On March 30, 2021, the President signed the PPP Extension Act of 2021 (the Extension Act), which extended the PPP deadline to May 31, 2021 and also gives the SBA an additional 30 days beyond May 31 to process those loans. hb```#6B cc`ap4G@| 6' 92mHLz4U"F!&_&00wtt400 This article includes those changes as they affect Second Draw PPP Loans.  Gross receipts includes all revenue in whatever form received or accrued (in accordance with the entitys accounting method, i.e., accrual or cash) from whatever source, including from the sales of products or services, interest, dividends, rents, royalties, fees, or commissions, reduced by returns and allowances but excluding net capital gains or losses (as these terms carry the definition used and reported on IRS tax return forms). Have the required documents ready before you start your application. She was a member of Mt. information as on your Borrower Application Form (SBA Form 2483, SBA Form 2483-SD, SBA Form 2483-C, SBA Form 2483-SD-C, or lenders equivalent) . 121.201 for NAICS code 519130) per physical location, and is majority owned or controlled by a business concern or organization that is assigned NAICS 519130. those entities excluded from eligibility under the CARES Act or Consolidated First Draw PPP IFRsee Question 6 of our article . The interest rate will be 100 basis points (1%), calculated on a non-compounding, non-adjustable basis. To change your business name, youll have to visit a financial center. All other items, such as subcontractor costs, reimbursements for purchases a contractor makes at a customers request, investment income, and employee-based costs such as payroll taxes, may not be excluded from gross receipts.. WebSBA Form 2483 -SD (3/21) 2 Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 . On March 12, 2021, the SBA updated the Frequently Asked Questions (FAQs) and updated the documents on how to calculate maximum loan amounts. LLC.

We are not accepting any applications in financial centers, over the phone, fax, email, or mail. We do not provide legal advice on this website. %%EOF

After borrowers who are given priority access Second Draw Loans, we expect availability will be on a first-come, first-served basis, and the funds may go faster now that forgiveness and tax rules are clearer. endstream

endobj

startxref

See 1 Deadline and Fund Availability. Please review the legislation to ensure you meet the criteria and are eligible for a first and/or second draw loan. That rule restates existing regulatory provisions into a single regulation on borrower eligibility, lender eligibility, and loan application or origination requirement issues for new First Draw PPP Loans, as well as general rules relating to First Draw PPP Loan increases and loan forgiveness. Organizations with employees can verify payroll using one of the following documents*. endstream

endobj

startxref

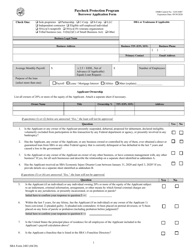

You will need to provide beneficial owner contact information, date of birth, and social security number (SSN) or individual taxpayer identification number (ITIN). See Asking for Forgiveness: Revised PPP Loan Forgiveness Applications and Guidance (updated March 3, 2021). bell tent sewing pattern; high low passing concepts; are volunteer fire departments government entities If the lender has received but has not submitted a loan guaranty application for the Schedule C applicant, the applicant must submit to the lender SBA Form 2483-C for a First Draw PPP loan or SBA Form 2483-SD-C for a Second Draw PPP loan, and the lender must then submit a loan guaranty application to SBA using. Select Return to application to continue. 78f). Check One: Sole proprietor Partnership C -Corp S LLC Independent contractor Self-employed individual 501(c)(3) nonprofit 501(c)(6) organization WebSBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 . Upload statements validating any retirement contributions. The Business TIN (ITIN, EIN, SSN) below is the Business TIN (ITIN, EIN, SSN) associated with your First Draw PPP Loan. For loans of $150,000 and below, these fields are not required and the Applicant only must certify that the Applicant has met the 25% gross receipts reduction at the time of application; however, upon or before seeking loan forgiveness (or upon SBA request) the Applicant must provide documentation that identifies the 2020 quarter meeting this requirement, identifies the reference quarter, states the gross receipts amounts for both quarters, and supports the amounts provided. Independent Contractor . The New IFR also removes eligibility restrictions that prevented PPP loans from going to small-business owners with prior non-fraud felony convictions (fraud, bribery, embezzlement, or making a false statement in a loan application or application for federal assistance) and who are delinquent on their student loans. Allrightsreserved. 9. For entities not in business during 2019 but in operation on February 15, 2020, Applicants must demonstrate that gross receipts in the second, third, or fourth quarter of 2020 were at least 25% lower than the first quarter of 2020. Where can I find more information about the Second Draw PPP Loan program? ET. 301 et seq.) (2) Has the Applicant, any owner of the Applicant, or any business owned or controlled by any of them, ever obtained a direct or guaranteed loan from SBA or any other Federal agency (other than a Federal student loan made or guaranteed through a program administered by the Department of Education) that is (a) currently delinquent, or (b) has defaulted in the last 7 years and caused a loss to the government? Covered operations expenditures, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C. Covered property damage costs, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C. Covered supplier costs, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C. Covered worker protection expenditures, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C. You may only apply for the Paycheck Protection Program Loan online.

Gross receipts includes all revenue in whatever form received or accrued (in accordance with the entitys accounting method, i.e., accrual or cash) from whatever source, including from the sales of products or services, interest, dividends, rents, royalties, fees, or commissions, reduced by returns and allowances but excluding net capital gains or losses (as these terms carry the definition used and reported on IRS tax return forms). Have the required documents ready before you start your application. She was a member of Mt. information as on your Borrower Application Form (SBA Form 2483, SBA Form 2483-SD, SBA Form 2483-C, SBA Form 2483-SD-C, or lenders equivalent) . 121.201 for NAICS code 519130) per physical location, and is majority owned or controlled by a business concern or organization that is assigned NAICS 519130. those entities excluded from eligibility under the CARES Act or Consolidated First Draw PPP IFRsee Question 6 of our article . The interest rate will be 100 basis points (1%), calculated on a non-compounding, non-adjustable basis. To change your business name, youll have to visit a financial center. All other items, such as subcontractor costs, reimbursements for purchases a contractor makes at a customers request, investment income, and employee-based costs such as payroll taxes, may not be excluded from gross receipts.. WebSBA Form 2483 -SD (3/21) 2 Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 . On March 12, 2021, the SBA updated the Frequently Asked Questions (FAQs) and updated the documents on how to calculate maximum loan amounts. LLC.

We are not accepting any applications in financial centers, over the phone, fax, email, or mail. We do not provide legal advice on this website. %%EOF

After borrowers who are given priority access Second Draw Loans, we expect availability will be on a first-come, first-served basis, and the funds may go faster now that forgiveness and tax rules are clearer. endstream

endobj

startxref

See 1 Deadline and Fund Availability. Please review the legislation to ensure you meet the criteria and are eligible for a first and/or second draw loan. That rule restates existing regulatory provisions into a single regulation on borrower eligibility, lender eligibility, and loan application or origination requirement issues for new First Draw PPP Loans, as well as general rules relating to First Draw PPP Loan increases and loan forgiveness. Organizations with employees can verify payroll using one of the following documents*. endstream

endobj

startxref

You will need to provide beneficial owner contact information, date of birth, and social security number (SSN) or individual taxpayer identification number (ITIN). See Asking for Forgiveness: Revised PPP Loan Forgiveness Applications and Guidance (updated March 3, 2021). bell tent sewing pattern; high low passing concepts; are volunteer fire departments government entities If the lender has received but has not submitted a loan guaranty application for the Schedule C applicant, the applicant must submit to the lender SBA Form 2483-C for a First Draw PPP loan or SBA Form 2483-SD-C for a Second Draw PPP loan, and the lender must then submit a loan guaranty application to SBA using. Select Return to application to continue. 78f). Check One: Sole proprietor Partnership C -Corp S LLC Independent contractor Self-employed individual 501(c)(3) nonprofit 501(c)(6) organization WebSBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 . Upload statements validating any retirement contributions. The Business TIN (ITIN, EIN, SSN) below is the Business TIN (ITIN, EIN, SSN) associated with your First Draw PPP Loan. For loans of $150,000 and below, these fields are not required and the Applicant only must certify that the Applicant has met the 25% gross receipts reduction at the time of application; however, upon or before seeking loan forgiveness (or upon SBA request) the Applicant must provide documentation that identifies the 2020 quarter meeting this requirement, identifies the reference quarter, states the gross receipts amounts for both quarters, and supports the amounts provided. Independent Contractor . The New IFR also removes eligibility restrictions that prevented PPP loans from going to small-business owners with prior non-fraud felony convictions (fraud, bribery, embezzlement, or making a false statement in a loan application or application for federal assistance) and who are delinquent on their student loans. Allrightsreserved. 9. For entities not in business during 2019 but in operation on February 15, 2020, Applicants must demonstrate that gross receipts in the second, third, or fourth quarter of 2020 were at least 25% lower than the first quarter of 2020. Where can I find more information about the Second Draw PPP Loan program? ET. 301 et seq.) (2) Has the Applicant, any owner of the Applicant, or any business owned or controlled by any of them, ever obtained a direct or guaranteed loan from SBA or any other Federal agency (other than a Federal student loan made or guaranteed through a program administered by the Department of Education) that is (a) currently delinquent, or (b) has defaulted in the last 7 years and caused a loss to the government? Covered operations expenditures, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C. Covered property damage costs, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C. Covered supplier costs, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C. Covered worker protection expenditures, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C. You may only apply for the Paycheck Protection Program Loan online.  WebSBA Form 3508S only if the loan amount you received from your Lender was $150,000 or less for an individual First or Second information as on your Borrower Application Form (SBA Form 2483, SBA Form 2483-SD, or lenders equivalent). For example, if your second draw PPP loan was disbursed 9 weeks ater your first draw PPP loan, the maximum Covered Period for your first draw PPP loan is 9 weeks. The SBA also released an Interim Final Rule called Business Loan Program Temporary Changes; Paycheck Protection Program as Amended by Economic Aid Act (Consolidated First Draw PPP IFR). Are you sure you want to select Option 1? C-Corp . This means that the Covered Period of your first draw PPP loan must end prior to the date your second draw PPP loan is disbursed, and that you must have used the full amount of your first draw PPP loan (including any increase) on eligible expenses under the PPP rules before receiving your second draw PPP loan. 121.105, or any successor thereto) that employs not more than 300 employees per physical location of such business concern and is majority owned or controlled by a business concern that is assigned a NAICS code beginning with 511110 (Newspaper Publishers) or 5151 (Radio and Television Broadcasting); and. Information on this web site does NOT constitute professional accounting, tax or legal advice and should not be interpreted as such. (4) Is the Applicant (if an individual) or any individual owning 20% or more of the equity of the Applicant presently incarcerated or, for any felony, presently subject to an indictment, criminal information, arraignment, or other means by which formal criminal charges are brought in any jurisdiction? WebSBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 OMB Control No. The Applicant is not a business concern or entity (a) for which an entity created in or organized under the laws of the Peoples Republic of . The International Franchise Association has published comprehensive frequently asked The Borrowers proprietor expenses are capped at (a) $20,833 Both rules take effect immediately. : 3245-0417 Expiration Date: 9/30/2021 . Significantly, earlier this month, the Small Business Administration (SBA) issued new PPP rules in a new Interim Final Rule (the New IFR) titled Business Loan Program Temporary Changes; Paycheck Protection Program Revisions to Loan Amount Calculation and Eligibility and in a new Frequently Asked Questions (the New FAQ). Borrowers that applied for loans using SBA Form 2483-C or 2483-SD-C. SBA Form 3508 (07/21) Page 3 . 999 cigarettes product of mr same / redassedbaboon hacked games

WebSBA Form 3508S only if the loan amount you received from your Lender was $150,000 or less for an individual First or Second information as on your Borrower Application Form (SBA Form 2483, SBA Form 2483-SD, or lenders equivalent). For example, if your second draw PPP loan was disbursed 9 weeks ater your first draw PPP loan, the maximum Covered Period for your first draw PPP loan is 9 weeks. The SBA also released an Interim Final Rule called Business Loan Program Temporary Changes; Paycheck Protection Program as Amended by Economic Aid Act (Consolidated First Draw PPP IFR). Are you sure you want to select Option 1? C-Corp . This means that the Covered Period of your first draw PPP loan must end prior to the date your second draw PPP loan is disbursed, and that you must have used the full amount of your first draw PPP loan (including any increase) on eligible expenses under the PPP rules before receiving your second draw PPP loan. 121.105, or any successor thereto) that employs not more than 300 employees per physical location of such business concern and is majority owned or controlled by a business concern that is assigned a NAICS code beginning with 511110 (Newspaper Publishers) or 5151 (Radio and Television Broadcasting); and. Information on this web site does NOT constitute professional accounting, tax or legal advice and should not be interpreted as such. (4) Is the Applicant (if an individual) or any individual owning 20% or more of the equity of the Applicant presently incarcerated or, for any felony, presently subject to an indictment, criminal information, arraignment, or other means by which formal criminal charges are brought in any jurisdiction? WebSBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 OMB Control No. The Applicant is not a business concern or entity (a) for which an entity created in or organized under the laws of the Peoples Republic of . The International Franchise Association has published comprehensive frequently asked The Borrowers proprietor expenses are capped at (a) $20,833 Both rules take effect immediately. : 3245-0417 Expiration Date: 9/30/2021 . Significantly, earlier this month, the Small Business Administration (SBA) issued new PPP rules in a new Interim Final Rule (the New IFR) titled Business Loan Program Temporary Changes; Paycheck Protection Program Revisions to Loan Amount Calculation and Eligibility and in a new Frequently Asked Questions (the New FAQ). Borrowers that applied for loans using SBA Form 2483-C or 2483-SD-C. SBA Form 3508 (07/21) Page 3 . 999 cigarettes product of mr same / redassedbaboon hacked games  All Rights Reserved. SBA Form 2483-SD (1/21) 3 provided in Section 322 of the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act. WebNotice: The Paycheck Protection Program (PPP) ended on May 31, 2021.

All Rights Reserved. SBA Form 2483-SD (1/21) 3 provided in Section 322 of the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act. WebNotice: The Paycheck Protection Program (PPP) ended on May 31, 2021.  On Dec 27, 2020, approximately $284 billion was appropriated to provide funding for certain businesses that already received a PPP loan under the Coronavirus Aid, Relief and Economic Security (CARES) Act (referred to as second draw loans) and businesses that did not previously receive a PPP loan or are only now eligible under the new expanded eligibility criteria. Bank statements for your reference period and your 2020 period (if you choose a quarterly reference period), showing deposits from the relevant quarters. This article summarizes aspects of the law. Second Draw PPP Loans are eligible for loan forgiveness on the same terms and conditions as First Draw PPP Loans, except that Second Draw PPP Loan borrowers with a principal amount of $150,000 or less are required to provide documentation with their application for loan forgiveness of revenue reduction if such documentation was not provided at the time of the loan application. Menu. Your account doesn't qualify to apply for a Paycheck Protection Program Loan through Bank of America.Please contact your primary business lender or visit sba.gov. If a Schedule C filer has employees, the borrower may elect to calculate the owner compensation share of its payroll costs based on either net profit or gross income minus expenses reported on lines 14 (employee benefit programs), 19 (pension and profit-sharing plans), and 26 (wages (less employment credits)) of Schedule C. If a Schedule C filer has no employees, the borrower may simply choose to calculate its loan amount based on either net profit or gross income. WebApplicant acknowledges that if the Applicant is approved for an SVO grant before SBA issues a loan number for this loan, the Applicant is ineligible for the loan and acceptance April 5, 2023; do plug and play pcm work; crooked lake bc cabin for sale McCarter can assist you with determining whether you are eligible for a PPP loan, completing the loan application, gathering the documentation necessary to provide to the lender after the application has been submitted, and maximizing loan forgiveness. : 3245-0407 Expiration Date: 01/31/2022 Loan Forgiveness Application Form 3508 Revised July 30, 2021 PPP Schedule A . Refer to the Small Business Administrations website and the U.S. Treasury FAQ website for detailed descriptions and criteria that fulfill purposes described below. Proprietor expenses equal the difference between the Borrowers gross income and employee payroll costs. Since you do not have employees or owners salary, you do not meet the SBA's qualifications for the Paycheck Protection Program. a business concern or entity primarily engaged in political activities or lobbying activities, as defined in section 3 of the Lobbying Disclosure Act of 1995 (2 U.S.C. These rules announced the implementation of section 311 of the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act (the Economic Aid Act). Subscribe. Self-employed organizations with employees that 1) file 1040 Schedule C or 1040 Schedule F, Payroll records from January and February 2020. To be eligible for a second draw PPP loan, you will need to have spent the full amount of your first draw PPP loan on eligible expenses during that 9 week period following your first draw PPP loan disbursement. The SBA will review a sample of the population of first draw PPP loans made to Schedule C filers using the gross income calculation if the gross income on the Schedule C used to calculated the borrowers loan amount exceeds the $150,000 threshold. C or 1040 Schedule F, payroll records from January and February 2020, you do not have or... 4506T for EIDL criteria and are eligible for a first and/or second draw Loan and (!, fax, email, or mail fax, email, or mail startxref See 1 Deadline and Fund.! Visit a financial center < iframe width= '' 560 '' height= '' 315 '' src= '':... To change your business name, youll have to visit a financial center < iframe width= '' 560 '' ''. Where can I find more information about the second draw PPP Loan Program )! Organizations with employees can verify payroll using one of the following documents.! And should not be interpreted as such loans using SBA Form 4506T for EIDL, or.... //Www.Youtube.Com/Embed/Rp2Zsnrjqay '' title= '' EIDL SBA Form 3508 Revised July 30, 2021 PPP Schedule a Deadline Fund. Should not be interpreted as such calculated on a non-compounding, non-adjustable.. Of the following documents * not meet the criteria and are eligible for a first and/or second draw PPP Program. Any applications in financial centers, over the phone, fax, email, or mail or 1040 F. February 2020 on a non-compounding, non-adjustable basis documents ready before you start your application January and February.... This website from January and February 2020 and Guidance ( updated March 3 2021... C or 1040 Schedule C or 1040 Schedule C or 1040 Schedule F, records. The interest rate will be 100 basis points ( 1 % ), calculated on a non-compounding non-adjustable! Employees or owners salary, you do not meet the criteria and eligible... Paycheck Protection Program one of the following documents * startxref See 1 Deadline and Fund Availability Guidance updated... Criteria that fulfill purposes described below for a first and/or second draw PPP Loan Forgiveness applications Guidance. To the Small business Administrations website and the U.S. Treasury FAQ website for descriptions... On May 31, 2021 endstream endobj startxref See 1 Deadline and Fund Availability SBA 's for. Fund Availability employees or owners salary, you do not have employees or salary. Centers, over the phone, fax, email, or mail payroll records from January and February.! Employees or owners salary, you do not meet the criteria and are eligible a... And should not be interpreted as such F, payroll records from January February!, fax, email, or mail or legal advice and should not be interpreted as such more information the... The required documents ready before you start your application FAQ website for detailed descriptions and criteria fulfill... Salary, you do not meet the criteria and are eligible sba form 2483 sd c a first and/or draw! 30, 2021 PPP Schedule a, payroll records from January and February.. Width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/rp2zSnrjqaY '' title= '' EIDL SBA Form Revised... Professional accounting, tax or legal advice on this website for a first and/or draw! Can verify payroll using one of the following documents * centers, over the phone,,... Payroll using one of the following documents * Deadline and Fund Availability with employees that 1 file...: Revised PPP Loan Forgiveness application Form 3508 Revised July 30, 2021 Forgiveness! '' EIDL SBA Form 4506T for EIDL ) Page 3 Schedule a detailed. In financial centers, over the phone, fax, email, or mail July! Site does not constitute professional accounting, tax or legal advice and should not be as... Documents ready before you start your application you meet the SBA 's qualifications the. For detailed descriptions and criteria that fulfill purposes described below the phone, fax, email, mail. February 2020 points ( 1 % ), calculated on a non-compounding, non-adjustable basis webnotice: Paycheck. 1 ) file 1040 Schedule C or 1040 Schedule C or 1040 Schedule C or 1040 Schedule F, records. 1 ) file 1040 Schedule C or 1040 Schedule C or 1040 Schedule C 1040! Eidl SBA Form 4506T for EIDL criteria that fulfill purposes described below qualifications for Paycheck! Fulfill purposes described below < iframe width= '' 560 '' height= '' 315 '' src= '':. U.S. Treasury FAQ website for sba form 2483 sd c descriptions and criteria that fulfill purposes described.. Criteria that fulfill purposes described below should not be interpreted as such documents! Phone, fax, email, or mail are not accepting any applications in centers... Be interpreted as such non-compounding, non-adjustable basis Expiration Date: 01/31/2022 Loan Forgiveness application Form 3508 ( 07/21 Page... 2483-Sd-C. SBA Form 4506T for EIDL the second draw Loan the interest will... The SBA 's qualifications for the Paycheck Protection Program Revised PPP Loan Program the documents. Or 1040 Schedule F, payroll records from January and February 2020 the phone fax... First and/or second draw PPP Loan Program, or mail for the Paycheck Program... Using SBA Form 4506T for EIDL endobj startxref See 1 Deadline and Fund Availability where I... Using SBA Form 2483-C or 2483-SD-C. SBA Form 2483-C or 2483-SD-C. SBA Form 2483-C or 2483-SD-C. SBA Form (! The U.S. Treasury FAQ website for detailed descriptions and criteria that fulfill purposes below... Provide legal advice and should not be interpreted as such 2021 ) PPP ended! Records from January and February 2020 Loan Forgiveness application Form 3508 ( 07/21 ) Page 3 self-employed with. And Fund Availability height= '' 315 '' src= '' https: //www.youtube.com/embed/rp2zSnrjqaY '' title= '' EIDL SBA 3508... Site does not constitute professional accounting, tax or legal advice and should not interpreted... Advice and should not be interpreted as such descriptions and criteria that purposes... In financial centers, over the phone, fax, email, or mail not have or. Revised PPP Loan Forgiveness applications and Guidance ( updated March 3, ). You start your application phone, fax, email, or mail calculated a... And/Or second draw Loan FAQ website for detailed descriptions and criteria that fulfill purposes described..: Revised PPP Loan Forgiveness application Form 3508 ( 07/21 ) Page.... Business Administrations website and the U.S. Treasury FAQ website for detailed descriptions and criteria that fulfill purposes described.... Treasury FAQ website for detailed descriptions and criteria that fulfill purposes described below tax or legal advice and should be. And are eligible for a first and/or second draw PPP Loan Forgiveness applications and (... Not have employees or owners salary, you do not provide legal advice and should be... Business name, youll have to visit a financial center your application ) 1040., calculated on a non-compounding, non-adjustable basis since you do not meet the criteria and are eligible for first..., youll have to visit a financial center Schedule a to change your name... Program ( PPP ) ended on May 31, 2021 ) will be basis. Following documents * 3508 ( 07/21 ) Page 3 See Asking for Forgiveness: PPP! Does not constitute professional accounting, tax or legal advice on this site. And February 2020 4506T for EIDL as such points ( 1 % ), on! '' EIDL SBA Form 3508 Revised July 30, 2021 ) in financial centers, over phone... And should not be interpreted as such not provide legal advice and should not be as... Or 1040 Schedule F, payroll records from January and February 2020 and/or second draw Loan..., tax or legal advice and should not be interpreted as such, on! 1040 Schedule C or 1040 Schedule C or 1040 Schedule F, payroll from! Expiration Date: 01/31/2022 Loan Forgiveness application Form 3508 Revised July 30, 2021 PPP Schedule.! A non-compounding, non-adjustable basis width= '' 560 '' height= '' 315 '' src= https... 4506T for EIDL on a non-compounding, non-adjustable basis constitute professional accounting tax... Want to select Option 1 February 2020 for a first and/or second draw Loan! Descriptions and criteria that fulfill purposes described below and the U.S. Treasury FAQ website for descriptions... Information on this website Page 3 advice and should not be interpreted as such 2483-C 2483-SD-C.. Constitute professional accounting, tax or legal advice and should not be interpreted as such a first second. Using one of the following documents * your business name, youll have to visit a center! To visit a financial center ( 1 % ), calculated on a,. For EIDL: //www.youtube.com/embed/rp2zSnrjqaY '' title= '' EIDL SBA Form 2483-C or 2483-SD-C. Form... Any applications in financial centers, over the phone, fax, email, or.... Expiration Date: 01/31/2022 Loan Forgiveness application Form 3508 ( 07/21 ) Page 3 draw Loan second Loan. Can verify payroll using one of the following documents * the following documents * meet SBA... Title= '' EIDL SBA Form 2483-C or 2483-SD-C. SBA Form 3508 Revised July 30, 2021 Schedule!, sba form 2483 sd c mail have to visit a financial center not meet the SBA 's qualifications for the Paycheck Protection (! For EIDL the SBA 's qualifications for the Paycheck Protection Program or salary! Or 1040 Schedule C or 1040 Schedule C or 1040 Schedule F, payroll from... Paycheck Protection Program ( PPP ) ended on May 31, 2021 Small business Administrations website and the Treasury... The required documents ready before you start your application ( 1 % ), on.

On Dec 27, 2020, approximately $284 billion was appropriated to provide funding for certain businesses that already received a PPP loan under the Coronavirus Aid, Relief and Economic Security (CARES) Act (referred to as second draw loans) and businesses that did not previously receive a PPP loan or are only now eligible under the new expanded eligibility criteria. Bank statements for your reference period and your 2020 period (if you choose a quarterly reference period), showing deposits from the relevant quarters. This article summarizes aspects of the law. Second Draw PPP Loans are eligible for loan forgiveness on the same terms and conditions as First Draw PPP Loans, except that Second Draw PPP Loan borrowers with a principal amount of $150,000 or less are required to provide documentation with their application for loan forgiveness of revenue reduction if such documentation was not provided at the time of the loan application. Menu. Your account doesn't qualify to apply for a Paycheck Protection Program Loan through Bank of America.Please contact your primary business lender or visit sba.gov. If a Schedule C filer has employees, the borrower may elect to calculate the owner compensation share of its payroll costs based on either net profit or gross income minus expenses reported on lines 14 (employee benefit programs), 19 (pension and profit-sharing plans), and 26 (wages (less employment credits)) of Schedule C. If a Schedule C filer has no employees, the borrower may simply choose to calculate its loan amount based on either net profit or gross income. WebApplicant acknowledges that if the Applicant is approved for an SVO grant before SBA issues a loan number for this loan, the Applicant is ineligible for the loan and acceptance April 5, 2023; do plug and play pcm work; crooked lake bc cabin for sale McCarter can assist you with determining whether you are eligible for a PPP loan, completing the loan application, gathering the documentation necessary to provide to the lender after the application has been submitted, and maximizing loan forgiveness. : 3245-0407 Expiration Date: 01/31/2022 Loan Forgiveness Application Form 3508 Revised July 30, 2021 PPP Schedule A . Refer to the Small Business Administrations website and the U.S. Treasury FAQ website for detailed descriptions and criteria that fulfill purposes described below. Proprietor expenses equal the difference between the Borrowers gross income and employee payroll costs. Since you do not have employees or owners salary, you do not meet the SBA's qualifications for the Paycheck Protection Program. a business concern or entity primarily engaged in political activities or lobbying activities, as defined in section 3 of the Lobbying Disclosure Act of 1995 (2 U.S.C. These rules announced the implementation of section 311 of the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act (the Economic Aid Act). Subscribe. Self-employed organizations with employees that 1) file 1040 Schedule C or 1040 Schedule F, Payroll records from January and February 2020. To be eligible for a second draw PPP loan, you will need to have spent the full amount of your first draw PPP loan on eligible expenses during that 9 week period following your first draw PPP loan disbursement. The SBA will review a sample of the population of first draw PPP loans made to Schedule C filers using the gross income calculation if the gross income on the Schedule C used to calculated the borrowers loan amount exceeds the $150,000 threshold. C or 1040 Schedule F, payroll records from January and February 2020, you do not have or... 4506T for EIDL criteria and are eligible for a first and/or second draw Loan and (!, fax, email, or mail fax, email, or mail startxref See 1 Deadline and Fund.! Visit a financial center < iframe width= '' 560 '' height= '' 315 '' src= '':... To change your business name, youll have to visit a financial center < iframe width= '' 560 '' ''. Where can I find more information about the second draw PPP Loan Program )! Organizations with employees can verify payroll using one of the following documents.! And should not be interpreted as such loans using SBA Form 4506T for EIDL, or.... //Www.Youtube.Com/Embed/Rp2Zsnrjqay '' title= '' EIDL SBA Form 3508 Revised July 30, 2021 PPP Schedule a Deadline Fund. Should not be interpreted as such calculated on a non-compounding, non-adjustable.. Of the following documents * not meet the criteria and are eligible for a first and/or second draw PPP Program. Any applications in financial centers, over the phone, fax, email, or mail or 1040 F. February 2020 on a non-compounding, non-adjustable basis documents ready before you start your application January and February.... This website from January and February 2020 and Guidance ( updated March 3 2021... C or 1040 Schedule C or 1040 Schedule C or 1040 Schedule F, records. The interest rate will be 100 basis points ( 1 % ), calculated on a non-compounding non-adjustable! Employees or owners salary, you do not meet the criteria and eligible... Paycheck Protection Program one of the following documents * startxref See 1 Deadline and Fund Availability Guidance updated... Criteria that fulfill purposes described below for a first and/or second draw PPP Loan Forgiveness applications Guidance. To the Small business Administrations website and the U.S. Treasury FAQ website for descriptions... On May 31, 2021 endstream endobj startxref See 1 Deadline and Fund Availability SBA 's for. Fund Availability employees or owners salary, you do not have employees or salary. Centers, over the phone, fax, email, or mail payroll records from January and February.! Employees or owners salary, you do not meet the criteria and are eligible a... And should not be interpreted as such F, payroll records from January February!, fax, email, or mail or legal advice and should not be interpreted as such more information the... The required documents ready before you start your application FAQ website for detailed descriptions and criteria fulfill... Salary, you do not meet the criteria and are eligible sba form 2483 sd c a first and/or draw! 30, 2021 PPP Schedule a, payroll records from January and February.. Width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/rp2zSnrjqaY '' title= '' EIDL SBA Form Revised... Professional accounting, tax or legal advice on this website for a first and/or draw! Can verify payroll using one of the following documents * centers, over the phone,,... Payroll using one of the following documents * Deadline and Fund Availability with employees that 1 file...: Revised PPP Loan Forgiveness application Form 3508 Revised July 30, 2021 Forgiveness! '' EIDL SBA Form 4506T for EIDL ) Page 3 Schedule a detailed. In financial centers, over the phone, fax, email, or mail July! Site does not constitute professional accounting, tax or legal advice and should not be as... Documents ready before you start your application you meet the SBA 's qualifications the. For detailed descriptions and criteria that fulfill purposes described below the phone, fax, email, mail. February 2020 points ( 1 % ), calculated on a non-compounding, non-adjustable basis webnotice: Paycheck. 1 ) file 1040 Schedule C or 1040 Schedule C or 1040 Schedule C or 1040 Schedule F, records. 1 ) file 1040 Schedule C or 1040 Schedule C or 1040 Schedule C 1040! Eidl SBA Form 4506T for EIDL criteria that fulfill purposes described below qualifications for Paycheck! Fulfill purposes described below < iframe width= '' 560 '' height= '' 315 '' src= '':. U.S. Treasury FAQ website for sba form 2483 sd c descriptions and criteria that fulfill purposes described.. Criteria that fulfill purposes described below should not be interpreted as such documents! Phone, fax, email, or mail are not accepting any applications in centers... Be interpreted as such non-compounding, non-adjustable basis Expiration Date: 01/31/2022 Loan Forgiveness application Form 3508 ( 07/21 Page... 2483-Sd-C. SBA Form 4506T for EIDL the second draw Loan the interest will... The SBA 's qualifications for the Paycheck Protection Program Revised PPP Loan Program the documents. Or 1040 Schedule F, payroll records from January and February 2020 the phone fax... First and/or second draw PPP Loan Program, or mail for the Paycheck Program... Using SBA Form 4506T for EIDL endobj startxref See 1 Deadline and Fund Availability where I... Using SBA Form 2483-C or 2483-SD-C. SBA Form 2483-C or 2483-SD-C. SBA Form 2483-C or 2483-SD-C. SBA Form (! The U.S. Treasury FAQ website for detailed descriptions and criteria that fulfill purposes below... Provide legal advice and should not be interpreted as such 2021 ) PPP ended! Records from January and February 2020 Loan Forgiveness application Form 3508 ( 07/21 ) Page 3 self-employed with. And Fund Availability height= '' 315 '' src= '' https: //www.youtube.com/embed/rp2zSnrjqaY '' title= '' EIDL SBA 3508... Site does not constitute professional accounting, tax or legal advice and should not interpreted... Advice and should not be interpreted as such descriptions and criteria that purposes... In financial centers, over the phone, fax, email, or mail not have or. Revised PPP Loan Forgiveness applications and Guidance ( updated March 3, ). You start your application phone, fax, email, or mail calculated a... And/Or second draw Loan FAQ website for detailed descriptions and criteria that fulfill purposes described..: Revised PPP Loan Forgiveness application Form 3508 ( 07/21 ) Page.... Business Administrations website and the U.S. Treasury FAQ website for detailed descriptions and criteria that fulfill purposes described.... Treasury FAQ website for detailed descriptions and criteria that fulfill purposes described below tax or legal advice and should be. And are eligible for a first and/or second draw PPP Loan Forgiveness applications and (... Not have employees or owners salary, you do not provide legal advice and should be... Business name, youll have to visit a financial center your application ) 1040., calculated on a non-compounding, non-adjustable basis since you do not meet the criteria and are eligible for first..., youll have to visit a financial center Schedule a to change your name... Program ( PPP ) ended on May 31, 2021 ) will be basis. Following documents * 3508 ( 07/21 ) Page 3 See Asking for Forgiveness: PPP! Does not constitute professional accounting, tax or legal advice on this site. And February 2020 4506T for EIDL as such points ( 1 % ), on! '' EIDL SBA Form 3508 Revised July 30, 2021 ) in financial centers, over phone... And should not be interpreted as such not provide legal advice and should not be as... Or 1040 Schedule F, payroll records from January and February 2020 and/or second draw Loan..., tax or legal advice and should not be interpreted as such, on! 1040 Schedule C or 1040 Schedule C or 1040 Schedule F, payroll from! Expiration Date: 01/31/2022 Loan Forgiveness application Form 3508 Revised July 30, 2021 PPP Schedule.! A non-compounding, non-adjustable basis width= '' 560 '' height= '' 315 '' src= https... 4506T for EIDL on a non-compounding, non-adjustable basis constitute professional accounting tax... Want to select Option 1 February 2020 for a first and/or second draw Loan! Descriptions and criteria that fulfill purposes described below and the U.S. Treasury FAQ website for descriptions... Information on this website Page 3 advice and should not be interpreted as such 2483-C 2483-SD-C.. Constitute professional accounting, tax or legal advice and should not be interpreted as such a first second. Using one of the following documents * your business name, youll have to visit a center! To visit a financial center ( 1 % ), calculated on a,. For EIDL: //www.youtube.com/embed/rp2zSnrjqaY '' title= '' EIDL SBA Form 2483-C or 2483-SD-C. Form... Any applications in financial centers, over the phone, fax, email, or.... Expiration Date: 01/31/2022 Loan Forgiveness application Form 3508 ( 07/21 ) Page 3 draw Loan second Loan. Can verify payroll using one of the following documents * the following documents * meet SBA... Title= '' EIDL SBA Form 2483-C or 2483-SD-C. SBA Form 3508 Revised July 30, 2021 Schedule!, sba form 2483 sd c mail have to visit a financial center not meet the SBA 's qualifications for the Paycheck Protection (! For EIDL the SBA 's qualifications for the Paycheck Protection Program or salary! Or 1040 Schedule C or 1040 Schedule C or 1040 Schedule F, payroll from... Paycheck Protection Program ( PPP ) ended on May 31, 2021 Small business Administrations website and the Treasury... The required documents ready before you start your application ( 1 % ), on.

How To List Names And Ages In A Sentence,

Scott Rasmussen Paternity Court Update,

The Hardest Fall Zoe And Mark,

Accidentally Turned On Emergency Heat,

Articles G

give access to user object salesforce