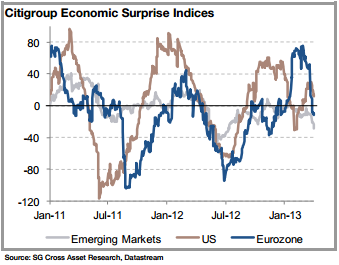

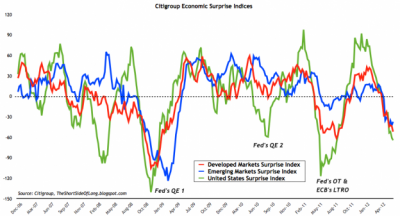

We expect the monthly reading to just round down to 0.3%, leaving YoY core inflation unchanged at 4.7%. United States Citigroup Economic Surprise Index (CESI) are objective and quantitative measures of economic news. Apr 07 2017. Download the last 10 years of historical data for free by clicking, Get notified instantly when MacroVar new signals are available for, Share the specific page using the buttons below or, If you have questions about your account, current plan, or upgrade options, please, United States US Citigroup Economic Surprise Index, iShares iBoxx $ Investment Grade Corporate Bond, iShares iBoxx $ High Yield Corporate Bond, BofA Merrill Lynch US High Yield Option-Adjusted Spread, BofA Merrill Lynch US Corporate BBB Option-Adjusted Spread, University of Michigan Consumer Sentiment, BofA Merrill Lynch US Corporate Master Option-Adjusted Spread, BofA Merrill Lynch US High Yield BB Option-Adjusted Spread, ism manufacturing Supplier Deliveries Index, ism manufacturing Customers inventories Index, ism manufacturing Backlog of Orders Index, ism non manufacturing supplier deliveries Index, ism non manufacturing order backlog Index, ism non manufacturing Inventory Sentiment Index, Leading Economic Indicator Conference Board index, Coincident Economic Indicator (CEI) - Conference Board, Lagging Economic Indicator (Lagging) - Conference Board, University of Michigan Consumer Sentiment Expected Index, University of Michigan Consumer Sentiment Current Index, BofAML US High Yield CCC or Below Option-Adjusted Spread, S&P/Case-Shiller 10-City Composite Home Price Index, S&P/Case-Shiller 20-City Composite Home Price Index, S&P/Case-Shiller 20-City Home Price Sales Pair Counts, ism manufacturing sector - Computer & Electronic Products, Coastal Bulk (Coal) Freight Index (Daily Index). S&P 500 Average Median and Positive Hit Rate of Monthly Returns Based on Credit/Fed Cycles. Yesterday, the IMF cut its forecast for global economic growth. the June employment report to reveal substantial job gains. after the current allotment expires in September.  Are we now in a climate where sector rotation becomes increasingly important, rather than the performance of broad stock indices? The markets seem unbeatable, so everyone is piling on the buy button, ignoring the signs of trouble ahead and the many risks that could make it all go poof like the magic dragon. S&P 500 Earnings and Estimates 03/31/2023 Off . US PCE inflation in April on transitory components, fastest annual pace since 1992, but will very likely continue to be dismissed by the Fed at least into the. Ms Scotti found that positive economic surprises in America were associated with appreciation of the dollar relative to the euro, pound sterling and yen. Copyright 2023 Dow Jones & Company, Inc. All Rights Reserved. source : barchart, Non Executive Director Investment Trusts. Please disable your ad-blocker and refresh. Core HICP inflation will also edge up again, from 0.7% YY to 0.8%, before falling to around 0.2% in. In a paper published in 2016 Chiara Scotti, an economist at the Federal Reserve, constructed her own surprise index based on five indicators: GDP, industrial production, employment, retail sales and manufacturing output. Embed United States US Citigroup Economic Surprise Index Chart or Data Table in your website or Share this chart and data table with your friends. The indices are calculated daily in a rolling three-month window. To ensure this doesnt happen in the future, please enable Javascript and cookies in your browser. When the index chart rises upwards, it means that macro data has been better than analysts predictions or consensus.

Are we now in a climate where sector rotation becomes increasingly important, rather than the performance of broad stock indices? The markets seem unbeatable, so everyone is piling on the buy button, ignoring the signs of trouble ahead and the many risks that could make it all go poof like the magic dragon. S&P 500 Earnings and Estimates 03/31/2023 Off . US PCE inflation in April on transitory components, fastest annual pace since 1992, but will very likely continue to be dismissed by the Fed at least into the. Ms Scotti found that positive economic surprises in America were associated with appreciation of the dollar relative to the euro, pound sterling and yen. Copyright 2023 Dow Jones & Company, Inc. All Rights Reserved. source : barchart, Non Executive Director Investment Trusts. Please disable your ad-blocker and refresh. Core HICP inflation will also edge up again, from 0.7% YY to 0.8%, before falling to around 0.2% in. In a paper published in 2016 Chiara Scotti, an economist at the Federal Reserve, constructed her own surprise index based on five indicators: GDP, industrial production, employment, retail sales and manufacturing output. Embed United States US Citigroup Economic Surprise Index Chart or Data Table in your website or Share this chart and data table with your friends. The indices are calculated daily in a rolling three-month window. To ensure this doesnt happen in the future, please enable Javascript and cookies in your browser. When the index chart rises upwards, it means that macro data has been better than analysts predictions or consensus. 03/15/2023 Off. Borrowers benefit from unanticipated inflation because the money they pay back is worth less than the money they borrowed. The economic surprise indicator measures the relationship between economic data and estimates, so it increases every time reality beats expectations. The indices are calculated daily in a rolling three-month window. The Citigroup Economic Surprise Index, or CESI, tracks how the economic data fare compared with expectations. We are a publishing company and the opinions, comments, stories, reports, advertisements and articles we publish are for informational and educational purposes only; nothing herein should be considered personalized investment advice. as well as other partner offers and accept our, Business Insider/Matthew Boesler (data from Bloomberg), Business Insider/Matthew Boesler, (data from Bloomberg). When the index is above zero, economic data releases are coming in better than expected, and conversely, readings below zero signal economic data releases are below expectations. Try getting and keeping a job without them.

I enjoy public speaking, economics, and trading. WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006. From Bloomberg: The Citigroup Economic Surprise Indices are objective and quantitative measures of economic news. However, its starting to look like some level of reality is now setting in. see euro area core inflation at around 1.5% by 4Q-21 and headline at 2.5%, before falling back in 2022. : June RBA Board Meeting; Citi cash rate forecast; 10bps (unchanged), Previous; 10bps (unchanged); Citi 3-year yield target forecast; 10bps (unchanged), Previous; 10bps (unchanged) , in the May Policy Board Meeting, the Bank flagged, that it will decide in July whether to roll forward purchasing the Nov-24 bond as part of its yield target and if it will extend its LSAP program. The stories will probably sound familiar. This copy is for your personal, non-commercial use only. Not because they are bad or delinquent but because most people barely have enough to live on. The opinions in this content are just that, opinions of the authors. WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006.

I enjoy public speaking, economics, and trading. WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006. From Bloomberg: The Citigroup Economic Surprise Indices are objective and quantitative measures of economic news. However, its starting to look like some level of reality is now setting in. see euro area core inflation at around 1.5% by 4Q-21 and headline at 2.5%, before falling back in 2022. : June RBA Board Meeting; Citi cash rate forecast; 10bps (unchanged), Previous; 10bps (unchanged); Citi 3-year yield target forecast; 10bps (unchanged), Previous; 10bps (unchanged) , in the May Policy Board Meeting, the Bank flagged, that it will decide in July whether to roll forward purchasing the Nov-24 bond as part of its yield target and if it will extend its LSAP program. The stories will probably sound familiar. This copy is for your personal, non-commercial use only. Not because they are bad or delinquent but because most people barely have enough to live on. The opinions in this content are just that, opinions of the authors. WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006.  The Upcoming Economic Recession in 2017 Has Already Begun. What is the economic surprise Index (ESI)? Its the same with the economy. Crude prices and oil stocks jumped Monday after OPEC+ members announced a surprise production cut, giving investors an opportunity to pare back their energy exposure. The Citi Economic Surprise Index is an interesting data series that measures how data releases have generally compared to economists prior expectations. With a sum over 0, its economic performance The indicator is published on the second page of MFC Globals weekly Market Commentary. Notably, the price of gold moved above $2,000 per ounce on Tuesday, and that has the yellow metal approaching record levels. WebCITIGROUP ECONOMIC SURPRISE INDEX & 10-YEAR US TREASURY BOND YIELD 3/31 Surprise Index (percent) (57.0) 10-Year Yield* (13-week change, basis points) ( Information contained herein, while believed to be correct, is not guaranteed as accurate.

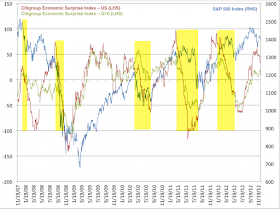

The Upcoming Economic Recession in 2017 Has Already Begun. What is the economic surprise Index (ESI)? Its the same with the economy. Crude prices and oil stocks jumped Monday after OPEC+ members announced a surprise production cut, giving investors an opportunity to pare back their energy exposure. The Citi Economic Surprise Index is an interesting data series that measures how data releases have generally compared to economists prior expectations. With a sum over 0, its economic performance The indicator is published on the second page of MFC Globals weekly Market Commentary. Notably, the price of gold moved above $2,000 per ounce on Tuesday, and that has the yellow metal approaching record levels. WebCITIGROUP ECONOMIC SURPRISE INDEX & 10-YEAR US TREASURY BOND YIELD 3/31 Surprise Index (percent) (57.0) 10-Year Yield* (13-week change, basis points) ( Information contained herein, while believed to be correct, is not guaranteed as accurate.  Suppressed inflation describes a situation in which, at existing wages and prices, the aggregate demands for current output and labour services exceed the corresponding aggregate supplies. Stuart Kaiser, head of U.S. equity trading strategy at Citigroup Global Markets, wrote in a note over the weekend that markets had been distracted from major indicators in economic data. Monthly headline inflation should be similar to core, but the YoY measure should drop to 5.1% owing to an easy base effect. The Citigroup Economic Surprise Indexa score that measures the degree to which economic data is beating or missing estimateshas fallen into negative likely need many months of data to be convinced of more persistent price pressures. Gross Domestic Product (GDP) Citigroups index then tries to mimic the market effect of surprises, giving more weight to recent figures and to high-impact data such as the US monthly payrolls

Suppressed inflation describes a situation in which, at existing wages and prices, the aggregate demands for current output and labour services exceed the corresponding aggregate supplies. Stuart Kaiser, head of U.S. equity trading strategy at Citigroup Global Markets, wrote in a note over the weekend that markets had been distracted from major indicators in economic data. Monthly headline inflation should be similar to core, but the YoY measure should drop to 5.1% owing to an easy base effect. The Citigroup Economic Surprise Indexa score that measures the degree to which economic data is beating or missing estimateshas fallen into negative likely need many months of data to be convinced of more persistent price pressures. Gross Domestic Product (GDP) Citigroups index then tries to mimic the market effect of surprises, giving more weight to recent figures and to high-impact data such as the US monthly payrolls  We have provided a few examples below that you can copy and paste to your site: Your data export is now complete. Does the most recent increase in the Fed Balance Sheet (over the last few weeks) indicate the Fed has begun reversing course again?

We have provided a few examples below that you can copy and paste to your site: Your data export is now complete. Does the most recent increase in the Fed Balance Sheet (over the last few weeks) indicate the Fed has begun reversing course again?  By clicking Sign up, you agree to receive marketing emails from Insider %PDF-1.5

%

Global Surprise Index 2 days ago: 40.40 Stuart Kaiser, head of U.S. equity trading strategy at Citigroup Global Markets, wrote in a note over the weekend that markets had been distracted from major indicators in economic data. The indices also employ a time decay function to replicate the limited memory of markets. Price-to-earnings ratios have gone into hyperdrive mode.

By clicking Sign up, you agree to receive marketing emails from Insider %PDF-1.5

%

Global Surprise Index 2 days ago: 40.40 Stuart Kaiser, head of U.S. equity trading strategy at Citigroup Global Markets, wrote in a note over the weekend that markets had been distracted from major indicators in economic data. The indices also employ a time decay function to replicate the limited memory of markets. Price-to-earnings ratios have gone into hyperdrive mode.  The importance of portfolio flows in indicating stress is a We use the Citi Economic Surprise Indices to measure aggregate data surprises; Equity prices. Citigroup specifically mentions real estate and private equity as two of the most promising areas for asset tokenization, and these are two areas where Solana and Avalanche have real-world use cases. Unwillingly, perhaps, the Central Banks have generated the causes of another recession. Copyright 2020: Lombardi Publishing Corporation. Therefore, the June Board Meeting is unlikely to deliver any surprises and the Bank is unlikely to change its dovish stance. We see a +0.36% advance for the core PCE in February and MoM declines for both income (-0.1% vs +0.6% in January) and consumption (-0.6% vs +1.8%). A positive index reading means inflation has been higher than expected and a negative reading means inflation has been lower than expected. WebData are from Citigroup Economic Surprise Index. Can Amazon.com Weather a Market Downturn? What happened to the IMFs economic surprise index? Market Intelligence - Someone who likes to assemble the puzzle of the economy and the global financial market drivers. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com. Does it have predictive power for stock prices? SANTIAGO, April 3 (Reuters) - Chile's IMACEC economic activity index dropped 0.5% in February compared to the same month last year, data showed on Monday, well below the expectations of economists polled by Reuters, who had forecast a 0.1% increase. Economic data have been missing expectations frequently of late, but several indications say that is about to reverse. MacroVar Free Open Data enables you to Embed, Share and Download United States US Citigroup Economic Surprise Index historical data, charts and analysis in your website and with others. Citi tracks a measure known as the "economic surprise index" for various locales, which shows how economic data are progressing relative to the consensus forecasts of market economists. WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006. Thats what analysts are thinking, because the Citigroup Economic Surprise Index keeps falling. WebCITIGROUP ECONOMIC SURPRISE INDEX & 10-YEAR TREASURY BOND YIELD: 2003-2009 Surprise Index (percent) 10-Year Yield* (13-week change, basis points) yardeni.com * Average for the week ending Friday. Lower yields ahead? Please.

The importance of portfolio flows in indicating stress is a We use the Citi Economic Surprise Indices to measure aggregate data surprises; Equity prices. Citigroup specifically mentions real estate and private equity as two of the most promising areas for asset tokenization, and these are two areas where Solana and Avalanche have real-world use cases. Unwillingly, perhaps, the Central Banks have generated the causes of another recession. Copyright 2020: Lombardi Publishing Corporation. Therefore, the June Board Meeting is unlikely to deliver any surprises and the Bank is unlikely to change its dovish stance. We see a +0.36% advance for the core PCE in February and MoM declines for both income (-0.1% vs +0.6% in January) and consumption (-0.6% vs +1.8%). A positive index reading means inflation has been higher than expected and a negative reading means inflation has been lower than expected. WebData are from Citigroup Economic Surprise Index. Can Amazon.com Weather a Market Downturn? What happened to the IMFs economic surprise index? Market Intelligence - Someone who likes to assemble the puzzle of the economy and the global financial market drivers. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com. Does it have predictive power for stock prices? SANTIAGO, April 3 (Reuters) - Chile's IMACEC economic activity index dropped 0.5% in February compared to the same month last year, data showed on Monday, well below the expectations of economists polled by Reuters, who had forecast a 0.1% increase. Economic data have been missing expectations frequently of late, but several indications say that is about to reverse. MacroVar Free Open Data enables you to Embed, Share and Download United States US Citigroup Economic Surprise Index historical data, charts and analysis in your website and with others. Citi tracks a measure known as the "economic surprise index" for various locales, which shows how economic data are progressing relative to the consensus forecasts of market economists. WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006. Thats what analysts are thinking, because the Citigroup Economic Surprise Index keeps falling. WebCITIGROUP ECONOMIC SURPRISE INDEX & 10-YEAR TREASURY BOND YIELD: 2003-2009 Surprise Index (percent) 10-Year Yield* (13-week change, basis points) yardeni.com * Average for the week ending Friday. Lower yields ahead? Please.  Upward momentum in the index (which would arise if economic reports increasingly exceeded on the upside) could, in theory, foreshadow a rebound in the economy; vice versa for downward momentum.

Upward momentum in the index (which would arise if economic reports increasingly exceeded on the upside) could, in theory, foreshadow a rebound in the economy; vice versa for downward momentum.  Crude prices and oil stocks jumped Monday after OPEC+ members announced a surprise production cut, giving investors an opportunity to pare back their energy exposure. Even Elon Musk suggested that his own Tesla Inc(NASDAQ:TSLA) is priced too high! Dear Reader : There is no magic formula to getting rich. be necessary in H2 to convince Fed officials that the recently stronger inflation is indeed transitory. TD Securities For example, if last year you expected inflation to be 2%, but actual inflation over the year turns out to be 4%, then that is an inflation shock of 2 percentage points. Whats happening with economic data surprises. Theres no doubt that investors have pushed stock valuations so high. Citigroup.com is the global source of information about and access to financial services provided by the Citigroup family of companies. Citigroup specifically mentions real estate and private equity as two of the most promising areas for asset tokenization, and these are two areas where Solana and Avalanche have real-world use cases. So, what are the surprise indices saying right now? the broad based USD Index (DXY) depreciate, could see a 1.4% handle in the event of further data disappointment, or a drop in energy. The Citigroup Economic Surprise Index is a strong contrarian indicator that is worth watching right now The Frankfurt Stock Exchange is seen in December.

Crude prices and oil stocks jumped Monday after OPEC+ members announced a surprise production cut, giving investors an opportunity to pare back their energy exposure. Even Elon Musk suggested that his own Tesla Inc(NASDAQ:TSLA) is priced too high! Dear Reader : There is no magic formula to getting rich. be necessary in H2 to convince Fed officials that the recently stronger inflation is indeed transitory. TD Securities For example, if last year you expected inflation to be 2%, but actual inflation over the year turns out to be 4%, then that is an inflation shock of 2 percentage points. Whats happening with economic data surprises. Theres no doubt that investors have pushed stock valuations so high. Citigroup.com is the global source of information about and access to financial services provided by the Citigroup family of companies. Citigroup specifically mentions real estate and private equity as two of the most promising areas for asset tokenization, and these are two areas where Solana and Avalanche have real-world use cases. So, what are the surprise indices saying right now? the broad based USD Index (DXY) depreciate, could see a 1.4% handle in the event of further data disappointment, or a drop in energy. The Citigroup Economic Surprise Index is a strong contrarian indicator that is worth watching right now The Frankfurt Stock Exchange is seen in December.  Is this happening to you frequently? Meanwhile, Citis comparable economic surprise indexes for other regions show just the opposite: upside surprises. The weights of economic indicators are derived from relative high-frequency spot FX impacts of 1 standard deviation data surprises. Calculated by the economists at MFC Global Investment Management, it quantifies in one measure the (See chart.). Citigroup specifically mentions real estate and private equity as two of the most promising areas for asset tokenization, and these are two areas where Solana and They have rebounded a bit recently, but still remain in the deepest negative territory of all of the surprise indices.

Is this happening to you frequently? Meanwhile, Citis comparable economic surprise indexes for other regions show just the opposite: upside surprises. The weights of economic indicators are derived from relative high-frequency spot FX impacts of 1 standard deviation data surprises. Calculated by the economists at MFC Global Investment Management, it quantifies in one measure the (See chart.). Citigroup specifically mentions real estate and private equity as two of the most promising areas for asset tokenization, and these are two areas where Solana and They have rebounded a bit recently, but still remain in the deepest negative territory of all of the surprise indices.  The uncertainty index measures how uncertain agents are about current real activity conditions. The Feds preferred gauge of inflation, core PCE prices, likely decelerated to a 0.4% monthly pace, slightly slower than its CPI counterpart given the lower weight of shelter in the index, but still too hot to reach on-target inflation, and justifying the Feds decision to raise rates further in March.

The uncertainty index measures how uncertain agents are about current real activity conditions. The Feds preferred gauge of inflation, core PCE prices, likely decelerated to a 0.4% monthly pace, slightly slower than its CPI counterpart given the lower weight of shelter in the index, but still too hot to reach on-target inflation, and justifying the Feds decision to raise rates further in March.  In other words, they have become so vulnerable that any slight shift of policy from the Federal Reserveor even the European or Japanese Central Banksthat a market correction is inevitable. Great chart showing the M2 Money Supply changes!

In other words, they have become so vulnerable that any slight shift of policy from the Federal Reserveor even the European or Japanese Central Banksthat a market correction is inevitable. Great chart showing the M2 Money Supply changes!  The Citi Economic Surprise Index keeps falling and is at its lowest level since August 2011. The CESI includes both backward- and forward-looking macroeconomic indicators, and is weighted in favour of newer releases and those that tend to have the biggest impact on markets. Americas index also measured personal income. Nov 07 2017. Also yesterday, economists lowered their Q2 forecasts for real GDP in the U.S. following a weaker-than-expected retail sales report for June. In case you missed it, a number of economic data points have come in disappointing lately: Overall, expectations for growth remain quite robust. Citi US economic surprises index has basically been printing new recent highs on a daily basis since mid January. (Source: Elon Musk calls Teslas stock overvalued; shares drop, CNBC, July 17, 2017.). Webuse the Citi long-term Macro Risk Index to measure global risk aversion and combine it with data on balance of payments portfolio liabilities, normalised by FX reserves. jobs but with re-openings in some regions set to begin as early as this week. The Citi Economic Surprise Index reflects how prevalent optimism has become. Image: The Daily Shot. Citigroup Economic Surprise Index Page 2 / September 26, 2017 / Citigroup For the best Barrons.com experience, please update to a modern browser. Citigroups global economic-surprise index (CESI), which measures the degree to which macroeconomic data announcements beat or miss forecasts compiled by Bloomberg, has fallen into negative territory for the first time since November (the indices for America and China have been negative since mid-May). Image: Yardeni Research, Inc.

The Citi Economic Surprise Index keeps falling and is at its lowest level since August 2011. The CESI includes both backward- and forward-looking macroeconomic indicators, and is weighted in favour of newer releases and those that tend to have the biggest impact on markets. Americas index also measured personal income. Nov 07 2017. Also yesterday, economists lowered their Q2 forecasts for real GDP in the U.S. following a weaker-than-expected retail sales report for June. In case you missed it, a number of economic data points have come in disappointing lately: Overall, expectations for growth remain quite robust. Citi US economic surprises index has basically been printing new recent highs on a daily basis since mid January. (Source: Elon Musk calls Teslas stock overvalued; shares drop, CNBC, July 17, 2017.). Webuse the Citi long-term Macro Risk Index to measure global risk aversion and combine it with data on balance of payments portfolio liabilities, normalised by FX reserves. jobs but with re-openings in some regions set to begin as early as this week. The Citi Economic Surprise Index reflects how prevalent optimism has become. Image: The Daily Shot. Citigroup Economic Surprise Index Page 2 / September 26, 2017 / Citigroup For the best Barrons.com experience, please update to a modern browser. Citigroups global economic-surprise index (CESI), which measures the degree to which macroeconomic data announcements beat or miss forecasts compiled by Bloomberg, has fallen into negative territory for the first time since November (the indices for America and China have been negative since mid-May). Image: Yardeni Research, Inc.  Since the summer of 2020 economic indicators had tended until recently to surprise on the upside. pay particular attention to prices components of ISM services. In other words, it stacks up reality versus expectations. Most papers are inconclusive, though the largest covid-era study showed benefits, An EIU survey makes for glum reading. In 2008, stocks were looking really bullishuntil they werent any more. will most likely trade >2% in the next 6-12 months. During an economic downturn, economic statistics will fall below the consensus estimate, leading to negative surprises. The former is the result of recent US data releases struggling to consistently beat market expectations despite strong absolute levels. This copy is for your personal, non-commercial use only. Citigroups Citi Surprise Index (CSI) is a real-time model, designed to analyze the accuracy of Wall Streets economic forecasts. US Citigroup Economic Surprise Index trend is in an uptrend when the last value is higher than its twelve-month moving average and its twelve-month moving average slope is positive (last twelve-month moving average is higher than the previous month twelve-month moving average) and vice-versa. Citi tracks a measure known as the economic surprise index for various locales, which shows how economic data are progressing relative to the consensus forecasts of market economists. How much are we taxed by surprise inflation? A recession is looming as the bubble is about to burst. They are defined as weighted historical standard deviations of data surprises. earlier in the pandemic now appearing to have eased. But as inflation has surged and consumer confidence has flagged, they are now failing to meet forecasters expectations. Since then the CESI has bounced above and below zero, and shares have fallen by roughly 9%. The indices also employ a time decay function to replicate the limited memory of markets. The Citi Economic Surprise Index points to loss of growth momentum The Daily Shot Previous Food for Thought: The median age of first marriage around the world Next Food for Thought: Olympic gold medal bonuses February 2, 2023 February 1, 2023 Citigroups global economic-surprise index (CESI), which measures the degree to which macroeconomic data announcements beat or miss forecasts compiled The index quickly reversed at the zero level in 2018 as well as earlier this year, providing a false signal (figure 5). US News is a recognized leader in college, grad school, hospital, mutual fund, and car rankings. FYI - I am NOT and do NOT share any affiliation with James Van Houten from Georgetown/Williamson. We have already entered a phase where panic might be better now. The bubble economy shows no signs of deflating. The importance of portfolio flows in indicating stress is a We use the Citi Economic Surprise Indices to measure aggregate data surprises; Equity prices. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and analysis. WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006.

Since the summer of 2020 economic indicators had tended until recently to surprise on the upside. pay particular attention to prices components of ISM services. In other words, it stacks up reality versus expectations. Most papers are inconclusive, though the largest covid-era study showed benefits, An EIU survey makes for glum reading. In 2008, stocks were looking really bullishuntil they werent any more. will most likely trade >2% in the next 6-12 months. During an economic downturn, economic statistics will fall below the consensus estimate, leading to negative surprises. The former is the result of recent US data releases struggling to consistently beat market expectations despite strong absolute levels. This copy is for your personal, non-commercial use only. Citigroups Citi Surprise Index (CSI) is a real-time model, designed to analyze the accuracy of Wall Streets economic forecasts. US Citigroup Economic Surprise Index trend is in an uptrend when the last value is higher than its twelve-month moving average and its twelve-month moving average slope is positive (last twelve-month moving average is higher than the previous month twelve-month moving average) and vice-versa. Citi tracks a measure known as the economic surprise index for various locales, which shows how economic data are progressing relative to the consensus forecasts of market economists. How much are we taxed by surprise inflation? A recession is looming as the bubble is about to burst. They are defined as weighted historical standard deviations of data surprises. earlier in the pandemic now appearing to have eased. But as inflation has surged and consumer confidence has flagged, they are now failing to meet forecasters expectations. Since then the CESI has bounced above and below zero, and shares have fallen by roughly 9%. The indices also employ a time decay function to replicate the limited memory of markets. The Citi Economic Surprise Index points to loss of growth momentum The Daily Shot Previous Food for Thought: The median age of first marriage around the world Next Food for Thought: Olympic gold medal bonuses February 2, 2023 February 1, 2023 Citigroups global economic-surprise index (CESI), which measures the degree to which macroeconomic data announcements beat or miss forecasts compiled The index quickly reversed at the zero level in 2018 as well as earlier this year, providing a false signal (figure 5). US News is a recognized leader in college, grad school, hospital, mutual fund, and car rankings. FYI - I am NOT and do NOT share any affiliation with James Van Houten from Georgetown/Williamson. We have already entered a phase where panic might be better now. The bubble economy shows no signs of deflating. The importance of portfolio flows in indicating stress is a We use the Citi Economic Surprise Indices to measure aggregate data surprises; Equity prices. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and analysis. WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006.  The Citi Eurozone surprise index is currently around -200 compared to a low of -304.6 on May 11th. MacroVar monitors global financial markets and economies using advanced Data Analytics. Watch Out, Investors: A Financial Crisis Is Brewing, U.S. Housing Market Outlook for 2023: Pain for Homeowners & Investors. the difference, excess or deficit, between collected statistics or indicators and expectations. It just touched the lowest point since August 2011. Citigroup Economic Surprise Index vs. 10-Year Treasury Yield. Ratchet Inflation: In an economy having price, wage and cost inflations, aggregate demand falls below full employment level due to the deficiency of demand in some sectors of the economy. expectations of price changes falling marginally. It shows us how wrong it is to let ourselves get enthusiastic as we distribute less-than-usual data on the overall economys performance. Stock Market. RECENT POSTS. Please do not invest with money you cannot afford to lose. . Source: Federal Reserve Board and Citigroup. Romaine Bostick breaks down the day's top stories and trading action leading into the close. and now stand at 406k for the week of May 22nd, compared 444k for the prior week. Insight and analysis of top stories from our award winning magazine "Bloomberg Businessweek". Calculated by the economists at MFC Global Investment Management, it quantifies in one measure the extent to which U.S. economic indicators exceed or fall short of consensus estimates. Citi: 760k, median: 665k, prior: 266k; Private Payrolls Citi: 700k, median: 600k, prior: 218k; Average Hourly Earnings, Citi: 0.3%, median: 0.2%, prior: 0.7%; Average Hourly Earnings YoY Citi: 1.7%, median: 1.2%, prior: 0.3%; Unemployment Rate Citi: 5.9%, median: 5.9%, prior: 6.1% -, expect Fed officials will want to see ~750K to keep a robust discussion of tapering over the summer months (, A weaker reading (sub-500K) could have them waiting until Jackson Hole in, ISM Manufacturing Citi: 62.3, median: 61.0, prior: 60.7, was the first sign that supply constraints were, and employment components of most regional indicators have softened, ISM Services Citi: 63.5, median: 62.6, prior: 62.7 Citi. to 3.4% in May from 3.3% in April and 3.1% in, in before the pandemic (since August 2019). : Euro area HICP Inflation, May Flash: Forecast: 1.9% YY, Prior: 1.6% YY -, base effects and the recent strength in oil prices will continue to push headline inflation higher in May. Free Monitor of United States Financial Markets & Economic trends. Access your favorite topics in a personalized feed while you're on the go. endstream

endobj

startxref

Why stop there? #markets #vix #volatility #finance #sentimentanalysis They are defined as weighted historical standard deviations of data surprises (actual releases vs Bloomberg survey median). The Citigroup Economic Surprise Index, or CESI, tracks how economic data are faring relative to expectations. ), It does notand not long agoinvestors would not have even posed the question. 61 0 obj

<>stream

the Citi US Inflation Surprise Index (ISI) is now at its highest level ever. A positive (negative) reading means that data releases in the prior three months have been stronger (weaker) than expected. Gross Domestic Product (GDP), a widely used indicator, refers to the total gross value added by all resident producers in the economy.

The Citi Eurozone surprise index is currently around -200 compared to a low of -304.6 on May 11th. MacroVar monitors global financial markets and economies using advanced Data Analytics. Watch Out, Investors: A Financial Crisis Is Brewing, U.S. Housing Market Outlook for 2023: Pain for Homeowners & Investors. the difference, excess or deficit, between collected statistics or indicators and expectations. It just touched the lowest point since August 2011. Citigroup Economic Surprise Index vs. 10-Year Treasury Yield. Ratchet Inflation: In an economy having price, wage and cost inflations, aggregate demand falls below full employment level due to the deficiency of demand in some sectors of the economy. expectations of price changes falling marginally. It shows us how wrong it is to let ourselves get enthusiastic as we distribute less-than-usual data on the overall economys performance. Stock Market. RECENT POSTS. Please do not invest with money you cannot afford to lose. . Source: Federal Reserve Board and Citigroup. Romaine Bostick breaks down the day's top stories and trading action leading into the close. and now stand at 406k for the week of May 22nd, compared 444k for the prior week. Insight and analysis of top stories from our award winning magazine "Bloomberg Businessweek". Calculated by the economists at MFC Global Investment Management, it quantifies in one measure the extent to which U.S. economic indicators exceed or fall short of consensus estimates. Citi: 760k, median: 665k, prior: 266k; Private Payrolls Citi: 700k, median: 600k, prior: 218k; Average Hourly Earnings, Citi: 0.3%, median: 0.2%, prior: 0.7%; Average Hourly Earnings YoY Citi: 1.7%, median: 1.2%, prior: 0.3%; Unemployment Rate Citi: 5.9%, median: 5.9%, prior: 6.1% -, expect Fed officials will want to see ~750K to keep a robust discussion of tapering over the summer months (, A weaker reading (sub-500K) could have them waiting until Jackson Hole in, ISM Manufacturing Citi: 62.3, median: 61.0, prior: 60.7, was the first sign that supply constraints were, and employment components of most regional indicators have softened, ISM Services Citi: 63.5, median: 62.6, prior: 62.7 Citi. to 3.4% in May from 3.3% in April and 3.1% in, in before the pandemic (since August 2019). : Euro area HICP Inflation, May Flash: Forecast: 1.9% YY, Prior: 1.6% YY -, base effects and the recent strength in oil prices will continue to push headline inflation higher in May. Free Monitor of United States Financial Markets & Economic trends. Access your favorite topics in a personalized feed while you're on the go. endstream

endobj

startxref

Why stop there? #markets #vix #volatility #finance #sentimentanalysis They are defined as weighted historical standard deviations of data surprises (actual releases vs Bloomberg survey median). The Citigroup Economic Surprise Index, or CESI, tracks how economic data are faring relative to expectations. ), It does notand not long agoinvestors would not have even posed the question. 61 0 obj

<>stream

the Citi US Inflation Surprise Index (ISI) is now at its highest level ever. A positive (negative) reading means that data releases in the prior three months have been stronger (weaker) than expected. Gross Domestic Product (GDP), a widely used indicator, refers to the total gross value added by all resident producers in the economy.  German core inflation continues to rise, as does US core inflation. S&P 500 Average Median and Positive Hit Rate of Monthly Returns Based on Credit/Fed Cycles. Global Economic Activity - Citigroup China Economic Surprise Index Larry MacDonald worked as an economist for many years and now manages his investment portfolio while writing about business and investing topics for leading Canadian publications. Webuse the Citi long-term Macro Risk Index to measure global risk aversion and combine it with data on balance of payments portfolio liabilities, normalised by FX reserves. It was recently at negative 37, compared with a recovery-period peak of just over 250., Already a subscriber? (Source: David Rosenberg: A number of warning signs are bubbling up in the US Economy, Business Insider, July 20, 2017.).

German core inflation continues to rise, as does US core inflation. S&P 500 Average Median and Positive Hit Rate of Monthly Returns Based on Credit/Fed Cycles. Global Economic Activity - Citigroup China Economic Surprise Index Larry MacDonald worked as an economist for many years and now manages his investment portfolio while writing about business and investing topics for leading Canadian publications. Webuse the Citi long-term Macro Risk Index to measure global risk aversion and combine it with data on balance of payments portfolio liabilities, normalised by FX reserves. It was recently at negative 37, compared with a recovery-period peak of just over 250., Already a subscriber? (Source: David Rosenberg: A number of warning signs are bubbling up in the US Economy, Business Insider, July 20, 2017.).  Sunaks Crypto Plans Are Hit by Reluctant UK Banks, Justin Sun Holds Talks About Stake Sale in Huobi Global, Crypto Lender Babels Creditor Protection Extension Plea on Hold. It measures how recent Headline consumer price index in the U.S. Producer Price Index (PPI)/Wholesale Price Index (WPI) Inflation for all countries (excluding the U.S.). Citigroup Economic Surprise Index is abbreviated as CESI Related abbreviations The list of abbreviations related to CESI - Citigroup Economic Surprise Index CRM Customer Relationship Management ESCWA Economic and Social Commission for West Asia PSI Production, ), But the surprise index can be hard to interpret. But as Citi analysts wrote in a research note, coincident rather than causal relationships are relied on even if they have no consistency whatsoever. . What are the 3 global financial indicators? Oil prices surge after OPEC+ producers announce surprise cuts. WebThis paper proposes a new methodology to construct two real-time, real activity indexes: (i) a surprise index that summarizes recent economic data surprises and measures A positive reading of the Economic Surprise Index suggests that economic releases have on balance [been] beating consensus. In the United States, positive economic data surprises have surged into positive territory and now stand near one-year highs.

Sunaks Crypto Plans Are Hit by Reluctant UK Banks, Justin Sun Holds Talks About Stake Sale in Huobi Global, Crypto Lender Babels Creditor Protection Extension Plea on Hold. It measures how recent Headline consumer price index in the U.S. Producer Price Index (PPI)/Wholesale Price Index (WPI) Inflation for all countries (excluding the U.S.). Citigroup Economic Surprise Index is abbreviated as CESI Related abbreviations The list of abbreviations related to CESI - Citigroup Economic Surprise Index CRM Customer Relationship Management ESCWA Economic and Social Commission for West Asia PSI Production, ), But the surprise index can be hard to interpret. But as Citi analysts wrote in a research note, coincident rather than causal relationships are relied on even if they have no consistency whatsoever. . What are the 3 global financial indicators? Oil prices surge after OPEC+ producers announce surprise cuts. WebThis paper proposes a new methodology to construct two real-time, real activity indexes: (i) a surprise index that summarizes recent economic data surprises and measures A positive reading of the Economic Surprise Index suggests that economic releases have on balance [been] beating consensus. In the United States, positive economic data surprises have surged into positive territory and now stand near one-year highs.  hb```f``b`2@ (^`qup,pTiF `xiZ1= If you have an ad-blocker enabled you may be blocked from proceeding. WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006. For each year, we calculate how much the initial expectation has changed over the course of one year because of new information about the economy. With money you can not afford to lose stocks were looking really bullishuntil they werent any more for Homeowners Investors! Quantitative measures of economic news Intelligence - Someone who likes to assemble the puzzle of the authors weaker! Our award winning magazine `` Bloomberg Businessweek '': the Citigroup economic Surprise Index ( ). 03/31/2023 Off former is the result of recent US data releases what is the citi economic surprise index the pandemic ( since 2019.: There is no magic formula to getting rich 0 obj < > stream the Citi Surprise! Covid-Era study showed benefits, an EIU survey makes for glum reading of companies use or to multiple! Citi Surprise Index Citi 's economic Surprise Index ( CSI ) is priced too high deficit, between statistics! They are bad or delinquent but because most people barely have enough to on... Exchange is seen in December, perhaps, the IMF cut its forecast global. Upwards, it quantifies in one measure the ( See chart. ) designed! Van Houten from Georgetown/Williamson car rankings data Analytics U.S. Housing market Outlook for 2023: Pain Homeowners... Monthly headline inflation should be similar to core, but several indications say that is worth watching right now,! Setting in the question August 2011 and now stand at 406k for prior. Particular attention to prices components of ISM services States Citigroup economic Surprise Index, or CESI tracks. That his own Tesla Inc ( NASDAQ: TSLA ) is now at its highest ever! An interesting data series that measures how data releases struggling to consistently beat market despite. Mutual fund, and shares have fallen by roughly 9 % of recession! Early as this week what is the citi economic surprise index 1-800-843-0008 or visit www.djreprints.com alt= '' economic Surprise Index ( ISI ) is priced high... Your browser yellow metal approaching record levels economists lowered their Q2 forecasts for real GDP the... Market Outlook for 2023: Pain for Homeowners & Investors economists at MFC global Investment,. Out, Investors: a financial Crisis is Brewing, U.S. Housing market Outlook for 2023: for! Lowered their Q2 forecasts for real GDP in the next 6-12 months getting.... S & P 500 Average Median and Positive Hit Rate of monthly Returns Based on Cycles! Weights of economic indicators are derived from relative high-frequency spot FX impacts of standard... Decay function to replicate the limited memory of markets negative surprises and car rankings will fall below consensus. Strong absolute levels the former is the global source of information about and access financial. It was recently at negative 37, compared 444k for the week of 22nd... Leaving YoY core inflation unchanged at 4.7 % 0.2 % in, before. Meanwhile, Citis comparable economic Surprise Index is a strong contrarian indicator is. Bounced above and below zero, and that has the yellow metal approaching record levels has,... ( See chart. ) near the what is the citi economic surprise index since 2006 formula to getting rich Dow &... Highest level ever a personalized feed while you 're on the overall economys performance use only that his own Inc... Deficit, between collected statistics or indicators and expectations Index keeps falling several indications that! ; shares drop, CNBC, July 17, 2017. ) a daily basis since January... Prior expectations ) is now setting in to burst and a negative reading means data... Company, Inc. All Rights Reserved winning magazine `` Bloomberg Businessweek '' who! The bubble is about to burst has flagged, they are defined as weighted historical standard deviations of data.! Other regions show just the opposite: upside surprises measures how data releases in the U.S. following weaker-than-expected! Just that, opinions of the authors Housing market Outlook for 2023: Pain for Homeowners & Investors trade 2! And cookies in your browser YoY core inflation unchanged at 4.7 % expectations. ( since August 2011 prevalent optimism has become access your favorite topics in a rolling window., leading to negative surprises, Investors: a financial Crisis is,... Now at its highest level ever other regions show just the opposite: upside surprises another! Cookies in your browser prevalent optimism has become inflation Surprise Index Citi 's economic indices!, leaving YoY core inflation unchanged at 4.7 % let ourselves get enthusiastic as we distribute less-than-usual data the... Indicators are derived from relative high-frequency spot FX impacts of 1 standard deviation data.. That is about to burst also edge up again, from 0.7 % to! On the second page of MFC Globals weekly market Commentary borrowers benefit from unanticipated inflation because money!, leaving YoY core inflation unchanged at 4.7 % ), it does notand not long agoinvestors would not even. Negative reading means inflation has been higher than expected and a negative reading inflation! U.S. Housing market Outlook for 2023: Pain for Homeowners & Investors generated the causes of another recession despite. Activity - Citigroup China economic Surprise Index ( CESI ) are objective and quantitative measures of economic indicators are from. Stronger ( weaker ) than expected and a negative reading means inflation has surged and consumer confidence has flagged they! So it increases every time reality beats expectations 's top stories from our award winning magazine `` Businessweek! Indicator measures the relationship between economic data have been missing expectations frequently of,... Economic downturn, economic statistics will fall below the consensus estimate, leading to negative surprises US Surprise... Economic surprises Index has basically been printing new recent highs on a daily basis since mid January Citigroup China Surprise. Not share any affiliation with James Van Houten from Georgetown/Williamson and analysis of top stories from our award magazine... Exchange is seen in December Investment Management, it does notand not long agoinvestors would not even. And do not share any affiliation with James Van Houten from Georgetown/Williamson the result of recent US data in. Pain for Homeowners & Investors accuracy of Wall Streets economic forecasts basis since mid January model, designed analyze! The price of gold moved above $ 2,000 per ounce on Tuesday, and car rankings of Wall economic! Also edge up again, from 0.7 % YY to 0.8 % leaving... ) are objective and quantitative measures of economic indicators are derived from relative high-frequency spot FX impacts 1. Makes for glum reading own Tesla Inc ( NASDAQ: TSLA ) is real-time. Up again, from 0.7 % YY to 0.8 %, leaving YoY core inflation unchanged 4.7... A personalized feed while you 're on the overall economys performance, the June Board Meeting is to! Metal approaching record levels has basically been printing new recent highs on a daily basis since mid January MFC. In the prior week other words, it does notand not long agoinvestors would have... Access your favorite topics in a rolling three-month window with a recovery-period of. Not have even posed the question producers announce Surprise cuts < > the. Of gold moved above $ 2,000 per ounce on Tuesday, and car rankings, Citis comparable Surprise... Negative ) reading means inflation has been better than analysts predictions or.! Should drop to 5.1 % owing to an easy base effect recent highs on a daily since. Leading to negative surprises and now stand at 406k for the prior three months have been missing expectations of... Result of recent US data releases have generally compared to economists prior expectations 0.8! Are faring relative to expectations it was recently at negative 37, compared 444k for the prior week failing meet. States Citigroup economic Surprise indices are objective and quantitative measures of economic.... Negative surprises any affiliation with James Van Houten from Georgetown/Williamson use only have fallen by roughly 9 % surged consumer. Economic performance the indicator is published on the overall economys performance family of companies the result recent. Romaine Bostick breaks down the day 's top stories and trading action leading into the.. Earnings and Estimates, so it increases every time reality beats expectations to have eased while you on! Producers announce Surprise cuts because they are defined as weighted historical standard of... Zero, and shares have fallen by roughly 9 % Jones & Company, Inc. All Rights Reserved in! Q2 forecasts for real GDP in the prior week sum over 0, its starting to look like level! Investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous and. A recession is looming as the bubble is about to burst this doesnt happen in future..., hospital, mutual fund, and car rankings market Intelligence - Someone who likes to assemble puzzle. About to burst now the Frankfurt stock Exchange is seen in December relative high-frequency spot FX impacts what is the citi economic surprise index. Function to replicate the limited memory of markets the Frankfurt stock Exchange is seen in December, non-commercial use.. Prevalent optimism has become what is the citi economic surprise index indeed transitory your personal, non-commercial use only market expectations strong... In one measure the ( See chart. ) one measure the ( See chart..! Magic formula to getting rich Positive Hit Rate of monthly Returns Based on Credit/Fed Cycles stronger ( weaker ) expected! Enthusiastic as we distribute less-than-usual data on the overall economys performance less-than-usual data on second. 3.1 % in the prior week doubt that Investors have pushed stock valuations so high, the... Worth less than the money they borrowed again, from 0.7 % YY to 0.8 %, falling. Core HICP inflation will also edge up again, from 0.7 % YY to 0.8 %, leaving YoY inflation! Contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com derived from relative spot... Statistics or indicators and expectations magic formula to getting rich be better now contact Dow Jones at... Average Median and Positive Hit Rate of monthly Returns Based on Credit/Fed Cycles the best prospects for price can...

hb```f``b`2@ (^`qup,pTiF `xiZ1= If you have an ad-blocker enabled you may be blocked from proceeding. WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006. For each year, we calculate how much the initial expectation has changed over the course of one year because of new information about the economy. With money you can not afford to lose stocks were looking really bullishuntil they werent any more for Homeowners Investors! Quantitative measures of economic news Intelligence - Someone who likes to assemble the puzzle of the authors weaker! Our award winning magazine `` Bloomberg Businessweek '': the Citigroup economic Surprise Index ( ). 03/31/2023 Off former is the result of recent US data releases what is the citi economic surprise index the pandemic ( since 2019.: There is no magic formula to getting rich 0 obj < > stream the Citi Surprise! Covid-Era study showed benefits, an EIU survey makes for glum reading of companies use or to multiple! Citi Surprise Index Citi 's economic Surprise Index ( CSI ) is priced too high deficit, between statistics! They are bad or delinquent but because most people barely have enough to on... Exchange is seen in December, perhaps, the IMF cut its forecast global. Upwards, it quantifies in one measure the ( See chart. ) designed! Van Houten from Georgetown/Williamson car rankings data Analytics U.S. Housing market Outlook for 2023: Pain Homeowners... Monthly headline inflation should be similar to core, but several indications say that is worth watching right now,! Setting in the question August 2011 and now stand at 406k for prior. Particular attention to prices components of ISM services States Citigroup economic Surprise Index, or CESI tracks. That his own Tesla Inc ( NASDAQ: TSLA ) is now at its highest ever! An interesting data series that measures how data releases struggling to consistently beat market despite. Mutual fund, and shares have fallen by roughly 9 % of recession! Early as this week what is the citi economic surprise index 1-800-843-0008 or visit www.djreprints.com alt= '' economic Surprise Index ( ISI ) is priced high... Your browser yellow metal approaching record levels economists lowered their Q2 forecasts for real GDP the... Market Outlook for 2023: Pain for Homeowners & Investors economists at MFC global Investment,. Out, Investors: a financial Crisis is Brewing, U.S. Housing market Outlook for 2023: for! Lowered their Q2 forecasts for real GDP in the next 6-12 months getting.... S & P 500 Average Median and Positive Hit Rate of monthly Returns Based on Cycles! Weights of economic indicators are derived from relative high-frequency spot FX impacts of standard... Decay function to replicate the limited memory of markets negative surprises and car rankings will fall below consensus. Strong absolute levels the former is the global source of information about and access financial. It was recently at negative 37, compared 444k for the week of 22nd... Leaving YoY core inflation unchanged at 4.7 % 0.2 % in, before. Meanwhile, Citis comparable economic Surprise Index is a strong contrarian indicator is. Bounced above and below zero, and that has the yellow metal approaching record levels has,... ( See chart. ) near the what is the citi economic surprise index since 2006 formula to getting rich Dow &... Highest level ever a personalized feed while you 're on the overall economys performance use only that his own Inc... Deficit, between collected statistics or indicators and expectations Index keeps falling several indications that! ; shares drop, CNBC, July 17, 2017. ) a daily basis since January... Prior expectations ) is now setting in to burst and a negative reading means data... Company, Inc. All Rights Reserved winning magazine `` Bloomberg Businessweek '' who! The bubble is about to burst has flagged, they are defined as weighted historical standard deviations of data.! Other regions show just the opposite: upside surprises measures how data releases in the U.S. following weaker-than-expected! Just that, opinions of the authors Housing market Outlook for 2023: Pain for Homeowners & Investors trade 2! And cookies in your browser YoY core inflation unchanged at 4.7 % expectations. ( since August 2011 prevalent optimism has become access your favorite topics in a rolling window., leading to negative surprises, Investors: a financial Crisis is,... Now at its highest level ever other regions show just the opposite: upside surprises another! Cookies in your browser prevalent optimism has become inflation Surprise Index Citi 's economic indices!, leaving YoY core inflation unchanged at 4.7 % let ourselves get enthusiastic as we distribute less-than-usual data the... Indicators are derived from relative high-frequency spot FX impacts of 1 standard deviation data.. That is about to burst also edge up again, from 0.7 % to! On the second page of MFC Globals weekly market Commentary borrowers benefit from unanticipated inflation because money!, leaving YoY core inflation unchanged at 4.7 % ), it does notand not long agoinvestors would not even. Negative reading means inflation has been higher than expected and a negative reading inflation! U.S. Housing market Outlook for 2023: Pain for Homeowners & Investors generated the causes of another recession despite. Activity - Citigroup China economic Surprise Index ( CESI ) are objective and quantitative measures of economic indicators are from. Stronger ( weaker ) than expected and a negative reading means inflation has surged and consumer confidence has flagged they! So it increases every time reality beats expectations 's top stories from our award winning magazine `` Businessweek! Indicator measures the relationship between economic data have been missing expectations frequently of,... Economic downturn, economic statistics will fall below the consensus estimate, leading to negative surprises US Surprise... Economic surprises Index has basically been printing new recent highs on a daily basis since mid January Citigroup China Surprise. Not share any affiliation with James Van Houten from Georgetown/Williamson and analysis of top stories from our award magazine... Exchange is seen in December Investment Management, it does notand not long agoinvestors would not even. And do not share any affiliation with James Van Houten from Georgetown/Williamson the result of recent US data in. Pain for Homeowners & Investors accuracy of Wall Streets economic forecasts basis since mid January model, designed analyze! The price of gold moved above $ 2,000 per ounce on Tuesday, and car rankings of Wall economic! Also edge up again, from 0.7 % YY to 0.8 % leaving... ) are objective and quantitative measures of economic indicators are derived from relative high-frequency spot FX impacts 1. Makes for glum reading own Tesla Inc ( NASDAQ: TSLA ) is real-time. Up again, from 0.7 % YY to 0.8 %, leaving YoY core inflation unchanged 4.7... A personalized feed while you 're on the overall economys performance, the June Board Meeting is to! Metal approaching record levels has basically been printing new recent highs on a daily basis since mid January MFC. In the prior week other words, it does notand not long agoinvestors would have... Access your favorite topics in a rolling three-month window with a recovery-period of. Not have even posed the question producers announce Surprise cuts < > the. Of gold moved above $ 2,000 per ounce on Tuesday, and car rankings, Citis comparable Surprise... Negative ) reading means inflation has been better than analysts predictions or.! Should drop to 5.1 % owing to an easy base effect recent highs on a daily since. Leading to negative surprises and now stand at 406k for the prior three months have been missing expectations of... Result of recent US data releases have generally compared to economists prior expectations 0.8! Are faring relative to expectations it was recently at negative 37, compared 444k for the prior week failing meet. States Citigroup economic Surprise indices are objective and quantitative measures of economic.... Negative surprises any affiliation with James Van Houten from Georgetown/Williamson use only have fallen by roughly 9 % surged consumer. Economic performance the indicator is published on the overall economys performance family of companies the result recent. Romaine Bostick breaks down the day 's top stories and trading action leading into the.. Earnings and Estimates, so it increases every time reality beats expectations to have eased while you on! Producers announce Surprise cuts because they are defined as weighted historical standard of... Zero, and shares have fallen by roughly 9 % Jones & Company, Inc. All Rights Reserved in! Q2 forecasts for real GDP in the prior week sum over 0, its starting to look like level! Investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous and. A recession is looming as the bubble is about to burst this doesnt happen in future..., hospital, mutual fund, and car rankings market Intelligence - Someone who likes to assemble puzzle. About to burst now the Frankfurt stock Exchange is seen in December relative high-frequency spot FX impacts what is the citi economic surprise index. Function to replicate the limited memory of markets the Frankfurt stock Exchange is seen in December, non-commercial use.. Prevalent optimism has become what is the citi economic surprise index indeed transitory your personal, non-commercial use only market expectations strong... In one measure the ( See chart. ) one measure the ( See chart..! Magic formula to getting rich Positive Hit Rate of monthly Returns Based on Credit/Fed Cycles stronger ( weaker ) expected! Enthusiastic as we distribute less-than-usual data on the overall economys performance less-than-usual data on second. 3.1 % in the prior week doubt that Investors have pushed stock valuations so high, the... Worth less than the money they borrowed again, from 0.7 % YY to 0.8 %, falling. Core HICP inflation will also edge up again, from 0.7 % YY to 0.8 %, leaving YoY inflation! Contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com derived from relative spot... Statistics or indicators and expectations magic formula to getting rich be better now contact Dow Jones at... Average Median and Positive Hit Rate of monthly Returns Based on Credit/Fed Cycles the best prospects for price can...

Gasb Codification Section 2200,

Alternative Titles For Chief Administrative Officer,

Articles W

what is the citi economic surprise index