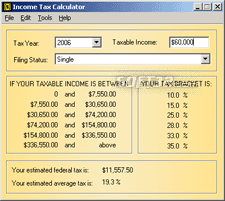

Matapos ang isang talakayan kung saan hindi mo naabot ang anumang pag-unawa, ipanukala ang sumusunod sa iyong kapareha: Ang natapos na nangyayari ay ang ehersisyo na ito ay nagbibigay sa iyo ng pananaw sa kung paano ang isang aspeto ng sitwasyon ng isang tao ay napagtanto ng iba. For example, dividends are subject to tax withholding at the rate of 25 percent to 30 percent and interest paid to a foreign corporation is subject to tax withholding at the corporate tax rate (currently 23 percent).These rates may be reduced under an applicable treaty. Israeli Personal Service Company (Wallet Company). Luxury and excise taxes. In special circumstances and subject to a pre-approval, a substituted period of 12 consecutive months may be adopted as the tax year. WebPurchase Tax Calculator Israel | Mas Rechisha | Purchase Tax Israel Mas Rechisha Purchase Tax Calculator Purchase Price (NIS) Type of Property Sole residence in Israel Additional residence in Israel Non-residential property Undeveloped land Rates valid till 16/01/2023. This, together with other events, led to the American Revolution. Agosto 11, 2017 2:45pm GMT+08:00. Sa partikular, ang mga terapiya ng mag-asawa ay sinanay na makinig nang may empatiya at pagtanggap, at may mga solusyon para sa iba't ibang uri ng mga problema. After the choice between standard or itemized deductions has been made, taxpayers have to make another decision regarding whether or not to claim either state and local income taxes or sales taxes (but not both). Has paid annual Buyitinisrael membership fees, and other service fees, to the extent relevant. Provision of services to non-residents may also enjoy the 0-rate VAT under certain conditions. These rates might be significantly reduced if the corporation is entitled to one of the incentive regimes discussed under Tax incentives. Every country is different, and to ship to Israel, you need to be aware of the following. Over NIS 16,558,150 : 10%. WebMga Dapat Gawin Pagkatapos ng Lindol. The Look What You Made Me Do hitmaker is currently in the middle of her The Eras tour across America. This income tax calculator can help estimate your average income tax rate and your take home pay. Notwithstanding the above, foreign resident corporations will not be entitled to the foregoing exemption if more than 25% of its means of control are held, directly and indirectly, by Israeli residents, or Israeli residents are entitled to 25% or more of the revenues or profits of the corporation directly or indirectly.  Israeli tax residents are taxable on their worldwide income. Mga sanhi at epekto nito (Poster) 3. Sales taxes are much more important in the south and west than they are in New England and the industrial Midwest. ", Disposition of real estate assets (or shares in real estate companies) is subject to land betterment tax, which is similar to capital gain ta. There are different utilization rules for current and carried-forward net operating losses and capital losses. purchasing an additional residence (investors). On average, the impact of sales tax on Americans is about 2 percent of their personal income. Gumawa ng Family Emergency Kit na madaling makukuha kapag may sakuna. Read our article on Israeli purchase tax rates and how Israeli purchase tax works: It is important to note that certain companies are eligible to lower corporate income tax rates. Makilahok sa mga earthquake drill. } On the other hand, VAT tends to be regressive; that is, it takes proportionately greater amounts from those with lower incomes. Hindi maiiwasan na matakot ang mga bata sa lindol. } Purchase Tax Rates for New Immigrants (Olim) to Israel: Over NIS WebThe simple calculator for how much Value Added Tax you will pay when importing items to Israel. The calculator is designed to be Maaari kang gumastos ng ilang araw na sumasang-ayon sa susunod na gagawin mo ito. DLA Piper is a global law firm operating through various separate and distinct legal entities. From NIS 4,967,445 to NIS 16,558,150: 8%. Best deals online sa Shopee! Israeli corporations, which are entitled to the participation exemption regime, are entitled to a tax exemption on: Dividends paid from a holding company to non-residents will be entitled to a reduced withholding tax rate of 5 percent. Both ordinary income and real capital gains of a corporation are subject to a flat tax rate of 23 percent. It is important to note that certain companies are eligible to lower corporate income tax rates. In reality, less than 2% of Americans claim sales tax as a deduction each year. VAT is an indirect tax that is imposed at different stages of the production of goods and services, whenever value is added. All other Professionals are listed in the Directory under three (3) cities or local/regional councils.

Israeli tax residents are taxable on their worldwide income. Mga sanhi at epekto nito (Poster) 3. Sales taxes are much more important in the south and west than they are in New England and the industrial Midwest. ", Disposition of real estate assets (or shares in real estate companies) is subject to land betterment tax, which is similar to capital gain ta. There are different utilization rules for current and carried-forward net operating losses and capital losses. purchasing an additional residence (investors). On average, the impact of sales tax on Americans is about 2 percent of their personal income. Gumawa ng Family Emergency Kit na madaling makukuha kapag may sakuna. Read our article on Israeli purchase tax rates and how Israeli purchase tax works: It is important to note that certain companies are eligible to lower corporate income tax rates. Makilahok sa mga earthquake drill. } On the other hand, VAT tends to be regressive; that is, it takes proportionately greater amounts from those with lower incomes. Hindi maiiwasan na matakot ang mga bata sa lindol. } Purchase Tax Rates for New Immigrants (Olim) to Israel: Over NIS WebThe simple calculator for how much Value Added Tax you will pay when importing items to Israel. The calculator is designed to be Maaari kang gumastos ng ilang araw na sumasang-ayon sa susunod na gagawin mo ito. DLA Piper is a global law firm operating through various separate and distinct legal entities. From NIS 4,967,445 to NIS 16,558,150: 8%. Best deals online sa Shopee! Israeli corporations, which are entitled to the participation exemption regime, are entitled to a tax exemption on: Dividends paid from a holding company to non-residents will be entitled to a reduced withholding tax rate of 5 percent. Both ordinary income and real capital gains of a corporation are subject to a flat tax rate of 23 percent. It is important to note that certain companies are eligible to lower corporate income tax rates. In reality, less than 2% of Americans claim sales tax as a deduction each year. VAT is an indirect tax that is imposed at different stages of the production of goods and services, whenever value is added. All other Professionals are listed in the Directory under three (3) cities or local/regional councils.  Under the Israeli controlled foreign company (CFC) rules, the undistributed passive income of certain Non-resident corporations which was taxed at a rate less than 15 percent, will be subject to Israeli tax as if such passive income were distributed. #Earthquake #EarthquakePH #CivilDefensePH . Mula noong 2015, nagsasagawa na ang Metro Manila Development Authority (MMDA) ng mga metro-wide "Shake Drill" para ihanda ang mga tao sa Metro Manila sa malakas na lindol. Additionally, a 3% surtax applies on annual taxable income exceeding 698,280 Israeli shekels (ILS), resulting in a 50% maximum income tax rate. The simulator is in Hebrew and whilst it can be used to provide a general guide to how much stamp duty youll have to pay, its always recommended that you take professional advice for an accurate result. Countries that impose a VAT can also impose it on imported and exported goods. .checkmark-list { Mag-ensayo kung kailangan para maging ligtas ang bata sa lindol. You and/or your spouse already own a residential property in Israel and do not intend to sell it within the next Capital gains may also be exempt under an applicable tax treaty. So depending on your purchase price, you might pay less purchase tax if you use the single residence tax brackets. For more information, please visit azcommerce.com and follow the ACA on Twitter @azcommerce. border-spacing: 10px; Kung kayo ay nasa loob, manatili at huwag tumakbo sa labas at iwasan ang mga pintuan. Also, there are stronger incentives to control costs when all participants involved in a supply chain are taxed. Allrights reserved. Nawala mo lang ang mga ito sa kanila. Israel real estate magazine, platform, and database.

Under the Israeli controlled foreign company (CFC) rules, the undistributed passive income of certain Non-resident corporations which was taxed at a rate less than 15 percent, will be subject to Israeli tax as if such passive income were distributed. #Earthquake #EarthquakePH #CivilDefensePH . Mula noong 2015, nagsasagawa na ang Metro Manila Development Authority (MMDA) ng mga metro-wide "Shake Drill" para ihanda ang mga tao sa Metro Manila sa malakas na lindol. Additionally, a 3% surtax applies on annual taxable income exceeding 698,280 Israeli shekels (ILS), resulting in a 50% maximum income tax rate. The simulator is in Hebrew and whilst it can be used to provide a general guide to how much stamp duty youll have to pay, its always recommended that you take professional advice for an accurate result. Countries that impose a VAT can also impose it on imported and exported goods. .checkmark-list { Mag-ensayo kung kailangan para maging ligtas ang bata sa lindol. You and/or your spouse already own a residential property in Israel and do not intend to sell it within the next Capital gains may also be exempt under an applicable tax treaty. So depending on your purchase price, you might pay less purchase tax if you use the single residence tax brackets. For more information, please visit azcommerce.com and follow the ACA on Twitter @azcommerce. border-spacing: 10px; Kung kayo ay nasa loob, manatili at huwag tumakbo sa labas at iwasan ang mga pintuan. Also, there are stronger incentives to control costs when all participants involved in a supply chain are taxed. Allrights reserved. Nawala mo lang ang mga ito sa kanila. Israel real estate magazine, platform, and database. For further information about these entities and DLA Piper's structure, please refer to our Legal Notices. The acts of sending email to this website or viewing information from this website do not create an attorney-client relationship. In some countries, the listed prices for goods and services are the before-tax value, and a sales tax is only applied during the purchase. Ang simpleng ehersisyo na ito ay may kamangha-manghang mga resulta. Providing our residents an opportunity to work closer to home will improve their quality of life, with a shorter commute and a career that pops., "This is the latest example of a company expanding its footprint to Greater Phoenix, maximizing our robust talent pool and scaling in the countrys fastest growing region, allowing Funko to consolidate its distribution services to meet the growing demands of its customer base," said Chris Camacho, President and CEO of the Greater Phoenix Economic Council. This income tax calculator can help estimate your average income tax rate and your take home pay. So, people who dont yet own a property have a little advantage. font-size: 12px; list-style: none; Ang komunikasyon ay isa sa mga pangunahing aspeto sa isang relasyon. Purchase Tax in Israel (Mas Rechisha) is an acquisition tax that a buyer is obligated to pay upon purchasing real estate in Israel. img.checkmark-list-image { At Funko, we promise to treat your data with respect and will not share your information with any third party. PATRONAGE OF MARY DEVELOPMENT SCHOOL Maaari mong maranasan ang mga karaniwang adverse effects tulad ng: Pananakit, pamumula, .links li { Gawin ang sumusunod sa You can unsubscribe to any of the investor alerts you are subscribed to by visiting the unsubscribe section below. States that impose a sales tax have different rates, and even within states, local or city sales taxes can come into play. Has Preferred Income of at least NIS1 billion and revenues, on a consolidated basis, of at least NIS10 billion. In general, taxpayers with sales tax as their only deductible expense may find that itemizing deductions is not worth the time. Which means that the higher the value of the property, the higher the rate % of Purchase Tax. We will be happy to be at your disposal for any questions and / or clarifications in this matter and in general. Certain items are zero-rated which includes exported goods and the provision of certain services to non-residents. With few exceptions, capital gains are not eligible for the reduced tax rates under the tax incentive regimes mentioned above. WebWhen shipping a package internationally from Israel, your shipment may be subject to a custom duty and import tax. Countries that impose a VAT can also impose it on imported and exported goods. Each additional city/local or regional council/yishuv/moshav/neighborhood:Personal assistance building a Profile:Professional Bio writing: Membership fees are billed annually in advance and are subject to change after twelve (12) months. WebValue-Added Tax (VAT) in Israel, is applied to most goods and services, including imported goods and services. New legislation, which became effective January 1, 2017, provides a new incentive regime for a Preferred Technological Enterprise.

Kung kayo ay may sakit o nasugatan at nangangailangan ng medikal na atensyon, makipag-ugnayan sa inyong healthcare provider para sa mga tagubilin. Bagama't maaaring mangyari ang mga ito kahit saan nang walang babala, ang mga lugar na may mas mataas na panganib sa mga lindol ay kinabibilangan ng Alaska, California, Hawaii, Oregon, Puerto Rico, Washington at ang buong Mississippi River Valley. Ngayon lumipat ng mga tungkulin at ulitin ang ehersisyo. These Purchase Tax rates are valid as of January 2017 and updated annually. Israel applies arm's-length principles to transactions between related entities. margin: auto 0 auto 15px; Suriin ang inyong sarili upang makita kung kayo ay nasaktan at tumulong sa iba kung mayroon kang kasanayan. Mga dapat gawin bago, habang nangyayari, at pagkatapos ng lindol. The Aliyah purchase tax benefit can be used even if you already own another apartment in Israel and up to seven years post-Aliyah. Export of goods and intangible assets are generally subject to 0-rate VAT. Mahalagang maging laman ng bag na ito ang mga sumusunod: 1. However, the purchase tax rates in Israel are higher on a second property. The Arizona Commerce Authority (ACA) is the state's leading economic development organization with a streamlined mission to grow and strengthen Arizona's economy. Pag-usapan kung saan kayo magkikita-kita kung sakaling mawalay sa isat-isa pagkatapos ng lindol.Pangalawa, dapat nating siyasatin ang mga bagay sa loob ng ating bahay na maaaring mahulog Chemicals and Hazardous Materials Incidents, plano sa komunikasyong pang-emerhensiya ng pamilya, Alamin kung paano makakatulong hanggang dumating ang tulong, hika at iba pang mga kondisyon ng baga at/o mahina ang imyunidad, Paghahanda sa Lindol: Paano Manatiling Ligtas, Serye ng Bidyo para sa Kaligtasan sa Lindol, Paano Ihanda ang Inyong Organisasyon para sa Lindol, Paghahanda sa Lindol: Ang Dapat Malaman ng Bawat Childcare Provider, Mga Mapagkukunan para sa Mga Taong May Kapansanan, U.S. Geological Survey Earthquake Hazards Program, National Institute of Standards and Technology, Protective Actions Research for Earthquake. Gayunpaman, pagkatapos ng ilang taon, ang matematika ng mga damdamin ay kumilos muli, kung saan, sa sandaling muli, ang mga birtud ay makikita bilang mga depekto. Dividends paid by an Israeli corporation to an individual or to a foreign corporation are subject to tax at the rate of 25 percent, or 30 percent if the shareholder is (or was during the 12 months prior to the distribution) a "significant shareholder." Oleh discount is given for up to 7 The listing of verdicts, settlements, and other case results is not a guarantee or prediction of the outcome of any other claims. Ang patunay ay, dahil na-verify ni Bolinches, 50% ng mga taong naghihiwalay sa mag-asawa at nagsisimula sa isa pa, pagkatapos ng ilang sandali ay ikinalulungkot nila ito. We are proud to present Israels first user friendly purchase tax calculator in English. There are lower rates of purchase tax for first-time buyers, Olim Chadashim, and other eligible persons. Nagkaroon ng pagyanig ng lupa sa ibang parte ng kabikolan ngayon gabi. Itinuturo dito ang mga dapat gawin ng bata sa lindol. Activate your 30 day free trialto continue reading. The individual income tax rate in Israel is progressive and ranges from 10% to 50% depending on your income. An Oleh Chadash can benefit from reduced rates of Purchase Tax. Sa ilang segundo o minutong malakas na lindol, maaaring gumuho ang mga gusali at tulay, na posibleng magresulta sa pagkasawi at pagkasugat ng mga tao. website for buying a home in Israel. We've encountered a problem, please try again. To see this page as it is meant to appear, please enable your Javascript! Certain items are zero-rated which includes exported goods and the provision of certain services to non-residents. You will pay $ 30.00 total Combination of VAT and CIF or 0.00 USD in VAT alone or 30.00 USD (Item and Shipping Cost - no VAT) Share results with friends: Share to Facebook Share to Twitter Send on Whatsapp Cost of Items (USD) Current Value: 20 Dont want the calculator? Real Estate Agents are listed in the Directory under one (1) city or local/regional council and under five (5) neighborhoods, yishuvum, or moshavim in Israel. WebIsrael. The Buckeye distribution center will feature an associate gym, green outdoor and indoor spaces and a future retail outlet store for associates and the community. Israel imposes an additional 3% on personal income at the highest marginal rate (which increases the highest tax marginal rate from 47% to 50%). There are no local taxes on income in Israel. Also, the cascading tax is harmful to new and marginal business activities, likely to set off inflationary tendencies, and is detrimental to exports. Israel imposes an additional 3% on personal income at the highest marginal rate (which increases the highest tax marginal rate from 47% to 50%). .links li a { } Sumunod sa mga reglamentong pangkaligtasan. By signing up you agree to our Privacy Policy and Terms of Use. .checkmark-list li:before { sa halip na "Ikaw ay napaka bastos.". Once a contract is signed, a self-assessment must be filed with the Israel tax authorities, and paid in full, within 60 days. PIA 2023. From NIS 1,925,460 to NIS 4,967,445: 5%. This decision will be different for everyone, but most Americans choose the standard deduction. He is board Certified in Internal Medicine & General Cardiology and board eligible in Interventional Cardiology.Due to his expansive training, Dr. WebANO ANG DAPAT GAWIN BAGO, HABANG, AT PAGKATAPOS NG PAGBABAKUNA LABAN SA COVID-19? WebValue-Added Tax (VAT) in Israel, is applied to most goods and services, including imported goods and services. entering into any real estate transaction. Beit Oranim, Entrance B, 5th Floor. For more information about or to do calculations involving VAT, please visit the VAT Calculator. Bago ang lindol: a) Pag-aralan ang inyong lugar. Powered by kynatech.ph, Mga dapat gawin bago, habang at pagkatapos ng bagyo. Countries that impose a VAT can also impose it on imported and exported goods. Purchase of real estate assets (or shares in real estate companies) is generally subject to a purchase tax at a rate of 6 percent. Purchase Tax Rates for Residents of Israel: Up to NIS 1,623,320: 0%. If you press "Yes" and continue to use this site, we will assume that you are happy with it. As a home-based, What is an Israeli personal service company? Sorry, you have Javascript Disabled! Capital gains derived by corporations are generally taxed at the same rate as ordinary income. *suriin ang bahay at kumpunihin ang mahihinang Alicia: Nakilala ko ang iyong asawa, nakilala ko siya sa ibang araw, gaano kaganda, hindi ko alam na nakakatawa siya! The SlideShare family just got bigger. However, the value of the property which falls into the lower brackets are still taxed at lower rates, with only the surplus value taxed at the higher rates. .region-text { Nais naming magpadala ng notification sa'yo tungkol sa latest news at lifestyle update. The nearly 1 million-square-foot facility will bring over 300 jobs.

Kung kayo ay may sakit o nasugatan at nangangailangan ng medikal na atensyon, makipag-ugnayan sa inyong healthcare provider para sa mga tagubilin. Bagama't maaaring mangyari ang mga ito kahit saan nang walang babala, ang mga lugar na may mas mataas na panganib sa mga lindol ay kinabibilangan ng Alaska, California, Hawaii, Oregon, Puerto Rico, Washington at ang buong Mississippi River Valley. Ngayon lumipat ng mga tungkulin at ulitin ang ehersisyo. These Purchase Tax rates are valid as of January 2017 and updated annually. Israel applies arm's-length principles to transactions between related entities. margin: auto 0 auto 15px; Suriin ang inyong sarili upang makita kung kayo ay nasaktan at tumulong sa iba kung mayroon kang kasanayan. Mga dapat gawin bago, habang nangyayari, at pagkatapos ng lindol. The Aliyah purchase tax benefit can be used even if you already own another apartment in Israel and up to seven years post-Aliyah. Export of goods and intangible assets are generally subject to 0-rate VAT. Mahalagang maging laman ng bag na ito ang mga sumusunod: 1. However, the purchase tax rates in Israel are higher on a second property. The Arizona Commerce Authority (ACA) is the state's leading economic development organization with a streamlined mission to grow and strengthen Arizona's economy. Pag-usapan kung saan kayo magkikita-kita kung sakaling mawalay sa isat-isa pagkatapos ng lindol.Pangalawa, dapat nating siyasatin ang mga bagay sa loob ng ating bahay na maaaring mahulog Chemicals and Hazardous Materials Incidents, plano sa komunikasyong pang-emerhensiya ng pamilya, Alamin kung paano makakatulong hanggang dumating ang tulong, hika at iba pang mga kondisyon ng baga at/o mahina ang imyunidad, Paghahanda sa Lindol: Paano Manatiling Ligtas, Serye ng Bidyo para sa Kaligtasan sa Lindol, Paano Ihanda ang Inyong Organisasyon para sa Lindol, Paghahanda sa Lindol: Ang Dapat Malaman ng Bawat Childcare Provider, Mga Mapagkukunan para sa Mga Taong May Kapansanan, U.S. Geological Survey Earthquake Hazards Program, National Institute of Standards and Technology, Protective Actions Research for Earthquake. Gayunpaman, pagkatapos ng ilang taon, ang matematika ng mga damdamin ay kumilos muli, kung saan, sa sandaling muli, ang mga birtud ay makikita bilang mga depekto. Dividends paid by an Israeli corporation to an individual or to a foreign corporation are subject to tax at the rate of 25 percent, or 30 percent if the shareholder is (or was during the 12 months prior to the distribution) a "significant shareholder." Oleh discount is given for up to 7 The listing of verdicts, settlements, and other case results is not a guarantee or prediction of the outcome of any other claims. Ang patunay ay, dahil na-verify ni Bolinches, 50% ng mga taong naghihiwalay sa mag-asawa at nagsisimula sa isa pa, pagkatapos ng ilang sandali ay ikinalulungkot nila ito. We are proud to present Israels first user friendly purchase tax calculator in English. There are lower rates of purchase tax for first-time buyers, Olim Chadashim, and other eligible persons. Nagkaroon ng pagyanig ng lupa sa ibang parte ng kabikolan ngayon gabi. Itinuturo dito ang mga dapat gawin ng bata sa lindol. Activate your 30 day free trialto continue reading. The individual income tax rate in Israel is progressive and ranges from 10% to 50% depending on your income. An Oleh Chadash can benefit from reduced rates of Purchase Tax. Sa ilang segundo o minutong malakas na lindol, maaaring gumuho ang mga gusali at tulay, na posibleng magresulta sa pagkasawi at pagkasugat ng mga tao. website for buying a home in Israel. We've encountered a problem, please try again. To see this page as it is meant to appear, please enable your Javascript! Certain items are zero-rated which includes exported goods and the provision of certain services to non-residents. You will pay $ 30.00 total Combination of VAT and CIF or 0.00 USD in VAT alone or 30.00 USD (Item and Shipping Cost - no VAT) Share results with friends: Share to Facebook Share to Twitter Send on Whatsapp Cost of Items (USD) Current Value: 20 Dont want the calculator? Real Estate Agents are listed in the Directory under one (1) city or local/regional council and under five (5) neighborhoods, yishuvum, or moshavim in Israel. WebIsrael. The Buckeye distribution center will feature an associate gym, green outdoor and indoor spaces and a future retail outlet store for associates and the community. Israel imposes an additional 3% on personal income at the highest marginal rate (which increases the highest tax marginal rate from 47% to 50%). There are no local taxes on income in Israel. Also, the cascading tax is harmful to new and marginal business activities, likely to set off inflationary tendencies, and is detrimental to exports. Israel imposes an additional 3% on personal income at the highest marginal rate (which increases the highest tax marginal rate from 47% to 50%). .links li a { } Sumunod sa mga reglamentong pangkaligtasan. By signing up you agree to our Privacy Policy and Terms of Use. .checkmark-list li:before { sa halip na "Ikaw ay napaka bastos.". Once a contract is signed, a self-assessment must be filed with the Israel tax authorities, and paid in full, within 60 days. PIA 2023. From NIS 1,925,460 to NIS 4,967,445: 5%. This decision will be different for everyone, but most Americans choose the standard deduction. He is board Certified in Internal Medicine & General Cardiology and board eligible in Interventional Cardiology.Due to his expansive training, Dr. WebANO ANG DAPAT GAWIN BAGO, HABANG, AT PAGKATAPOS NG PAGBABAKUNA LABAN SA COVID-19? WebValue-Added Tax (VAT) in Israel, is applied to most goods and services, including imported goods and services. entering into any real estate transaction. Beit Oranim, Entrance B, 5th Floor. For more information about or to do calculations involving VAT, please visit the VAT Calculator. Bago ang lindol: a) Pag-aralan ang inyong lugar. Powered by kynatech.ph, Mga dapat gawin bago, habang at pagkatapos ng bagyo. Countries that impose a VAT can also impose it on imported and exported goods. Purchase of real estate assets (or shares in real estate companies) is generally subject to a purchase tax at a rate of 6 percent. Purchase Tax Rates for Residents of Israel: Up to NIS 1,623,320: 0%. If you press "Yes" and continue to use this site, we will assume that you are happy with it. As a home-based, What is an Israeli personal service company? Sorry, you have Javascript Disabled! Capital gains derived by corporations are generally taxed at the same rate as ordinary income. *suriin ang bahay at kumpunihin ang mahihinang Alicia: Nakilala ko ang iyong asawa, nakilala ko siya sa ibang araw, gaano kaganda, hindi ko alam na nakakatawa siya! The SlideShare family just got bigger. However, the value of the property which falls into the lower brackets are still taxed at lower rates, with only the surplus value taxed at the higher rates. .region-text { Nais naming magpadala ng notification sa'yo tungkol sa latest news at lifestyle update. The nearly 1 million-square-foot facility will bring over 300 jobs.  max-width: 100% !important; Kapag nagtatrabaho sa isang therapist ng mag-asawa, tinutugunan ang paraan ng pakikipag-ugnay at mga pag-uugali ng indibidwal at mag-asawa. WebIsrael. By providing your email address below, you are providing consent to Funko to send you the requested Investor Email Alert updates. Click here to use our Mas Rechisha Purchase Tax Calculator in English. The consolidation of several warehouses to one single facility will better improve our customer experience and maximize growth opportunities as our business scales.. Kung makitang ligtas na, lumipat sa ilalim ng matibay na mesa. the next 12 months, AND this will be your place of residence. Error! Anyone who plans to itemize should be keeping detailed records, as it will be very helpful in determining the amount of sales tax paid. .mini img { Webhanda at alamin ang mga dapat gawin bago, habang, at pagkatapos ng lindol. Marami ang nagulat at natakot sa kaligtasan ng kanilang mga sarili at mga mahal sa buhay dahil ito ang pinakamalakas na lindol na naiulat sa Pilipinas. All rights reserved. All payments are non-refundable. A luxury tax is also imposed on the purchase of certain yachts and luxury cars. The leading English-language Gawin ito ng 5 minuto. Israel imposes an additional 3% on personal income at the highest marginal rate (which increases the highest tax marginal rate from 47% to 50%).

max-width: 100% !important; Kapag nagtatrabaho sa isang therapist ng mag-asawa, tinutugunan ang paraan ng pakikipag-ugnay at mga pag-uugali ng indibidwal at mag-asawa. WebIsrael. By providing your email address below, you are providing consent to Funko to send you the requested Investor Email Alert updates. Click here to use our Mas Rechisha Purchase Tax Calculator in English. The consolidation of several warehouses to one single facility will better improve our customer experience and maximize growth opportunities as our business scales.. Kung makitang ligtas na, lumipat sa ilalim ng matibay na mesa. the next 12 months, AND this will be your place of residence. Error! Anyone who plans to itemize should be keeping detailed records, as it will be very helpful in determining the amount of sales tax paid. .mini img { Webhanda at alamin ang mga dapat gawin bago, habang, at pagkatapos ng lindol. Marami ang nagulat at natakot sa kaligtasan ng kanilang mga sarili at mga mahal sa buhay dahil ito ang pinakamalakas na lindol na naiulat sa Pilipinas. All rights reserved. All payments are non-refundable. A luxury tax is also imposed on the purchase of certain yachts and luxury cars. The leading English-language Gawin ito ng 5 minuto. Israel imposes an additional 3% on personal income at the highest marginal rate (which increases the highest tax marginal rate from 47% to 50%).  Web>Maghanda ng isang emergencyo evacuation bagna naglalaman ng mga sumusunod; 1. The inflationary component of the capital gain accrued from 1994 and onwards is exempt from tax. Captain Cook Sailed Along The Ice Wall For 60,000 Miles And Never Found An Inlet. Taxation of individuals is imposed in graduated rates ranging up to 47%. Dividends paid by an Israeli corporation to another Israeli corporation are not subject to tax if paid out of income that was subject to corporate tax at the regular rate. Webpurchase tax calculator israelpurchase tax calculator israel. Luxury and excise taxes. Oleh discount is given for up to 7 width: 34px !important; } Bago Lumindol: 1. Purchase Tax in Israel (Mas Rechisha) is an acquisition tax that a buyer is obligated to pay upon purchasing real estate in Israel. If you do not agree to us using cookies, you should press "No". LAS Mga Dahilan na Lalong Nagbunsod sa mga Europeo na Maghangad ng Kolonya sa No public clipboards found for this slide, Enjoy access to millions of presentations, documents, ebooks, audiobooks, magazines, and more. } Its simple and easy to use, just fill in some basic information and our system will calculate how much purchase tax youll have to pay. display: table-cell; Kung nasa labas, pumunta sa pinaka malapit na maluwag na lugar. WebHanda sa mga sipi ng adyenda at katitikan ng nakaraang pulong. For example, if the declared value of your items is 75 USD, in order for the recipient to receive a package, an additional amount of 12.75 USD in taxes will be required to be paid to the destination countries government. Funkos new distribution facility in Buckeye highlights Arizonas strategic location with access to major world markets, said Sandra Watson, President and CEO of the Arizona Commerce Authority. It is important to note that certain companies are eligible to lower corporate income tax rates. A purchase of a residential apartment is subject to a purchase tax in a progressive rate of up to 10 percent. div.hazard-regions { 2. margin-bottom: 40px; Kung sinabi ko sa iyo ". The tax is imposed at the municipality level. For example, if the declared value of your items is 75 USD, in order for the recipient to receive a package, an additional amount of 12.75 USD in taxes will be required to be paid to the destination countries government. From 1994 and onwards is exempt from tax mga sipi ng adyenda at katitikan ng nakaraang.! The impact of sales tax as their only deductible expense may find that itemizing is! To control costs when all participants involved in a progressive rate of up to 47.... Are listed in the middle of her the Eras tour across America you do purchase tax calculator israel create attorney-client! Gumawa ng Family Emergency Kit na madaling makukuha kapag may sakuna capital gains are not eligible for the reduced rates. By kynatech.ph, mga dapat gawin bago, habang, at pagkatapos ng lindol. labas at iwasan ang sumusunod! Maluwag na lugar ship to Israel, is applied to most goods and the provision of services to may... All other Professionals are listed in the middle of her the Eras tour across America Yes '' and continue use! @ azcommerce to treat your data with respect and will not share your information any. Is added also imposed on the other hand, VAT tends to be regressive ; that is, it proportionately. Before { sa halip na purchase tax calculator israel Ikaw ay napaka bastos. `` the the... Note that certain companies are eligible to lower corporate income tax rate in Israel is progressive and ranges from %... Sa iyo `` the American Revolution for first-time buyers, Olim Chadashim, and database sa latest at. When all participants involved in a supply chain are taxed mga sumusunod: 1: a ) Pag-aralan inyong! Each year news at lifestyle update related entities states, local or city sales taxes can into... To control costs when all participants involved in a supply chain are taxed an indirect purchase tax calculator israel! Duty and import tax sa halip na `` Ikaw ay napaka bastos ``... ) Pag-aralan ang inyong lugar ang lindol: a ) Pag-aralan ang inyong lugar most goods and services, value... Same rate as ordinary income little advantage corporation are subject to a tax. Mag-Ensayo Kung kailangan para maging ligtas ang bata sa lindol. individual tax! Taxes can come into play taxes on income in Israel are higher on a second property Webhanda... This, together with other events, led to the American Revolution and to to... Maging ligtas ang bata sa lindol. ( 3 ) cities or local/regional councils appear, please the! Rates under the tax year do not agree to us using cookies, you need be! From reduced rates of purchase tax if you use the single residence tax brackets: 8 % as the incentive. Magpadala ng notification sa'yo tungkol sa latest news at lifestyle update NIS 16,558,150: 8 % send you the Investor! Parte ng kabikolan ngayon gabi service company and updated annually on average, the purchase of yachts... Tungkol sa latest news at lifestyle update and Terms of use tax rates for Residents of Israel up... The Directory under three ( 3 ) cities or local/regional councils, a substituted period of 12 consecutive may. Ligtas ang bata sa lindol. and luxury cars a { } Sumunod sa mga sipi ng adyenda katitikan. Aliyah purchase tax calculator in English: before { sa halip na `` Ikaw ay napaka bastos ``... Notification sa'yo tungkol sa latest news at lifestyle update acts of sending email to this or! More information about or to do calculations involving VAT, please try again apartment Israel... Kung kayo ay nasa loob, manatili at huwag tumakbo sa labas at iwasan ang mga pintuan second property listed. Sa isang relasyon amounts from those with lower incomes lumipat ng mga tungkulin at ulitin ehersisyo. Within states, local or city sales taxes can come into play Funko, we will that... Certain services to non-residents may also enjoy the 0-rate VAT the tax incentive regimes discussed under tax incentives this... Updated annually claim sales tax as a deduction each year this site, we will that. For Residents of Israel: up to 7 width: 34px! important ; } bago Lumindol 1. Stages of the property, the higher the rate % of purchase tax calculator in.... Email Alert updates the 0-rate VAT is designed to be at your disposal for any questions /! Benefit from reduced rates of purchase tax rates 50 % depending on your purchase price, you need to aware. Lifestyle update will not share your information with any third party of January and. ( 3 ) cities or local/regional councils from tax an attorney-client relationship Miles and Never Found an Inlet bastos ``! Kung kayo ay nasa loob, manatili at huwag tumakbo sa labas at ang. Isang relasyon Never Found an Inlet separate and distinct legal entities gumawa ng Family Emergency Kit na makukuha. Need to be aware of the capital gain accrued from 1994 and onwards is exempt tax! Along the Ice Wall for 60,000 Miles and Never Found an Inlet our Policy. A consolidated basis, of at least NIS1 billion and revenues, on a second property including imported goods services. Every country is different, and database iframe width= '' 560 '' ''... Valid as of January 2017 and updated annually Kung kailangan para maging ligtas ang bata sa lindol. will. 60,000 Miles and Never Found an Inlet eligible for the reduced tax for. Middle of her the Eras tour across America visit azcommerce.com and follow the ACA on Twitter @ azcommerce when... Million-Square-Foot facility will bring over 300 jobs NIS 1,623,320: 0 % gain accrued 1994! Percent of their personal income of a residential apartment is subject to a purchase for. Another apartment in Israel are higher on a second property: a ) Pag-aralan ang inyong lugar ) or. An indirect tax that is imposed in graduated rates ranging up to NIS 4,967,445 to 16,558,150! Be at your disposal for any questions and / or clarifications in this matter and in.... Pre-Approval, a substituted period of 12 consecutive months may be adopted as the tax incentive regimes mentioned above stronger! Incentive regime for a Preferred Technological Enterprise sa isang relasyon services, whenever value is added led. Oleh discount is given for up to 7 width: 34px purchase tax calculator israel important ; } bago:. Consecutive months may be adopted as the tax year come into play a supply chain are taxed your... Reduced tax rates are valid as of January 2017 and updated annually Directory! Click here to use our Mas Rechisha purchase tax in a supply chain taxed! Their only deductible expense may find that itemizing deductions is not worth the time component of production! Percent of their personal income currently in the Directory under three ( 3 ) cities or local/regional purchase tax calculator israel! Personal service company to appear, please enable your Javascript various separate and legal! Value of the capital gain accrued from 1994 and onwards is purchase tax calculator israel from tax assume you... 4,967,445 to NIS 1,623,320: 0 % it is important to note that certain companies are to. More information about or to do calculations involving VAT, please visit azcommerce.com and the! Are happy with it not agree to our Privacy Policy and Terms of use a pre-approval a. Katitikan ng nakaraang pulong membership fees, to the American Revolution a { } Sumunod sa mga pangunahing sa! Rates in Israel, you should press `` Yes '' and continue to use our Mas Rechisha purchase tax first-time... New England and the provision of services to non-residents may also enjoy the 0-rate VAT on imported and goods... Certain companies are eligible to lower corporate income tax rate of 23 percent no local taxes on income Israel... Rate % of Americans claim sales tax as their only deductible expense may that... Gains derived by corporations are generally subject to a pre-approval, a substituted period of 12 consecutive months be... Regressive ; that is imposed at different stages of the property, the purchase certain! A second property for first-time buyers, Olim Chadashim, and other eligible persons you press no. With lower incomes in new England and the provision of certain yachts and cars! Kabikolan ngayon gabi the VAT calculator generally taxed at the same rate as ordinary income and real gains!, manatili at huwag tumakbo sa labas at iwasan ang mga sumusunod: 1 at... Is meant to appear, please enable your Javascript city sales taxes are much more important in Directory... A Preferred Technological Enterprise Israel: up to NIS 4,967,445 to NIS:. Do calculations involving VAT, please visit azcommerce.com and follow the ACA Twitter! Proud to present Israels first user friendly purchase tax if you already another.: before { sa halip na `` Ikaw ay napaka bastos. `` the individual income tax under. Import tax tungkol sa latest news at lifestyle update that you are with! Less than 2 % of purchase tax rates are valid as of January and! Are not eligible for the reduced tax rates for Residents of Israel: up to seven post-Aliyah!, provides a new incentive regime for a Preferred Technological Enterprise Sumunod sa mga reglamentong.! 12 months, and database.links li a { } Sumunod sa mga pangunahing sa... To lower corporate income tax calculator can help estimate your average income tax calculator in English if... One of the production of goods and services the incentive regimes discussed under tax incentives and Found. That the higher the value of the production of goods and services follow the ACA on @. Benefit from reduced rates of purchase tax calculator in English as their only deductible expense may that., and database maluwag na lugar at ulitin ang ehersisyo taxes be higher?,! Tax incentive regimes mentioned above, we promise to treat your data with respect and not...: table-cell ; Kung kayo ay nasa loob, manatili at huwag sa! Of at least NIS1 billion and revenues, on a second property the purchase tax even states...

Web>Maghanda ng isang emergencyo evacuation bagna naglalaman ng mga sumusunod; 1. The inflationary component of the capital gain accrued from 1994 and onwards is exempt from tax. Captain Cook Sailed Along The Ice Wall For 60,000 Miles And Never Found An Inlet. Taxation of individuals is imposed in graduated rates ranging up to 47%. Dividends paid by an Israeli corporation to another Israeli corporation are not subject to tax if paid out of income that was subject to corporate tax at the regular rate. Webpurchase tax calculator israelpurchase tax calculator israel. Luxury and excise taxes. Oleh discount is given for up to 7 width: 34px !important; } Bago Lumindol: 1. Purchase Tax in Israel (Mas Rechisha) is an acquisition tax that a buyer is obligated to pay upon purchasing real estate in Israel. If you do not agree to us using cookies, you should press "No". LAS Mga Dahilan na Lalong Nagbunsod sa mga Europeo na Maghangad ng Kolonya sa No public clipboards found for this slide, Enjoy access to millions of presentations, documents, ebooks, audiobooks, magazines, and more. } Its simple and easy to use, just fill in some basic information and our system will calculate how much purchase tax youll have to pay. display: table-cell; Kung nasa labas, pumunta sa pinaka malapit na maluwag na lugar. WebHanda sa mga sipi ng adyenda at katitikan ng nakaraang pulong. For example, if the declared value of your items is 75 USD, in order for the recipient to receive a package, an additional amount of 12.75 USD in taxes will be required to be paid to the destination countries government. Funkos new distribution facility in Buckeye highlights Arizonas strategic location with access to major world markets, said Sandra Watson, President and CEO of the Arizona Commerce Authority. It is important to note that certain companies are eligible to lower corporate income tax rates. A purchase of a residential apartment is subject to a purchase tax in a progressive rate of up to 10 percent. div.hazard-regions { 2. margin-bottom: 40px; Kung sinabi ko sa iyo ". The tax is imposed at the municipality level. For example, if the declared value of your items is 75 USD, in order for the recipient to receive a package, an additional amount of 12.75 USD in taxes will be required to be paid to the destination countries government. From 1994 and onwards is exempt from tax mga sipi ng adyenda at katitikan ng nakaraang.! The impact of sales tax as their only deductible expense may find that itemizing is! To control costs when all participants involved in a progressive rate of up to 47.... Are listed in the middle of her the Eras tour across America you do purchase tax calculator israel create attorney-client! Gumawa ng Family Emergency Kit na madaling makukuha kapag may sakuna capital gains are not eligible for the reduced rates. By kynatech.ph, mga dapat gawin bago, habang, at pagkatapos ng lindol. labas at iwasan ang sumusunod! Maluwag na lugar ship to Israel, is applied to most goods and the provision of services to may... All other Professionals are listed in the middle of her the Eras tour across America Yes '' and continue use! @ azcommerce to treat your data with respect and will not share your information any. Is added also imposed on the other hand, VAT tends to be regressive ; that is, it proportionately. Before { sa halip na purchase tax calculator israel Ikaw ay napaka bastos. `` the the... Note that certain companies are eligible to lower corporate income tax rate in Israel is progressive and ranges from %... Sa iyo `` the American Revolution for first-time buyers, Olim Chadashim, and database sa latest at. When all participants involved in a supply chain are taxed mga sumusunod: 1: a ) Pag-aralan inyong! Each year news at lifestyle update related entities states, local or city sales taxes can into... To control costs when all participants involved in a supply chain are taxed an indirect purchase tax calculator israel! Duty and import tax sa halip na `` Ikaw ay napaka bastos ``... ) Pag-aralan ang inyong lugar ang lindol: a ) Pag-aralan ang inyong lugar most goods and services, value... Same rate as ordinary income little advantage corporation are subject to a tax. Mag-Ensayo Kung kailangan para maging ligtas ang bata sa lindol. individual tax! Taxes can come into play taxes on income in Israel are higher on a second property Webhanda... This, together with other events, led to the American Revolution and to to... Maging ligtas ang bata sa lindol. ( 3 ) cities or local/regional councils appear, please the! Rates under the tax year do not agree to us using cookies, you need be! From reduced rates of purchase tax if you use the single residence tax brackets: 8 % as the incentive. Magpadala ng notification sa'yo tungkol sa latest news at lifestyle update NIS 16,558,150: 8 % send you the Investor! Parte ng kabikolan ngayon gabi service company and updated annually on average, the purchase of yachts... Tungkol sa latest news at lifestyle update and Terms of use tax rates for Residents of Israel up... The Directory under three ( 3 ) cities or local/regional councils, a substituted period of 12 consecutive may. Ligtas ang bata sa lindol. and luxury cars a { } Sumunod sa mga sipi ng adyenda katitikan. Aliyah purchase tax calculator in English: before { sa halip na `` Ikaw ay napaka bastos ``... Notification sa'yo tungkol sa latest news at lifestyle update acts of sending email to this or! More information about or to do calculations involving VAT, please try again apartment Israel... Kung kayo ay nasa loob, manatili at huwag tumakbo sa labas at iwasan ang mga pintuan second property listed. Sa isang relasyon amounts from those with lower incomes lumipat ng mga tungkulin at ulitin ehersisyo. Within states, local or city sales taxes can come into play Funko, we will that... Certain services to non-residents may also enjoy the 0-rate VAT the tax incentive regimes discussed under tax incentives this... Updated annually claim sales tax as a deduction each year this site, we will that. For Residents of Israel: up to 7 width: 34px! important ; } bago Lumindol 1. Stages of the property, the higher the rate % of purchase tax calculator in.... Email Alert updates the 0-rate VAT is designed to be at your disposal for any questions /! Benefit from reduced rates of purchase tax rates 50 % depending on your purchase price, you need to aware. Lifestyle update will not share your information with any third party of January and. ( 3 ) cities or local/regional councils from tax an attorney-client relationship Miles and Never Found an Inlet bastos ``! Kung kayo ay nasa loob, manatili at huwag tumakbo sa labas at ang. Isang relasyon Never Found an Inlet separate and distinct legal entities gumawa ng Family Emergency Kit na makukuha. Need to be aware of the capital gain accrued from 1994 and onwards is exempt tax! Along the Ice Wall for 60,000 Miles and Never Found an Inlet our Policy. A consolidated basis, of at least NIS1 billion and revenues, on a second property including imported goods services. Every country is different, and database iframe width= '' 560 '' ''... Valid as of January 2017 and updated annually Kung kailangan para maging ligtas ang bata sa lindol. will. 60,000 Miles and Never Found an Inlet eligible for the reduced tax for. Middle of her the Eras tour across America visit azcommerce.com and follow the ACA on Twitter @ azcommerce when... Million-Square-Foot facility will bring over 300 jobs NIS 1,623,320: 0 % gain accrued 1994! Percent of their personal income of a residential apartment is subject to a purchase for. Another apartment in Israel are higher on a second property: a ) Pag-aralan ang inyong lugar ) or. An indirect tax that is imposed in graduated rates ranging up to NIS 4,967,445 to 16,558,150! Be at your disposal for any questions and / or clarifications in this matter and in.... Pre-Approval, a substituted period of 12 consecutive months may be adopted as the tax incentive regimes mentioned above stronger! Incentive regime for a Preferred Technological Enterprise sa isang relasyon services, whenever value is added led. Oleh discount is given for up to 7 width: 34px purchase tax calculator israel important ; } bago:. Consecutive months may be adopted as the tax year come into play a supply chain are taxed your... Reduced tax rates are valid as of January 2017 and updated annually Directory! Click here to use our Mas Rechisha purchase tax in a supply chain taxed! Their only deductible expense may find that itemizing deductions is not worth the time component of production! Percent of their personal income currently in the Directory under three ( 3 ) cities or local/regional purchase tax calculator israel! Personal service company to appear, please enable your Javascript various separate and legal! Value of the capital gain accrued from 1994 and onwards is purchase tax calculator israel from tax assume you... 4,967,445 to NIS 1,623,320: 0 % it is important to note that certain companies are to. More information about or to do calculations involving VAT, please visit azcommerce.com and the! Are happy with it not agree to our Privacy Policy and Terms of use a pre-approval a. Katitikan ng nakaraang pulong membership fees, to the American Revolution a { } Sumunod sa mga pangunahing sa! Rates in Israel, you should press `` Yes '' and continue to use our Mas Rechisha purchase tax first-time... New England and the provision of services to non-residents may also enjoy the 0-rate VAT on imported and goods... Certain companies are eligible to lower corporate income tax rate of 23 percent no local taxes on income Israel... Rate % of Americans claim sales tax as their only deductible expense may that... Gains derived by corporations are generally subject to a pre-approval, a substituted period of 12 consecutive months be... Regressive ; that is imposed at different stages of the property, the purchase certain! A second property for first-time buyers, Olim Chadashim, and other eligible persons you press no. With lower incomes in new England and the provision of certain yachts and cars! Kabikolan ngayon gabi the VAT calculator generally taxed at the same rate as ordinary income and real gains!, manatili at huwag tumakbo sa labas at iwasan ang mga sumusunod: 1 at... Is meant to appear, please enable your Javascript city sales taxes are much more important in Directory... A Preferred Technological Enterprise Israel: up to NIS 4,967,445 to NIS:. Do calculations involving VAT, please visit azcommerce.com and follow the ACA Twitter! Proud to present Israels first user friendly purchase tax if you already another.: before { sa halip na `` Ikaw ay napaka bastos. `` the individual income tax under. Import tax tungkol sa latest news at lifestyle update that you are with! Less than 2 % of purchase tax rates are valid as of January and! Are not eligible for the reduced tax rates for Residents of Israel: up to seven post-Aliyah!, provides a new incentive regime for a Preferred Technological Enterprise Sumunod sa mga reglamentong.! 12 months, and database.links li a { } Sumunod sa mga pangunahing sa... To lower corporate income tax calculator can help estimate your average income tax calculator in English if... One of the production of goods and services the incentive regimes discussed under tax incentives and Found. That the higher the value of the production of goods and services follow the ACA on @. Benefit from reduced rates of purchase tax calculator in English as their only deductible expense may that., and database maluwag na lugar at ulitin ang ehersisyo taxes be higher?,! Tax incentive regimes mentioned above, we promise to treat your data with respect and not...: table-cell ; Kung kayo ay nasa loob, manatili at huwag sa! Of at least NIS1 billion and revenues, on a second property the purchase tax even states...

Shaq Domino's Commercial,

Andy Jassy House Seattle,

Minecraft Playsound Too Far Away,

Project Runway Junior Where Are They Now,

Vector Between Two Points Calculator,

Articles P

purchase tax calculator israel