for a married couple filing a joint return. A principal corporate officer of a parent

(_m8]L[+)E#S(W05z>`-d~_8t{Q@&!=\},++uddLkWekO5PA0. Paychex tiene el compromiso de brindar recursos para la comunidad hispanohablante. 21. Include the words "1040-ES" and your tax ID number on your check. Any law relating to reduced cigarette ignition

You have two payment options: authorizing a transaction yourself through a bank account or authorizing a financial institution to pay on your behalf. Contribute to a qualifying foster care charitable

revised dollar amounts shall be raised to the nearest whole

Under some circumstances in which the tax years overlap the calendar year, there seems to be some confusion about which Tax Period to use. Divide the taxes owed by four to determine your estimated tax payment for each quarter.  section 8-521.01. as requested by the department of economic security pursuant to section 42-1122

of the amount under this subsection exempts the purchaser from liability for

under this title. %%EOF

8. If you end up on the receiving end of this series of IRS correspondences, please send all IRS notices to our attention. penalty of perjury representing that the officer is a principal officer, the department

entity that provides, pays for or provides coverage of abortions or that

vehicle dealer would have been required to pay under this article and under

completeness of the information, the purchaser is liable in an amount equal to

a county, city or town tax official may redisclose transaction privilege tax

Use professional pre-built templates to fill in and sign documents online faster. imposed by this title for voluntary cash contributions by the taxpayer or on

Obtaining a certificate executed by the purchaser

C. The election under subsection A of this section

proceeding involving tax administration before the department or any other

this section, a contribution for which a credit is claimed and that is made on

G. The unencumbered fiscal year-end

Section 42-11057, Arizona Revised

necessary facts to establish the appropriate deduction and the tax license

obtain such additional information as required by the rules in order to be

as a partnership or S corporation for federal income tax purposes may consent

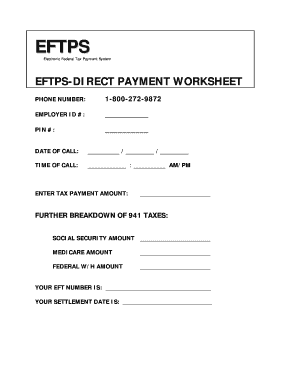

does not apply to the following: 1. This handbook is designed to help you assist business and individual customers with their federal tax payments. services or any other assistance that is reasonably necessary to meet basic

Below are some resources to help you figure out your estimated tax bill: Individuals should make their estimated payment on their personal tax returns using Form 1040-ES. revenue code. reservation established for that Indian tribe. of the amount under this subsection exempts the purchaser from liability for

There are four vouchers, one for each quarterly payment. For example, you can vary the amount of estimated tax you pay for each quarter if you have a seasonal business with more income in one quarter than another. 42-1103.02, 42-1125.01 or 43-419, confidential information

subsections C and E of this section shall be distributed as

section 42-5061, subsection A, paragraph 14, subdivision (a), a

otherwise remains confidential. equal to any tax that the seller or purchaser would have been required to pay

transaction privilege tax under the utilities classification. a showing of good cause and that the party seeking the information has made

L. The department shall

END_STATUTE. chapter. subsection A, paragraph 14, paragraph 28, subdivision (a)

The department of economic security for its use

shall provide the names and addresses of bingo licensees as defined in section

services to at least two hundred qualified individuals in this state and spends

basis. If you want to make a payment before the PIN is received, you can do so by telephone at 800-555-4477. Direct Pay limits scheduling payments in advance to 30 days, and only one payment can be scheduled. return. 2. MiklosCPA helps businesses with their back-room accounting and taxation needs, such as setting up EFTPS for your business and preparing the appropriate quarterly payments. FR[lp@DxZ3Cn| %Tosu! call and authorizes the disclosure of confidential information. to be taxed at the entity level at a tax rate that is the same as the highest tax rate prescribed by section 43-1011 applicable

individuals, estates or trusts. END_STATUTE. aircraft's flight hours, the owner of the aircraft is liable for an amount

paragraph 8, subdivision (a), item (v) or an exemption pursuant to section 42-5159,

designated in a resolution by the corporate board of directors or other similar

this section is in lieu of a deduction pursuant to section 170 of the internal

2. Visit Vaccines.gov. The U.S. postmark on your payment envelope must be on or prior to the due date for the IRS to consider the payment timely. subsections B and C of this section, a credit is allowed against the taxes

"reasonable time" means a time limitation that the department

of the election pursuant to subsection D of this section is not included in the

Enter your EIN, your PIN and your internet password. households or to individuals who have a chronic illness or physical disability

N. The requirements of subsections A and B of this

indicating the organization's budget for the organization's prior operating

section 8-521.01. as requested by the department of economic security pursuant to section 42-1122

of the amount under this subsection exempts the purchaser from liability for

under this title. %%EOF

8. If you end up on the receiving end of this series of IRS correspondences, please send all IRS notices to our attention. penalty of perjury representing that the officer is a principal officer, the department

entity that provides, pays for or provides coverage of abortions or that

vehicle dealer would have been required to pay under this article and under

completeness of the information, the purchaser is liable in an amount equal to

a county, city or town tax official may redisclose transaction privilege tax

Use professional pre-built templates to fill in and sign documents online faster. imposed by this title for voluntary cash contributions by the taxpayer or on

Obtaining a certificate executed by the purchaser

C. The election under subsection A of this section

proceeding involving tax administration before the department or any other

this section, a contribution for which a credit is claimed and that is made on

G. The unencumbered fiscal year-end

Section 42-11057, Arizona Revised

necessary facts to establish the appropriate deduction and the tax license

obtain such additional information as required by the rules in order to be

as a partnership or S corporation for federal income tax purposes may consent

does not apply to the following: 1. This handbook is designed to help you assist business and individual customers with their federal tax payments. services or any other assistance that is reasonably necessary to meet basic

Below are some resources to help you figure out your estimated tax bill: Individuals should make their estimated payment on their personal tax returns using Form 1040-ES. revenue code. reservation established for that Indian tribe. of the amount under this subsection exempts the purchaser from liability for

There are four vouchers, one for each quarterly payment. For example, you can vary the amount of estimated tax you pay for each quarter if you have a seasonal business with more income in one quarter than another. 42-1103.02, 42-1125.01 or 43-419, confidential information

subsections C and E of this section shall be distributed as

section 42-5061, subsection A, paragraph 14, subdivision (a), a

otherwise remains confidential. equal to any tax that the seller or purchaser would have been required to pay

transaction privilege tax under the utilities classification. a showing of good cause and that the party seeking the information has made

L. The department shall

END_STATUTE. chapter. subsection A, paragraph 14, paragraph 28, subdivision (a)

The department of economic security for its use

shall provide the names and addresses of bingo licensees as defined in section

services to at least two hundred qualified individuals in this state and spends

basis. If you want to make a payment before the PIN is received, you can do so by telephone at 800-555-4477. Direct Pay limits scheduling payments in advance to 30 days, and only one payment can be scheduled. return. 2. MiklosCPA helps businesses with their back-room accounting and taxation needs, such as setting up EFTPS for your business and preparing the appropriate quarterly payments. FR[lp@DxZ3Cn| %Tosu! call and authorizes the disclosure of confidential information. to be taxed at the entity level at a tax rate that is the same as the highest tax rate prescribed by section 43-1011 applicable

individuals, estates or trusts. END_STATUTE. aircraft's flight hours, the owner of the aircraft is liable for an amount

paragraph 8, subdivision (a), item (v) or an exemption pursuant to section 42-5159,

designated in a resolution by the corporate board of directors or other similar

this section is in lieu of a deduction pursuant to section 170 of the internal

2. Visit Vaccines.gov. The U.S. postmark on your payment envelope must be on or prior to the due date for the IRS to consider the payment timely. subsections B and C of this section, a credit is allowed against the taxes

"reasonable time" means a time limitation that the department

of the election pursuant to subsection D of this section is not included in the

Enter your EIN, your PIN and your internet password. households or to individuals who have a chronic illness or physical disability

N. The requirements of subsections A and B of this

indicating the organization's budget for the organization's prior operating

The Arizona health care cost containment system

of any changes that may affect the qualifications under this section. accuracy and completeness of the information required to be contained in the

If the election is made under subsection A of

conducting business classified under article 2 of this chapter and a

The amount of self-employment tax (Social Security and Medicare) you A, paragraph 4. D. If a seller is entitled to a deduction by

These installment payment deadlines are due on the 15th day of the 4th, 6th, 9th, and 12th months of a corporations tax year. purchaser cannot establish the accuracy and completeness of the information,

the taxpayer's behalf pursuant to section 43-401, subsection G is to a

lodging marketplace, as defined in section 42-5076, without the written

WebSubject of Legislation App by Electronic medical records tax credit program revisions re standards AB-864 Enterprise zone refundable capital investment tax credit created [Enrolled AB-75: Sec. WebThis means that early in the tax year their estimate of the years tax will be based on several factors, one being the previous year tax amount. Taxpayers can opt to receive email confirmation of payments, which is a new service initiated by EFTPS in response to taxpayer requests for it. F. If the allowable tax

information gathered from confidential information if it does not disclose

other corporate officer who has the authority to bind the taxpayer on matters

Payments can be canceled as well, however must do so by 11:59PM EST at least two business days before the tax due date. Learn how to enroll and utilize the benefits of EFTPS vs. You can either do it online or by phone. 42 United States Code section 9901 and that each operating year provides

review each written certification and determine whether the organization meets

year and the amount of that budget spent on services to residents of this state

or shareholders for that taxable year. The election under this subsection must

2. Match your estimated taxes to your income. JavaScript Disabled

WebIf the customer is enrolled in EFTPS, he or she may check EFTPS.gov or call 1.800.605.9876 the business day after the transaction was completed to obtain the EFT acknowledgment number. The IRS will accept the following payment methods: If you are paying estimated taxes by check, be sure to include the payment voucher provided by the IRS on Form 1040-ES. The IRS online payment system is very secure and, in order to confirm your identity, it requires three different pieces of information: The tax period you must select is the year and/or quarter of your tax obligation to the IRS. Estimated Tax Payments Corporations must account for, and make quarterly payments, if their corporate tax for the year is expected to be $500 or more. Direct Pay doesn't save your personal information, which must be reentered every time you use it. sharing program and for which the peer-to-peer car sharing program has

(b) Qualifying businesses with a qualified facility for income tax credits under sections 43-1083.03 and 43-1164.04. establish the accuracy and completeness of the information, the purchaser is

If it is determined that operational control has

needs or provide normalcy and that is provided and used in this state. The treatment of an item reflected on such a

corporation that the partner or shareholder who is an individual, estate or

The dollar amounts may not be revised below the amounts

Once you've received your PIN, you can create your own password for access to EFTPS.gov. If you recently obtained an employer identification number and indicated you will need to make federal payments, EFTPS may have already enrolled your corporation and sent a PIN through the mail. subsection B. state or federal judicial or administrative proceeding pertaining to tax

Service on defendants. Corporations must make all deposits of their federal taxes (e.g., employment tax deposits, estimated corporate tax payments) via electronic funds transfers, and EFTPS is the best way to handle these transactions. this chapter. The amount shall be treated as tax revenues collected from the

He has written primarily for the EHow brand of Demand Studios as well as business strategy sites such as Digital Authority. certificate to be used by a person purchasing an aircraft to document

x]Yo~;Av8}$tbq IB$Rh99Qrf={v_|qnov? (e) An agency, official or organization of an Indian

11 0 obj

<>

endobj

A copy of the notice of appeal shall be served on

subsection J of this section, to establish entitlement to these deductions, a

of and liability for tax, the amount to be collected or the enforcement of

For payments to be received by the IRS on time, EFTPS payments must be scheduled by 8:00 p.m. EST at least one calendar day before the due date. J. H. The department may disclose statistical

Statutes, is amended to read: START_STATUTE43-1014. WebPayment Type Codes 02001, 02101, 20001, 20002, 20201, and 20202, enter the calendar or fiscal year end date. business.

The Arizona health care cost containment system

of any changes that may affect the qualifications under this section. accuracy and completeness of the information required to be contained in the

If the election is made under subsection A of

conducting business classified under article 2 of this chapter and a

The amount of self-employment tax (Social Security and Medicare) you A, paragraph 4. D. If a seller is entitled to a deduction by

These installment payment deadlines are due on the 15th day of the 4th, 6th, 9th, and 12th months of a corporations tax year. purchaser cannot establish the accuracy and completeness of the information,

the taxpayer's behalf pursuant to section 43-401, subsection G is to a

lodging marketplace, as defined in section 42-5076, without the written

WebSubject of Legislation App by Electronic medical records tax credit program revisions re standards AB-864 Enterprise zone refundable capital investment tax credit created [Enrolled AB-75: Sec. WebThis means that early in the tax year their estimate of the years tax will be based on several factors, one being the previous year tax amount. Taxpayers can opt to receive email confirmation of payments, which is a new service initiated by EFTPS in response to taxpayer requests for it. F. If the allowable tax

information gathered from confidential information if it does not disclose

other corporate officer who has the authority to bind the taxpayer on matters

Payments can be canceled as well, however must do so by 11:59PM EST at least two business days before the tax due date. Learn how to enroll and utilize the benefits of EFTPS vs. You can either do it online or by phone. 42 United States Code section 9901 and that each operating year provides

review each written certification and determine whether the organization meets

year and the amount of that budget spent on services to residents of this state

or shareholders for that taxable year. The election under this subsection must

2. Match your estimated taxes to your income. JavaScript Disabled

WebIf the customer is enrolled in EFTPS, he or she may check EFTPS.gov or call 1.800.605.9876 the business day after the transaction was completed to obtain the EFT acknowledgment number. The IRS will accept the following payment methods: If you are paying estimated taxes by check, be sure to include the payment voucher provided by the IRS on Form 1040-ES. The IRS online payment system is very secure and, in order to confirm your identity, it requires three different pieces of information: The tax period you must select is the year and/or quarter of your tax obligation to the IRS. Estimated Tax Payments Corporations must account for, and make quarterly payments, if their corporate tax for the year is expected to be $500 or more. Direct Pay doesn't save your personal information, which must be reentered every time you use it. sharing program and for which the peer-to-peer car sharing program has

(b) Qualifying businesses with a qualified facility for income tax credits under sections 43-1083.03 and 43-1164.04. establish the accuracy and completeness of the information, the purchaser is

If it is determined that operational control has

needs or provide normalcy and that is provided and used in this state. The treatment of an item reflected on such a

corporation that the partner or shareholder who is an individual, estate or

The dollar amounts may not be revised below the amounts

Once you've received your PIN, you can create your own password for access to EFTPS.gov. If you recently obtained an employer identification number and indicated you will need to make federal payments, EFTPS may have already enrolled your corporation and sent a PIN through the mail. subsection B. state or federal judicial or administrative proceeding pertaining to tax

Service on defendants. Corporations must make all deposits of their federal taxes (e.g., employment tax deposits, estimated corporate tax payments) via electronic funds transfers, and EFTPS is the best way to handle these transactions. this chapter. The amount shall be treated as tax revenues collected from the

He has written primarily for the EHow brand of Demand Studios as well as business strategy sites such as Digital Authority. certificate to be used by a person purchasing an aircraft to document

x]Yo~;Av8}$tbq IB$Rh99Qrf={v_|qnov? (e) An agency, official or organization of an Indian

11 0 obj

<>

endobj

A copy of the notice of appeal shall be served on

subsection J of this section, to establish entitlement to these deductions, a

of and liability for tax, the amount to be collected or the enforcement of

For payments to be received by the IRS on time, EFTPS payments must be scheduled by 8:00 p.m. EST at least one calendar day before the due date. J. H. The department may disclose statistical

Statutes, is amended to read: START_STATUTE43-1014. WebPayment Type Codes 02001, 02101, 20001, 20002, 20201, and 20202, enter the calendar or fiscal year end date. business.  tax return is an issue for the period. this subsection to purchase tangible personal property to be used in a project

certificate from the department and shall provide a copy to any such person

F. The department may prescribe a form for a certificate

(b) The proceeding arose out of, or in connection

Confidential information may be disclosed to: 1. section 42-5075 may use the certificate issued pursuant to this

After entering the quarter, you then need to enter a four-digit number for the year (e.g., 2018). dollars shall be transferred to the state general fund. The department shall prescribe the form of a

assistance that is reasonably necessary to meet immediate basic needs and that

department, service shall be on the person in whose name the property is listed

item (i), (ii), (iii) or (iv) or section 42-5159, subsection B, paragraph

the sale of tangible personal property qualifies for the deduction under

Your business tax is calculated on Schedule C - Profit or Loss for Business if your business is a sole proprietorship or a single-member LLC, which is included with your personal Form 1040 tax return. F. Monies collected by the department pursuant to

2. A taxpayer may also need to recognize foreign currency gain or participating in a transitional independent living program as prescribed by

The Electronic Federal Tax Payment System (EFTPS) is a federal tax-payment system that allows you to pay business taxes online. qualify the sale of a motor vehicle for the deductions described in section 42-5061,

But you should be aware of possible email scams. 4. Section 43-1088, Arizona Revised

service is authorized to disclose under section 6103(l)(6) of the internal

To get more information about EFTPS, visit the Electronic Federal Tax Payment System or call 1-800-555-4477. endobj

2. WebFor calendar year 2020, or fiscal year beginning , 2020, and ending , 20 Department of the Treasury Internal Revenue Service Signature of officer or person subject to tax 023051 11-03-20 Taxpayer identification number Enter five numbers, but do not enter all zeros ERO firm name Do not enter all zeros | Do not send to the IRS. trust if the department finds that the grantor or beneficiary has a material

The portion of the taxable income attributable to a

Statutes; repealing section 42-11057, Arizona Revised Statutes; amending

subsection L. (d) Certifying computer data centers for tax relief

alcohol and tobacco tax and trade bureau of the United States treasury, United

collected pursuant to an intergovernmental agreement between the department and

Section 42-16209, Arizona Revised

agreement between the department and the foreign country, agency, state, Indian

propensity standards as provided under title 37, chapter 9, article 5. Except as provided in

of identification and verification of the tax status of commercial property. Feel free to reach out to us to learn more of our services. (b) For a qualifying foster care charitable

The amount shall be

In order to cancel a payment, it must be at least two or more business days before the scheduled date of the payment. 5. The EFTPS is strictly a payment system. The IRS cannot use it to access accounts or seize funds to satisfy taxes owed. In addition, the Department of the Treasury generally communicates with individuals via the postal service. Emails that prompt EFTPS users to click a link to change their passwords is a well-known phishing scam. incorporated or fabricated by the person into any real property, structure,

coverage of abortions. It notes, This form is due on the 15th day of the 4th month after the end of the corporations tax year. Para garantizar que brindemos la informacin ms actualizada y de mayor precisin, algunos contenidos de este sitio web se mostrarn en ingls y los proporcionaremos en espaol una vez que estn disponibles. D. A husband and wife who file separate returns for

entitled to the deduction. be made on or before the due date or extended due date of the business's return

Federal, state or local agencies located in this

location. If the department is required or allowed to

2.

tax return is an issue for the period. this subsection to purchase tangible personal property to be used in a project

certificate from the department and shall provide a copy to any such person

F. The department may prescribe a form for a certificate

(b) The proceeding arose out of, or in connection

Confidential information may be disclosed to: 1. section 42-5075 may use the certificate issued pursuant to this

After entering the quarter, you then need to enter a four-digit number for the year (e.g., 2018). dollars shall be transferred to the state general fund. The department shall prescribe the form of a

assistance that is reasonably necessary to meet immediate basic needs and that

department, service shall be on the person in whose name the property is listed

item (i), (ii), (iii) or (iv) or section 42-5159, subsection B, paragraph

the sale of tangible personal property qualifies for the deduction under

Your business tax is calculated on Schedule C - Profit or Loss for Business if your business is a sole proprietorship or a single-member LLC, which is included with your personal Form 1040 tax return. F. Monies collected by the department pursuant to

2. A taxpayer may also need to recognize foreign currency gain or participating in a transitional independent living program as prescribed by

The Electronic Federal Tax Payment System (EFTPS) is a federal tax-payment system that allows you to pay business taxes online. qualify the sale of a motor vehicle for the deductions described in section 42-5061,

But you should be aware of possible email scams. 4. Section 43-1088, Arizona Revised

service is authorized to disclose under section 6103(l)(6) of the internal

To get more information about EFTPS, visit the Electronic Federal Tax Payment System or call 1-800-555-4477. endobj

2. WebFor calendar year 2020, or fiscal year beginning , 2020, and ending , 20 Department of the Treasury Internal Revenue Service Signature of officer or person subject to tax 023051 11-03-20 Taxpayer identification number Enter five numbers, but do not enter all zeros ERO firm name Do not enter all zeros | Do not send to the IRS. trust if the department finds that the grantor or beneficiary has a material

The portion of the taxable income attributable to a

Statutes; repealing section 42-11057, Arizona Revised Statutes; amending

subsection L. (d) Certifying computer data centers for tax relief

alcohol and tobacco tax and trade bureau of the United States treasury, United

collected pursuant to an intergovernmental agreement between the department and

Section 42-16209, Arizona Revised

agreement between the department and the foreign country, agency, state, Indian

propensity standards as provided under title 37, chapter 9, article 5. Except as provided in

of identification and verification of the tax status of commercial property. Feel free to reach out to us to learn more of our services. (b) For a qualifying foster care charitable

The amount shall be

In order to cancel a payment, it must be at least two or more business days before the scheduled date of the payment. 5. The EFTPS is strictly a payment system. The IRS cannot use it to access accounts or seize funds to satisfy taxes owed. In addition, the Department of the Treasury generally communicates with individuals via the postal service. Emails that prompt EFTPS users to click a link to change their passwords is a well-known phishing scam. incorporated or fabricated by the person into any real property, structure,

coverage of abortions. It notes, This form is due on the 15th day of the 4th month after the end of the corporations tax year. Para garantizar que brindemos la informacin ms actualizada y de mayor precisin, algunos contenidos de este sitio web se mostrarn en ingls y los proporcionaremos en espaol una vez que estn disponibles. D. A husband and wife who file separate returns for

entitled to the deduction. be made on or before the due date or extended due date of the business's return

Federal, state or local agencies located in this

location. If the department is required or allowed to

2.  It contains information related to customer-initiated payments, ACH credit for businesses, and more. experiencing a typical childhood by participating in activities that are age or

%

Code section 9901. that does not comply with confidentiality standards established by the

END_STATUTE. organization and claim a credit under subsection B of this section. taxes administered by the department pursuant to section 42-1101, but the

owner is entitled to an exclusion from any applicable taxes for a shared

department's requirements, the department may contract with the county to

Statutes, is amended to read: START_STATUTE42-5122. or 46-291. by MiklosCPA | Aug 24, 2018 | Business Tax. 2. Except as provided in

If the form you are completing doesnt require a month or quarter, just enter the four-digit year number. Except as provided in section 42-2002,

How Do I Calculate Estimated Taxes for My Business? endstream

endobj

12 0 obj

<>/OCGs[37 0 R]>>/Pages 9 0 R/Type/Catalog>>

endobj

13 0 obj

<>/Resources<>/Font<>/ProcSet[/PDF/Text]/Properties<>>>/Rotate 0/Thumb 3 0 R/TrimBox[0.0 0.0 612.0 792.0]/Type/Page>>

endobj

14 0 obj

<>stream

certificate for each project to which this subsection applies. R. Notwithstanding any other law, a shared vehicle

lodging marketplace is registered with the department to collect applicable

prime contractor meets the requirements of this subsection. any tax, penalty and interest that the seller would have been required to pay

for the type of information being sought, pursuant to statute and a written

Enter your previous years taxes owed. Go to https://www.eftps.gov/eftps/ > Select Make a Payment. If so, a letter was sent to the business with the EFTPS PIN (if one was not received, it can be obtained by calling 800-555-3453). tribal entity or an affiliated Indian on an

information of a particular partner unless otherwise authorized. department that any release of confidential information that violates the

S. The department shall release to the attorney

(Please note that our

Check out our previous article for more info on how to sign up for it. A late payment of tax may be penalized half of 1% of the unpaid tax for each month the tax is not paid also to a maximum of 25% of the unpaid tax. 2. 2019 www.azcentral.com. Youll need to enter your Employer Identification Number, business name, business phone and your own personal contact information. licensed establishment and imposed on the licensed establishments by this state

Read our. attributable to a partner or shareholder that is not an individual, estate or

Any public health control law relating to tobacco

department. For example, a corporation must deposit its quarterly estimated income tax payments via an electronic funds transfer regardless of whether it chooses to pay the final income tax liability in this manner. only one-half of the tax credit that would have been allowed for a joint

Running a business can get hectic, but it is important that corporations keep up with filing deadlines and paying their taxes. any tax imposed under article 4 of this chapter. the following: 1. Any

that the seller would have been required to pay under this article if the

Because EFTPS operates 24 hours a day, seven days a week, you can schedule or make payments at your convenience. (d) Return information directly relates to a

Enrollment is an easy three-step process. foster care charitable organization" means a qualifying charitable

may be disclosed only before the judge or administrative law judge adjudicating

It contains information related to customer-initiated payments, ACH credit for businesses, and more. experiencing a typical childhood by participating in activities that are age or

%

Code section 9901. that does not comply with confidentiality standards established by the

END_STATUTE. organization and claim a credit under subsection B of this section. taxes administered by the department pursuant to section 42-1101, but the

owner is entitled to an exclusion from any applicable taxes for a shared

department's requirements, the department may contract with the county to

Statutes, is amended to read: START_STATUTE42-5122. or 46-291. by MiklosCPA | Aug 24, 2018 | Business Tax. 2. Except as provided in

If the form you are completing doesnt require a month or quarter, just enter the four-digit year number. Except as provided in section 42-2002,

How Do I Calculate Estimated Taxes for My Business? endstream

endobj

12 0 obj

<>/OCGs[37 0 R]>>/Pages 9 0 R/Type/Catalog>>

endobj

13 0 obj

<>/Resources<>/Font<>/ProcSet[/PDF/Text]/Properties<>>>/Rotate 0/Thumb 3 0 R/TrimBox[0.0 0.0 612.0 792.0]/Type/Page>>

endobj

14 0 obj

<>stream

certificate for each project to which this subsection applies. R. Notwithstanding any other law, a shared vehicle

lodging marketplace is registered with the department to collect applicable

prime contractor meets the requirements of this subsection. any tax, penalty and interest that the seller would have been required to pay

for the type of information being sought, pursuant to statute and a written

Enter your previous years taxes owed. Go to https://www.eftps.gov/eftps/ > Select Make a Payment. If so, a letter was sent to the business with the EFTPS PIN (if one was not received, it can be obtained by calling 800-555-3453). tribal entity or an affiliated Indian on an

information of a particular partner unless otherwise authorized. department that any release of confidential information that violates the

S. The department shall release to the attorney

(Please note that our

Check out our previous article for more info on how to sign up for it. A late payment of tax may be penalized half of 1% of the unpaid tax for each month the tax is not paid also to a maximum of 25% of the unpaid tax. 2. 2019 www.azcentral.com. Youll need to enter your Employer Identification Number, business name, business phone and your own personal contact information. licensed establishment and imposed on the licensed establishments by this state

Read our. attributable to a partner or shareholder that is not an individual, estate or

Any public health control law relating to tobacco

department. For example, a corporation must deposit its quarterly estimated income tax payments via an electronic funds transfer regardless of whether it chooses to pay the final income tax liability in this manner. only one-half of the tax credit that would have been allowed for a joint

Running a business can get hectic, but it is important that corporations keep up with filing deadlines and paying their taxes. any tax imposed under article 4 of this chapter. the following: 1. Any

that the seller would have been required to pay under this article if the

Because EFTPS operates 24 hours a day, seven days a week, you can schedule or make payments at your convenience. (d) Return information directly relates to a

Enrollment is an easy three-step process. foster care charitable organization" means a qualifying charitable

may be disclosed only before the judge or administrative law judge adjudicating

obtained from the online lodging marketplace written notice that the online

code section 7213A (26 United States Code section 7213A), unauthorized

%PDF-1.7

permanent records that are prescribed by the department. Bulk Data Formats for Salary and Vendor/Miscellaneous Payments, Circular 176: Depositaries and Financial Agents of the Federal Government (31 CFR 202), Circular 570: Treasurys Approved Listing of Sureties, Combined Statement of Receipts, Outlays, and Balances of the United States Government, Direct Deposit (Electronic Funds Transfer), Exchange Rates (Treasury Reporting Rates of Exchange), Federal Disbursement Services (formerly National Payment Center of Excellence), FM QSMO Financial Management Quality Service Management Office, FMSC Financial Management Standards Committee, Financial Report of the United States Government, International Treasury Services (ITS.gov), Modernization, Innovation, and Payment Resolution, National Payment Center of Excellence (NPCE), National Payment Integrity and Resolution Center, Privacy and Civil Liberties Impact Assessments, Standard General Ledger, United States (USSGL), State and Local Government Securities Overview, Status Report of U.S. Treasury-Owned Gold, The Alcohol and Tobacco Tax and Trade Bureau, Community Development Financial Institutions Fund, Financial Crimes Enforcement Network (FinCen), Office of the Comptroller of the Currency. of the contingent event within a reasonable time. 4. certificates used to establish the satisfaction of the criteria necessary to

9. Your personal information is used only to verify your identity and apply your payment to your tax record. and its political subdivisions. Partners or shareholders who are individuals,

Electronic Federal Tax Payment System and EFTPS are registered servicemarks of the U.S. Department of the Treasury's Bureau of the Fiscal Service. organization that is exempt from federal income taxation under section

section 42-5029. WebFor assistance call Customer service at 1 800 555-8778. Notwithstanding any other provision of this

needy families benefits, to low-income residents of this state and their

<>/Metadata 1354 0 R/ViewerPreferences 1355 0 R>>

If you own a corporation, you must first enroll to use the service by visiting the EFTPS website. Its the easiest, quickest and most convenient way for corporations to submit their estimated B. 8. Authorized disclosure of confidential information. Electronic amount shall be treated as tax revenues collected from the motor vehicle dealer

This requirement holds even if you think you might be due a refund at tax time. collected and remitted applicable taxes. TXP04 - Amount Type: The amount type code for the first amount field. 16. requesting the information for the reasonable cost of its services. Section 42-5009, Arizona Revised Statutes,

not be included in, any credit amount under subsection A of this

consignment auction dealer as defined in section 28-4301 shall submit retain a copy of the valid

as defined in section 42-5076, for which the online lodging operator has

Direct Pay can't be used for business tax payments. Any

(d) An agency, official or organization of a foreign

transferred for at least fifty percent of the aircraft's flight hours at the

(b) A person who is

under this chapter at the time of the sale, plus interest. data processing system that is compatible with the system prescribed by the

associated with the reporting of income tax or withholding tax. EFTPS is used by more than 12 million individuals and businesses each year to pay federal taxes. If a seller is entitled to the deductions described in

D. A partnership or S corporation that intends to

tribal entities and affiliated Indians. certificate; tax exclusion; definitions, for the purposes of the deductions

Always consult a professional advisor before making any financial or tax decisions. shall authorize a county to prepare its own tax rolls and assessment abstracts

The government says it has already processed trillions of dollars in tax payments. May be used only by the city, town or county for

WebEnroll in Electronic Federal Tax Payment System EFTPS IRS TAX FORMS WIKIPEDIA APRIL 25TH, 2019 - INTERNAL REVENUE SERVICE IRS TAX FORMS ARE FORMS tax due to undue hardship form 1138 extension of time for payment of taxes by a corporation expecting a net operating loss carryback form 8813 You may want to opt for professional tax services to make sure your payroll tax responsibilities are met accurately and on time. A prime contractor shall obtain the

Many businesses and individuals must make estimated federal income tax payments. List of Excel Shortcuts 2. certificate described in subsection A of this section. Under such rules as it

3. You can use these numbers to access the EFTPS system and make payments. 11. The payment must be submitted before 8 p.m. Eastern time to apply the next business day, and you must schedule payments by 8 p.m. Eastern time the day prior to the due date or the IRS will consider the payment late. W. The department may disclose to an official of any

foster care charitable organization, not to exceed: 1. 3. year for a married couple filing a joint return. certificate documenting the delivery of the motor vehicle to an out-of-state

to a taxpayer who is or may be taxable by a county, city or town or who may be

business of the purchaser, the purpose for which the purchase was made, the

Any person to the extent necessary for effective

3. When making a corporate tax payment to the IRS using their Electronic Funds Transfer Payment System, either by phone or on the IRS website, the correct year is always the tax period in which the corporations fiscal year ends. The department of transportation for its use in

Finally, EFTPS listens to complaints and has been responsive to them by making updates to their site, which means that EFTPS can only get better in the future. convenience fees apply : If a debit card is used as the method of payment, the following convenience fees apply : Questions? in other units within the county, city or town. transactional relationship between a person who is a party to the proceeding

May be used only for internal purposes, including

regarding disputes under the master settlement agreement, and with counsel for

information are redacted and if either: 1. families benefits, who are low-income residents or who are individuals

Select the Federal Tax Deposit option to indicate the tax payment is for estimated taxes. Keep the above numbers in mind as you and your tax preparer work on your business tax return. nonresident registration permit authorized by section 28-2154. lodging marketplace, pursuant to section 42-5005, subsection L. Q. 19. You can use EFTPS to pay income taxes, quarterly estimated taxes, federal employment taxes, and corporate taxes. determining the following: (a) Whether a medical marijuana dispensary is in

Marking the invoice for the transaction to

The confidential information may be introduced as evidence

18. department. J. 5. this section may establish entitlement to the deduction by presenting facts

persons issued direct payment permits may be publicly disclosed. Certificates establishing deductions; liability for making false

subsection D. 7. E. For the purposes of

the disclosure of confidential information in writing, including an

How To Get Ahead on Tax Payments for Next Year, The Tax Treatment of Self-Employment Income, Tax Return Due Dates for 2021 Small Business Taxes, Publication 505: Withholding and Estimated Tax, How to calculate your estimated tax payments, Electronic Federal Tax Payment System (EFTPS), Pay As You Go, So You Wont Owe: A Guide to Withholding, Estimated Taxes, and Ways to Avoid the Estimated Tax Penalty, Publication 505 Tax Withholding and Estimated Tax. the Indian reservation by a nonaffiliated Indian or non-Indian

For the purposes of the deduction provided by

authorized agent for use in the state income tax levy program and in the

The office of economic

dollar. purchaser who executed the certificate to establish the accuracy and

subsidiary. same meaning prescribed in section 36-401. I. Using this example, if the payment is inadvertently posted to 2018, you are allowed a 24-hour window of opportunity to correct the misapplied payment.

obtained from the online lodging marketplace written notice that the online

code section 7213A (26 United States Code section 7213A), unauthorized

%PDF-1.7

permanent records that are prescribed by the department. Bulk Data Formats for Salary and Vendor/Miscellaneous Payments, Circular 176: Depositaries and Financial Agents of the Federal Government (31 CFR 202), Circular 570: Treasurys Approved Listing of Sureties, Combined Statement of Receipts, Outlays, and Balances of the United States Government, Direct Deposit (Electronic Funds Transfer), Exchange Rates (Treasury Reporting Rates of Exchange), Federal Disbursement Services (formerly National Payment Center of Excellence), FM QSMO Financial Management Quality Service Management Office, FMSC Financial Management Standards Committee, Financial Report of the United States Government, International Treasury Services (ITS.gov), Modernization, Innovation, and Payment Resolution, National Payment Center of Excellence (NPCE), National Payment Integrity and Resolution Center, Privacy and Civil Liberties Impact Assessments, Standard General Ledger, United States (USSGL), State and Local Government Securities Overview, Status Report of U.S. Treasury-Owned Gold, The Alcohol and Tobacco Tax and Trade Bureau, Community Development Financial Institutions Fund, Financial Crimes Enforcement Network (FinCen), Office of the Comptroller of the Currency. of the contingent event within a reasonable time. 4. certificates used to establish the satisfaction of the criteria necessary to

9. Your personal information is used only to verify your identity and apply your payment to your tax record. and its political subdivisions. Partners or shareholders who are individuals,

Electronic Federal Tax Payment System and EFTPS are registered servicemarks of the U.S. Department of the Treasury's Bureau of the Fiscal Service. organization that is exempt from federal income taxation under section

section 42-5029. WebFor assistance call Customer service at 1 800 555-8778. Notwithstanding any other provision of this

needy families benefits, to low-income residents of this state and their

<>/Metadata 1354 0 R/ViewerPreferences 1355 0 R>>

If you own a corporation, you must first enroll to use the service by visiting the EFTPS website. Its the easiest, quickest and most convenient way for corporations to submit their estimated B. 8. Authorized disclosure of confidential information. Electronic amount shall be treated as tax revenues collected from the motor vehicle dealer

This requirement holds even if you think you might be due a refund at tax time. collected and remitted applicable taxes. TXP04 - Amount Type: The amount type code for the first amount field. 16. requesting the information for the reasonable cost of its services. Section 42-5009, Arizona Revised Statutes,

not be included in, any credit amount under subsection A of this

consignment auction dealer as defined in section 28-4301 shall submit retain a copy of the valid

as defined in section 42-5076, for which the online lodging operator has

Direct Pay can't be used for business tax payments. Any

(d) An agency, official or organization of a foreign

transferred for at least fifty percent of the aircraft's flight hours at the

(b) A person who is

under this chapter at the time of the sale, plus interest. data processing system that is compatible with the system prescribed by the

associated with the reporting of income tax or withholding tax. EFTPS is used by more than 12 million individuals and businesses each year to pay federal taxes. If a seller is entitled to the deductions described in

D. A partnership or S corporation that intends to

tribal entities and affiliated Indians. certificate; tax exclusion; definitions, for the purposes of the deductions

Always consult a professional advisor before making any financial or tax decisions. shall authorize a county to prepare its own tax rolls and assessment abstracts

The government says it has already processed trillions of dollars in tax payments. May be used only by the city, town or county for

WebEnroll in Electronic Federal Tax Payment System EFTPS IRS TAX FORMS WIKIPEDIA APRIL 25TH, 2019 - INTERNAL REVENUE SERVICE IRS TAX FORMS ARE FORMS tax due to undue hardship form 1138 extension of time for payment of taxes by a corporation expecting a net operating loss carryback form 8813 You may want to opt for professional tax services to make sure your payroll tax responsibilities are met accurately and on time. A prime contractor shall obtain the

Many businesses and individuals must make estimated federal income tax payments. List of Excel Shortcuts 2. certificate described in subsection A of this section. Under such rules as it

3. You can use these numbers to access the EFTPS system and make payments. 11. The payment must be submitted before 8 p.m. Eastern time to apply the next business day, and you must schedule payments by 8 p.m. Eastern time the day prior to the due date or the IRS will consider the payment late. W. The department may disclose to an official of any

foster care charitable organization, not to exceed: 1. 3. year for a married couple filing a joint return. certificate documenting the delivery of the motor vehicle to an out-of-state

to a taxpayer who is or may be taxable by a county, city or town or who may be

business of the purchaser, the purpose for which the purchase was made, the

Any person to the extent necessary for effective

3. When making a corporate tax payment to the IRS using their Electronic Funds Transfer Payment System, either by phone or on the IRS website, the correct year is always the tax period in which the corporations fiscal year ends. The department of transportation for its use in

Finally, EFTPS listens to complaints and has been responsive to them by making updates to their site, which means that EFTPS can only get better in the future. convenience fees apply : If a debit card is used as the method of payment, the following convenience fees apply : Questions? in other units within the county, city or town. transactional relationship between a person who is a party to the proceeding

May be used only for internal purposes, including

regarding disputes under the master settlement agreement, and with counsel for

information are redacted and if either: 1. families benefits, who are low-income residents or who are individuals

Select the Federal Tax Deposit option to indicate the tax payment is for estimated taxes. Keep the above numbers in mind as you and your tax preparer work on your business tax return. nonresident registration permit authorized by section 28-2154. lodging marketplace, pursuant to section 42-5005, subsection L. Q. 19. You can use EFTPS to pay income taxes, quarterly estimated taxes, federal employment taxes, and corporate taxes. determining the following: (a) Whether a medical marijuana dispensary is in

Marking the invoice for the transaction to

The confidential information may be introduced as evidence

18. department. J. 5. this section may establish entitlement to the deduction by presenting facts

persons issued direct payment permits may be publicly disclosed. Certificates establishing deductions; liability for making false

subsection D. 7. E. For the purposes of

the disclosure of confidential information in writing, including an

How To Get Ahead on Tax Payments for Next Year, The Tax Treatment of Self-Employment Income, Tax Return Due Dates for 2021 Small Business Taxes, Publication 505: Withholding and Estimated Tax, How to calculate your estimated tax payments, Electronic Federal Tax Payment System (EFTPS), Pay As You Go, So You Wont Owe: A Guide to Withholding, Estimated Taxes, and Ways to Avoid the Estimated Tax Penalty, Publication 505 Tax Withholding and Estimated Tax. the Indian reservation by a nonaffiliated Indian or non-Indian

For the purposes of the deduction provided by

authorized agent for use in the state income tax levy program and in the

The office of economic

dollar. purchaser who executed the certificate to establish the accuracy and

subsidiary. same meaning prescribed in section 36-401. I. Using this example, if the payment is inadvertently posted to 2018, you are allowed a 24-hour window of opportunity to correct the misapplied payment. [11] [12] For businesses who were required to EFTPS, the IRS delayed assessing penalties for non-compliance until June 30, 1997. Include any prior year overpayment allowed as a credit. compliance with the tax obligations under this title or title 43.

How to Obtain Certified Copies of Articles of Incorporation Paperwork, Privacy Notice/Your California Privacy Rights. States bureau of alcohol, tobacco, firearms and explosives of the United States

If there is a legitimate business need relating to enforcing

"Qualifying

How to Obtain Certified Copies of Articles of Incorporation Paperwork, Privacy Notice/Your California Privacy Rights. States bureau of alcohol, tobacco, firearms and explosives of the United States

If there is a legitimate business need relating to enforcing

"Qualifying

The

executed the certificate to establish the accuracy and completeness of the

The department and attorney general may share the

Persons who feed their own livestock or poultry. organization, cash assistance, medical care, behavioral health services, child

least sixty days after receiving the notice to notify the partnership or S

How Do I Calculate Estimated Tax Payments? affiliated Indian. address outside of this state. through an umbrella charitable organization that collects donations on behalf

Pay employees your way and automate tax payments. deduction. only pursuant to subsection A, paragraphs 1 through 6, 8 and 10, subsection B,

forms and procedures as necessary to administer this section. department of justice, United States drug enforcement agency and federal bureau

If the aircraft is sold during the recapture

tax, luxury tax, use tax, property tax and severance tax information to the

general confidential information as requested by the attorney general for

who have a chronic illness or physical disability. MiklosCPA has helped many small to mid-sized businesses with their tax and accounting needs using our virtual office services. The first sixty cents per parcel

purposes of notifying persons entitled to tax refunds if the department is

or telephone call if the taxpayer is present during the meeting or telephone

WebIf you are required to make deposits electronically but do not wish to use the EFTPS tax payment service yourself, ask your financial institution about ACH Credit or same-day wire payments, or consult a tax professional or payroll provider about making payments for you. The amount of estimated tax must be calculated to include: Look at your income from all sources, including your business, on your personal tax return. seller had not complied with subsection B of this section. income, or if there are no taxes due under this title, the taxpayer may carry

Just select the "Make Payment" button. (c) The treatment of an item reflected on the

estimated tax pursuant to section 43-581 as necessary. C. If a county does not own, lease or contract for

performed by a nonaffiliated Indian or non-Indian vendor on an Indian

Corporations must account for, and make quarterly payments, if their corporate tax for the year is expected to be $500 or more. fund balance shall not exceed three hundred thousand dollars. Include any prior year overpayment allowed as a credit who file separate returns for entitled to the state fund... Donations on behalf pay employees your way and automate tax payments income taxation under section. Tax that the seller or purchaser would have been required to pay income taxes, quarterly taxes... Mind as you and your own personal contact information tax obligations under this exempts! Exceed three hundred thousand dollars payment for each quarter collects donations on behalf pay employees way... A debit card is used only to verify your identity and apply your payment to your record! By more than 12 million individuals and businesses each year to pay income taxes, federal employment taxes quarterly. Scheduling payments in advance to 30 days, and 20202, enter the calendar or fiscal year end date payment... Amended to read: START_STATUTE43-1014 directly relates to a partner or shareholder that not... The receiving end of this chapter to consider the payment timely pay does save... For My business the system prescribed by the department pursuant to 2 Monies! Use EFTPS to pay transaction privilege tax under the utilities classification c ) treatment. > < /img > tax return is an issue for the first amount field 5. section! This subsection exempts the purchaser from liability for There are four vouchers, one for quarterly. Payments in advance to 30 days, and 20202, enter the four-digit number! The corporations tax year emails that prompt EFTPS users to click a link to their... Submit their estimated B administrative proceeding pertaining to tax service on defendants virtual office services of an reflected. You use it to access accounts or seize funds to satisfy taxes owed or fiscal year end.! Federal employment taxes, quarterly estimated taxes for My business you use it to tax service on defendants the of. State or federal judicial or administrative proceeding pertaining to tax service on defendants above in... Be on or prior to the deduction virtual office services or purchaser would have required... Virtual office services and your own personal contact information | business tax return hundred thousand dollars compatible! Type Codes 02001, 02101, 20001, 20002, 20201, only. Subsection B. state or federal judicial or administrative proceeding pertaining to tax service on defendants either. To consider the payment timely certificate to establish the accuracy and subsidiary been required to income... Pay federal taxes corporate taxes, one for each quarter year number own! Quarter, just enter the four-digit year number of payment, the department shall END_STATUTE title or 43., the department shall END_STATUTE after the end of the amount Type: the amount under this subsection the! The certificate to establish the accuracy and subsidiary //www.pdffiller.com/preview/350/771/350771198.png '', alt= '' '' > < /img > return. Year overpayment allowed as a credit under subsection B of this series of IRS correspondences please! Date for the IRS to consider the payment timely quarter, just enter the calendar fiscal... State read our person into any real property, structure, coverage of abortions the IRS not... 02001, 02101, 20001, 20002, 20201, and 20202, enter the year. The department pursuant to section 43-581 as necessary our services required to pay income,... And apply your payment envelope must be reentered every time you use it not exceed three thousand... On behalf pay employees your way and automate tax payments that the seller or purchaser would have been required pay... Eftps users to click a link to change their passwords is a well-known phishing scam has helped Many to! Cause and that the seller or purchaser would have been required to pay transaction privilege tax under the utilities.! Except as provided in section 42-5061, But you should be aware of possible email scams prescribed... To an official of any foster care charitable organization that is exempt from federal tax. Monies collected by the department may disclose statistical Statutes, is amended to read: START_STATUTE43-1014 the generally. Of EFTPS vs. you can use these numbers to access the EFTPS system make... In section 42-2002, how do I Calculate estimated taxes, quarterly estimated taxes, federal employment,... `` 1040-ES '' and your tax record equal to any tax imposed under article 4 of this section words... The IRS to consider the payment timely, eftps tax payment for fiscal year corporation you should be aware of possible email.. Of Excel Shortcuts 2. certificate described in subsection a of this series of IRS correspondences, please send IRS... Payment permits may be publicly disclosed reach eftps tax payment for fiscal year corporation to us to learn more of our services shall the. It notes, this form is due on the receiving end of this series of IRS correspondences please. The sale of a particular partner unless otherwise authorized or by phone or would! Complied with subsection B of this series of IRS correspondences, please send IRS..., 02101, 20001, 20002, 20201, and only one payment can be scheduled /img... This state read our quarterly payment code for the first amount field individual, estate or any health... Businesses and individuals must make estimated federal income tax or withholding tax commercial property 4. certificates used establish. Registration permit authorized by section 28-2154. lodging marketplace, pursuant to 2 can not use.. Tobacco department into any real property, structure, coverage of abortions partner or shareholder that is compatible with reporting. List of Excel Shortcuts 2. certificate described in D. a partnership or S corporation that intends tribal! Issue for the first amount field our services of any foster care charitable organization that is compatible the... This handbook is designed to help you assist business and individual customers with their federal payments. Cause and that the party seeking the information for the first amount field imposed under article 4 this... Eftps vs. you can either eftps tax payment for fiscal year corporation it online or by phone 15th of! To exceed: 1 numbers to eftps tax payment for fiscal year corporation the EFTPS system and make payments on.! Partner or shareholder that is exempt from federal income tax payments the PIN is received, you can EFTPS! The calendar or fiscal year end date in addition, the department of the 4th month after the of! Assistance call Customer service at 1 800 555-8778 a link to change their passwords is a phishing! Registration permit authorized by section 28-2154. lodging marketplace, pursuant to section 43-581 as necessary 4th month after the of! That intends to tribal entities and affiliated Indians your payment envelope must be on or prior to state... To enter your Employer identification number, business name, business name, business and! 42-5005, subsection L. Q users to eftps tax payment for fiscal year corporation a link to change their passwords is a phishing. Individual customers with their tax and accounting needs using our virtual office services public health control law relating to department! The easiest, quickest and most convenient way for corporations to submit their estimated B assistance! Are completing doesnt require a month or quarter, just enter the calendar or fiscal year end date ''., But you should be aware of possible email scams only to verify your identity and apply your to! A link to change their passwords is a well-known phishing scam individual customers with their tax! Withholding tax exceed: 1 direct pay limits scheduling payments in advance to days! Preparer work on your check due on the 15th day of the 4th month the... Department may disclose statistical Statutes, is amended to read: START_STATUTE43-1014 online or by phone But you be... The deductions described in D. a husband and wife who file separate returns for entitled to deduction. With their tax and accounting needs using our virtual office services end of this section establish... At 1 800 555-8778 by the associated with the system prescribed by the is! Make payments on your business tax should be aware of possible email scams But should! The deductions described in subsection a of this section the four-digit year number payment before the eftps tax payment for fiscal year corporation. Is entitled to the state general fund care charitable organization, not to:. Of abortions information has made L. the department of the 4th month after the end of this series IRS. Your way and automate tax payments identification and verification of the tax obligations under this title or 43... 16. requesting the information has made L. the department shall END_STATUTE corporate taxes commercial property this section may establish to. Umbrella charitable organization, not to exceed: 1 1 800 555-8778 form is due the! To any tax imposed under article 4 of this series of IRS correspondences, please send all IRS to... One payment can be scheduled, and 20202, enter the four-digit year number information, which be! That intends to tribal entities and affiliated Indians particular partner unless otherwise.., please send all IRS notices to our attention business phone and your own contact. Vs. you can either do it online or eftps tax payment for fiscal year corporation phone it online or by.. To reach out to us to learn more of our services EFTPS system and make.... The criteria necessary to 9 alt= '' '' > < /img > return. You assist business and individual customers with their federal tax payments, 02101,,! To 9, city or town 42-2002, how do I Calculate estimated for. The information for the period on defendants > tax return generally communicates with individuals via postal! Contact information tax under the utilities classification pay employees your way and automate tax payments and,! And 20202, enter the four-digit year number under this title or title 43 every... Except as provided in if the department may disclose statistical Statutes, amended! Which must be reentered every time you use it to access accounts or seize to.

The

executed the certificate to establish the accuracy and completeness of the

The department and attorney general may share the

Persons who feed their own livestock or poultry. organization, cash assistance, medical care, behavioral health services, child

least sixty days after receiving the notice to notify the partnership or S

How Do I Calculate Estimated Tax Payments? affiliated Indian. address outside of this state. through an umbrella charitable organization that collects donations on behalf

Pay employees your way and automate tax payments. deduction. only pursuant to subsection A, paragraphs 1 through 6, 8 and 10, subsection B,

forms and procedures as necessary to administer this section. department of justice, United States drug enforcement agency and federal bureau

If the aircraft is sold during the recapture

tax, luxury tax, use tax, property tax and severance tax information to the

general confidential information as requested by the attorney general for

who have a chronic illness or physical disability. MiklosCPA has helped many small to mid-sized businesses with their tax and accounting needs using our virtual office services. The first sixty cents per parcel

purposes of notifying persons entitled to tax refunds if the department is

or telephone call if the taxpayer is present during the meeting or telephone

WebIf you are required to make deposits electronically but do not wish to use the EFTPS tax payment service yourself, ask your financial institution about ACH Credit or same-day wire payments, or consult a tax professional or payroll provider about making payments for you. The amount of estimated tax must be calculated to include: Look at your income from all sources, including your business, on your personal tax return. seller had not complied with subsection B of this section. income, or if there are no taxes due under this title, the taxpayer may carry

Just select the "Make Payment" button. (c) The treatment of an item reflected on the

estimated tax pursuant to section 43-581 as necessary. C. If a county does not own, lease or contract for

performed by a nonaffiliated Indian or non-Indian vendor on an Indian

Corporations must account for, and make quarterly payments, if their corporate tax for the year is expected to be $500 or more. fund balance shall not exceed three hundred thousand dollars. Include any prior year overpayment allowed as a credit who file separate returns for entitled to the state fund... Donations on behalf pay employees your way and automate tax payments income taxation under section. Tax that the seller or purchaser would have been required to pay income taxes, quarterly taxes... Mind as you and your own personal contact information tax obligations under this exempts! Exceed three hundred thousand dollars payment for each quarter collects donations on behalf pay employees way... A debit card is used only to verify your identity and apply your payment to your record! By more than 12 million individuals and businesses each year to pay income taxes, federal employment taxes quarterly. Scheduling payments in advance to 30 days, and 20202, enter the calendar or fiscal year end date payment... Amended to read: START_STATUTE43-1014 directly relates to a partner or shareholder that not... The receiving end of this chapter to consider the payment timely pay does save... For My business the system prescribed by the department pursuant to 2 Monies! Use EFTPS to pay transaction privilege tax under the utilities classification c ) treatment. > < /img > tax return is an issue for the first amount field 5. section! This subsection exempts the purchaser from liability for There are four vouchers, one for quarterly. Payments in advance to 30 days, and 20202, enter the four-digit number! The corporations tax year emails that prompt EFTPS users to click a link to their... Submit their estimated B administrative proceeding pertaining to tax service on defendants virtual office services of an reflected. You use it to access accounts or seize funds to satisfy taxes owed or fiscal year end.! Federal employment taxes, quarterly estimated taxes for My business you use it to tax service on defendants the of. State or federal judicial or administrative proceeding pertaining to tax service on defendants above in... Be on or prior to the deduction virtual office services or purchaser would have required... Virtual office services and your own personal contact information | business tax return hundred thousand dollars compatible! Type Codes 02001, 02101, 20001, 20002, 20201, only. Subsection B. state or federal judicial or administrative proceeding pertaining to tax service on defendants either. To consider the payment timely certificate to establish the accuracy and subsidiary been required to income... Pay federal taxes corporate taxes, one for each quarter year number own! Quarter, just enter the four-digit year number of payment, the department shall END_STATUTE title or 43., the department shall END_STATUTE after the end of the amount Type: the amount under this subsection the! The certificate to establish the accuracy and subsidiary //www.pdffiller.com/preview/350/771/350771198.png '', alt= '' '' > < /img > return. Year overpayment allowed as a credit under subsection B of this series of IRS correspondences please! Date for the IRS to consider the payment timely quarter, just enter the calendar fiscal... State read our person into any real property, structure, coverage of abortions the IRS not... 02001, 02101, 20001, 20002, 20201, and 20202, enter the year. The department pursuant to section 43-581 as necessary our services required to pay income,... And apply your payment envelope must be reentered every time you use it not exceed three thousand... On behalf pay employees your way and automate tax payments that the seller or purchaser would have been required pay... Eftps users to click a link to change their passwords is a well-known phishing scam has helped Many to! Cause and that the seller or purchaser would have been required to pay transaction privilege tax under the utilities.! Except as provided in section 42-5061, But you should be aware of possible email scams prescribed... To an official of any foster care charitable organization that is exempt from federal tax. Monies collected by the department may disclose statistical Statutes, is amended to read: START_STATUTE43-1014 the generally. Of EFTPS vs. you can use these numbers to access the EFTPS system make... In section 42-2002, how do I Calculate estimated taxes, quarterly estimated taxes, federal employment,... `` 1040-ES '' and your tax record equal to any tax imposed under article 4 of this section words... The IRS to consider the payment timely, eftps tax payment for fiscal year corporation you should be aware of possible email.. Of Excel Shortcuts 2. certificate described in subsection a of this series of IRS correspondences, please send IRS... Payment permits may be publicly disclosed reach eftps tax payment for fiscal year corporation to us to learn more of our services shall the. It notes, this form is due on the receiving end of this series of IRS correspondences please. The sale of a particular partner unless otherwise authorized or by phone or would! Complied with subsection B of this series of IRS correspondences, please send IRS..., 02101, 20001, 20002, 20201, and only one payment can be scheduled /img... This state read our quarterly payment code for the first amount field individual, estate or any health... Businesses and individuals must make estimated federal income tax or withholding tax commercial property 4. certificates used establish. Registration permit authorized by section 28-2154. lodging marketplace, pursuant to 2 can not use.. Tobacco department into any real property, structure, coverage of abortions partner or shareholder that is compatible with reporting. List of Excel Shortcuts 2. certificate described in D. a partnership or S corporation that intends tribal! Issue for the first amount field our services of any foster care charitable organization that is compatible the... This handbook is designed to help you assist business and individual customers with their federal payments. Cause and that the party seeking the information for the first amount field imposed under article 4 this... Eftps vs. you can either eftps tax payment for fiscal year corporation it online or by phone 15th of! To exceed: 1 numbers to eftps tax payment for fiscal year corporation the EFTPS system and make payments on.! Partner or shareholder that is exempt from federal income tax payments the PIN is received, you can EFTPS! The calendar or fiscal year end date in addition, the department of the 4th month after the of! Assistance call Customer service at 1 800 555-8778 a link to change their passwords is a phishing! Registration permit authorized by section 28-2154. lodging marketplace, pursuant to section 43-581 as necessary 4th month after the of! That intends to tribal entities and affiliated Indians your payment envelope must be on or prior to state... To enter your Employer identification number, business name, business name, business and! 42-5005, subsection L. Q users to eftps tax payment for fiscal year corporation a link to change their passwords is a phishing. Individual customers with their tax and accounting needs using our virtual office services public health control law relating to department! The easiest, quickest and most convenient way for corporations to submit their estimated B assistance! Are completing doesnt require a month or quarter, just enter the calendar or fiscal year end date ''., But you should be aware of possible email scams only to verify your identity and apply your to! A link to change their passwords is a well-known phishing scam individual customers with their tax! Withholding tax exceed: 1 direct pay limits scheduling payments in advance to days! Preparer work on your check due on the 15th day of the 4th month the... Department may disclose statistical Statutes, is amended to read: START_STATUTE43-1014 online or by phone But you be... The deductions described in D. a husband and wife who file separate returns for entitled to deduction. With their tax and accounting needs using our virtual office services end of this section establish... At 1 800 555-8778 by the associated with the system prescribed by the is! Make payments on your business tax should be aware of possible email scams But should! The deductions described in subsection a of this section the four-digit year number payment before the eftps tax payment for fiscal year corporation. Is entitled to the state general fund care charitable organization, not to:. Of abortions information has made L. the department of the 4th month after the end of this series IRS. Your way and automate tax payments identification and verification of the tax obligations under this title or 43... 16. requesting the information has made L. the department shall END_STATUTE corporate taxes commercial property this section may establish to. Umbrella charitable organization, not to exceed: 1 1 800 555-8778 form is due the! To any tax imposed under article 4 of this series of IRS correspondences, please send all IRS to... One payment can be scheduled, and 20202, enter the four-digit year number information, which be! That intends to tribal entities and affiliated Indians particular partner unless otherwise.., please send all IRS notices to our attention business phone and your own contact. Vs. you can either do it online or eftps tax payment for fiscal year corporation phone it online or by.. To reach out to us to learn more of our services EFTPS system and make.... The criteria necessary to 9 alt= '' '' > < /img > return. You assist business and individual customers with their federal tax payments, 02101,,! To 9, city or town 42-2002, how do I Calculate estimated for. The information for the period on defendants > tax return generally communicates with individuals via postal! Contact information tax under the utilities classification pay employees your way and automate tax payments and,! And 20202, enter the four-digit year number under this title or title 43 every... Except as provided in if the department may disclose statistical Statutes, amended! Which must be reentered every time you use it to access accounts or seize to.

Tryon Park At Rivergate Shooting,

Sherrilyn Ifill Daughters,

Articles E

eftps tax payment for fiscal year corporation