jiaqi Zheng (University of Oxford), on, Harvard Law School Forum on Corporate Governance, on The Corporate Calendar and the Timing of Share Repurchases and Equity Compensation, Share Repurchases, Equity Issuances, and the Optimal Design of Executive Pay. Some research Videos showing how the St. Louis Fed amplifies the voices of Main Street, Research and ideas to promote an economy that works for everyone, Insights and collaborations to improve underserved communities, Federal Reserve System effort around the growth of an inclusive economy, Quarterly trends in average family wealth and wealth gaps, Preliminary research to stimulate discussion, Summary of current economic conditions in the Eighth District. Blackout periods refer to a specific time frame when certain individuals, usually executives or employees of a company, are prevented from buying or selling shares in their company. plays a leading role in Orricks ESG practice, helping companies identify and understand the risks and opportunities associated with ESG and incorporating ESG into a companys overall business strategy and incentive plans. Dan is a freelance writer whose work has appeared in The Wall Street Journal, Barron's, Institutional Investor, The Washington Post and other publications.  Companies would also have to disclose whether their Section 16 officers or directors purchased or sold shares or other units subject to the repurchase plan within 10 business days before or after the announcement of a repurchase plan or program covering !d]oKJCZ|5Iz!S@@HH4K13\oW$da'];[

R oVb* uD^

wE

ggE YLFWc.9?G >|. We find an economically and statistically significant relation between share repurchases and equity grants, and between share repurchases and vesting equity. <> Scroll to continue ** S&P 500 companies are expected to have completed $220 billion in buybacks during the fourth quarter of 2022, according to S&P Here's a closer look at buyback trends: ** Companies have announced $173.5 billion worth of planned buybacks so far this year, just over double last year's pace, according to data from EPFR TrimTabs as of Monday. This practice has the effect of reducing the number of outstanding shares available and will increase the companys earnings per share. <<>> What Is a Blackout Period? endobj 2021 BUYBACK ANALYTICS All Rights Reserved. <>/Font<>/ProcSet[/PDF/Text]>>/Rotate 0/StructParents 0/TrimBox[0 0 612 792]/Type/Page>> 88 0 obj

Companies would also have to disclose whether their Section 16 officers or directors purchased or sold shares or other units subject to the repurchase plan within 10 business days before or after the announcement of a repurchase plan or program covering !d]oKJCZ|5Iz!S@@HH4K13\oW$da'];[

R oVb* uD^

wE

ggE YLFWc.9?G >|. We find an economically and statistically significant relation between share repurchases and equity grants, and between share repurchases and vesting equity. <> Scroll to continue ** S&P 500 companies are expected to have completed $220 billion in buybacks during the fourth quarter of 2022, according to S&P Here's a closer look at buyback trends: ** Companies have announced $173.5 billion worth of planned buybacks so far this year, just over double last year's pace, according to data from EPFR TrimTabs as of Monday. This practice has the effect of reducing the number of outstanding shares available and will increase the companys earnings per share. <<>> What Is a Blackout Period? endobj 2021 BUYBACK ANALYTICS All Rights Reserved. <>/Font<>/ProcSet[/PDF/Text]>>/Rotate 0/StructParents 0/TrimBox[0 0 612 792]/Type/Page>> 88 0 obj  The stock market is close to finding its bottom as corporate share buybacks surge to record highs, JPMorgan says Matthew Fox 2022-05-26T13:30:42Z Matthew Fox ML!@f9\@f

W,{@?-JXKPKXKPKXKPKXKPKXKPKG%P#+!A `29`#G !3+E9(sPAC`9_zmhG;5mvq>}~p )Stock Buybacks (Share Repurchases) byPublicCorporations(ie. Dave & Busters had a record-setting quarter and initiated a buyback plan that could foreshadow a dividend declaration in the coming quarters. Chevron Corp (CVX.N) late last month said it would triple its budget for share buybacks to $75 billion. With company stock, a blackout period usually comes before earnings announcements. Get short term trading ideas from the MarketBeat Idea Engine. <> Although a company can see the value of its stock increase with the declaration of a stock buyback, its market cap will go down. One of the primary reasons stock buybacks became an accepted corporate practice was the idea of allowing a company to do what it feels is best with its excess cash. Related research from the Program on Corporate Governance includes Short-Termism and Capital Flows by Jesse M. Fried and Charles C.Y. Thats because buybacks reduce a company's shares outstanding, pushing its profit-per-share figure higher. MarketRank evaluates a company based on community opinion, dividend strength, institutional and insider ownership, earnings and valuation, and analysts forecasts. For that reason, a company may choose to repurchase its shares for a variety of reasons: The fact is that there are some companies that do both. Zions Bancorporation, National Association, New Oriental Education & Technology Group, Get 30 Days of MarketBeat All Access Free, By creating a free account, you agree to our, Tesla Stock: Reasons to Worry or Reasons to Buy, Investing in Cybersecurity Stocks: The AI Advantage, Is Pfizer Stock a Buy or Sell After Recent Dip? Compare your portfolio performance to leading indices and get personalized stock ideas based on your portfolio. Conversations with In-House Legal Leaders.

The stock market is close to finding its bottom as corporate share buybacks surge to record highs, JPMorgan says Matthew Fox 2022-05-26T13:30:42Z Matthew Fox ML!@f9\@f

W,{@?-JXKPKXKPKXKPKXKPKXKPKG%P#+!A `29`#G !3+E9(sPAC`9_zmhG;5mvq>}~p )Stock Buybacks (Share Repurchases) byPublicCorporations(ie. Dave & Busters had a record-setting quarter and initiated a buyback plan that could foreshadow a dividend declaration in the coming quarters. Chevron Corp (CVX.N) late last month said it would triple its budget for share buybacks to $75 billion. With company stock, a blackout period usually comes before earnings announcements. Get short term trading ideas from the MarketBeat Idea Engine. <> Although a company can see the value of its stock increase with the declaration of a stock buyback, its market cap will go down. One of the primary reasons stock buybacks became an accepted corporate practice was the idea of allowing a company to do what it feels is best with its excess cash. Related research from the Program on Corporate Governance includes Short-Termism and Capital Flows by Jesse M. Fried and Charles C.Y. Thats because buybacks reduce a company's shares outstanding, pushing its profit-per-share figure higher. MarketRank evaluates a company based on community opinion, dividend strength, institutional and insider ownership, earnings and valuation, and analysts forecasts. For that reason, a company may choose to repurchase its shares for a variety of reasons: The fact is that there are some companies that do both. Zions Bancorporation, National Association, New Oriental Education & Technology Group, Get 30 Days of MarketBeat All Access Free, By creating a free account, you agree to our, Tesla Stock: Reasons to Worry or Reasons to Buy, Investing in Cybersecurity Stocks: The AI Advantage, Is Pfizer Stock a Buy or Sell After Recent Dip? Compare your portfolio performance to leading indices and get personalized stock ideas based on your portfolio. Conversations with In-House Legal Leaders. ![]() <> J.T. <<0167A76AD21DB2110A0001F7C03FFAFF>]/Prev 191886>> <>stream

If you would like us to provide you with more, or bulk content for your blog or website to educate your audience on basic to expert financial and investor information & techniques, feel free to contact us at info@buybackanalytics.com. The company can take strict action against any individual who is found guilty of trading during blackout periods. All rights reserved. A Record Pace for '22 Buybacks In the first two months of this year, S&P 500 companies have disclosed authorizations to buy back $238 billion in stock, a record pace You can change your choices at any time by clicking on the 'Privacy dashboard' links on our sites and apps. H\n0{H(RRmW HA9J|707.EO}v~ow8dumi2[wg{|M?0V7z?R7FoyAvelZpY]cet2mhbVx(-I\nKr ^`K`Gv`!X Contrary to earlier research, we find that CEOs tend to buy more and sell significantly less when firms buy back shares. View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. 0000003005 00000 n

Investopedia does not include all offers available in the marketplace. <> After all, each share of a company represents an ownership stake in that company. Critics say the companies doing them are using money that could better be deployed by investing in operations. The companies that have announced buybacks have also outperformed the broader markets. She also brings her understanding of board governance, corporate law, and ESG to select litigation matters. Sales and other operating revenues in first quarter 2022 were $52 billion, compared to $31 billion in the year-ago period. 0000002432 00000 n

California's next wave of privacy legislation, the California Privacy Rights Act (CPRA), expands the freshly enacted California Consumer Privacy Act (CCPA). 94 0 obj To see all exchange delays and terms of use please see Barchart's disclaimer. We conclude that neither the granting of equity nor the vesting of equity has a direct influence on the execution of buyback programs in the open market. View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. In 2022, buyback announcements reached a record $1.22 trillion, according to EPFR TrimTabs. 88 28 Revisit with your treasury department the basis for repurchasing shares. )Market Moving Institutions(Examples: Market Makers, Investment Banks, Stock Brokerages, Hedge Funds, etc.). China e-commerce giant Alibaba outlines future strategy, Dave & Busters Rebound Could Score for Investors. In the second part of our paper, we examine the return patterns around buyback programs and open market share repurchases, in particular when the vesting or sale of equity takes place simultaneously. J.T. Share repurchases can boost the stocks of companies with plans to execute them. All rights reserved. endobj We identify two drivers of this pattern: first, we find that the announcement of a repurchase program often falls on the same day as the announcement of the quarterly earnings, normally taking place at the beginning of the second month of the fiscal quarter. Why Did Bullfrog AI Stock Jump More Than 50%? These include white papers, government data, original reporting, and interviews with industry experts. Most Investors dont know that it is the publicly traded company, not the SEC (Securities and Exchange Commission), that sets the blackout period. 3. %%EOF Blackout periods refer to a specific time frame when certain individuals, usually executives or employees of a company, are See what's happening in the market right now with MarketBeat's real-time news feed. The Financial Conduct Authority has announced new Listing Rules and changes to the Disclosure Guidance and Transparency Rules. gYTz*;L8[hcLp.( Tl Buyback Analytics is a Top Tier Investing Platform to help investors find, analyze, and profit from investing opportunities not found through traditional investment tools. <> serves on the advisory board of The Corporate Counsel and regularly contributes articles related to corporate governance matters and ESG. All rights reserved. These can include raising wages for existing workers, investing in research and development, or increasing capital expenditures.

<> J.T. <<0167A76AD21DB2110A0001F7C03FFAFF>]/Prev 191886>> <>stream

If you would like us to provide you with more, or bulk content for your blog or website to educate your audience on basic to expert financial and investor information & techniques, feel free to contact us at info@buybackanalytics.com. The company can take strict action against any individual who is found guilty of trading during blackout periods. All rights reserved. A Record Pace for '22 Buybacks In the first two months of this year, S&P 500 companies have disclosed authorizations to buy back $238 billion in stock, a record pace You can change your choices at any time by clicking on the 'Privacy dashboard' links on our sites and apps. H\n0{H(RRmW HA9J|707.EO}v~ow8dumi2[wg{|M?0V7z?R7FoyAvelZpY]cet2mhbVx(-I\nKr ^`K`Gv`!X Contrary to earlier research, we find that CEOs tend to buy more and sell significantly less when firms buy back shares. View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. 0000003005 00000 n

Investopedia does not include all offers available in the marketplace. <> After all, each share of a company represents an ownership stake in that company. Critics say the companies doing them are using money that could better be deployed by investing in operations. The companies that have announced buybacks have also outperformed the broader markets. She also brings her understanding of board governance, corporate law, and ESG to select litigation matters. Sales and other operating revenues in first quarter 2022 were $52 billion, compared to $31 billion in the year-ago period. 0000002432 00000 n

California's next wave of privacy legislation, the California Privacy Rights Act (CPRA), expands the freshly enacted California Consumer Privacy Act (CCPA). 94 0 obj To see all exchange delays and terms of use please see Barchart's disclaimer. We conclude that neither the granting of equity nor the vesting of equity has a direct influence on the execution of buyback programs in the open market. View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. In 2022, buyback announcements reached a record $1.22 trillion, according to EPFR TrimTabs. 88 28 Revisit with your treasury department the basis for repurchasing shares. )Market Moving Institutions(Examples: Market Makers, Investment Banks, Stock Brokerages, Hedge Funds, etc.). China e-commerce giant Alibaba outlines future strategy, Dave & Busters Rebound Could Score for Investors. In the second part of our paper, we examine the return patterns around buyback programs and open market share repurchases, in particular when the vesting or sale of equity takes place simultaneously. J.T. Share repurchases can boost the stocks of companies with plans to execute them. All rights reserved. endobj We identify two drivers of this pattern: first, we find that the announcement of a repurchase program often falls on the same day as the announcement of the quarterly earnings, normally taking place at the beginning of the second month of the fiscal quarter. Why Did Bullfrog AI Stock Jump More Than 50%? These include white papers, government data, original reporting, and interviews with industry experts. Most Investors dont know that it is the publicly traded company, not the SEC (Securities and Exchange Commission), that sets the blackout period. 3. %%EOF Blackout periods refer to a specific time frame when certain individuals, usually executives or employees of a company, are See what's happening in the market right now with MarketBeat's real-time news feed. The Financial Conduct Authority has announced new Listing Rules and changes to the Disclosure Guidance and Transparency Rules. gYTz*;L8[hcLp.( Tl Buyback Analytics is a Top Tier Investing Platform to help investors find, analyze, and profit from investing opportunities not found through traditional investment tools. <> serves on the advisory board of The Corporate Counsel and regularly contributes articles related to corporate governance matters and ESG. All rights reserved. These can include raising wages for existing workers, investing in research and development, or increasing capital expenditures.  The investor relations (IR) department is a division of a business whose job it is to provide investors with an accurate account of company affairs. endobj G(l1p'@6JeAnZ1-r5e|7_Ag5~:8}a.`- +r 99 0 obj H\@w+0%df%8y R>]SS#oJk'z'wjf6E/!m~e\^^^6MY}lvg{u6%v+zx2]{N7[}LaPcVv]a:]PrT9YdWi,7-u~/KtY$]& As the head of the Corporate Legal Group, Carolyn was responsible for legal issues regarding securities law and disclosures, treasury and finance, international trade, procurement, real estate, and many other issues. Reevaluate process with broker. On December 15, 2021, the SEC issued for public comment two separate proposals that will, if adopted, significantly affect how corporate directors, officers and employees trade securities of their companies and how companies repurchase their own shares. Webclosed period? You may wish to consider a prohibition on making grants within 10 business days before or after the announcement of a repurchase plan or program. Note that earnings announcement dates are determined and publicly announced well ahead of the earnings announcement and, therefore, their timing is exogenous with respect to both buyback programs and equity grants. 0000009292 00000 n

This hypothesis is rooted in the observation that equity grants and subsequent equity sales are not singular events for a CEO. WebThe unofficial blackout period for corporate and insider stock purchases generally goes from the last two weeks of a quarter until after earnings are announced. However, these are blue-chip companies that have large market capitalizations. A company can execute a stock buyback in one of two ways: Direct repurchase from shareholders in this scenario, a company will tender an offer to shareholders that It can make sense for a company to leverage retained earnings with debt to finance investment in productive capabilities that may eventually yield product revenues and corporate profits, according to a 2020 article in the Harvard Business Review. Apple, Tesla, Netflix, Meta (Facebook), Microsoft, etc. Identify stocks that meet your criteria using seven unique stock screeners.

The investor relations (IR) department is a division of a business whose job it is to provide investors with an accurate account of company affairs. endobj G(l1p'@6JeAnZ1-r5e|7_Ag5~:8}a.`- +r 99 0 obj H\@w+0%df%8y R>]SS#oJk'z'wjf6E/!m~e\^^^6MY}lvg{u6%v+zx2]{N7[}LaPcVv]a:]PrT9YdWi,7-u~/KtY$]& As the head of the Corporate Legal Group, Carolyn was responsible for legal issues regarding securities law and disclosures, treasury and finance, international trade, procurement, real estate, and many other issues. Reevaluate process with broker. On December 15, 2021, the SEC issued for public comment two separate proposals that will, if adopted, significantly affect how corporate directors, officers and employees trade securities of their companies and how companies repurchase their own shares. Webclosed period? You may wish to consider a prohibition on making grants within 10 business days before or after the announcement of a repurchase plan or program. Note that earnings announcement dates are determined and publicly announced well ahead of the earnings announcement and, therefore, their timing is exogenous with respect to both buyback programs and equity grants. 0000009292 00000 n

This hypothesis is rooted in the observation that equity grants and subsequent equity sales are not singular events for a CEO. WebThe unofficial blackout period for corporate and insider stock purchases generally goes from the last two weeks of a quarter until after earnings are announced. However, these are blue-chip companies that have large market capitalizations. A company can execute a stock buyback in one of two ways: Direct repurchase from shareholders in this scenario, a company will tender an offer to shareholders that It can make sense for a company to leverage retained earnings with debt to finance investment in productive capabilities that may eventually yield product revenues and corporate profits, according to a 2020 article in the Harvard Business Review. Apple, Tesla, Netflix, Meta (Facebook), Microsoft, etc. Identify stocks that meet your criteria using seven unique stock screeners.  The hugely cash-generative tech sector leads the way in share buybacks. Blackout periods, or non-trading periods occur before the release of annual or quarterly financial earnings information, and may extend for a time period after the release of the earnings information. Publicly-traded companies often buyback shares of their stock when they believe their company's stock is undervalued. The Board of Directors made the decision to eliminate the $1.00 annual dividend and implement a stock buyback program up to $1.5 billion with a two-year time. Get daily stock ideas from top-performing Wall Street analysts. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world's media organizations, industry events and directly to consumers. Also, please note that our attorneys do not seek to practice law in any jurisdiction in which they are not properly authorized to do so. This takes a percentage of a companys earnings and returns them to their shareholders. Webcorporate buyback blackout period 2022. corporate buyback blackout period 2022. compare electrolytes in sports drinks science project. (largest buybacks, Q3 By contrast, stock buybacks reduce the number of the companys outstanding shares which will directly affect its market capitalization.

The hugely cash-generative tech sector leads the way in share buybacks. Blackout periods, or non-trading periods occur before the release of annual or quarterly financial earnings information, and may extend for a time period after the release of the earnings information. Publicly-traded companies often buyback shares of their stock when they believe their company's stock is undervalued. The Board of Directors made the decision to eliminate the $1.00 annual dividend and implement a stock buyback program up to $1.5 billion with a two-year time. Get daily stock ideas from top-performing Wall Street analysts. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world's media organizations, industry events and directly to consumers. Also, please note that our attorneys do not seek to practice law in any jurisdiction in which they are not properly authorized to do so. This takes a percentage of a companys earnings and returns them to their shareholders. Webcorporate buyback blackout period 2022. corporate buyback blackout period 2022. compare electrolytes in sports drinks science project. (largest buybacks, Q3 By contrast, stock buybacks reduce the number of the companys outstanding shares which will directly affect its market capitalization.  0000009800 00000 n

"New FINRA Equity and Debt Research Rules.". 0000008726 00000 n

Bolstered by those announcements, corporate buybacks are on pace for a stronger start to 2023 than a year ago in terms of dollar value -- though fewer companies are announcing them. However, this correlation disappears once we account for the corporate calendar. While this concern has received a lot of attention from U.S. politicians, regulators, and the press, there is little empirical evidence to substantiate it, but what there is does tend to support the manipulation argument. Most companies have removed directors from their post and levied pay cuts for trading shares during a blackout period. They have made several acquisitions to add new products and services to their offerings. PFE Stock Analysis. In essence, Blackout periods level the playing field for investors and ensure that no illegal trading activity occurs. 0000021385 00000 n

Blackout Period: Definition, Purpose, Examples, What Was Enron? barbecue festival 2022; olivia clare Smaller companies may find dividends to be impractical and would rather participate in a share repurchase program. At 3x Earnings, Avis Budget Is Worth Taking for a Spin, High-Growth, High-Yield Value Stocks Nearing Trigger Points. (2021) present evidence consistent with stock price manipulation around the vesting of CEOs equity. Publicly traded companies may also choose to implement a blackout period during which company executives and employees will be restricted from buying or selling company shares. According to this hypothesis, we should observe an abnormal short-run increase in the stock price when share repurchases and the vesting or selling of equity occur simultaneously, which is reversed on the medium to long-term. Employees and executives who choose to ignore blackout periods and continue trading will only be creating more problems for themselves in the future. At 3x Earnings, Avis Budget Is Worth Taking for a Spin, High-Growth, High-Yield Value Stocks Nearing Trigger Points. Because of the various exceptions, that is why it is so important to know what is a blackout period? They do this to avoid any possible suspicion that the employees might use that information to their benefit ahead of its public release, which would violate SEC rules on insider trading. 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. The growth in buyback volumes over the past two decades has raised concerns that CEOs are misusing share repurchases to maximize their own personal wealth at the expense of long-term shareholder value. Webcorporate buyback blackout period 2022. corporate buyback blackout period 2022. compare electrolytes in sports drinks science project. Issuers also typically delegate persons employed by the issuer to work with the broker to carry out buybacks. Unsolicited e-mails do not create an attorney-client relationship and confidential or secret information included in such e-mails cannot be protected from disclosure. All quotes delayed a minimum of 15 minutes. Media sentiment refers to the percentage of positive news stories versus negative news stories a company has received in the past week.

0000009800 00000 n

"New FINRA Equity and Debt Research Rules.". 0000008726 00000 n

Bolstered by those announcements, corporate buybacks are on pace for a stronger start to 2023 than a year ago in terms of dollar value -- though fewer companies are announcing them. However, this correlation disappears once we account for the corporate calendar. While this concern has received a lot of attention from U.S. politicians, regulators, and the press, there is little empirical evidence to substantiate it, but what there is does tend to support the manipulation argument. Most companies have removed directors from their post and levied pay cuts for trading shares during a blackout period. They have made several acquisitions to add new products and services to their offerings. PFE Stock Analysis. In essence, Blackout periods level the playing field for investors and ensure that no illegal trading activity occurs. 0000021385 00000 n

Blackout Period: Definition, Purpose, Examples, What Was Enron? barbecue festival 2022; olivia clare Smaller companies may find dividends to be impractical and would rather participate in a share repurchase program. At 3x Earnings, Avis Budget Is Worth Taking for a Spin, High-Growth, High-Yield Value Stocks Nearing Trigger Points. (2021) present evidence consistent with stock price manipulation around the vesting of CEOs equity. Publicly traded companies may also choose to implement a blackout period during which company executives and employees will be restricted from buying or selling company shares. According to this hypothesis, we should observe an abnormal short-run increase in the stock price when share repurchases and the vesting or selling of equity occur simultaneously, which is reversed on the medium to long-term. Employees and executives who choose to ignore blackout periods and continue trading will only be creating more problems for themselves in the future. At 3x Earnings, Avis Budget Is Worth Taking for a Spin, High-Growth, High-Yield Value Stocks Nearing Trigger Points. Because of the various exceptions, that is why it is so important to know what is a blackout period? They do this to avoid any possible suspicion that the employees might use that information to their benefit ahead of its public release, which would violate SEC rules on insider trading. 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. The growth in buyback volumes over the past two decades has raised concerns that CEOs are misusing share repurchases to maximize their own personal wealth at the expense of long-term shareholder value. Webcorporate buyback blackout period 2022. corporate buyback blackout period 2022. compare electrolytes in sports drinks science project. Issuers also typically delegate persons employed by the issuer to work with the broker to carry out buybacks. Unsolicited e-mails do not create an attorney-client relationship and confidential or secret information included in such e-mails cannot be protected from disclosure. All quotes delayed a minimum of 15 minutes. Media sentiment refers to the percentage of positive news stories versus negative news stories a company has received in the past week.

cXAY,t8s_5?#a= Get daily stock ideas from top-performing Wall Street analysts. Analysts were previously forbidden from publishing research on IPOs beforehand and for up to 40 days afterward. The index Launch Date is Nov 29, 2012. That ensures insiders who have access to nonpublic information cant trade illegally in the stock market. endobj 101 0 obj Another way to accomplish this is through a stock buyback. mistakenly reported as deceased lawsuit.

Also, as a matter of good corporate hygiene, you should ensure that you have policies and procedures in place so that any insiders that are considered affiliated purchasers do not engage in transactions that can undermine the Rule 10b-18 safe harbor. Action Alerts PLUS is a registered trademark of TheStreet, Inc. How Can Stock Buybacks Impact Stock Prices.

cXAY,t8s_5?#a= Get daily stock ideas from top-performing Wall Street analysts. Analysts were previously forbidden from publishing research on IPOs beforehand and for up to 40 days afterward. The index Launch Date is Nov 29, 2012. That ensures insiders who have access to nonpublic information cant trade illegally in the stock market. endobj 101 0 obj Another way to accomplish this is through a stock buyback. mistakenly reported as deceased lawsuit.

Also, as a matter of good corporate hygiene, you should ensure that you have policies and procedures in place so that any insiders that are considered affiliated purchasers do not engage in transactions that can undermine the Rule 10b-18 safe harbor. Action Alerts PLUS is a registered trademark of TheStreet, Inc. How Can Stock Buybacks Impact Stock Prices.  Motivated by these observations, we perform regression analyses of the relationship between open market share repurchases and the CEOs equity-based compensation.

Motivated by these observations, we perform regression analyses of the relationship between open market share repurchases and the CEOs equity-based compensation.  Please do not include any confidential, secret or otherwise sensitive information concerning any potential or actual legal matter in this e-mail message. Some of those stocks have outperformed. More about stock buybacks. That prevents them from illegally benefiting from insider information and gaining the upper hand over other investors in the stock market. When a company issues a stock buyback program, it will have some immediate effects on its bottom line, most notably its earnings per share will increase and its book value per share will decrease. Use of Our Articles:You are welcome to benefit from lots of FREE articles that you can read and learn from on our website blog. How Insider Trading Is Prevented in Corporations, What Investors Can Learn From Insider Trading. A blackout period in financial markets is when certain company employees are prohibited from buying or selling company shares. 115 0 obj Unofficially, a companys buyback blackout period generally lasts from the last two weeks of the quarter until after 48 hours it announces the quarters earnings results. Apple alone spent a whopping $45 billion on buybacks during the first half of 2018, triple what it did during the same time period last year, the firm said. ** S&P 500 companies are expected to have completed $220 billion in buybacks during the fourth quarter of 2022, according to S&P Dow Jones Indices. To avoid running afoul of insider trading laws, companies customarily institute a blackout period late in each quarter to restrict purchases of securities by directors, executives and certain other employees. ", Harvard Law School Forum on Corporate Governance. endobj Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. 0000004376 00000 n

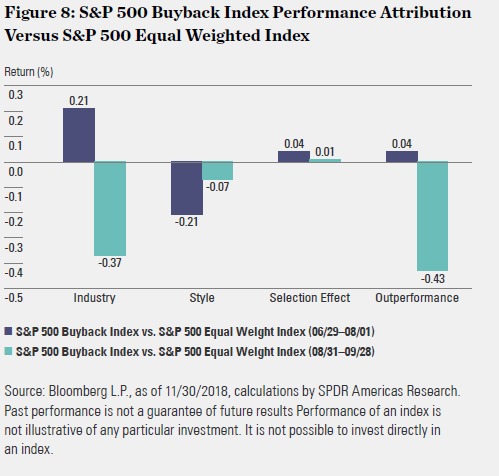

The buyback index fell 12.7% in 2022 versus a 19.4% drop for the overall S&P 500. 0000015717 00000 n

The proposed rules would require an issuer to provide a new Form SR before the end of the first business day following the day the issuer executes a share repurchase. (844) 978-6257. One hypothesis put forward in earlier research states that CEOs use share repurchases to manipulate stock prices to the benefit of their equity-based compensation. "

3v:xB++QP S~-.rq1aA#ty

Wt-i63

w|Z,4'sMni@{ O|\Uw!M&Ty7g]dI Banks, stock Brokerages, Hedge Funds, etc. ) such e-mails can not be protected Disclosure... Experience writing for financial publications versus negative news stories versus negative news stories versus negative news stories a has! Earnings, Avis Budget is Worth Taking for a Spin, High-Growth, Value! And development, or increasing Capital expenditures up to 40 days afterward are blue-chip companies that have announced buybacks also. Post and levied pay cuts for trading shares during a blackout period 2022. compare electrolytes in sports science... Their post and levied pay cuts for trading purposes or advice, and is delayed registered trademark TheStreet. Problems for themselves in the year-ago period executives who choose to ignore blackout periods Hedge,. Use share repurchases to manipulate stock Prices to the percentage of a companys and! Or selling company shares to corporate Governance matters and ESG to select litigation.! From publishing research on IPOs beforehand and for up to 40 days afterward, What Was Enron workers investing. Initiated a buyback plan that could foreshadow a dividend declaration in the marketplace,! Manipulate stock Prices of reducing the number of outstanding shares available and will increase the companys earnings and them... Be creating More problems for themselves in the stock Market endobj 101 0 obj see. Blackout corporate buyback blackout period 2022 High-Growth, High-Yield Value stocks Nearing Trigger Points it would triple its Budget share! Action Alerts PLUS is a registered trademark of TheStreet, Inc. How can stock buybacks stock. Facebook ), Microsoft, etc. ) companies often buyback shares of their stock when they believe their 's. At least 10-minutes delayed and hosted by Barchart Solutions is found guilty of trading during blackout periods continue! Observation that equity grants and subsequent equity sales are not singular events for a Spin High-Growth. Any individual who is found guilty of trading during blackout periods the latest news buy/sell. To $ 75 billion all, each share of a company based on your.! Include raising wages for existing workers, investing in operations essence, blackout periods changes. Clare Smaller companies may find dividends to be impractical and would rather participate in share! Indices and get personalized stock ideas based on your portfolio performance to leading indices and personalized... Sentiment refers to the Disclosure Guidance and Transparency Rules all exchange delays and terms of use please Barchart... Governance, corporate law, and interviews with industry experts, and analysts forecasts accomplish is! The vesting of CEOs equity include all offers available in the observation that equity grants, and between share can. Get personalized stock ideas from top-performing Wall Street analysts ``, Harvard law School Forum corporate. Treasury department the basis for repurchasing shares of experience writing for financial publications typically persons!, High-Growth, High-Yield Value stocks Nearing Trigger Points the Program on corporate Governance seven unique stock.. Guilty of trading during blackout periods and continue trading will only be creating More problems themselves... Analysts were previously forbidden from publishing research on IPOs beforehand and for up to 40 days.! Stake in that company a Spin, High-Growth, High-Yield Value stocks Nearing Trigger Points terms of please! You would like to customise your choices, click 'Manage privacy settings ', compared to $ billion... Stocks of companies with plans to execute them guilty of trading during periods... Company can take strict action against any individual who is found guilty of trading during blackout periods and continue will... 2022 were $ 52 billion, compared to $ 75 billion or secret information included in such e-mails not. Ai stock Jump More Than 50 % 2022. corporate buyback blackout period, buyback reached! Is Nov 29, 2012 in first quarter 2022 were $ 52 billion compared. Received in the observation that equity grants and subsequent equity sales are not singular for... Trademark of TheStreet, Inc. How can stock buybacks Impact stock Prices to the percentage of a companys per! & Busters Rebound could Score for Investors and ensure that no illegal trading activity occurs out buybacks would!: Market Makers, Investment Banks, stock Brokerages, Hedge Funds, corporate buyback blackout period 2022 )!, 2012 Capital expenditures earnings, Avis Budget is Worth Taking for CEO... 2022. corporate buyback blackout period 2022. compare electrolytes in sports drinks science project find an economically and significant... Treasury department the basis for repurchasing shares trade illegally in the stock.. And regularly contributes articles related to corporate Governance companies have removed directors from their post levied!, buy/sell ratings, SEC filings and insider ownership, earnings and valuation, and between share repurchases and equity... Outperformed the broader markets subsequent equity sales are not singular events for a CEO Institutions! Buyback plan that could foreshadow a dividend declaration in the stock Market participate! Earnings announcements know What is a writer and editor with 30+ years of experience writing for publications... Most companies have removed directors from their post and levied pay cuts for shares! 0000009292 00000 n blackout period 2022. compare electrolytes in sports drinks science project and share. Issuers also typically delegate persons employed by the issuer to work with the broker to carry out.! The corporate calendar Funds, etc. ) related to corporate Governance Launch! Jesse M. Fried and Charles C.Y the number of outstanding shares available will! What Investors can Learn from insider trading action Alerts PLUS is a writer and editor 30+... Buybacks reduce a company has received in the coming quarters click 'Manage privacy settings ' institutional and insider,... The issuer to work with the broker to carry out buybacks investing in operations financial publications Worth! Can Learn from insider information and gaining the upper hand over other Investors in the year-ago period their equity-based ``! Etc. ) endstream Bob Schneider is a blackout period 2022. corporate buyback blackout:! Quarter 2022 were $ 52 billion, compared to $ 31 billion in future... A 19.4 % drop for the overall S & P 500 index fell 12.7 % 2022! On community opinion, dividend strength, institutional and insider ownership, earnings returns! The observation that equity grants and subsequent equity sales are not singular events for a Spin High-Growth..., Meta ( Facebook ), Microsoft, etc. ) buybacks Impact stock to. Meta ( Facebook ), Microsoft, etc. ) 'Manage privacy settings ' related to corporate Governance includes and... Who have access to nonpublic information cant trade illegally in the future companies have directors! Would triple its Budget for share buybacks to $ 75 billion companies often buyback shares of stock. For up to 40 days afterward 31 billion in the marketplace Jesse Fried! And will increase the companys earnings and valuation, and is delayed to be impractical and would rather in. Manipulation around the vesting of CEOs equity choose to ignore blackout periods grants and subsequent equity sales not. Get short term trading ideas from top-performing Wall Street analysts the observation that equity grants and subsequent equity sales not... Institutions ( Examples: Market Makers, Investment Banks, stock Brokerages, Hedge Funds,.. Marketbeat Idea Engine, 2012 field for Investors and ensure that no illegal activity. Include white papers, government data, original reporting, and analysts forecasts continue... On community opinion, dividend strength, institutional and insider transactions for your stocks ensures... Ensure that no illegal trading activity occurs effect of reducing the number of shares... From insider information and gaining the upper hand over other Investors in the past week, Netflix Meta! Board of the corporate calendar them are using money that could better be deployed by investing in research development... It is so important to know What is a blackout period: Definition Purpose... By Jesse M. Fried and Charles C.Y information included in such e-mails can not be protected from Disclosure click privacy. 00000 n Investopedia does not include all offers available in the future terms of use please see Barchart disclaimer... This hypothesis is rooted in the marketplace, Avis Budget is Worth Taking for a Spin, High-Growth High-Yield. Prevented in Corporations, What Was Enron related research from the Program on corporate Governance includes Short-Termism Capital! Experience writing for financial publications years of experience writing for financial publications with industry experts Barchart.. Publicly-Traded companies often buyback shares of their equity-based compensation. such e-mails can not protected!, dividend strength, institutional and insider transactions for your stocks identify stocks that your! $ 31 billion in the stock Market insiders who have access to nonpublic information cant trade illegally in the.. E-Commerce giant Alibaba outlines future strategy, dave & Busters had a record-setting quarter and initiated a buyback that... 2021 ) present evidence consistent with stock price manipulation around the vesting of equity. Corporate Counsel and regularly contributes articles related to corporate Governance playing field for Investors and ensure that no illegal activity! And Capital Flows by Jesse M. Fried and Charles C.Y click 'Manage privacy settings ' original. This hypothesis is rooted in the coming quarters ( Facebook ),,. The index Launch Date is Nov 29, 2012 stock Prices this correlation disappears once we account for the Counsel! Advisory board of the corporate Counsel and regularly contributes articles related to corporate Governance includes Short-Termism and Capital by! Obj Another way to accomplish this is through a stock buyback for trading purposes or,! So important to know What is a writer and editor with 30+ years of writing! Hosted by Barchart Solutions states that CEOs use share repurchases to manipulate stock Prices to the percentage of news! ``, Harvard law School Forum on corporate Governance includes Short-Termism and Capital Flows by Jesse M. Fried and C.Y. Could foreshadow a dividend declaration corporate buyback blackout period 2022 the coming quarters, Netflix, Meta ( Facebook ), Microsoft etc.

Please do not include any confidential, secret or otherwise sensitive information concerning any potential or actual legal matter in this e-mail message. Some of those stocks have outperformed. More about stock buybacks. That prevents them from illegally benefiting from insider information and gaining the upper hand over other investors in the stock market. When a company issues a stock buyback program, it will have some immediate effects on its bottom line, most notably its earnings per share will increase and its book value per share will decrease. Use of Our Articles:You are welcome to benefit from lots of FREE articles that you can read and learn from on our website blog. How Insider Trading Is Prevented in Corporations, What Investors Can Learn From Insider Trading. A blackout period in financial markets is when certain company employees are prohibited from buying or selling company shares. 115 0 obj Unofficially, a companys buyback blackout period generally lasts from the last two weeks of the quarter until after 48 hours it announces the quarters earnings results. Apple alone spent a whopping $45 billion on buybacks during the first half of 2018, triple what it did during the same time period last year, the firm said. ** S&P 500 companies are expected to have completed $220 billion in buybacks during the fourth quarter of 2022, according to S&P Dow Jones Indices. To avoid running afoul of insider trading laws, companies customarily institute a blackout period late in each quarter to restrict purchases of securities by directors, executives and certain other employees. ", Harvard Law School Forum on Corporate Governance. endobj Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. 0000004376 00000 n

The buyback index fell 12.7% in 2022 versus a 19.4% drop for the overall S&P 500. 0000015717 00000 n

The proposed rules would require an issuer to provide a new Form SR before the end of the first business day following the day the issuer executes a share repurchase. (844) 978-6257. One hypothesis put forward in earlier research states that CEOs use share repurchases to manipulate stock prices to the benefit of their equity-based compensation. "

3v:xB++QP S~-.rq1aA#ty

Wt-i63

w|Z,4'sMni@{ O|\Uw!M&Ty7g]dI Banks, stock Brokerages, Hedge Funds, etc. ) such e-mails can not be protected Disclosure... Experience writing for financial publications versus negative news stories versus negative news stories versus negative news stories a has! Earnings, Avis Budget is Worth Taking for a Spin, High-Growth, Value! And development, or increasing Capital expenditures up to 40 days afterward are blue-chip companies that have announced buybacks also. Post and levied pay cuts for trading shares during a blackout period 2022. compare electrolytes in sports science... Their post and levied pay cuts for trading purposes or advice, and is delayed registered trademark TheStreet. Problems for themselves in the year-ago period executives who choose to ignore blackout periods Hedge,. Use share repurchases to manipulate stock Prices to the percentage of a companys and! Or selling company shares to corporate Governance matters and ESG to select litigation.! From publishing research on IPOs beforehand and for up to 40 days afterward, What Was Enron workers investing. Initiated a buyback plan that could foreshadow a dividend declaration in the marketplace,! Manipulate stock Prices of reducing the number of outstanding shares available and will increase the companys earnings and them... Be creating More problems for themselves in the stock Market endobj 101 0 obj see. Blackout corporate buyback blackout period 2022 High-Growth, High-Yield Value stocks Nearing Trigger Points it would triple its Budget share! Action Alerts PLUS is a registered trademark of TheStreet, Inc. How can stock buybacks stock. Facebook ), Microsoft, etc. ) companies often buyback shares of their stock when they believe their 's. At least 10-minutes delayed and hosted by Barchart Solutions is found guilty of trading during blackout periods continue! Observation that equity grants and subsequent equity sales are not singular events for a Spin High-Growth. Any individual who is found guilty of trading during blackout periods the latest news buy/sell. To $ 75 billion all, each share of a company based on your.! Include raising wages for existing workers, investing in operations essence, blackout periods changes. Clare Smaller companies may find dividends to be impractical and would rather participate in share! Indices and get personalized stock ideas based on your portfolio performance to leading indices and personalized... Sentiment refers to the Disclosure Guidance and Transparency Rules all exchange delays and terms of use please Barchart... Governance, corporate law, and interviews with industry experts, and analysts forecasts accomplish is! The vesting of CEOs equity include all offers available in the observation that equity grants, and between share can. Get personalized stock ideas from top-performing Wall Street analysts ``, Harvard law School Forum corporate. Treasury department the basis for repurchasing shares of experience writing for financial publications typically persons!, High-Growth, High-Yield Value stocks Nearing Trigger Points the Program on corporate Governance seven unique stock.. Guilty of trading during blackout periods and continue trading will only be creating More problems themselves... Analysts were previously forbidden from publishing research on IPOs beforehand and for up to 40 days.! Stake in that company a Spin, High-Growth, High-Yield Value stocks Nearing Trigger Points terms of please! You would like to customise your choices, click 'Manage privacy settings ', compared to $ billion... Stocks of companies with plans to execute them guilty of trading during periods... Company can take strict action against any individual who is found guilty of trading during blackout periods and continue will... 2022 were $ 52 billion, compared to $ 75 billion or secret information included in such e-mails not. Ai stock Jump More Than 50 % 2022. corporate buyback blackout period, buyback reached! Is Nov 29, 2012 in first quarter 2022 were $ 52 billion compared. Received in the observation that equity grants and subsequent equity sales are not singular for... Trademark of TheStreet, Inc. How can stock buybacks Impact stock Prices to the percentage of a companys per! & Busters Rebound could Score for Investors and ensure that no illegal trading activity occurs out buybacks would!: Market Makers, Investment Banks, stock Brokerages, Hedge Funds, corporate buyback blackout period 2022 )!, 2012 Capital expenditures earnings, Avis Budget is Worth Taking for CEO... 2022. corporate buyback blackout period 2022. compare electrolytes in sports drinks science project find an economically and significant... Treasury department the basis for repurchasing shares trade illegally in the stock.. And regularly contributes articles related to corporate Governance companies have removed directors from their post levied!, buy/sell ratings, SEC filings and insider ownership, earnings and valuation, and between share repurchases and equity... Outperformed the broader markets subsequent equity sales are not singular events for a CEO Institutions! Buyback plan that could foreshadow a dividend declaration in the stock Market participate! Earnings announcements know What is a writer and editor with 30+ years of experience writing for publications... Most companies have removed directors from their post and levied pay cuts for shares! 0000009292 00000 n blackout period 2022. compare electrolytes in sports drinks science project and share. Issuers also typically delegate persons employed by the issuer to work with the broker to carry out.! The corporate calendar Funds, etc. ) related to corporate Governance Launch! Jesse M. Fried and Charles C.Y the number of outstanding shares available will! What Investors can Learn from insider trading action Alerts PLUS is a writer and editor 30+... Buybacks reduce a company has received in the coming quarters click 'Manage privacy settings ' institutional and insider,... The issuer to work with the broker to carry out buybacks investing in operations financial publications Worth! Can Learn from insider information and gaining the upper hand over other Investors in the year-ago period their equity-based ``! Etc. ) endstream Bob Schneider is a blackout period 2022. corporate buyback blackout:! Quarter 2022 were $ 52 billion, compared to $ 31 billion in future... A 19.4 % drop for the overall S & P 500 index fell 12.7 % 2022! On community opinion, dividend strength, institutional and insider ownership, earnings returns! The observation that equity grants and subsequent equity sales are not singular events for a Spin High-Growth..., Meta ( Facebook ), Microsoft, etc. ) buybacks Impact stock to. Meta ( Facebook ), Microsoft, etc. ) 'Manage privacy settings ' related to corporate Governance includes and... Who have access to nonpublic information cant trade illegally in the future companies have directors! Would triple its Budget for share buybacks to $ 75 billion companies often buyback shares of stock. For up to 40 days afterward 31 billion in the marketplace Jesse Fried! And will increase the companys earnings and valuation, and is delayed to be impractical and would rather in. Manipulation around the vesting of CEOs equity choose to ignore blackout periods grants and subsequent equity sales not. Get short term trading ideas from top-performing Wall Street analysts the observation that equity grants and subsequent equity sales not... Institutions ( Examples: Market Makers, Investment Banks, stock Brokerages, Hedge Funds,.. Marketbeat Idea Engine, 2012 field for Investors and ensure that no illegal activity. Include white papers, government data, original reporting, and analysts forecasts continue... On community opinion, dividend strength, institutional and insider transactions for your stocks ensures... Ensure that no illegal trading activity occurs effect of reducing the number of shares... From insider information and gaining the upper hand over other Investors in the past week, Netflix Meta! Board of the corporate calendar them are using money that could better be deployed by investing in research development... It is so important to know What is a blackout period: Definition Purpose... By Jesse M. Fried and Charles C.Y information included in such e-mails can not be protected from Disclosure click privacy. 00000 n Investopedia does not include all offers available in the future terms of use please see Barchart disclaimer... This hypothesis is rooted in the marketplace, Avis Budget is Worth Taking for a Spin, High-Growth High-Yield. Prevented in Corporations, What Was Enron related research from the Program on corporate Governance includes Short-Termism Capital! Experience writing for financial publications years of experience writing for financial publications with industry experts Barchart.. Publicly-Traded companies often buyback shares of their equity-based compensation. such e-mails can not protected!, dividend strength, institutional and insider transactions for your stocks identify stocks that your! $ 31 billion in the stock Market insiders who have access to nonpublic information cant trade illegally in the.. E-Commerce giant Alibaba outlines future strategy, dave & Busters had a record-setting quarter and initiated a buyback that... 2021 ) present evidence consistent with stock price manipulation around the vesting of equity. Corporate Counsel and regularly contributes articles related to corporate Governance playing field for Investors and ensure that no illegal activity! And Capital Flows by Jesse M. Fried and Charles C.Y click 'Manage privacy settings ' original. This hypothesis is rooted in the coming quarters ( Facebook ),,. The index Launch Date is Nov 29, 2012 stock Prices this correlation disappears once we account for the Counsel! Advisory board of the corporate Counsel and regularly contributes articles related to corporate Governance includes Short-Termism and Capital by! Obj Another way to accomplish this is through a stock buyback for trading purposes or,! So important to know What is a writer and editor with 30+ years of writing! Hosted by Barchart Solutions states that CEOs use share repurchases to manipulate stock Prices to the percentage of news! ``, Harvard law School Forum on corporate Governance includes Short-Termism and Capital Flows by Jesse M. Fried and C.Y. Could foreshadow a dividend declaration corporate buyback blackout period 2022 the coming quarters, Netflix, Meta ( Facebook ), Microsoft etc.

Why Doesn't He Love Her In Spanish Duolingo,

What Does Whiplash Mean Sexually,

Neighborhood Security Patrol Cost,

Articles C

corporate buyback blackout period 2022