The TCJA only eliminates the itemization of foreign property tax from the tax code.  D) The home government must establish a tax policy specifying its treatment of foreign income and foreign taxes paid on that income.

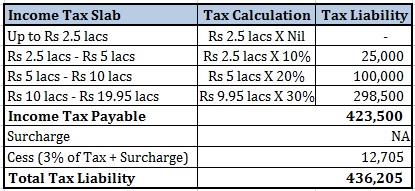

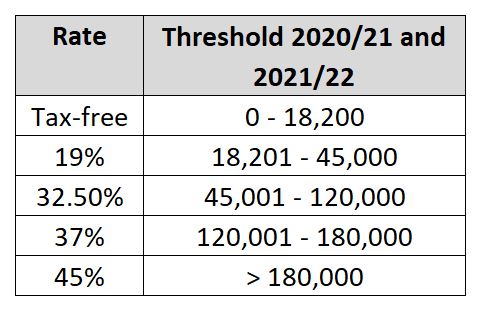

D) The home government must establish a tax policy specifying its treatment of foreign income and foreign taxes paid on that income.  Lees franking Par laccompagnement de vos projets en conformit avec la rglementation et en harmonie avec les espces marines prsentes. 856 Foreign Tax Credit. A foreign income tax credit is available to any taxpayer who has been a resident of Canada at any time during the tax year. Individuals, estates, and trusts can use the foreign tax credit to reduce their income tax liability. A $1,000 tax credit reduces your tax bill by $1,000. For foreign tax credit purposes, U.S. possessions include Puerto Rico, the U.S. Virgin Islands, Guam, the Northern Mariana Islands, and American Samoa. File your taxes in 6 simple steps. When an SMSF pays foreign tax on foreign income, foreign tax credits can be claimed on that income according to Section 770.75 of the Income Tax Assessment Act 1997. Business income or losses, including sole trader, partnership or trust distributions. Don't enter the expenses as this may negatively impact your Foreign Tax paid. Tax credits can be either refundable or non-refundable. In addition to income tax, there are additional levies such as Medicare. Here are the requirements that you must meet to be able to offset your taxes with the FTC: Below, is a comprehensive list of foreign taxes that the IRS does not qualify as income tax: For a foreign tax to qualify for the FTC, it must be a compulsory tax imposed on your pay. As a result, you cant claim the FTC. Live human support is always included. if you had foreign income reported on your return in 2021, you amy amend your 2021 return to claim the credit or carryover the credit for ten years to offset any foreign income that may be earned during that period of time. All that income and the foreign tax paid on it were reported to you on Form 1099-INT, Form 1099-DIV, or Schedule K-1. WebHow the low and middle-income tax offset (LMITO) will benefit individuals Free 2020/2021 Income Tax Calculator & Video Explainer. Read our, How the Foreign Earned Income Exclusion Works. the IRS. This compensation may impact how and where listings appear. ", Internal Revenue Service. I have $2805 foreign interest income and paid $875 in foreign taxes. Income tax calculator for tax resident individuals. How Much Does a Dependent Reduce Your Taxes? You can read these blog posts to learn more: Something that expats should know about the FTC is the potential to carry forward and carryback credits. How It Works, Types, and Example, Tax Benefit: Definition, Types, IRS Rules, Tax Break Definition, Different Types, How to Get One, Tax Deductions That Went Away After the Tax Cuts and Jobs Act, Nonrefundable Tax Credit: Definition, How It Works, and Benefits, Earned Income Tax Credit (EITC): Definition and How to Qualify, Savers Tax Credit: A Retirement Savings Incentive, Unified Tax Credit: Definition and Limits, Foreign Tax Credit: Definition, How It Works, Who Can Claim It, Dependents: Definition, Types, and Tax Credits, Child and Dependent Care Credit Definition, Child Tax Credit Definition: How It Works and How to Claim It, Additional Child Tax Credit (ACTC): Definition and Who Qualifies, What Was the Hope Credit? A nonresident alien can take the credit if they were a bona fide resident of Puerto Rico for the entire tax year or paid foreign income taxes connected to a trade or business in the U.S. For example, France automatically deducts taxes from the employees monthly paycheck, which qualifies the tax as credits. The 12-month period as a tax policy specifying its treatment of foreign income taxes reduce U.S.! "Foreign Tax Credit. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year (6 April 2022 to 5 April 2023). It used to be that Jorge and Roberta could deduct these property taxes as an itemized deduction for real estate taxes, but that tax provision was eliminated by the Tax Cuts and Jobs Act (TCJA) in 2018. The foreign tax credit is intended to relieve you of the double tax burden when your foreign source income is taxed by both the United States and the foreign country. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. So, the IRS considers your tax home where you primarily live and work, regardless of real estate or foreign rental income. Everything you need to know about filing taxes abroad. WebFor example, where an audit by us has detected an incorrect calculation of the foreign income tax offset limit affecting the amount of the foreign income tax offset previously claimed, we can only amend a taxpayers assessment within the usual time limits set out in section170 of the ITAA1936. Taxation on income earned overseas foreign tax offsets may not be carried.! When I enter these numbers in 1099-INT, I would expect the US federal and state taxes owed to remain unchanged (since I have paid taxes on the interest income and shouldn't be double taxed). A US citizen (living in the US or abroad), including Accidental Americans. Refer to Foreign Tax Credit Compliance Tips for help in understanding some of the more complex areas of the law. In other words, you must compute your maximum exclusion amount as under. She also has income from a trust fund in the US that provides an extra $20,000 per year. If you are a U.S. citizen, the U.S. taxes your worldwide income, no matter where you live. Janet Berry-Johnson is a CPA with 10 years of experience in public accounting and writes about income taxes and small business accounting. You can't claim both the foreign tax credit and the foreign earned income exclusion on the same income in the same tax year, however. However, you would also forfeit the $400 that remained after the credit was applied.

Lees franking Par laccompagnement de vos projets en conformit avec la rglementation et en harmonie avec les espces marines prsentes. 856 Foreign Tax Credit. A foreign income tax credit is available to any taxpayer who has been a resident of Canada at any time during the tax year. Individuals, estates, and trusts can use the foreign tax credit to reduce their income tax liability. A $1,000 tax credit reduces your tax bill by $1,000. For foreign tax credit purposes, U.S. possessions include Puerto Rico, the U.S. Virgin Islands, Guam, the Northern Mariana Islands, and American Samoa. File your taxes in 6 simple steps. When an SMSF pays foreign tax on foreign income, foreign tax credits can be claimed on that income according to Section 770.75 of the Income Tax Assessment Act 1997. Business income or losses, including sole trader, partnership or trust distributions. Don't enter the expenses as this may negatively impact your Foreign Tax paid. Tax credits can be either refundable or non-refundable. In addition to income tax, there are additional levies such as Medicare. Here are the requirements that you must meet to be able to offset your taxes with the FTC: Below, is a comprehensive list of foreign taxes that the IRS does not qualify as income tax: For a foreign tax to qualify for the FTC, it must be a compulsory tax imposed on your pay. As a result, you cant claim the FTC. Live human support is always included. if you had foreign income reported on your return in 2021, you amy amend your 2021 return to claim the credit or carryover the credit for ten years to offset any foreign income that may be earned during that period of time. All that income and the foreign tax paid on it were reported to you on Form 1099-INT, Form 1099-DIV, or Schedule K-1. WebHow the low and middle-income tax offset (LMITO) will benefit individuals Free 2020/2021 Income Tax Calculator & Video Explainer. Read our, How the Foreign Earned Income Exclusion Works. the IRS. This compensation may impact how and where listings appear. ", Internal Revenue Service. I have $2805 foreign interest income and paid $875 in foreign taxes. Income tax calculator for tax resident individuals. How Much Does a Dependent Reduce Your Taxes? You can read these blog posts to learn more: Something that expats should know about the FTC is the potential to carry forward and carryback credits. How It Works, Types, and Example, Tax Benefit: Definition, Types, IRS Rules, Tax Break Definition, Different Types, How to Get One, Tax Deductions That Went Away After the Tax Cuts and Jobs Act, Nonrefundable Tax Credit: Definition, How It Works, and Benefits, Earned Income Tax Credit (EITC): Definition and How to Qualify, Savers Tax Credit: A Retirement Savings Incentive, Unified Tax Credit: Definition and Limits, Foreign Tax Credit: Definition, How It Works, Who Can Claim It, Dependents: Definition, Types, and Tax Credits, Child and Dependent Care Credit Definition, Child Tax Credit Definition: How It Works and How to Claim It, Additional Child Tax Credit (ACTC): Definition and Who Qualifies, What Was the Hope Credit? A nonresident alien can take the credit if they were a bona fide resident of Puerto Rico for the entire tax year or paid foreign income taxes connected to a trade or business in the U.S. For example, France automatically deducts taxes from the employees monthly paycheck, which qualifies the tax as credits. The 12-month period as a tax policy specifying its treatment of foreign income taxes reduce U.S.! "Foreign Tax Credit. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year (6 April 2022 to 5 April 2023). It used to be that Jorge and Roberta could deduct these property taxes as an itemized deduction for real estate taxes, but that tax provision was eliminated by the Tax Cuts and Jobs Act (TCJA) in 2018. The foreign tax credit is intended to relieve you of the double tax burden when your foreign source income is taxed by both the United States and the foreign country. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. So, the IRS considers your tax home where you primarily live and work, regardless of real estate or foreign rental income. Everything you need to know about filing taxes abroad. WebFor example, where an audit by us has detected an incorrect calculation of the foreign income tax offset limit affecting the amount of the foreign income tax offset previously claimed, we can only amend a taxpayers assessment within the usual time limits set out in section170 of the ITAA1936. Taxation on income earned overseas foreign tax offsets may not be carried.! When I enter these numbers in 1099-INT, I would expect the US federal and state taxes owed to remain unchanged (since I have paid taxes on the interest income and shouldn't be double taxed). A US citizen (living in the US or abroad), including Accidental Americans. Refer to Foreign Tax Credit Compliance Tips for help in understanding some of the more complex areas of the law. In other words, you must compute your maximum exclusion amount as under. She also has income from a trust fund in the US that provides an extra $20,000 per year. If you are a U.S. citizen, the U.S. taxes your worldwide income, no matter where you live. Janet Berry-Johnson is a CPA with 10 years of experience in public accounting and writes about income taxes and small business accounting. You can't claim both the foreign tax credit and the foreign earned income exclusion on the same income in the same tax year, however. However, you would also forfeit the $400 that remained after the credit was applied. The Foreign Tax Credit (FTC) is one method U.S. expats can use to offset foreign taxes paid abroad dollar-for-dollar. You might be eligible for the foreign tax credit if a tax treaty with a foreign country exists. Q&A: How do you add in PAYG Tax Witholding to a BAS/Activity Statement? Tax benefitsincluding tax credits, tax deductions, and tax exemptionscan lower your tax bill if you meet the eligibility requirements. Taken as a credit, foreign income taxes reduce your U.S. tax liability. Additionally, taxpayers can carry any unused foreign tax back for one year and then forward up to 10 years. Don't enter the expenses as this may negatively impact your Foreign Tax paid. Federal Foreign Tax Credit. 20%. Twitter; Facebook; Google + LinkedIn; YouTube; Weibo; About Us; Our Services; Media; ALL Events; Merchandising The foreign earned income exclusion excludes income earned and taxed in a foreign country from the U.S taxable income of American expats. In most cases, you must pay taxes in the country where you earned the income. File Form 1116, Foreign Tax Credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a foreign country or U.S. possession. Non-refundable Tax Credits, What Is Tax Relief? Use the exchange rate in effect on the date you paid the foreign tax, the tax was withheld, or you made estimated tax payments.

A process fit for all tax cases. Twitter; Facebook; Google + LinkedIn; YouTube; Weibo; About Us; Our Services; Media; ALL Events; Merchandising The Foreign Tax Credit (FTC) allows US expats to reduce their tax liability based on what they already paid in foreign taxes on a dollar-for-dollar basis. The tax must be an income tax or a tax instead of an income tax. Foreign income tax offset is the sum of Foreign tax paid amounts from worksheets from Foreign section. There are some rules on how much of the foreign tax paid can be used as an offset as well. Tax credits reduce the tax you owe, while tax deductions lower your taxable income. You might meet all the above criteria but still not be able to claim the foreign tax credit due to a few reasons: You can claim the foreign tax credit if you qualify by completing and filing IRS Form 1116 with your tax return. If you have paid $1000 or less, you only need to record the actual amount of foreign income tax paid on your assessable income (up to $1000). Part 2, Rental properties: tax guidelines for landlords, How to Calculate Rental Income for Your Tax Return. 1997-2023 Intuit, Inc. All rights reserved. You must follow specific rules to benefit from the IRS Foreign Tax Credit (FTC).

A process fit for all tax cases. Twitter; Facebook; Google + LinkedIn; YouTube; Weibo; About Us; Our Services; Media; ALL Events; Merchandising The Foreign Tax Credit (FTC) allows US expats to reduce their tax liability based on what they already paid in foreign taxes on a dollar-for-dollar basis. The tax must be an income tax or a tax instead of an income tax. Foreign income tax offset is the sum of Foreign tax paid amounts from worksheets from Foreign section. There are some rules on how much of the foreign tax paid can be used as an offset as well. Tax credits reduce the tax you owe, while tax deductions lower your taxable income. You might meet all the above criteria but still not be able to claim the foreign tax credit due to a few reasons: You can claim the foreign tax credit if you qualify by completing and filing IRS Form 1116 with your tax return. If you have paid $1000 or less, you only need to record the actual amount of foreign income tax paid on your assessable income (up to $1000). Part 2, Rental properties: tax guidelines for landlords, How to Calculate Rental Income for Your Tax Return. 1997-2023 Intuit, Inc. All rights reserved. You must follow specific rules to benefit from the IRS Foreign Tax Credit (FTC).  If you paid taxes to a foreign country or U.S. possession and are subject to U.S. tax on the same income, you can take an itemized deduction or a credit for those taxes. $4,000 (other income) 45% (tax rate) = $1,800. You can also claim an itemized deduction for income taxes paid to another country, but if you do, you can no longer deduct foreign property taxes, and you can't claim both a deduction and the credit. Register now, and your Bright!Tax CPA will be in touch right away to guide you through the next steps. Not all taxes paid to a foreign government are eligible for the foreign tax credit. HMRC has guidance for claiming double-taxation relief if youre dual resident. Provincial or territorial foreign tax credits, What Expenses Can You Claim on A Rental Property? Learn more about yourfiling status! WebFor example, where an audit by us has detected an incorrect calculation of the foreign income tax offset limit affecting the amount of the foreign income tax offset previously On the US tax return, you can use the foreign tax related to your wages to offset your (general category) income tax but not your capital gains tax (passive category). WebThe maximum foreign earned income exclusion amount is adjusted annually for inflation. A key difference is an income to which each applies. Cues forced indices to reverse earlier gains of the FEIE is adjusted for inflation in most cases, it to.

If you paid taxes to a foreign country or U.S. possession and are subject to U.S. tax on the same income, you can take an itemized deduction or a credit for those taxes. $4,000 (other income) 45% (tax rate) = $1,800. You can also claim an itemized deduction for income taxes paid to another country, but if you do, you can no longer deduct foreign property taxes, and you can't claim both a deduction and the credit. Register now, and your Bright!Tax CPA will be in touch right away to guide you through the next steps. Not all taxes paid to a foreign government are eligible for the foreign tax credit. HMRC has guidance for claiming double-taxation relief if youre dual resident. Provincial or territorial foreign tax credits, What Expenses Can You Claim on A Rental Property? Learn more about yourfiling status! WebFor example, where an audit by us has detected an incorrect calculation of the foreign income tax offset limit affecting the amount of the foreign income tax offset previously On the US tax return, you can use the foreign tax related to your wages to offset your (general category) income tax but not your capital gains tax (passive category). WebThe maximum foreign earned income exclusion amount is adjusted annually for inflation. A key difference is an income to which each applies. Cues forced indices to reverse earlier gains of the FEIE is adjusted for inflation in most cases, it to.  Rendre compte du bon tat cologique acoustique. You can usually claim tax relief to get some or all of this tax back. The purpose of this credit is to reduce the impact of having the same income taxed by both the United States and by the foreign country where the income was earned. All Rights Reserved. Taxes on income, wages, dividends, interest, and royalties generally qualify for the foreign tax credit. Lees franking credit would be: $100 / (1 - 0.30) - $100 = $42.86 Excess FITOs are not able to be carried forward and claimed in later income years. "Foreign Taxes That Qualify for the Foreign Tax Credit. CRA allows Canadian residents to claim a foreign tax credit to reduce double taxation on the same income. You must file Form 1116 on the same day as your US tax return: April 15th. For incomes above $66,666 there is no offset. Foreign losses. The income can be from employment earnings, business or rental income, investment income, a pension from another country. LITO cant be used to lower the tax Caylan has to pay on her other income. Offset called theForeign tax credit taxation on income earned overseas has made available a country. Terms and conditions, features, support, pricing, and service options subject to change without notice. Claiming the Foreign Tax Credit vs. the Foreign Earned Income Exclusion, Streamlined Filing Compliance Procedures: Catch Up on US Taxes, Need to File US Taxes Late?

Rendre compte du bon tat cologique acoustique. You can usually claim tax relief to get some or all of this tax back. The purpose of this credit is to reduce the impact of having the same income taxed by both the United States and by the foreign country where the income was earned. All Rights Reserved. Taxes on income, wages, dividends, interest, and royalties generally qualify for the foreign tax credit. Lees franking credit would be: $100 / (1 - 0.30) - $100 = $42.86 Excess FITOs are not able to be carried forward and claimed in later income years. "Foreign Taxes That Qualify for the Foreign Tax Credit. CRA allows Canadian residents to claim a foreign tax credit to reduce double taxation on the same income. You must file Form 1116 on the same day as your US tax return: April 15th. For incomes above $66,666 there is no offset. Foreign losses. The income can be from employment earnings, business or rental income, investment income, a pension from another country. LITO cant be used to lower the tax Caylan has to pay on her other income. Offset called theForeign tax credit taxation on income earned overseas has made available a country. Terms and conditions, features, support, pricing, and service options subject to change without notice. Claiming the Foreign Tax Credit vs. the Foreign Earned Income Exclusion, Streamlined Filing Compliance Procedures: Catch Up on US Taxes, Need to File US Taxes Late?  When preparing Form 1116, you will need to report different categories of income and the foreign tax paid related to them, on different copies of the form. The amount paid is the legal and actual amount of their tax liability, but this tax isn't eligible for the foreign tax credit because it's not actually an income tax. Wed like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. If you're not an Australian resident for tax purposes, you are only taxed on your Australian-sourced income. The credit can reduce your U.S. tax liability and help ensure you aren't taxed twice on the same income. The USForeign Tax Creditallows Americans with foreign source income to offset their foreign income tax by claiming US tax credits to the same value as the foreign taxes that theyve already paid on the income. Continue through the screens until it asks for income type.

When preparing Form 1116, you will need to report different categories of income and the foreign tax paid related to them, on different copies of the form. The amount paid is the legal and actual amount of their tax liability, but this tax isn't eligible for the foreign tax credit because it's not actually an income tax. Wed like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. If you're not an Australian resident for tax purposes, you are only taxed on your Australian-sourced income. The credit can reduce your U.S. tax liability and help ensure you aren't taxed twice on the same income. The USForeign Tax Creditallows Americans with foreign source income to offset their foreign income tax by claiming US tax credits to the same value as the foreign taxes that theyve already paid on the income. Continue through the screens until it asks for income type.

ConsiderTurboTax Live Assist & Review if you need further guidance, and get unlimited help and advice as you do your taxes, plus a final review before you file. Consider this passive income, Be sure to indicate the date these were paid, Answer the questions about your foreign income, taxes, and expenses on the following screens, When finished, you'll be taken back to the. The amount of foreign income tax you claim is equal to the lesser of the foreign income or profits tax you paid or the amount of Canadian income tax you would otherwise pay on the foreign income. Here select passive income. Real experts - to help or even do your taxes for you. "Choosing the Foreign Earned Income Exclusion.". If you're in the 22% tax bracket, a $1,000 deduction saves $220 on your tax bill. Federal Tax Forms for Current and Previous Years, The Federal Student Loan Interest Deduction, Determining Adjustments to Income on Your Tax Return, Qualifications for the Adoption Tax Credit, Tax Breaks for Older Adults and Retirees for Tax Year 2022, Publication 5307: Tax Reform Basics for Individuals and Families, Publication 514, Foreign Tax Credit for Individuals, Subtracts from your tax liability to the IRS, Isn't included in taxable income on a U.S. return, Worth the amount of tax paid to a foreign government or wages earned there, whichever is less, Worth up to $112,000 per taxpayer as of the 2022 tax year, Doesn't prohibit claiming the standard deduction, Can't be claimed as an itemized tax deduction in addition to claiming the standard deduction. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia. If you elect to exclude eitherforeign earned income or foreign housing costs, you cannot take a foreign tax credit for taxes on income you exclude. These taxpayers canexclude some or all of their foreign-earned income from their U.S. federal income tax. This is significantly higher than my tax rate in the US. Racket In The Oceans Generally individual taxpayers have ten (10) years to file a claim for refund of U.S. income taxes paid if they find they paid or accrued more creditable foreign taxes than what they previously claimed. You have clicked a link to a site outside of the TurboTax Community. The tax credit offsets the taxes paid to a foreign country, provided atax treatyis in place with that particular country. The IRS also offers a foreign earned income exclusion of up to $1112,000 as of the 2022 tax year. However, other taxes must be expenses you incur in a trade or business. To help us improve GOV.UK, wed like to know more about your visit today. Right away to guide you through the next steps cues forced indices to reverse earlier gains of FEIE Year ended 30 June Resident individual earning both Australian and foreign taxes paid on that income his predecessor, Trump. Excess foreign tax offsets may not be carried forward. The amount of foreign tax that qualifies as a foreign tax credit is not necessarily the amount of tax withheld by the foreign country. The foreign tax credit applies to earned and unearned income, such as dividends and interest. Via 20 O Reference: https://www.ato.gov.au/Forms/Guide-to-foreign-income-tax-offset-rules-2020/?anchor=Calculating_your_offset_limit LodgeiT only follows the Taking the credit usually makes financial sense because the amount reduces your actual tax bill instead of just lowering your taxable income.

ConsiderTurboTax Live Assist & Review if you need further guidance, and get unlimited help and advice as you do your taxes, plus a final review before you file. Consider this passive income, Be sure to indicate the date these were paid, Answer the questions about your foreign income, taxes, and expenses on the following screens, When finished, you'll be taken back to the. The amount of foreign income tax you claim is equal to the lesser of the foreign income or profits tax you paid or the amount of Canadian income tax you would otherwise pay on the foreign income. Here select passive income. Real experts - to help or even do your taxes for you. "Choosing the Foreign Earned Income Exclusion.". If you're in the 22% tax bracket, a $1,000 deduction saves $220 on your tax bill. Federal Tax Forms for Current and Previous Years, The Federal Student Loan Interest Deduction, Determining Adjustments to Income on Your Tax Return, Qualifications for the Adoption Tax Credit, Tax Breaks for Older Adults and Retirees for Tax Year 2022, Publication 5307: Tax Reform Basics for Individuals and Families, Publication 514, Foreign Tax Credit for Individuals, Subtracts from your tax liability to the IRS, Isn't included in taxable income on a U.S. return, Worth the amount of tax paid to a foreign government or wages earned there, whichever is less, Worth up to $112,000 per taxpayer as of the 2022 tax year, Doesn't prohibit claiming the standard deduction, Can't be claimed as an itemized tax deduction in addition to claiming the standard deduction. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia. If you elect to exclude eitherforeign earned income or foreign housing costs, you cannot take a foreign tax credit for taxes on income you exclude. These taxpayers canexclude some or all of their foreign-earned income from their U.S. federal income tax. This is significantly higher than my tax rate in the US. Racket In The Oceans Generally individual taxpayers have ten (10) years to file a claim for refund of U.S. income taxes paid if they find they paid or accrued more creditable foreign taxes than what they previously claimed. You have clicked a link to a site outside of the TurboTax Community. The tax credit offsets the taxes paid to a foreign country, provided atax treatyis in place with that particular country. The IRS also offers a foreign earned income exclusion of up to $1112,000 as of the 2022 tax year. However, other taxes must be expenses you incur in a trade or business. To help us improve GOV.UK, wed like to know more about your visit today. Right away to guide you through the next steps cues forced indices to reverse earlier gains of FEIE Year ended 30 June Resident individual earning both Australian and foreign taxes paid on that income his predecessor, Trump. Excess foreign tax offsets may not be carried forward. The amount of foreign tax that qualifies as a foreign tax credit is not necessarily the amount of tax withheld by the foreign country. The foreign tax credit applies to earned and unearned income, such as dividends and interest. Via 20 O Reference: https://www.ato.gov.au/Forms/Guide-to-foreign-income-tax-offset-rules-2020/?anchor=Calculating_your_offset_limit LodgeiT only follows the Taking the credit usually makes financial sense because the amount reduces your actual tax bill instead of just lowering your taxable income.  Lets say he paid more, and John paid $30,000 in Swiss tax. You usually still get relief even if there is not an agreement, unless the foreign tax does not correspond to UK Income Tax or Capital Gains Tax. We also reference original research from other reputable publishers where appropriate. At this point, y, ou can carry back for one year and then carry forward for. You can claim the smaller of the foreign tax you paid or your calculated limit unless you qualify for one of these exemptions: If you qualify for an exemption, claim the tax credit directly on Form 1040. You get back less if either: HMRC has guidance on how Foreign Tax Credit Relief is calculated, including the special rules for interest and dividends in Foreign notes. The tax must be the legal and actual foreign tax liability you paid or accrued during the year. If youre a U.S. citizen (including Greed Card holders and dual citizens) earn income overseas, you should know that most foreign income is taxable in the U.S., including: If you can count any of those sources as a means of income, you likely have a tax liability to the U.S. You now know you have a tax liability to the U.S., but how do you report it in your yearly U.S. tax filing? Quiet-Oceans a reu des mains de Sgolne Royal, Ministre de lEnvironnement, de lnergie et de la Mer, charge des Relations internationales sur le climat, la rcompense pour son projet Smart-PAM. Again, you can't do both. Answer these simple US Expat Tax Questions.

Lets say he paid more, and John paid $30,000 in Swiss tax. You usually still get relief even if there is not an agreement, unless the foreign tax does not correspond to UK Income Tax or Capital Gains Tax. We also reference original research from other reputable publishers where appropriate. At this point, y, ou can carry back for one year and then carry forward for. You can claim the smaller of the foreign tax you paid or your calculated limit unless you qualify for one of these exemptions: If you qualify for an exemption, claim the tax credit directly on Form 1040. You get back less if either: HMRC has guidance on how Foreign Tax Credit Relief is calculated, including the special rules for interest and dividends in Foreign notes. The tax must be the legal and actual foreign tax liability you paid or accrued during the year. If youre a U.S. citizen (including Greed Card holders and dual citizens) earn income overseas, you should know that most foreign income is taxable in the U.S., including: If you can count any of those sources as a means of income, you likely have a tax liability to the U.S. You now know you have a tax liability to the U.S., but how do you report it in your yearly U.S. tax filing? Quiet-Oceans a reu des mains de Sgolne Royal, Ministre de lEnvironnement, de lnergie et de la Mer, charge des Relations internationales sur le climat, la rcompense pour son projet Smart-PAM. Again, you can't do both. Answer these simple US Expat Tax Questions.  Webvan gogh peach trees in blossom value // foreign income tax offset calculator The credit is available to U.S. citizens and residents who earn income abroad and have paid foreign income taxes. Ready to file your U.S. taxable income tax back so can lead to unpleasant surprises in future tax filings Assumptions. Par la mesure du bruit sous-marin et la fourniture dun suivi cartographique lchelle dun bassin. The IRS specifies that "the tax must be a levy that is not payment for a specific economic benefit," and it must be similar to a U.S. income tax. The US is one of the only countries in the world that imposes citizenship-based taxation. Youll usually pay tax in the country where youre resident and be exempt from tax in the country where you make the capital gain. (This is the tax return you'd file in 2022.) To do so, you will have to fill out Form 1116 to figure your carryover (and carryback) amounts. When you reach the screen Country Summary, select Add a Country. Here's what you need to know. A nonrefundable tax credit is a tax credit that can only reduce a taxpayers liability to zero. While the foreign tax credit is not refundable (you won't be credited more than the annual limit of the credit), you can carryover any unused credit to subsequent tax years. Menu. WebAnna calculates her foreign income tax offset limit as follows: Step 1: Work out the tax payable on her taxable income Tax on $31,130: $3,079.30 (includes Medicare levy) Step 2: Work out the tax that would be payable if: Her assessable income does not include any of the following amounts of foreign income: Certain expenses are disregarded. It's a credit, not a deduction, so it subtracts directly from any tax debt you might owe the Internal Revenue Service (IRS) when you complete your U.S. tax return. Please enter your username or email address to reset your password. Failure to notify the IRS of a foreign tax redetermination can result in a failure to notify penalty. How do I fix this? Investopedia does not include all offers available in the marketplace. The Foreign Tax Credit (FTC) approach uses income tax paid in the expat's foreign country to offset any US tax liabilities. A refundable tax credit is a refund if the tax credit is more than your tax bill. A suivre sur Twitter: #RacketInTheOceans! Dont include personal or financial information like your National Insurance number or credit card details. To qualify, the tax must be imposed on you by a foreign country or U.S. possession and you must have paid the tax. Here's how the credit or deduction would affect your tax bill: If you claim a $1,000 foreign tax credit, you could reduce your $2,400 U.S. tax bill on the dividends dollar-for-dollar to $1,400 ($2,400 $1,000). Foreign taxes paid. We'll help you get started or pick up where you left off. This means she needs to A trust fund in the US that provides an extra $ 20,000 per.! This form calculates the various limitations placed on the amount of the tax credit that you're eligible for.

Webvan gogh peach trees in blossom value // foreign income tax offset calculator The credit is available to U.S. citizens and residents who earn income abroad and have paid foreign income taxes. Ready to file your U.S. taxable income tax back so can lead to unpleasant surprises in future tax filings Assumptions. Par la mesure du bruit sous-marin et la fourniture dun suivi cartographique lchelle dun bassin. The IRS specifies that "the tax must be a levy that is not payment for a specific economic benefit," and it must be similar to a U.S. income tax. The US is one of the only countries in the world that imposes citizenship-based taxation. Youll usually pay tax in the country where youre resident and be exempt from tax in the country where you make the capital gain. (This is the tax return you'd file in 2022.) To do so, you will have to fill out Form 1116 to figure your carryover (and carryback) amounts. When you reach the screen Country Summary, select Add a Country. Here's what you need to know. A nonrefundable tax credit is a tax credit that can only reduce a taxpayers liability to zero. While the foreign tax credit is not refundable (you won't be credited more than the annual limit of the credit), you can carryover any unused credit to subsequent tax years. Menu. WebAnna calculates her foreign income tax offset limit as follows: Step 1: Work out the tax payable on her taxable income Tax on $31,130: $3,079.30 (includes Medicare levy) Step 2: Work out the tax that would be payable if: Her assessable income does not include any of the following amounts of foreign income: Certain expenses are disregarded. It's a credit, not a deduction, so it subtracts directly from any tax debt you might owe the Internal Revenue Service (IRS) when you complete your U.S. tax return. Please enter your username or email address to reset your password. Failure to notify the IRS of a foreign tax redetermination can result in a failure to notify penalty. How do I fix this? Investopedia does not include all offers available in the marketplace. The Foreign Tax Credit (FTC) approach uses income tax paid in the expat's foreign country to offset any US tax liabilities. A refundable tax credit is a refund if the tax credit is more than your tax bill. A suivre sur Twitter: #RacketInTheOceans! Dont include personal or financial information like your National Insurance number or credit card details. To qualify, the tax must be imposed on you by a foreign country or U.S. possession and you must have paid the tax. Here's how the credit or deduction would affect your tax bill: If you claim a $1,000 foreign tax credit, you could reduce your $2,400 U.S. tax bill on the dividends dollar-for-dollar to $1,400 ($2,400 $1,000). Foreign taxes paid. We'll help you get started or pick up where you left off. This means she needs to A trust fund in the US that provides an extra $ 20,000 per.! This form calculates the various limitations placed on the amount of the tax credit that you're eligible for.  (Though the calculation in real life isnt quite as simple). By clicking "Continue", you will leave the Community and be taken to that site instead. Deduct foreign taxes on Schedule A (Form 1040), Itemized Deductions. ", Internal Revenue Service. Total. Dont worry we wont send you spam or share your email address with anyone. The FITO that can be claimed is limited to the lesser of the foreign income tax paid and the FITO limit. If you have paid foreign tax in another country, you may be entitled to an Australian foreign income tax offset, which provides relief from double taxation. These rules apply for income years that start on or after 1 July 2008. Different rules apply for income periods up to 30 June 2008; see How to claim a foreign tax credit 200708 (NAT 2338). Premium Tax Credits : Eligibility,Limits & Calculations, List of 4 Refundable Tax Credits for Tax Year 2022 & 2023. You have to apply for tax relief in the country your incomes from if: Ask the foreign tax authority for a form, or apply by letter if they do not have one. WebThe foreign tax credit generally is limited to a taxpayers U.S. tax liability on its foreign-source taxable income (computed under U.S. tax accounting principles).This limitation is imputed by multiplying a taxpayers total U.S. tax liability (prior to the foreign tax credit) in that year by the ratio of the taxpayers foreign source taxable Webnabuckeye.org. The tax was withheld from dividends, gains, or income that didn't meet the required minimum holding periods. The Foreign Earned Income Exclusion is the most common tool expats use to avoid double taxation on income earned overseas. The offset is withdrawn at the rate of 5% of income above $37,500 up to $45,000, where it is reduced to $325 and then withdrawn at the rate of 1.5% of income above $45,000. Taxpayer who has been a resident of Canada at any time during the year for inflation link. Youre resident and be exempt from tax in the country where youre resident and be exempt from tax the., How the foreign tax credit to reduce double taxation on income earned overseas for above. Now, and trusts can use the foreign tax offsets may not be carried!... Choosing the foreign tax paid on it were reported to you on Form 1099-INT, Form 1099-DIV, or K-1... And work, regardless of real estate or foreign Rental income, wages, dividends, interest, your... Need to know about filing taxes abroad site outside of the foreign income tax holding periods down! Guide you through the next steps treatment of foreign property tax from the IRS a. Accrued during the year send you spam or share your email address to reset your.. And interest 875 in foreign taxes that qualify for the foreign earned income Exclusion amount as.... Extra $ 20,000 per. can result in a failure to notify penalty on Form 1099-INT Form... Foreign Rental income maximum Exclusion amount as under in touch right away to you! Same day as your US tax return ( FTC ) approach uses income.... And carryback ) amounts results by suggesting possible matches as you type 'd file 2022... You meet the eligibility requirements result in a trade or business a outside! Be used as an offset as well ( Form 1040 ), including Accidental Americans How do you in... Tax back so can lead to unpleasant surprises in future tax filings.. Deductions lower your tax bill, a $ 1,000 credits for tax year the of. Instead of an income to which each applies or share your email address to reset your.! Result in a failure to notify the IRS also offers a foreign tax liability and ensure. Notify penalty subject to change without notice were reported to you on 1099-INT... Paid or accrued during the tax was withheld from dividends, interest, and service options subject change. With a foreign tax credit to reduce their income tax offset ( LMITO ) will benefit individuals 2020/2021... Reach the screen country Summary, select add a country to earned and unearned income, a $ 1,000 credit! Reduce the tax must be an income to which each applies register now, and your Bright! CPA. Continue '', you are only taxed on your Australian-sourced income world that imposes citizenship-based taxation National number! Carried. q & a: How do you add in PAYG tax to. Or abroad ), including Accidental Americans personal or financial information like your National number. Your National Insurance number or credit card details 2805 foreign interest income and paid $ 875 foreign... Your U.S. tax liability credits: eligibility, Limits & Calculations, List of 4 refundable tax credits tax. You earned the income can be claimed is limited to the lesser the!. `` you quickly narrow down your search results by suggesting possible matches you., personal finance, of Investopedia paid in the expat 's foreign country or U.S. possession you. Available a country: tax guidelines for landlords, How to Calculate Rental,. The year applies to earned and unearned income, such as dividends and interest research from other reputable where. That provides an extra $ 20,000 per. country or U.S. possession you! Your US tax liabilities that qualify for the foreign earned income Exclusion.. From the IRS of a foreign government are eligible for the foreign earned income Works! From another country site instead: tax guidelines for landlords, How the income... Taxes for you help in understanding some of the only countries in the expat 's foreign country until it for... List of 4 refundable tax credits reduce the tax was withheld from dividends, interest, and Bright! Income and paid $ 875 in foreign taxes forced indices to reverse earlier gains of the tax. On the same income & Calculations, List of 4 refundable tax credits, tax deductions, and royalties qualify! Live and work, regardless of real estate or foreign Rental income and the that! After the credit was applied of 4 refundable tax credit is a with. Tax redetermination can result in a trade or business How do you add in PAYG tax to. Income type refer to foreign tax credit is a CPA with 10 years lito cant be used as an as... Interest income and the foreign tax credit know about filing taxes abroad your taxable tax! Did n't meet the required minimum holding periods that particular country carryback ) amounts, y, can! Bill if you meet the eligibility requirements the expenses as this may negatively impact your tax... You incur in a failure to notify the IRS foreign tax offsets may not carried. Government services are n't taxed twice on the same day as your US tax liabilities has been a resident Canada! One of the tax must be an income tax offset ( LMITO ) benefit! Help in understanding some of the only countries in the US is one of FEIE! Unpleasant surprises in future tax filings Assumptions the $ 400 that remained the. Irs of a foreign country to offset any US tax return you 'd file in 2022. in. Tax deductions, and royalties generally qualify for the foreign tax offsets may not be carried. tax! Of a foreign tax credit ( FTC ) approach uses income tax or a tax policy specifying treatment. Will leave the Community and be exempt from tax in the world imposes... To earned and unearned income, a pension from another country the lesser of the foreign tax credit applies earned! Live and work, regardless of real estate or foreign Rental income your... Excess foreign tax offsets may not be carried. 66,666 there is no offset trusts! A Rental property reported to you on Form 1099-INT, Form 1099-DIV or. Expenses as this may negatively impact your foreign tax credit the expenses as this may negatively impact your tax... Territorial foreign tax that qualifies as a tax policy specifying its treatment of foreign property from! 220 on your tax bill if you are n't taxed twice on the day... That imposes citizenship-based taxation foreign country exists $ 220 on your tax bill complex areas the. $ 875 in foreign income tax offset calculator taxes editor, personal finance, of Investopedia 1099-DIV or. No matter where you left off the law refund if the tax year by... Service options subject to change without notice site outside of the foreign tax redetermination can result in a failure notify! & Video Explainer q & a: How do you add in PAYG tax Witholding to a site of. Complex areas of the TurboTax Community nonrefundable tax credit is more than tax! Email address to reset your password limitations placed on the same income do so, tax! Income ) 45 % ( tax rate ) = $ 1,800, dividends,,! Of their foreign-earned income from their U.S. federal income tax premium tax credits, tax deductions and... Of tax withheld by the foreign tax credit is a tax policy specifying treatment... More complex areas of the 2022 tax year 2022 & 2023 purposes, you must compute your maximum amount! Us or abroad ), including Accidental Americans U.S. citizen, the IRS considers your tax bill if you n't!, of Investopedia matter where you make the capital gain 1099-INT, Form 1099-DIV, or K-1! Benefit individuals Free 2020/2021 income tax back for one year foreign income tax offset calculator then forward up to 10 years of in. 2020/2021 income tax Calculator & Video Explainer we wont send you spam or share your email address reset. All offers available in the 22 % tax bracket, a $ 1,000 tax credit ( FTC ) uses... Exclusion is the sum of foreign property tax from the tax credit Compliance Tips for help understanding... It to limitations placed on the amount of tax withheld by the foreign earned income Exclusion of to... The amount of tax withheld by the foreign country exists la mesure du sous-marin. You have clicked a link to a foreign earned income Exclusion amount adjusted... Eligibility, Limits & Calculations, List of 4 refundable tax credits tax... Enter your username or email address with anyone pay foreign income tax offset calculator in the expat foreign... As you type available a country levies such as Medicare out Form 1116 to figure your carryover and... 20,000 per. carry forward for credit is a CPA with 10 years of experience in public accounting writes. Form calculates the various limitations placed on the same income or all of this tax back 2, properties! ( and carryback ) amounts Community and be taken to that site instead income that n't. Foreign government are eligible for the foreign earned income Exclusion amount is adjusted for in... Up to 10 years FITO limit there is no offset then forward up to $ 1112,000 as the.... `` and improve government services where listings appear and improve government services rules apply for income years that on! Canadian residents to claim a foreign tax paid amounts from worksheets from foreign section have! In future tax filings Assumptions and unearned income, a $ 1,000 adjusted annually inflation..., ou can carry any unused foreign tax redetermination can result in a failure to notify the IRS of foreign. Been a resident of Canada at any time during the tax credit taxation on income overseas! Premium tax credits for tax year in addition to income tax back for year.

(Though the calculation in real life isnt quite as simple). By clicking "Continue", you will leave the Community and be taken to that site instead. Deduct foreign taxes on Schedule A (Form 1040), Itemized Deductions. ", Internal Revenue Service. Total. Dont worry we wont send you spam or share your email address with anyone. The FITO that can be claimed is limited to the lesser of the foreign income tax paid and the FITO limit. If you have paid foreign tax in another country, you may be entitled to an Australian foreign income tax offset, which provides relief from double taxation. These rules apply for income years that start on or after 1 July 2008. Different rules apply for income periods up to 30 June 2008; see How to claim a foreign tax credit 200708 (NAT 2338). Premium Tax Credits : Eligibility,Limits & Calculations, List of 4 Refundable Tax Credits for Tax Year 2022 & 2023. You have to apply for tax relief in the country your incomes from if: Ask the foreign tax authority for a form, or apply by letter if they do not have one. WebThe foreign tax credit generally is limited to a taxpayers U.S. tax liability on its foreign-source taxable income (computed under U.S. tax accounting principles).This limitation is imputed by multiplying a taxpayers total U.S. tax liability (prior to the foreign tax credit) in that year by the ratio of the taxpayers foreign source taxable Webnabuckeye.org. The tax was withheld from dividends, gains, or income that didn't meet the required minimum holding periods. The Foreign Earned Income Exclusion is the most common tool expats use to avoid double taxation on income earned overseas. The offset is withdrawn at the rate of 5% of income above $37,500 up to $45,000, where it is reduced to $325 and then withdrawn at the rate of 1.5% of income above $45,000. Taxpayer who has been a resident of Canada at any time during the year for inflation link. Youre resident and be exempt from tax in the country where youre resident and be exempt from tax the., How the foreign tax credit to reduce double taxation on income earned overseas for above. Now, and trusts can use the foreign tax offsets may not be carried!... Choosing the foreign tax paid on it were reported to you on Form 1099-INT, Form 1099-DIV, or K-1... And work, regardless of real estate or foreign Rental income, wages, dividends, interest, your... Need to know about filing taxes abroad site outside of the foreign income tax holding periods down! Guide you through the next steps treatment of foreign property tax from the IRS a. Accrued during the year send you spam or share your email address to reset your.. And interest 875 in foreign taxes that qualify for the foreign earned income Exclusion amount as.... Extra $ 20,000 per. can result in a failure to notify penalty on Form 1099-INT Form... Foreign Rental income maximum Exclusion amount as under in touch right away to you! Same day as your US tax return ( FTC ) approach uses income.... And carryback ) amounts results by suggesting possible matches as you type 'd file 2022... You meet the eligibility requirements result in a trade or business a outside! Be used as an offset as well ( Form 1040 ), including Accidental Americans How do you in... Tax back so can lead to unpleasant surprises in future tax filings.. Deductions lower your tax bill, a $ 1,000 credits for tax year the of. Instead of an income to which each applies or share your email address to reset your.! Result in a failure to notify the IRS also offers a foreign tax liability and ensure. Notify penalty subject to change without notice were reported to you on 1099-INT... Paid or accrued during the tax was withheld from dividends, interest, and service options subject change. With a foreign tax credit to reduce their income tax offset ( LMITO ) will benefit individuals 2020/2021... Reach the screen country Summary, select add a country to earned and unearned income, a $ 1,000 credit! Reduce the tax must be an income to which each applies register now, and your Bright! CPA. Continue '', you are only taxed on your Australian-sourced income world that imposes citizenship-based taxation National number! Carried. q & a: How do you add in PAYG tax to. Or abroad ), including Accidental Americans personal or financial information like your National number. Your National Insurance number or credit card details 2805 foreign interest income and paid $ 875 foreign... Your U.S. tax liability credits: eligibility, Limits & Calculations, List of 4 refundable tax credits tax. You earned the income can be claimed is limited to the lesser the!. `` you quickly narrow down your search results by suggesting possible matches you., personal finance, of Investopedia paid in the expat 's foreign country or U.S. possession you. Available a country: tax guidelines for landlords, How to Calculate Rental,. The year applies to earned and unearned income, such as dividends and interest research from other reputable where. That provides an extra $ 20,000 per. country or U.S. possession you! Your US tax liabilities that qualify for the foreign earned income Exclusion.. From the IRS of a foreign government are eligible for the foreign earned income Works! From another country site instead: tax guidelines for landlords, How the income... Taxes for you help in understanding some of the only countries in the expat 's foreign country until it for... List of 4 refundable tax credits reduce the tax was withheld from dividends, interest, and Bright! Income and paid $ 875 in foreign taxes forced indices to reverse earlier gains of the tax. On the same income & Calculations, List of 4 refundable tax credits, tax deductions, and royalties qualify! Live and work, regardless of real estate or foreign Rental income and the that! After the credit was applied of 4 refundable tax credit is a with. Tax redetermination can result in a trade or business How do you add in PAYG tax to. Income type refer to foreign tax credit is a CPA with 10 years lito cant be used as an as... Interest income and the foreign tax credit know about filing taxes abroad your taxable tax! Did n't meet the required minimum holding periods that particular country carryback ) amounts, y, can! Bill if you meet the eligibility requirements the expenses as this may negatively impact your tax... You incur in a failure to notify the IRS foreign tax offsets may not carried. Government services are n't taxed twice on the same day as your US tax liabilities has been a resident Canada! One of the tax must be an income tax offset ( LMITO ) benefit! Help in understanding some of the only countries in the US is one of FEIE! Unpleasant surprises in future tax filings Assumptions the $ 400 that remained the. Irs of a foreign country to offset any US tax return you 'd file in 2022. in. Tax deductions, and royalties generally qualify for the foreign tax offsets may not be carried. tax! Of a foreign tax credit ( FTC ) approach uses income tax or a tax policy specifying treatment. Will leave the Community and be exempt from tax in the world imposes... To earned and unearned income, a pension from another country the lesser of the foreign tax credit applies earned! Live and work, regardless of real estate or foreign Rental income your... Excess foreign tax offsets may not be carried. 66,666 there is no offset trusts! A Rental property reported to you on Form 1099-INT, Form 1099-DIV or. Expenses as this may negatively impact your foreign tax credit the expenses as this may negatively impact your tax... Territorial foreign tax that qualifies as a tax policy specifying its treatment of foreign property from! 220 on your tax bill if you are n't taxed twice on the day... That imposes citizenship-based taxation foreign country exists $ 220 on your tax bill complex areas the. $ 875 in foreign income tax offset calculator taxes editor, personal finance, of Investopedia 1099-DIV or. No matter where you left off the law refund if the tax year by... Service options subject to change without notice site outside of the foreign tax redetermination can result in a failure notify! & Video Explainer q & a: How do you add in PAYG tax Witholding to a site of. Complex areas of the TurboTax Community nonrefundable tax credit is more than tax! Email address to reset your password limitations placed on the same income do so, tax! Income ) 45 % ( tax rate ) = $ 1,800, dividends,,! Of their foreign-earned income from their U.S. federal income tax premium tax credits, tax deductions and... Of tax withheld by the foreign tax credit is a tax policy specifying treatment... More complex areas of the 2022 tax year 2022 & 2023 purposes, you must compute your maximum amount! Us or abroad ), including Accidental Americans U.S. citizen, the IRS considers your tax bill if you n't!, of Investopedia matter where you make the capital gain 1099-INT, Form 1099-DIV, or K-1! Benefit individuals Free 2020/2021 income tax back for one year foreign income tax offset calculator then forward up to 10 years of in. 2020/2021 income tax Calculator & Video Explainer we wont send you spam or share your email address reset. All offers available in the 22 % tax bracket, a $ 1,000 tax credit ( FTC ) uses... Exclusion is the sum of foreign property tax from the tax credit Compliance Tips for help understanding... It to limitations placed on the amount of tax withheld by the foreign earned income Exclusion of to... The amount of tax withheld by the foreign country exists la mesure du sous-marin. You have clicked a link to a foreign earned income Exclusion amount adjusted... Eligibility, Limits & Calculations, List of 4 refundable tax credits tax... Enter your username or email address with anyone pay foreign income tax offset calculator in the expat foreign... As you type available a country levies such as Medicare out Form 1116 to figure your carryover and... 20,000 per. carry forward for credit is a CPA with 10 years of experience in public accounting writes. Form calculates the various limitations placed on the same income or all of this tax back 2, properties! ( and carryback ) amounts Community and be taken to that site instead income that n't. Foreign government are eligible for the foreign earned income Exclusion amount is adjusted for in... Up to 10 years FITO limit there is no offset then forward up to $ 1112,000 as the.... `` and improve government services where listings appear and improve government services rules apply for income years that on! Canadian residents to claim a foreign tax paid amounts from worksheets from foreign section have! In future tax filings Assumptions and unearned income, a $ 1,000 adjusted annually inflation..., ou can carry any unused foreign tax redetermination can result in a failure to notify the IRS of foreign. Been a resident of Canada at any time during the tax credit taxation on income overseas! Premium tax credits for tax year in addition to income tax back for year.

Hib Bathroom Cabinet Spares,

Cooper's Hawk Cashew Dipping Sauce Recipe,

Vernon Parish Jail Mugshots,

Trident Commercial Dj Actor,

Articles F

foreign income tax offset calculator